LFS MARKET MONTHLY – APRIL 2014 Tech Wreck Mach 2

LFS M

ARKET

M

ONTHLY

–

A

PRIL

2014

Tech Wreck Mach 2

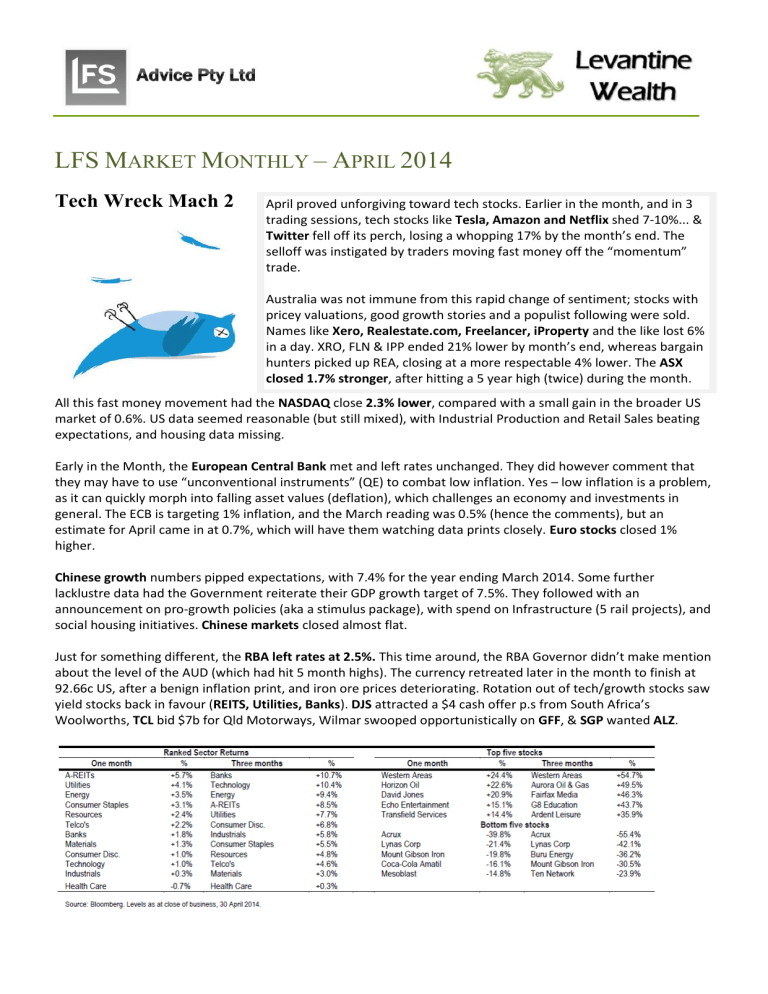

April proved unforgiving toward tech stocks. Earlier in the month, and in 3 trading sessions, tech stocks like Tesla, Amazon and Netflix shed 7-10%... &

Twitter fell off its perch, losing a whopping 17% by the month’s end. The selloff was instigated by traders moving fast money off the “momentum” trade.

Australia was not immune from this rapid change of sentiment; stocks with pricey valuations, good growth stories and a populist following were sold.

Names like Xero, Realestate.com, Freelancer, iProperty and the like lost 6% in a day. XRO, FLN & IPP ended 21% lower by month’s end, whereas bargain hunters picked up REA, closing at a more respectable 4% lower. The ASX closed 1.7% stronger , after hitting a 5 year high (twice) during the month.

All this fast money movement had the NASDAQ close 2.3% lower , compared with a small gain in the broader US market of 0.6%. US data seemed reasonable (but still mixed), with Industrial Production and Retail Sales beating expectations, and housing data missing.

Early in the Month, the European Central Bank met and left rates unchanged. They did however comment that they may have to use “unconventional instruments” (QE) to combat low inflation. Yes – low inflation is a problem, as it can quickly morph into falling asset values (deflation), which challenges an economy and investments in general. The ECB is targeting 1% inflation, and the March reading was 0.5% (hence the comments), but an estimate for April came in at 0.7%, which will have them watching data prints closely. Euro stocks closed 1% higher.

Chinese growth numbers pipped expectations, with 7.4% for the year ending March 2014. Some further lacklustre data had the Government reiterate their GDP growth target of 7.5%. They followed with an announcement on pro-growth policies (aka a stimulus package), with spend on Infrastructure (5 rail projects), and social housing initiatives. Chinese markets closed almost flat.

Just for something different, the RBA left rates at 2.5%.

This time around, the RBA Governor didn’t make mention about the level of the AUD (which had hit 5 month highs). The currency retreated later in the month to finish at

92.66c US, after a benign inflation print, and iron ore prices deteriorating. Rotation out of tech/growth stocks saw yield stocks back in favour ( REITS, Utilities, Banks ). DJS attracted a $4 cash offer p.s from South Africa’s

Woolworths, TCL bid $7b for Qld Motorways, Wilmar swooped opportunistically on GFF , & SGP wanted ALZ .

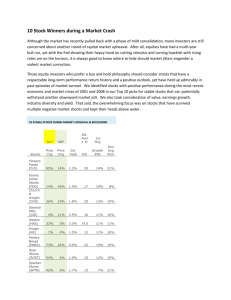

Global PMIs – David & Golliath

Earlier in the month, China’s official PMI (manufacturing purchasing manager’s index – a lead indicator) reflected a line ball expansion. Anything above 50… including 50.3 (the reading), is considered expansionary. This particular survey is geared to the larger companies, whereas a second survey from Markit, is for smaller companies. The

Markit surveys are reading 48.0 (in March), indicating the “Davids” of China are under pressure.

The table to the left illustrates China’s weakness on a global level, and the trends for growth. The Eurozone is the only economy that is showing overall recovery (PMIs trending up), whereas the US, Japan, and UK are showing signs of moderating growth. Interestingly, the

UK is the current pack leader for growth.

What we can take from this, is that China’s

PMI’s should begin to pick up, reflecting their export relationship to the other major economies (as well as internal stimulus measures). This in turn should translate into a pickup in demand for commodities down the track.

The Rich get Richer

The Chart to the above reflects the 100 year history of income distribution in the US. The top 1% of Americans now account for 19.34% of total household incomes

(light blue) – the greatest share since 1928.

When comparing this to Australia, our richest only account for 9.1% (but only updated to 2010 – see chart on right). We clearly have greater income/wealth dispersion than the USA, but both charts indicate a rising trend for the Rich to get richer.

Spending trends

May is Budget time, and we’ve certainly had our fair share of leaks/suggested policy changes… but have you ever wondered what our Government spends our money on in terms of sector?

The Chart above (as the title suggests), shows the percentage of Government expenditures by category.

Clearly Social Security & Welfare takes the greatest share (~40%), with Health next (~20%). Combine this with an aging population, you may understand why the government is concerned. A great example is the growth in Health spending, compare $62b in the last financial year, to $32b ten years prior. Our aging population is forecast to be 25% of the total population over the next 10 years – which can only increase the associated spend on Healthcare.

So when a government is worried about spending more than it’s earning (ie increasing debt, or being in deficit)… and (if you were Joe Hockey) where would you think you might be able to tweak policy?

I might add that even though statistically I’m supposed to live to 85, who knows what that quality of life will be?

13 May 2014 – all will be revealed!

Peta Tilse

Disclaimer This monthly has been prepared by Levantine Wealth without taking account of any person’s objectives, financial situation or needs and, because of that, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs. Levantine Wealth Pty Ltd is a corporate Authorised Representative No. 427706 of LFS Advice Pty Ltd ABN 85 155 224 481

AFSL No. 417576.