business calc formulas

advertisement

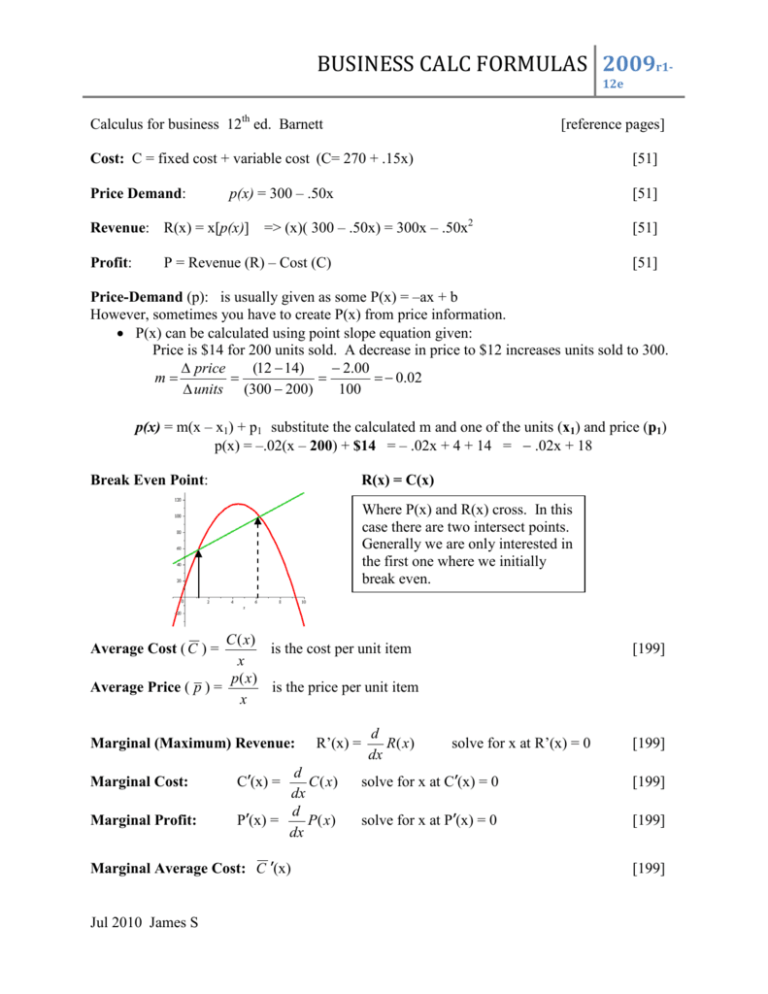

BUSINESS CALC FORMULAS 2009r112e Calculus for business 12th ed. Barnett [reference pages] Cost: C = fixed cost + variable cost (C= 270 + .15x) [51] Price Demand: [51] p(x) = 300 – .50x Revenue: R(x) = x[p(x)] Profit: => (x)( 300 – .50x) = 300x – .50x2 P = Revenue (R) – Cost (C) [51] [51] Price-Demand (p): is usually given as some P(x) = –ax + b However, sometimes you have to create P(x) from price information. • P(x) can be calculated using point slope equation given: Price is $14 for 200 units sold. A decrease in price to $12 increases units sold to 300. ∆ price (12 − 14) − 2.00 = = = − 0.02 m= ∆ units (300 − 200) 100 p(x) = m(x – x1) + p1 substitute the calculated m and one of the units (x1) and price (p1) p(x) = –.02(x – 200) + $14 = – .02x + 4 + 14 = − .02x + 18 Break Even Point: R(x) = C(x) Where P(x) and R(x) cross. In this case there are two intersect points. Generally we are only interested in the first one where we initially break even. C ( x) is the cost per unit item x p( x) Average Price ( p ) = is the price per unit item x Average Cost ( C ) = Marginal (Maximum) Revenue: Marginal Cost: Marginal Profit: d C (x) dx d P’(x) = P(x) dx C’(x) = Marginal Average Cost: C ’(x) Jul 2010 James S R’(x) = d R (x) dx [199] solve for x at R’(x) = 0 [199] solve for x at C’(x) = 0 [199] solve for x at P’(x) = 0 [199] [199] BUSINESS CALC FORMULAS 2009r112e − p f ' ( p) p p( x) = = p' xp' f ( p) Elasticity: E(p) = [258] Demand as a function of price: x = f (p) E(p) = 1 E(p) > 1 E(p) < 1 unit elasticity (demand change equal to price change) elastic (large demand change with price) inelastic (demand not sensitive to price change) x = f(p) = 10000 – 25p2 Find domain of p: set f(p) ≥ 0 10000 – 25p2 ≥ 0 p2 ≤ 400 0 ≤ p ≤ 20 𝑓𝑓 ′ (𝑝𝑝) = −50𝑝𝑝 Find where E(p) is 1: −𝑝𝑝𝑓𝑓 ′ (𝑝𝑝) E(p) = � p E(p) 0 𝑓𝑓(𝑝𝑝) 50𝑝𝑝 2 −(𝑝𝑝)(−50(𝑝𝑝)) � = �10000 −25(𝑝𝑝)2 � = �10000 −25(𝑝𝑝)2 � = 1 => 50p2 = 10000–25p2 => 75p2 = 10000 => p2 = 133.3 p = √133.3 = 11.55 (remember there is no negative value for p) 20 <1 =1 >1 Relative Rate of Change (RRC) 𝑓𝑓 ′ (𝑥𝑥) 𝑓𝑓(𝑥𝑥) [256] (find the derivative of f(x) and divide by f(x)) Also can be found with the dx( ln (f(p)) 1 Demand RRC = dp [ ln (f(p)) ] dx [ ln x ] = 𝑥𝑥 𝑑𝑑𝑑𝑑 Price RRC = f(x) = 10x+500 ln f(x) = ln [10x+500] = ln 10 + ln (x+50) (log expansion) 1 1 dx [f(x)] = 𝑥𝑥+50 𝑑𝑑𝑑𝑑 = 𝑥𝑥+50 ( ln10 is a constant so dx ln(10) = 0 ) Jul 2010 James S [259] BUSINESS CALC FORMULAS 2009r112e Future Value of a continuous income stream: 𝐹𝐹𝐹𝐹 = 𝑇𝑇 𝑒𝑒 𝑟𝑟𝑟𝑟 ∫0 𝑓𝑓(𝑡𝑡)𝑒𝑒 (−𝑟𝑟𝑟𝑟 ) [424] 𝑑𝑑𝑑𝑑 Continuous income flow 𝑓𝑓(𝑡𝑡) = 500𝑒𝑒 0.04𝑡𝑡 Future value: 12% Time: 5 yrs 5 𝐹𝐹𝐹𝐹 = 500𝑒𝑒 (.12)(5) � 𝑒𝑒 0.04(𝑡𝑡) 𝑒𝑒 −.12(𝑡𝑡) 0 FV = $3754 Surplus: 𝑥𝑥̅ PS (producer’s surplus) = ∫0 [ 𝑝𝑝̅ − 𝑆𝑆(𝑥𝑥)] 𝑑𝑑𝑑𝑑 CS (consumer’s surplus) 𝑥𝑥̅ = ∫0 [ Equilibrium is when: PS = CS x is the current supply 5 𝑒𝑒 −.08𝑡𝑡 .6 𝑑𝑑𝑑𝑑 = 500𝑒𝑒 � � −.08 0 [426] 𝐷𝐷(𝑥𝑥) − 𝑝𝑝̅ ] 𝑑𝑑𝑑𝑑 p is the current price 𝑦𝑦� 𝑦𝑦� 𝑥𝑥̅ 𝑥𝑥̅ Case A Case B 𝑥𝑥̅ The surplus is the area between the curve [∫0 𝑓𝑓(𝑥𝑥) ] and the area of the box created by the equilibrium point ( (𝑥𝑥̅ 𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡 𝑓𝑓(𝑥𝑥̅ ) ). In Case A it is the (area of the box) – ( the area under the curve); in Case B it is the (area under the curve) – ( area of the box). Gini Index: 1 1 1 2 ∫0 �𝑥𝑥 − 𝑓𝑓(𝑥𝑥)� = 2 ∫0 𝑥𝑥 − 2 ∫0 𝑓𝑓(𝑥𝑥)𝑑𝑑𝑑𝑑 of f(x) separately and then subtract it from Index is between 0 and 1. Jul 2010 James S 1 2 ∫0 𝑥𝑥 You can solve the integral which = 1. So essentially it is 1 − [416] 1 2 ∫0 𝑓𝑓(𝑥𝑥).