ARTICLES OF LIMITED PARTNERSHIP

CU

M

EN

T

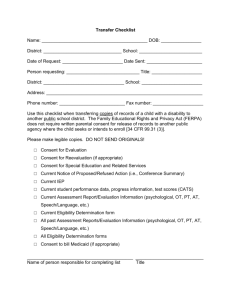

FOR FINANCIAL PROFESSIONAL USE ONLY-NOT FOR PUBLIC DISTRIBUTION.

Specimen documents are made available for educational purposes only. This specimen

form may be given to a client’s attorney for consideration as a sample document, when

requested. This specimen form shall not be given to a client. This document should not

be used as drafted. It has not been adapted to the specific circumstances or objectives

of any individual client, nor has it been prepared to meet the legal requirements of any

particular state. Clients should be advised to seek legal counsel when entering into

any transaction and in the preparation of all legal documents. All formalities

required under applicable local law should be observed.

*****

ARTICLES OF LIMITED PARTNERSHIP

DO

(NAME OF PARTNERSHIP), L.P.

ARTICLE ONE – STATUTORY AUTHORITY

M

PL

E

This limited partnership is formed under the authority of the (name of state) Limited Partnership

Act, and shall commence its existence upon the filing of the Certificate of Limited Partnership,

and its acceptance by the (name of state) Secretary of State (or name of appropriate state

official).

ARTICLE TWO – NAME OF PARTNERSHIP

SA

The name of this limited partnership is (name of entity), L.P.

ARTICLE THREE – PRINCIPAL BUSINESS OFFICE

The principal business office of (name of entity), L.P., at which all required business records are

kept, is:

(name of entity and address in full).

Sample Document - Page 1 of 13

ARTICLE FOUR – REGISTERED AGENT FOR SERVICE OF PROCESS

T

The name and address of the registered agent for service of process upon (name of entity), L.P.

is:

EN

(full name and address of registered agent)

ARTICLE FIVE – NAME OF GENERAL PARTNER

(full name and address of general partner)

CU

M

The name and address of the general partner of (name of entity), L.P. is:

DO

ARTICLE SIX – TYPE OF BUSINESS CONDUCTED

PL

E

(Name of entity), L.P. is in the business of (state type of business activities) and reserves the

right to engage in any lawful business permitted by the (name of state) Limited Partnership Act

or the comparable Act of any other state in which it may conduct business in the future.

ARTICLE SEVEN – SUCCESSOR GENERAL PARTNER

M

If the general partner dissolves, dies, withdraws or otherwise ceases to serve as a general partner

at a time when there is no remaining general partner, then the limited partners may elect a

successor general partner within 90 days after such general partner's cessation of service.

SA

If the limited partners should fail to select a new general partner within the required 90-day

period, the successor general partner, by default, shall be (full name and address of successor

general partner).

The withdrawing general partner shall not be liable for partnership debts and obligations arising

after (his, her, its) withdrawal from the partnership.

Sample Document - Page 2 of 13

The successor general partner, whether by selection or default, shall not incur the liabilities and

responsibilities of a general partner until such time as (he, she, it) formally enters the partnership

in that capacity.

T

ARTICLE EIGHT – PARTNERS' CAPITAL CONTRIBUTIONS

EN

The founding partners and their respective capital contributions and ownership percentages are

spelled out in Schedule A to this Agreement. The general partner shall maintain an updated

record of the ownership percentages arising from subsequent adjustments to the partner's capital

accounts.

DO

CU

M

Additional contributions to capital may be made by either general or limited partners. When such

additions to capital are not proportionately made by all partners, so that the ownership

percentages are affected, these additions are subject to conditions. First, the general partner must

consent to and accept additional contributions to capital by limited partners. Second, limited

partners representing at least (state percentage) percent of the total partnership interest must

consent to an additional contribution to capital by a general partner. Consents by either general

or limited partners need not be in writing, but will be presumed by default without written

evidence to the contrary.

ARTICLE NINE – LIABILITY OF LIMITED PARTNERS

PL

E

A limited partner shall not be liable for obligations of the partnership nor act on behalf of the

partnership except as provided in the (name of state) Limited Partnership Act.

M

A limited partner shall not be entitled to participate in the management of partnership business,

unless such limited partner also has an interest as a general partner.

SA

ARTICLE TEN – VOTING BY LIMITED PARTNERS

When partnership business or transactions require a limited partner's consent or vote, each

limited partner's vote will be based on his or her percent interest in the partnership.

