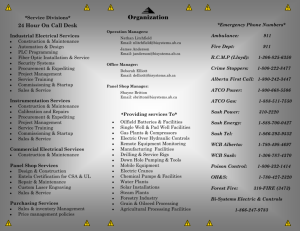

ATCO Ltd. 2011

advertisement