16: Disposals of Assets

advertisement

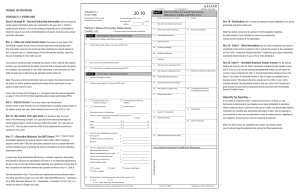

1 16: Disposals of Assets Examine types of GLDs in more detail Capital GLDs Do not commonly occur in engineering projects Section 1231, 1245, and 1250 GLDs Commonly occur in engineering projects Sometimes treated as a capital GLD 16.1 Capital Gains and Losses Compute tax effects of any disposal after computing taxes on OI Establish terminology and compute tax flows assuming only one disposal Next section considers multiple disposals Terminology Capital asset is any property except for depreciable property, real property used in a trade or business, inventory held for sale, and a few other items Examples include stocks, bonds, or person's home Assets that are not capital assets include equipment that is depreciated, real property used for rental purposes, office buildings, structures housing equipment Equipment and machines frequently associated with projects are not capital assets, but can be taxed under capital gain or loss provisions in some circumstances Need to understand capital assets before considering project equipment 2 Capital gain or loss occurs when amount realized from disposal of a capital asset does not equal its book value Capital Gain or Loss = Amount Realized – Book Value Gain if positive, loss if negative Short-term CGLs have holding periods of a year or less. Long-term CGLs occur after more than one year. Same brackets (e.g., 10%, 15%, 27%, …) used for OI apply when TI includes CGLs, but sometimes lower rates can be used for the CGL component Laws on CGLs change periodically depending upon political and economic conditions 3 Individuals CGL Taxes for Individuals G / L Term Gain Gain Loss Treatment Short Long Taxed as OI. First, any portion of the gain in the OI 15% bracket is taxed at 10%. Any remainder above the OI 15% bracket is taxed at 20%, with a few exceptions such as collectibles (28%) and gains on real property due to SL depreciation (25%). Either Up to $3,000 may be deducted from OI in the current year, and the remainder may be carried forward indefinitely. A loss remains a SCL or LCL when it is carried forward. Example 16.1 CGL Taxes for Individuals Only CGL is sale of stock having book value of $10,000 Not depreciated, so BV = price paid plus costs of purchase Different scenarios 1. Holding period ≤ 1 year, Sales price = $11,000 ⇒ SCG = $1,000 taxed as OI. If in OI 31% bracket ⇒ Fed tax = $310 = 0.31 × 1,000 2. Holding period > 1 year, Sales price = $11,000 ⇒ LCG = $1,000 Single, TI of update $26,650 before sale ⇒ First $400 in OI 15% bracket, next $600 in OI 27% bracket ⇒ Fed tax = $160 = 400(0.10) + 600(0.20) Single, TI before sale in 27% or higher bracket ⇒ Fed tax = $200 = 1,000(0.20) 3. Holding period ≤ 1 year, Sales price = $3,000 ⇒ SCL = $7,000 Deduct $3,000 from OI this year. Carry forward $4,000 of SCL. 4. Holding period > 1 year, Sales price = $3,000 ⇒ LCL = $7,000 Deduct $3,000 from OI this year. Carry forward $4000 of LCL. 4 CGL Taxes for Corporations G/L Term Treatment Gain Gain Short Long Loss Either Taxed as OI. Taxed as OI, or the corporation may elect to use a 35% rate. No deduction may be made from OI. Carry a loss back for up to 3 years to claim refunds on any CG taxes in those years, or carry it forward up to 5 years to reduce a future CG. Any amount carried back or forward always is classified as a SCL, even if it was originally a LCL. This is different from an individual's CL. Corporations Example 16.2 CGL Taxes for Corporations Different scenarios on sale of stock with book value of $10,000 1. Holding period ≤ 1 year, Sales price = $11,000 ⇒ SCG = $1,000 taxed as OI. If in OI 34% bracket ⇒ Fed tax = $340 = 0.34 × 1,000 2. Holding period > 1 year, Sales price = $11,000 ⇒ LCG = $1,000 If in OI 34% bracket, Fed tax = $340 = 0.34 × 1,000 If in OI 39% bracket, elect 35% LCG rate so Fed tax = $350 = 0.35 × 1,000 3. Holding period ≤ 1 year, Sales price = $6,000 ⇒ SCL = $4,000 Carry back then forward as SCL to reduce gains in other years 4. Holding period > 1 year, Sales price = $6,000 ⇒ LCL = $4,000 Carry back then forward as SCL to reduce gains in other years 5 16.2 Consolidation If either an individual or a corporation has several CGLs during a year, consolidate them using following procedure prior to computing tax 1. Sum the individual short-term gains and losses, to obtain a net shortterm capital gain (NSCG) or a net short-term capital loss (NSCL). 