[NOTE TO DRAFTSMAN: For example, if the limited partners

together own 90% of the partnership and the general partners own

10%, then a limited partner who had a 20% interest in the total

partnership would have a 22.22% voting interest among the

limited partners (20% divided by 90%). A limited partner with a

Sample Document - Page 3 of 13

15% interest in the whole would have a 16.67% voting interest

among the limited partners.]

ARTICLE ELEVEN – A PARTNERSHIP FOR FEDERAL TAX PURPOSES

EN

T

(Name of entity), L.P. is a partnership for federal tax purposes, and will file the appropriate

partnership tax returns in which partnership income, deductions, gains, losses and tax credits will

be reported. The general partner is responsible for filing the partnership tax returns, and for

reporting each partner's distributive share to him or her.

CU

M

The general partner may select the accounting method and taxable year of the partnership within

the constraints imposed by the federal income tax laws.

ARTICLE TWELVE –MAINTENANCE OF PARTNERS' CAPITAL ACCOUNTS

DO

The partnership shall maintain a non-interest-bearing capital account for each of the partners.

This account shall reflect all contributions to capital by that partner, and the partner's distributive

share of partnership income (or loss) shall be credited (charged) to the partner's account each

year. Any distributions to partners will likewise be charged to their capital accounts.

PL

E

The capital accounts shall be maintained in strict accordance with the information reported to the

Internal Revenue Service. Subchapter K of the Internal Revenue Code, or any successor to

Subchapter K, shall control all matters relating to a partner's distributive share of partnership

income or loss, as well as the cost basis of the partner's interest in the partnership.

M

ARTICLE THIRTEEN – INCOME, DEDUCTIONS, GAIN, LOSS, CREDITS

SA

The ownership percentage of a partner in the partnership is used to determine the partner's

distributive share of income, deductions, gain, loss and credits, both annually and upon

partnership dissolution.

If the partnership realizes income by virtue of the general partner's performance of personal

services, such income shall be allocated to the general partner and not as earnings on capital.

ARTICLE FOURTEEN – ADDITIONAL CAPITAL CONTRIBUTIONS

Sample Document - Page 4 of 13

The general partner has the authority to request (but not to demand) additional capital

contributions by the partners. Such request must be made on a proportionate, nondiscriminatory

basis, so that each partner has the opportunity to maintain his or her percentage ownership in the

partnership.

EN

T

After 60 days have passed since the request was made, the general partner is authorized to

reallocate ownership percentages in the event some partners have elected to contribute additional

capital while others have not.

ARTICLE FIFTEEN – WORKING CAPITAL

CU

M

The general partner may retain out of distributable monies such cash reserves as are needed, in

its sole discretion, to provide working capital and expense reserves for the partnership.

ARTICLE SIXTEEN – TERM OF PARTNERSHIP

DO

(Name of entity), L.P. will terminate if, at any time, there is no remaining limited partner.

Otherwise, the partnership will terminate and dissolve upon a vote to do so by limited partners

representing at least a two-thirds interest in the partnership. The consent of the general partner is

not required to trigger the dissolution.

PL

E

During the term of the partnership, each partner waives his or her right to compel a dissolution of

the partnership. Nor may a partner compel a partition of partnership property.

None of the following events will terminate the partnership:

M

death or disability of a limited partner;

SA

bankruptcy or insolvency of a limited partner;

withdrawal of a limited partner (unless there are no remaining limited partners);

death, disability or withdrawal of the general partner (unless no successor general

partner is in place after 90 days);

Sample Document - Page 5 of 13

addition of a new general partner; or

any other occurrence or nonoccurrence that could be deemed under Indiana law to

terminate the partnership, absent the consent of the partners; in such a case the

partnership shall continue without liquidation and the winding up of partnership

affairs.

EN

ARTICLE SEVENTEEN – DISTRIBUTIONS UPON

DISSOLUTION OF THE PARTNERSHIP

T

CU

M

The general partner is directed to wind up partnership affairs promptly following a dissolution of

the partnership. All obligations of the partnership and the expenses of windup shall have priority

in the winding-up process. The general partner has authority to retain sufficient cash reserves to

cover any contingent liabilities. The remaining assets of the partnership shall be distributed in the

following order of priority:

repayment of loans made to the partnership by a partner, and any remaining

obligations for the purchase of a deceased or withdrawing partner's interest;

distribution to the general and limited partners of an amount equal to the balance in

their respective capital accounts (a negative balance will be treated as a loan to the

partner from the partnership); and

any remaining assets will be distributed to the partners in proportion to their

ownership percentages in the partnership.

PL

E

DO

SA

M

In carrying out the disposition of partnership assets, the general partner may sell assets, partition

assets, or distribute partial interests in assets.

