handling nsf checks - RB Control Systems

advertisement

Phone: (866) 224-7225

Fax: (412) 829-0132

www.rbcontrolsystems.com

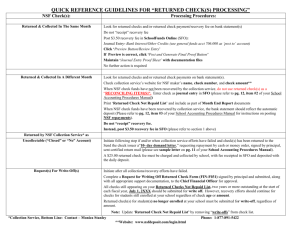

HANDLING NSF CHECKS

When a customer’s check is returned for non-sufficient funds, you have the option to set up another invoice for both the

amount of the original check and any finance/penalty fees that should be added in addition to the amount of the check. When

this additional charge is put into the system, it will not inflate your sales but will still allow you to track fees owed.

Setting Up Your Inventory and Accounting Interface

There are two inventory items already in the system to help with NSF checks.

• NSF Check

This part is not counted as sale so it will not affect your end of day sales.

• NSF Fee

This part is not counted as sale so it will not affect your end of day sales.

• These parts need to have accounts associated with them in QuickBooks.

Go to Tools > Company Setup > Setup QuickBooks Integration.

Under the Prevailing Accounts tab, choose Non-Inventory.

Click {Add New} and associate each part number with the correct account.

When applying to a sales order:

•

•

•

•

Apply both the NSF Check and NSF Fee part numbers onto the Sales Order.

Change the price of the NSF Check part number to be the same as the original check.

Add the original check number to the Serial #/Description of the item in order to track this later.

Change the price of the NSF Fee to be the amount of additional charges the customer owes.

Convert the Sales Order to Accounts Receivable.

This does not change your sales and tax totals for the day.

You can send your customer an invoice for the NSF check.

HANDLING NSF CHECKS