2. Sum the individual long-term gains and losses, to obtain a net longterm capital gain (NLCG) or a net long-term capital loss (NLCL). 3. Consolidated values equal the net values unless one is a gain and the other a loss. In this case, reduce or offset the gain by the loss and let the term (short/long) of the result be that of whichever is larger. Consolidation of Net Gains and Losses Short Term Long Term NSCL NSCL CLCL = NLCL CSCL = NSCL $0 CLCL = NLCL $0 NLCG If NLCG ≥ NSCL, then CLCG = NLCG − NSCL CSCL = NSCL If NSCL > NLCG, then CSCL = NSCL − NLCG --- CLCG = NLCG If NSCG ≥ NLCL, then CSCG = NSCG − NLCL CLCG = NLCG CSCG = NSCG NLCG CSCG = NSCG If NLCL > NSCG, then CLCL = NLCL − NSCG 6 Example 16.3 Consolidating Capital Gains and Losses Example of Consolidation Net Short -100 0 100 Net Long -100 -25 0 25 CSCL: 100 CSCL: 100 CLCL: 100 CLCL: 25 CSCL: 100 CSCL: 75 CLCL: 100 CLCL: 25 All: $0 CLCG: 25 All: $0 CSCG: 100 CSCG: 100 CSCG: 100 CLCG: 25 CLCG: 100 CSCG: 75 100 All : $0 CLCG: 100 7 Effect of Consolidation on Economic Analyses Taxpayer's net gain and loss situation prior to project can affect a project's ATCF Suppose taxpayer has a net capital loss in year of disposal before project Project CL might not produce tax savings in year of disposal since it might have to be carried forward Project CG might cause tax payment in year of disposal or reduce loss carried forward If analyst has knowledge of net gain and loss situation prior to project, should use it If several projects being analyzed for large corporation, then analyst might not know net gain and loss situation Scenarios one possibility Sometimes assume gains cause taxes and losses reduce taxes Measure potential of project, but accurate only if taxpayer is in net gain situation Errors will be from shifts in the timing of the cash flow for disposal taxes or possibly the tax rate Effect of errors on PW small since many other cash flows are larger and occur earlier 8 16.3 Types of Project Disposals Section 1231 disposals include depreciable assets and real property used in a trade or business Holding period of more than a year Regulations prevent converting accelerated depreciation into CG Consider an individual in 30% OI bracket with an early depreciation charge of $100 Create tax savings of $30 at OI rates in early years Make tax payment of $20 at LCG rates later if AR − BVd = 100 Gains due to accelerated depreciation are recaptured at OI rates Investor still benefits from saving $30 early and paying back $30 later Recaptures covered by Sections 1245 and 1250 of Internal Revenue Code Can be considered as categories of Section 1231 properties 9 Section 1245 Disposals Section 1245 properties include personal property and some real properties Non-residential real properties, such as office or factory buildings, acquired from 1980 through 1986, are Section 1245 properties. Their use of accelerated depreciation makes them subject to Section 1245 recapture just like project equipment. Section 1231 gain BV 0 Section 1245 recapture BV d Section 1231 loss Section 1245 Recapture Example where BV0 equals $800 and BVd is $600 Section 1245 Disposal Amount Realized $900 750 350 1231 Gain $100 0 0 1245 Recap. 