Month Direct Labor Hours (X) Factory Overhead in

advertisement

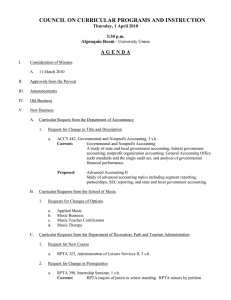

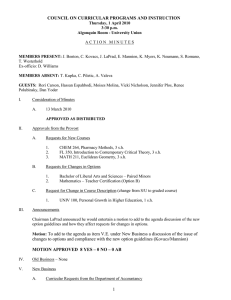

Department of Recreation, Park & Tourism Administration Western Illinois University RPTA 323 Administration of Leisure Services II Analysis of Mixed (Semi-Variable) Costs Mixed costs often need to be broken out into their respective fixed and variable components (e.g., for forecasting, planning, or budgeting). This can be done using a cost-volume formula: Y = a + bX where Y= the mixed cost to be broken out X= any measure of activity such as direct labor hours, production volume, etc. a= the fixed cost component b= the variable cost per unit of X Two common methods of applying this principle are the (a) high-low-method and (b) regression analysis. We will look at high-low analysis using the following table. Table 1: Raw Data vers. 2013/02 Month Direct Labor Hours (X) Factory Overhead in $ (Y) January 105 $2,510 February 100 $2,479 March 88 $2,080 April 116 $2,750 May 95 $2,330 June 107 $2,690 July 97 $2,480 August 110 $2,610 September 135 $2,920 October 115 $2,730 November 117 $2,760 December 96 $2,109 1 Hemingway RPTA 323 Administration of Leisure Services II Analysis of Mixed (Semi-Variable) Costs 1. Select the highest and the lowest pairs, based on activity level (X). Table 2: Direct Labor Hours (X) for High and Low Months Month Direct Labor Hours (X) Factory Overhead in $ (Y) High September 135 $2,920 Low March 88 $2,080 Source: Table 1 2. Compute the variable cost per unit of X, which is b in the cost-volume formula Variable cost (b) = Difference in the mixed cost Y _________________________ Difference in activity X Table 3: Calculate Differences between X and Y for High and Low Months X (Hours) Y ($) High (September) 135 $2,920 Low (March) 88 $2,080 Difference 47 $840 Source: Table 2 Variable cost (b) = 840 / 47 = $17.8723 per hour of direct labor vers. 2013/02 2 Hemingway RPTA 323 Administration of Leisure Services II Analysis of Mixed (Semi-Variable) Costs 3. Compute the fixed cost portion of total mixed costs, which is a in the cost-volume formula Fixed cost portion (a) = Total mixed cost (X) - Variable cost (b) Table 4: Compute Fixed Cost Portion of Total Mixed Costs High Low Factory overhead costs (Y) $2,920.00 $2,080.00 Total variable costs (b) $2,412.76 $1,572.76 Difference $507.234 $507.234 Sources: Table 1 for Y, Table 4A for calculation of b Table 4A: Compute Total Variable Expenses for X in High & Low Months (b)·(X) Variable Cost Per Unit (b) Hours of Direct Labor (X) Total High $17.8723 135 $2,412.76 Low $17.8723 88 $1,572.76 Source: Table 3 for b per unit, Table 1 for X (direct labor hours) Recall the cost-volume formula (on p. 1): Y = a + bX Using the results above, our example cost-volume formula for breaking mixed costs into fixed and variable components becomes: Y = $507.234 + $17.8723X where Y = mixed costs to be broken out X = total hours of direct labor $507.234 = fixed cost component of Y $17.8723 = variable cost per hour of direct labor Note that the High-Low method of breaking out mixed costs is less accurate than using multiple regression because it is more affected by extreme values. It is nonetheless useful when working with costs for relatively short periods, e.g., a year or two. vers. 2013/02 3