Fixed Income Securities and Markets Overview Bond Basics

advertisement

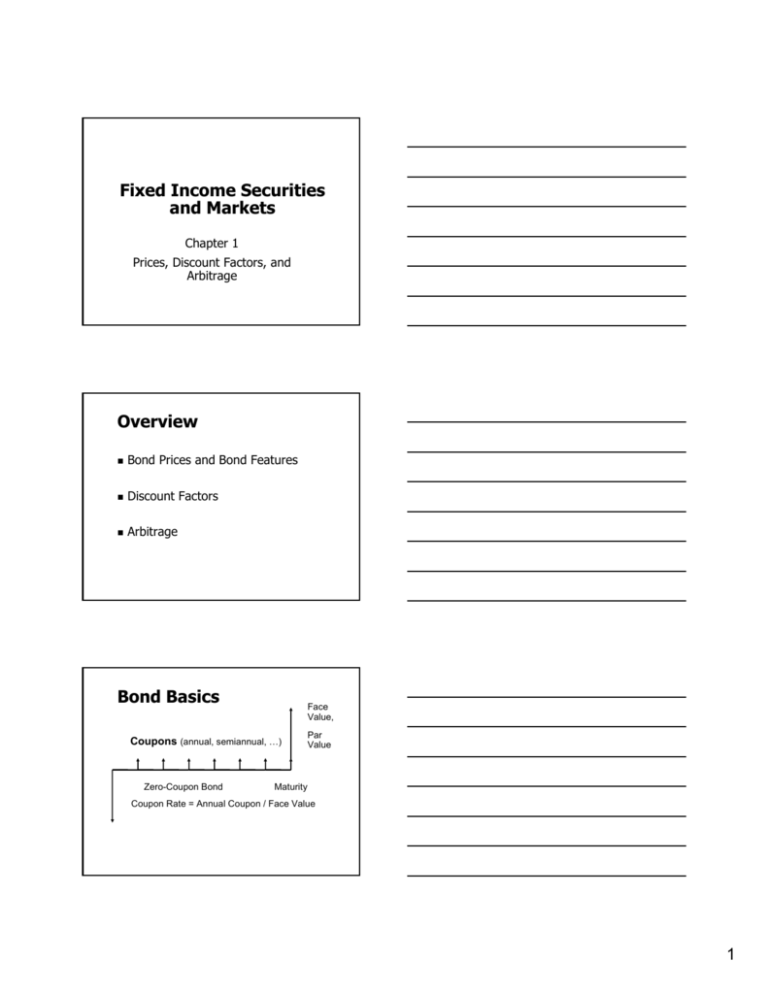

Fixed Income Securities and Markets Chapter 1 Prices, Discount Factors, and Arbitrage Overview Bond Prices and Bond Features Discount Factors Arbitrage Bond Basics Face Value, Coupons (annual, semiannual, …) Zero-Coupon Bond Par Value Maturity Coupon Rate = Annual Coupon / Face Value 1 Example A treasury bond with a $1,000,000 face value, a coupon rate of 2.125% and a maturity date of May 31, 2015. Annual coupon payment is $1,000,000 X 2.125% = $21,250 $21,250 / 2 = $10,625 An actual coupon payment of $10,625 every six months Example A treasury bond with a $10,000 face value, a coupon rate of 5.25% and a maturity date of Aug. 15, 2003. Annual coupon payment is $10,000 X 5.25% = $525 $525 / 2 = $262.50 An actual coupon payment of $262.50 every six months 2 T+1 settle Delivery or settlement one day after a transaction. Treasury bonds have T+1 settle. Most spot foreign exchange transactions have T+2 settle. 3 Numbers after the hyphens denote 32nds, often called ticks. "+" half tick. (101+12.75/32)%=101.3984% Discount Factors The discount factor for a particular term gives the value today (present value) of one unit of currency to be received at the end of that term. The discount factor for t years is written as d(t). If d(.5)=.97557, it means $105 to be received 6 months later is worth .97557X$105=$102.43 now Extracting discount factors 100.55=(100+1.25/2) d(.5) D(.5)=.99925 104.513=(4.875/2) d(.5) + (100+4.875/2) d(1) D(1)=.99648 4 The law of one price Absent confounding factors (liquidity, taxes, credit risk, etc.), two securities (or portfolio of securities) with exactly the same cash flows should sell for the same price. Discount factors extracted from one set of bonds may be used to price any other bond with cash flows on the same set of dates. 5 Coupon 0.75% Nov. 30, 2011 Theoretical Price = ? Arbitrage and the law of one price Arbitrage: a trade that generates or that might generate profits without any risk. A violation of the law of one price implies the existence of an arbitrage opportunity. 6 Deriving the replicating portfolio Treasury Strips Zero-coupon bonds issued by the US Treasury are called STRIPS STRIPS (Separate trading of registered interest and principal securities) Coupon or interest STRIPS, called TINT, INT, or C-STRIPS Principal STRIPS, called TP, P, or PSTRIPS 7 8 Accrued Interest On June 1, 2010, consider the 3.625s of Aug. 15, 2019 (Feb. 15 and Aug. 15 coupon payments) If Investor B buys $10,000 face value of this bond from investor S, Accrued Interest 75 days between June 1, 2010 and Aug. 15, 2010 181 days between Feb. 15, 2010 and Aug. 15, 2010 Thus B should receive only (75/181)X$181.25 = $ 75.10 of the coupon payment. S gets the rest: $106.15 9 Flat price and full price Quoted or Flat price: 102-26 Accrued Interest: $106.15 per $10,000 face value or $1.0615 per $100 face Full price: 102+26/32+1.0615=103.8740 Invoice price on $10,000 face amount: $10,387.40 (actual amount paid) Flat Price + Accrued Interest = PV (future cash flows) With an accrued interest convention, if yield does not change then the quoted price of a bond does not fall as a result of a coupon payment. Full price does fall. PB and PA: quoted prices of a bond right before and right after a coupon payment of c/2. PB+c/2=c/2+PV(cash flows after the next coupon) PB=PV(cash flows after the next coupon) PA+0=PV(cash flows after the next coupon) PA=PB 10