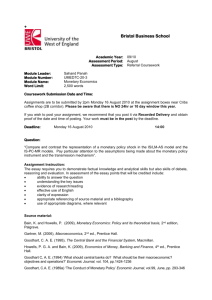

Monetary policy without interest rates.

advertisement