1231 Loss $200 150 0 $0 0 250 10 Section 1250 Disposals Section 1250 covers most real properties of interest to project economics Section 1250 includes non-Section 1245 real properties, so most nonresidential real properties acquired outside of the 1980-86 window are Section 1250 properties, as well as residential real assets. Any real property built from 1987 on (no accelerated component) Section 1231 gain BV0 SL Section 1231 gain (unrecaptured depreciation) Acc Section 1250 recapture BVd Section 1231 loss Section 1250 Recapture Example of Section 1250 disposal BV0 equals $80,000 and BVd is $60,000 BVd would have been $65,000 if SL Acc = 5,000 Amount Realized $53,000 62,000 71,000 87,000 Section 1250 Disposal 1231 Unrecap. 1250 Deprec. Recapt. Gain $0 0 6,000 22,000 $0 0 6,000 15,000 $0 2,000 5,000 5,000 1231 Loss $7,000 0 0 0 11 16.4 Taxes on Project Disposals Use Section 1245 and Section 1250 to determine amounts of recapture and Section 1231 gains and losses Procedure for Computing Taxes Apply Section 1231 rules to net GLDs and determine how to tax them 1. Sum the individual gains and losses to obtain a net Section 1231 gain or loss. 2. Deduct a net loss from OI. It will be subject to recapture for five years. 3. If there is a net gain and net losses were reported in the last five years, then recapture the prior net losses. For example, suppose that the current net gain is $100,000 and prior losses were $20,000. Then $20,000 of the $100,000 is treated as OI, leaving the remaining $80,000 as the net Section 1231 gain for the current year. 4. Treat a net gain as a LCG, where it becomes part of the capital gains consolidation process. 12 Capital Asset Type? Section 1245 or 1250 Compute CGL on project Compute Section 1245 or 1250 recapture. Tax as OI. Compute Section 1231 gain or loss on project. Net all CGLs Net Section 1231 gains and losses. Recapture any prior 1231 losses. Consolidate CGLs Treat net 1231 gain as LCG Gain Net gain or loss? Loss CSCG: Taxed at OI rate CLCG: Indiv - Taxed at CG rate Corp - Taxed at OI or 35% rate Deduct net Section 1231 loss from OI CSCL: Indiv - Deduct up to $3,000 and then carry as SCL Corp - Carry as SCL CLCL: Indiv - Deduct up to $3,000 and then carry as LCL Corp - Carry as SCL Disposal Logic 13 ATCFs for Section 1231 Asset (with Rounding to Fit Table in Display) Yr BTCF Dep / BV 0 -90,000 1 37,000 2 27,750 2-a 95,000 2-b 50,000 2-c 10,000 2-d 10,000 OI LCGL OI Tax LCG Tax ATCF 47,998 -10,998 0 -4,625 14,002 13,748 0 5,781 28,000 62,000 5,000 26,071 28,000 22,000 0 9,251 28,000 -18,000 0 -7,569 28,000 0 -18,000 0 0 0 1,847 0 0 -6,651 -90,000 41,625 21,969 67,082 40,749 17,569 16,651 Example 16.4 ATCFs With Recapture and Section 1231 GLDs Personal property with 3 year MACRS recovery period BV0 is $90,000 for MACRS 3 year property with disposal in year 2 Year 1 depreciation at 53.33310% and year 2 is one-half of depreciation at 31.1150% BV2 = $28,000 = 90,000 − 47,998 − 14,002 Corporation has OI rates of 39% for fed, 5% for state for combined OI marginal rate of 42.05% CG rates of 35% for fed, 3% for state for combined CG marginal rate of 36.95% Four scenarios for disposal of project a) AR = $95,000, net Section 1231 gain, CLCG before disposal Recapture = $62,000 = 90,000 − 28,000 Immediately tax as OI: $26,071 = 0.4205 × 62,000 Project Section 1231 gain = $5,000 = 95,000 − 90,000 Increase net Section 1231 gain and hence CLCG Tax as LCG: $1,847 = 0.3695 × 5,000 Total disposal tax = $27,918 = 26,071 + 1,847 Disposal ATCF = 67,082 = 95,000 − 27,918 Total ATCF = 89,051 = 67,082 + 21,969 14 b) AR = $50,000, any Section 1231 or CLG situation elsewhere Recapture = $22,000 = 50,000 − 28,000 Immediately tax as OI: $9,251 = 0.4205 × 22,000 No Section 1231 gain or loss Total disposal tax = $9,251 Do not need net Section 1231 or CGL position c) AR = $10,000, net Section 1231 loss of $300,000 before disposal No project recapture or project Section 1231 gain Project Section 1231 