The general partner shall prepare an accounting of the liquidation of the partnership, and have

the authority to require, as a condition of receiving a distribution, a written acknowledgment

from each partner that the accounting has been inspected and accepted; that the general partners

are discharged from further responsibilities; and that the general partners are released from

liability for lack of prudence or skill in the management of partnership assets, though not for

fraud, bad faith, or any undisclosed errors.

ARTICLE EIGHTEEN – REMOVAL OF GENERAL PARTNER

Sample Document - Page 6 of 13

The limited partners shall have the right to remove the general partner, to select a replacement,

and to add a new general partner, provided at least two-thirds of the total interest represented by

the limited partners vote to approve such action.

EN

T

When the general partner dissolves, dies or ceases to serve, the partnership shall be obligated to

purchase the general partner's interest. The purchase price and other conditions shall be specified

in a buyout agreement separate from these Articles of Limited Partnership.

CU

M

ARTICLE NINETEEN – AMENDMENTS TO

CERTIFICATE OF LIMITED PARTNERSHIP

When the general partner is unable or unwilling to execute an amendment to the Certificate of

Limited Partnership to witness the withdrawal and/or addition of a general partner, such

Certificate may be executed by the successor general partner and at least two-thirds in interest of

the limited partners.

DO

ARTICLE TWENTY – RESPONSIBILITIES OF GENERAL PARTNER

PL

E

The general partner shall be responsible for the operation and management of partnership

business, and shall have authority to do all of the following:

engage in transactions for the sale, purchase, lease, exchange or other transfer of

property on behalf of the partnership, and to execute the documentation necessary to

accomplish such transactions;

retain assets in the form received by the partnership without obligation to reinvest

such assets productively;

SA

M

employ advisors and consultants as necessary for partnership business;

secure insurance policies as necessary to protect the partnership from loss;

register securities in street name under a custodian agreement with a securities broker;

and

Sample Document - Page 7 of 13

register or receive title to assets in the name of the partnership.

ARTICLE TWENTY-ONE – AFFIDAVIT OF GENERAL PARTNER'S AUTHORITY

EN

T

Any party engaging in a transaction with the partnership may rely on a signed affidavit of the

general partner in which such general partner affirms his or its authority to carry out the

transaction.

ARTICLE TWENTY-TWO – SUCCESSOR GENERAL PARTNER'S LIABILITY

CU

M

A successor general partner may rely upon the accuracy of the records and accounts turned over

to him or her from a preceding general partner. The successor general partner shall not have a

duty to have such records and accounts audited, nor shall the successor be liable for any errors or

omissions of a predecessor.

DO

ARTICLE TWENTY-THREE – GENERAL PARTNER'S COMPENSATION

PL

E

The general partner shall be compensated in a fair and reasonable manner for its managerial and

administrative services provided to the partnership. The general partner shall also be reimbursed

for all necessary and reasonable expenses incurred on behalf of the partnership.

ARTICLE TWENTY-FOUR – NO BOND REQUIRED

M

The general partner, including any successors, shall not be required to provide a bond to secure

the general partner's performance.

SA

ARTICLE TWENTY-FIVE – CONSENT OF LIMITED PARTNERS REQUIRED

The general partner cannot engage in any of the following transactions unless it has the consent

of at least two-thirds in interest of the limited partners:

incur partnership indebtedness in excess of a loan-to-net-book-value-of-assets ratio of

50%;

Sample Document - Page 8 of 13

sell substantially all of the partnership assets in liquidation of the partnership or other

cessation of its business; or

compromise any claim or controversy in an amount exceeding 50 percent of the total

value of partnership assets.

T

EN

ARTICLE TWENTY-SIX – RESTRICTIONS ON LIMITED PARTNERS

CU

M

The limited partners may not participate in the management or operation of partnership business,

nor bind the partnership in any way, unless such limited partner is also the general partner and

acting in the latter capacity.

ARTICLE TWENTY-SEVEN – RESTRICTIONS ON

TRANSFER OF PARTNERSHIP INTERESTS

DO

A partnership interest in (name of entity), L.P., whether general or limited, may not be

transferred or encumbered without the consent of at least two-thirds in interest of the limited

partners. Such restrictions are intended to preserve the relationships of trust upon which this

partnership is formed, as well as the partnership's capital structure and tax status.

PL

E

The limited partnership interests have not been registered as securities under federal or state

laws, and may not be offered for sale unless so registered, or unless an exemption is obtained.

There are certain exceptions to the foregoing restrictions, which allow transfers of a limited

partnership interest in the following circumstances:

M

The personal representative of the estate of a deceased limited partner succeeds to the

rights and powers of the limited partner. The limited partner may designate a

beneficiary (or beneficiaries) for his or her limited partnership interest, and this will

be binding upon the partnership if delivered to a general partner within 60 days of the

limited partner's death.

