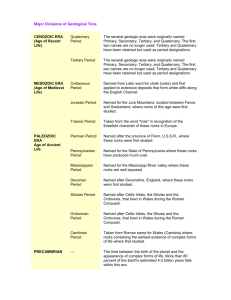

the primary, secondary, tertiary and quaternary sectors of the economy

advertisement