loss = $18,000 = 28,000 − 10,000 Net Section 1231 loss = $318,000 = 300,000 + 18,000 Increase Section 1231 loss that is deducted from OI OI tax saving: $7,569 = 0.4205 × 18,000 Total disposal tax saving = $7,569 d) AR = $10,000, net Section 1231 gain of $200,000 and CLCG of $300,000 before disposal No project recapture or project Section 1231 gain Project Section 1231 loss = $18,000 = 28,000 − 10,000 Net Section 1231 gain = $282,000 = 300,000 − 18,000 Decrease Section 1231 gain that becomes part of a CLCG CG tax saving: $6,651 = 0.3695 × 18,000 Total disposal tax saving = $6,651 15 Implementation Difficulty Taxpayer's net gain and loss situation prior to project can affect a project's ATCF If position known, use it If position not known Examine scenarios and if one alternative is dominant, choose it; otherwise, make subjective choice Chance of dominance occurring if disposal tax flows are comparatively small, late flows and there are many other flows Corporations also can use simplified Section 1231 GLD procedure and possibly incur small error Following scenarios allow Section 1231 GLDs to be treated as OI 1. A taxpayer has net Section 1231 losses before and after the new project. This is a very likely scenario since most spending is on equipment that is salvaged for less than its original book value, causing either recapture or a Section 1231 loss. 2. A corporation in a bracket of 35% or less has a consolidated LCG before and after the project. 3. A corporation in a bracket of 35% or less has no capital gains or losses and only Section 1231 losses and gains. 16 16.5 Corporate Procedure Foregoing material allows examining accuracy of simplified corporate procedure that treats any Section 1231 GLDs as OI One of the following must occur for any Section 1231 GLD If the GLD is a recapture, then treating it as OI is correct If the GLD is not a recapture If it becomes part of a net Section 1231 loss, then treating it as OI is correct If it becomes part of a net Section 1231 gain, then treating it as OI might create an error Likelihood of a Section 1231 net gain position seems small, but possible Section 1245 properties are equipment, and they are not likely to be sold for more than they cost If AR is between BVd and BV0 , then recapture is treated as OI and removed from further consideration If AR is less than BVd , project level losses increase probability of a net Section 1231 loss If most investment is in equipment, then net loss position becomes very likely Section 1250 consists of real property where gains are possible but chances are lessened by long recovery periods and SL If a net Section 1231 gain does occur, then it can still be recaptured as OI if there were net Section 1231 losses in prior years 17 If net Section 1231 gain does occur If it becomes part of a CLCG For corporations, using OI rates causes no error for CG rates of 35% or less and little error thereafter For individuals, using OI rates can cause a larger error If it becomes part of a consolidated CL If carried by a corporation, then might cause no error (in amount of taxes) for CG rates of 35% or less and at most little error thereafter, but timing of tax flow can be affected. Worse case occurs if CL can never be used. Errors for individuals can be either smaller or larger than corporations Conclusions For corporations, probable events of recapture or net Section 1231 loss result in no error. A small error is possible in the less likely event of a net Section 1231 gain. If error should occur, but it is late and comparatively small relative to other flows, then little effect on PW For individuals, probable events of recapture or net Section 1231 loss result in no error. Errors are possible in the less likely event of a net Section 1231 gain. Errors can be larger than in corporate analyses, so their potential for affecting PW should be examined