Practice Answers - MGMT-026

advertisement

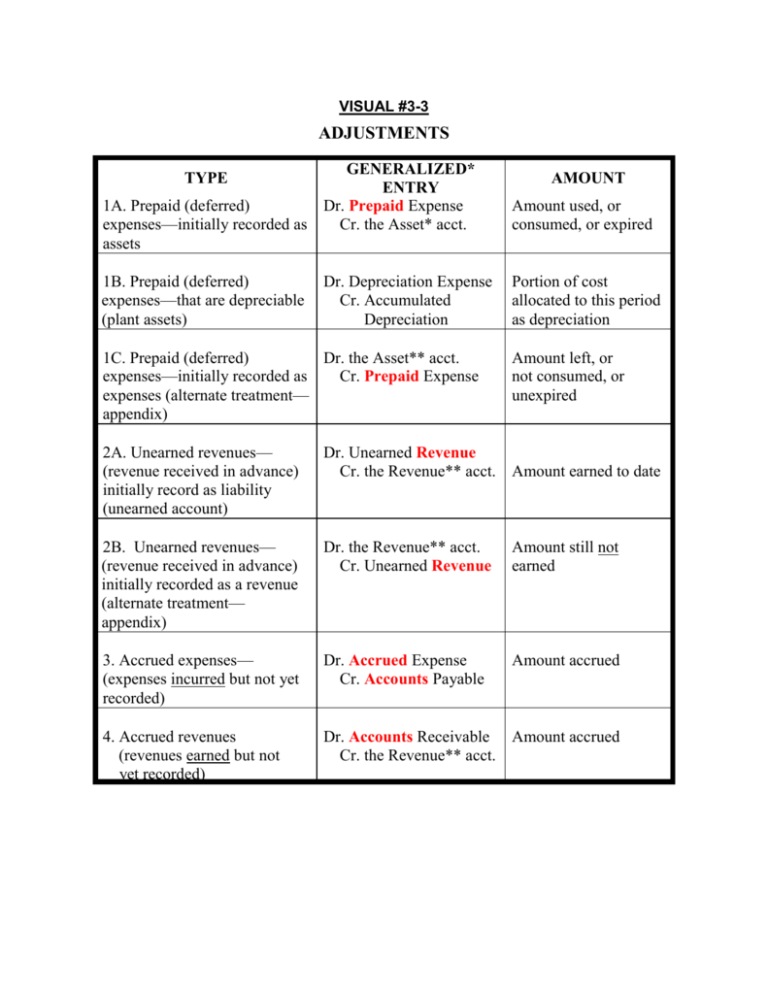

VISUAL #3-3 ADJUSTMENTS GENERALIZED* ENTRY 1A. Prepaid (deferred) Dr. Prepaid Expense expenses—initially recorded as Cr. the Asset* acct. assets TYPE 1B. Prepaid (deferred) expenses—that are depreciable (plant assets) Dr. Depreciation Expense Cr. Accumulated Depreciation 1C. Prepaid (deferred) Dr. the Asset** acct. expenses—initially recorded as Cr. Prepaid Expense expenses (alternate treatment— appendix) AMOUNT Amount used, or consumed, or expired Portion of cost allocated to this period as depreciation Amount left, or not consumed, or unexpired 2A. Unearned revenues— (revenue received in advance) initially record as liability (unearned account) Dr. Unearned Revenue Cr. the Revenue** acct. Amount earned to date 2B. Unearned revenues— (revenue received in advance) initially recorded as a revenue (alternate treatment— appendix) Dr. the Revenue** acct. Cr. Unearned Revenue Amount still not earned 3. Accrued expenses— (expenses incurred but not yet recorded) Dr. Accrued Expense Cr. Accounts Payable Amount accrued 4. Accrued revenues (revenues earned but not yet recorded) Dr. Accounts Receivable Amount accrued Cr. the Revenue** acct. *Note: (1) Each adjustment affects a Balance Sheet Account and an Income Statement Account and (2) CASH NEVER appears in an adjustment. **Title or account name varies. In Class Practice Problem Chapter Three On July 1, 2011, Howard M. Tenant, Inc., rents office space from John Q. Landlord for two years, starting immediately, at a rate of $100 per month, or $2,400 in total. The full $2,400 was paid on this date. Record the original transaction and the appropriate adjusting entries in 2011, 2012, and 2013 from the point of view of Tenant and Landlord. Solution: Alternate Demonstration Problem Chapter 3 Tenant 7/1/11 Prepaid rent Cash 12/31/11 Rent Expense Prepaid Rent 12/31/12 Rent Expense Prepaid Rent 12/31/13 Rent Expense Prepaid Rent Landlord Dr. 2,400 Dr. 600 Dr. 1,200 Dr. 600 Cr. 7/1/11 Cash 2,400 Unearned Rent Revenue Cr. 12/31/11 Unearned Rent Revenue 600 Rent Revenue Cr. 12/31/11 Unearned Rent Revenue 1,200 Rent Revenue Cr. 12/31/11 Unearned Rent Revenue 600 Rent Revenue Dr. 2,400 Dr. 600 Dr. 1,200 Dr. 600 Cr. 2,400 Cr. 600 Cr. 1,200 Cr. 600 An Alternative Solution (Based on the Appendix) Tenant 7/1/11 Rent Expense Cash 12/31/11 Prepaid Rent Rent Expense 12/31/12 Rent Expense Prepaid Rent 12/31/13 Rent Expense Prepaid Rent Landlord Dr. 2,400 Dr. 1,800 Dr. 1,200 Dr. 600 Cr. 7/1/11 Cash 2,400 Rent Revenue Cr. 12/31/11 Rent Revenue 1,800 