SA

The personal representative of an incapacitated limited partner succeeds to the rights

and powers of a limited partner if active pursuant to letters of guardianship or a

durable power of attorney.

Sample Document - Page 9 of 13

A limited partner may transfer his or her limited partnership interest during life for

the following purposes: to make a gift in trust for the limited partner, his or her

spouse, and/or his or her descendants; or to make a gift to a qualified public charity

under Internal Revenue Code Section 170(c).

EN

T

The recipient of a limited partnership interest transferred in any of these ways shall be bound by

these Articles of Limited Partnership; however, the recipient of any other type of transfer will not

be recognized. During any dispute, the partnership is not required to distribute the income of the

disputed partnership interest, but will credit such income to that interest's capital account.

CU

M

ARTICLE TWENTY-EIGHT – PARTNERSHIP INTEREST

ACQUIRED BY COURT JUDGMENT

DO

If a third party acquires a limited partnership interest as a result of a court judgment, the

partnership will then have the option to acquire such interest from the transferee at its fair market

value within 90 days of the third party's acquisition of the interest. The fair market value shall be

determined by a qualified business appraiser who is a member of the American Society of

Appraisers. The transferee must accept or reject the appraisal value with 60 days of its receipt. If

not formally rejected, the valuation therein will be deemed accepted. If the appraisal is formally

rejected, the transferee will be a non-voting owner of the limited partnership interest until the

valuation dispute is resolved, and the sale carried out.

PL

E

The general partner may transfer the partnership's option to one or more of the limited partners,

provided at least 60 percent in interest of the limited partners consent.

ARTICLE TWENTY-NINE – NEW LIMITED PARTNER

SA

M

The consent of at least two-thirds in interest of the limited partners shall be required to admit a

new limited partner. When a new limited partner is admitted, the ownership percentages of

partners will be adjusted accordingly.

Similarly, the redemption of a partner's interest or its acquisition by the partnership will require

adjustment of the ownership percentages of the remaining partners.

ARTICLE THIRTY – GENERAL PARTNER'S POWER OF ATTORNEY

Sample Document - Page 10 of 13

The limited partner's appoint the general partner as their attorney-in-fact to execute, certify and

record all partnership documents. This is a durable power of attorney and will survive any

incapacity of a limited partner.

T

ARTICLE THIRTY-ONE – NOTICE

EN

Any notice mentioned in these Articles of Partnership will be valid if delivered in person to the

intended recipient if sent by certified mail with return receipt requested. Each partner shall be

required to provide the general partner with his or her current address, and to notify the general

partner of any change of address.

CU

M

ARTICLE THIRTY-TWO – HEIRS, SUCCESSORS, AND ASSIGNS

These Articles of Partnership shall be binding upon not only the contracting parties, but also

upon their personal representatives, heirs, successors and assigns.

PL

E

Accepted for the Partnership:

DO

Dated this_____day of__________, (year).

By:________________________

M

(typed name), General Partner

SA

State of_______________

County of_____________

The person above named appeared before me on the above date and acknowledged that (he or

she) executed the preceding document as the duly authorized agent of (name of entity), L.P.

Witness my hand and seal this_____day of___________, (year).

Sample Document - Page 11 of 13

_______________________

Notary Public

My Commission Expires:

GENERAL PARTNER:

(name and address of General Partner)

DO

Capital Contribution: $__________

CU

M

SCHEDULE A

EN

T

*****

Percentage of Ownership: _____percent

PL

E

LIMITED PARTNERS:

(name and address of Limited Partner)

M

Capital Contribution: $__________

SA

Percentage of Ownership: _____percent

[repeat for each Limited Partner]

*****

Sample Document - Page 12 of 13

This information is provided by American General Life Insurance Company (AGL) and

The United States Life Insurance Company in the City of New York (US Life), members

of American International Group, Inc. (AIG).

EN

T

All companies mentioned, their employees, financial professionals, and other

representatives, are not authorized to give legal, tax, or accounting, advice, including

the drafting or execution of any legal document. Applicable laws and regulations are

complex and subject to change. Any tax statements in this material are not intended to

suggest the avoidance of U.S. federal, state or local tax penalties. AGL and US Life

shall not be liable for any loss or damage caused by the use of, or reliance on, the tax,

accounting, legal, investment or financial items contained in this material.

CU

M

FOR FINANCIAL PROFESSIONAL USE ONLY-NOT FOR PUBLIC DISTRIBUTION

SA

M

PL

E

DO

©2015. All rights reserved.

Sample Document - Page 13 of 13