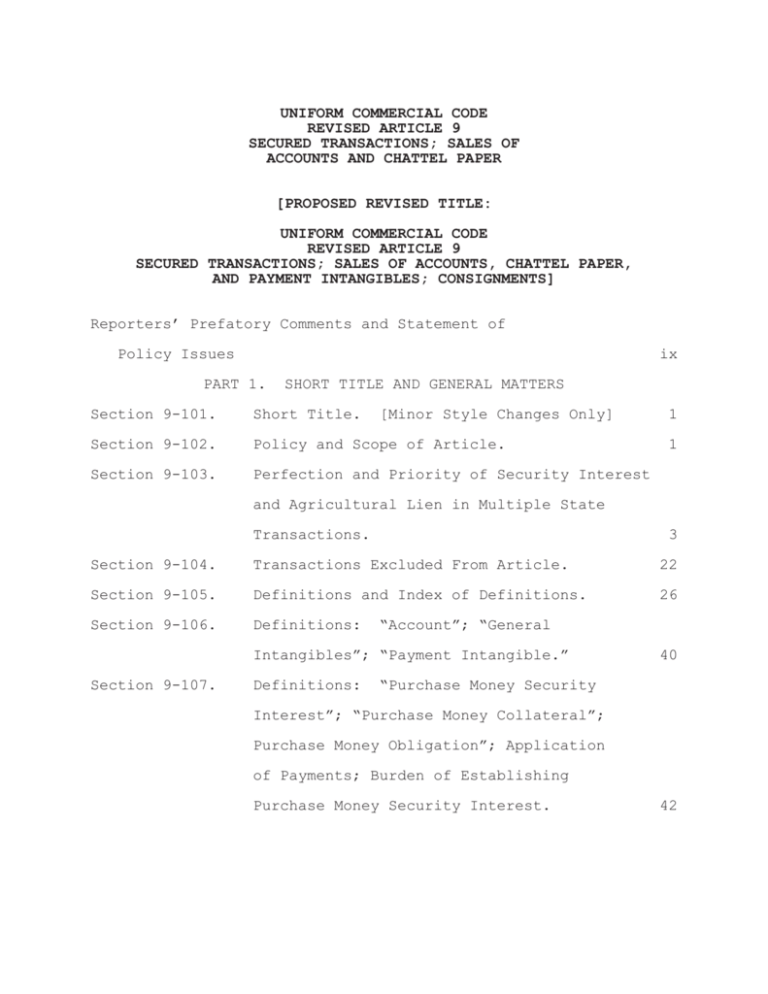

UNIFORM COMMERCIAL CODE REVISED ARTICLE 9 SECURED

advertisement