Unearned Rent Revenue Cr. 12/31/11 Unearned Rent Revenue 1,200 Rent Revenue Cr. 12/31/11 Unearned Rent Revenue 600 Rent Revenue Dr. 2,400 Dr. 1,800 Dr. 1,200 Dr. 600 Cr. 2,400 Cr. 1,800 Cr. 1,200 Cr. 600 *Notice the adjustment is the same in 2012 and 2013 under both approaches. This is because the adjustment in the appendix alternative solution places all remaining unexpired/unearned amounts in the asset/liability accounts to be considered for future adjustment. Problem 2 Chapter Three The trial balance of Large Company, Inc., at the end of its annual accounting period is as follows: LARGE COMPANY, INC. Trial Balance December 31, 2011 Cash .......................................................................... Prepaid Insurance ................................................... Supplies .................................................................. Equipment ............................................................... Accumulated Depreciation—Equipment ............... C. Large, Capital ..................................................... C. Large, Withdrawals ............................................. Revenue ................................................................... Salaries Expense ..................................................... Rent Expense .......................................................... Totals ........................................................................ Additional information: 1. Expired insurance, $600. 2. Unused supplies, per inventory, $800. 3. Estimated depreciation, $1,000. 4. Earned but unpaid salaries, $700. Required: 1. Prepare adjusting entries. 2. Prepare closing entries. 3. Prepare a post-closing trial balance. $ 4,000 1,600 2,100 20,000 $ 2,000 19,000 2,000 33,000 18,300 6,000 $54,000 ______ $54,000 Prepare adjusting entries. Solution: Problem 2 Chapter 3 Dr. 600 Insurance Expense Prepaid Insurance Supplies Expense Supplies Depreciation Expense, Equipment Accumulated Depreciation, Equipment Salaries Expense Salaries Payable Revenue Income Summary Income Summary Salaries Expense Rent Expense Insurance Expense Supplies Expense Depreciation Expense, Equipment Income Summary C. Large, Capital C. Large, Capital C. Large, Withdrawals Cash Prepaid Insurance Supplies Equipment Accumulated Depreciation, Equipment Salaries Payable C. Large, Capital Totals 1,300 1,000 700 33,000 27,900 5,100 2,000 LARGE COMPANY, INC. Post-Closing Trial Balance December 31, 2011 Dr. $ 4,000 1,000 800 20,000 $ 25,800 Cr. 600 1,300 1,000 700 33,000 19,000 6,000 600 1,300 1,000 5,100 2,000 Cr. $ 3,000 700 22,100 $ 25,800