MIRR Step-by-Step - it-educ.jmu.edu

advertisement

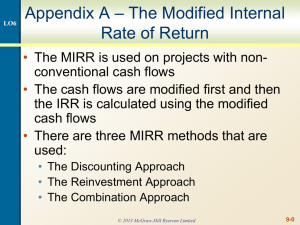

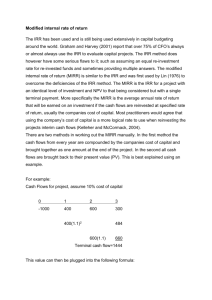

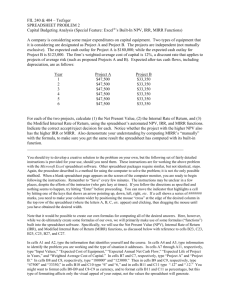

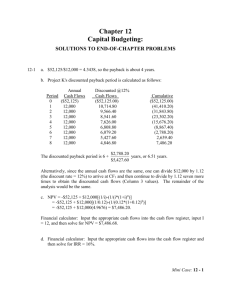

MIRR Step-by-Step Prepared by Pamela Peterson Drake, James Madison University The modified internal rate of return (MIRR) is the return on an investment, considering not only the cash flows of the investment, but the earnings on these cash flows based on a specific reinvestment rate. Assuming that the project’s cost of capital is 10% and the reinvestment rate is 8%, calculate the MIRR for the following series of cash flows: 0 1 2 3 4 | | | | | | | | | | -$100,000 $20,000 -$10,000 $80,000 $50,000 For comparison, the internal rate of return for this project is 11.48% and the net present value, at a project cost of capital of 10%, is $4,173.21. Using Excel If the data is: 1 2 3 4 5 6 A B Year 0 1 2 3 4 Cash flow -$100,000 $20,000 -$10,000 $80,000 $50,000 The NPV is =NPV(0.1,B3:B6)+B2 The IRR is =IRR(B2:B6) STEP 1: CALCULATE THE PRESENT VALUE OF THE OUTFLOWS, DISCOUNTED AT THE PROJECT’S COST OF CAPITAL 0 1 2 3 4 | | | | | | | | | | $20,000 -$10,000 10 000 (1 0 10)2 $80,000 $50,000 -$100,000 -$8,264.46 -$108,264.46 Using a financial calculator FV = 10000 i=8 N=2 Solve for FV STEP 2: CALCULATE THE FUTURE VALUE OF THE INFLOWS, COMPOUNDED AT THE REINVESTMENT RATE, 8%: 0 1 2 3 4 | | | | | | | | | | $20,000 -$10,000 $80,000 $80,000 (1 + 0.08) -$100,000 $20,000 (1 + 0.08)3 $50,000.00 86,400.00 25,194.24 $161,594.24 Using a financial calculator PV = 20000 i=8 N=3 Solve for FV STEP 3: PV = 80000 i=8 N=1 Solve for FV CALCULATE THE RETURN ON THE INVESTMENT 0 1 2 3 4 | | | | | | | | | | -$108,264.46 $161,594.24 PV = -108264.46 FV = 161594.24 N=4 Solve for i i = 10.53% Using Excel If the data is: STEP 4: MAKE A DECISION Because the MIRR of 10.53% is greater than the project’s cost of capital of 10% the project is acceptable. 1 2 3 4 5 6 A B Year 0 1 2 3 4 Cash flow -$100,000 $20,000 -$10,000 $80,000 $50,000 The MIRR is =MIRR(B2:B6,0.1,0.08) QUESTIONS 1. If the reinvestment rate were 5% instead of 8%, is the project still acceptable? 2. If the reinvestment rate were 6% instead of 8%, is the project still acceptable? SOLUTIONS 1. If the reinvestment rate is 5%, the project is not acceptable. Its MIRR is 9.76%, which is less than the project’s cost of capital. 2. If the reinvestment rate is 7%, the project is acceptable. Its MIRR is 10.27% which is more than the project’s cost of capital.