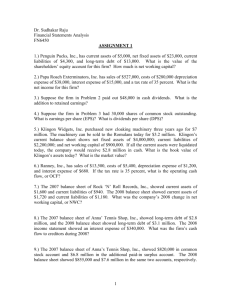

Sample Chapter (PDF, 67 Pages, 595

advertisement