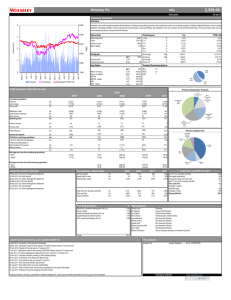

Wolseley 2008-2009

advertisement