REGISTER EARLY

advertisement

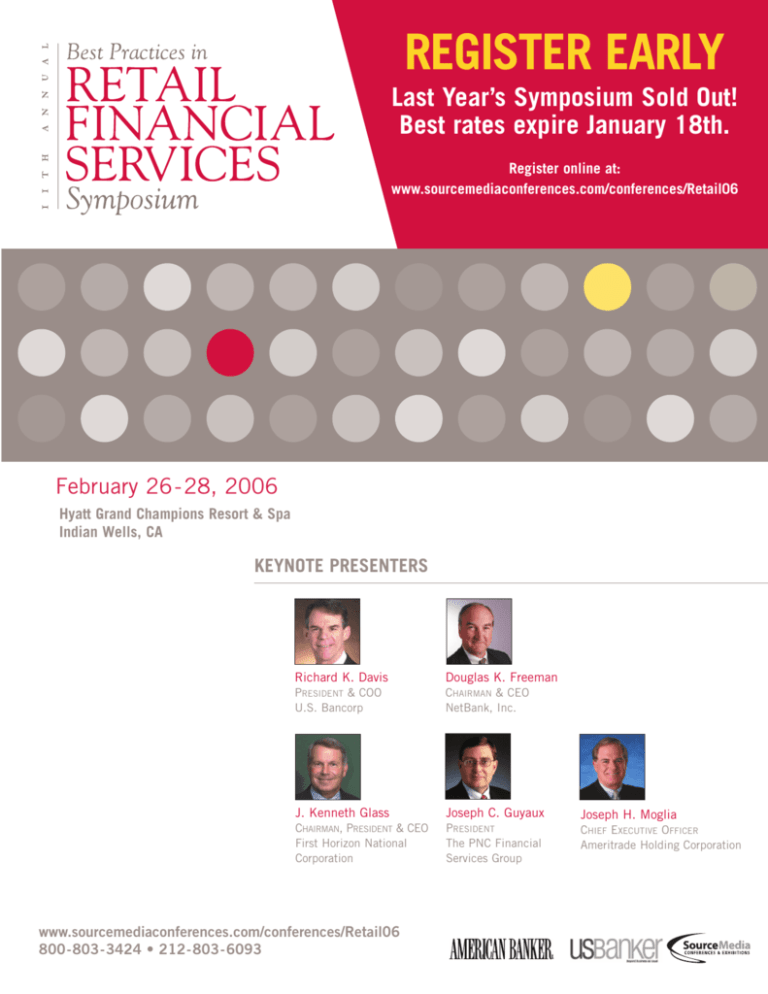

REGISTER EARLY Last Year’s Symposium Sold Out! Best rates expire January 18th. Register online at: www.sourcemediaconferences.com/conferences/Retail06 February 26-28, 2006 Hyatt Grand Champions Resort & Spa Indian Wells, CA KEYNOTE PRESENTERS Richard K. Davis Douglas K. Freeman PRESIDENT & COO U.S. Bancorp CHAIRMAN & CEO NetBank, Inc. J. Kenneth Glass Joseph C. Guyaux Joseph H. Moglia CHAIRMAN, PRESIDENT & CEO First Horizon National Corporation PRESIDENT The PNC Financial Services Group CHIEF EXECUTIVE OFFICER Ameritrade Holding Corporation www.sourcemediaconferences.com/conferences/Retail06 800-803-3424 • 212-803-6093 The industry-leading event for senior executives in retail financial services hosted by American Banker & U.S. Banker A LETTER FROM OUR CHAIRPERSON KEYNOTE SPEAKERS A Look at the 2006 Retail Finance Trends on Your Agenda... and Ours Richard K. Davis President and Chief Operating Officer U.S. BANCORP Davis is president and chief operating officer of U.S. Bancorp, a multi-state financial holding company with more than 2,377 full-service banking offices and 4,654 ATMs in 24 states. U. S. Bancorp has more than $198 billion in total assets and is headquartered in Minneapolis, Minnesota. For bank presidents, EVPs and senior retail finance executives, the 11th Annual Best Practices in Retail Financial Services Symposium will serve as a strategic “reality check” on the state of the industry. For 2006, we will be addressing three trends of critical importance that will shape the banking business in both the near- and long-term: • The two-pronged division of the U.S. Banking industry. While large national-scale players dominate the consumer loan business, the small local players are gaining share of consumer deposits and small business banking activities. At the Symposium, you'll hear from leading players on both sides of the equation - for a CEO-level perspective on how this major trend will affect your own institution's bottom line. • New pressures on profitability. Costs are going up as banks open new branches, refurbish old ones, and extend banking hours. Revenues are being pressured by a flattening yield curve, increased competition, and a slowdown in overall deposit growth. Get high-level recommendations on how to adjust your growth strategy in light of these new realities. • Renewed emphasis on superior execution by front-line employees. This is a marked difference from years past where the emphasis was on strategy, markets, and technology Join your colleagues in discovering how the best banking companies are winning by focusing on customer service excellence. I invite you to join me – and the major players in retail finance – at the Hyatt Grand Champions Resort in Palm Desert this February to be part of what is universally considered the premier networking experience in retail banking. Douglas K. Freeman Chairman and Chief Executive Officer NETBANK, INC. Douglas (Doug) K. Freeman has served as Chief Executive Officer of NetBank, Inc. since April 2002. He was named Chairman of NetBank, Inc.'s Board of Directors in January 2003. He is leading the company's effort to reengineer the traditional banking model to meet the needs of a rapidly changing consumer market. Joseph C. Guyaux President THE PNC FINANCIAL SERVICES GROUP Joseph C. Guyaux is president of The PNC Financial Services Group. In that role he is head of consumer banking responsible for leading all of PN's consumer business, which includes consumer and business banking, wealth management and brokerage businesses. Guyaux joined PNC in 1972 and, after holding several management positions, was named senior vice president and manager of Metropolitan Commercial Banking in Pittsburgh in 1989. J. Kenneth Glass Chairman, President and CEO FIRST HORIZON NATIONAL CORPORATION Ken Glass is chairman, president and chief executive officer of First Horizon National Corporation, which is headquartered in Memphis, Tennessee. In his 30-plus years at First Horizon he has managed various aspects of the business including the banking groups, retail and company operations before becoming CEO and then chairman of the board. Joe Moglia Chief Executive Officer AMERITRADE HOLDING CORPORATION Joe Moglia became CEO in March 2001 and his leadership has strengthened the Company by focusing on the three priorities of clients, shareholders and associates. This strategy has produced a client-centric offering with an emphasis on customization and choice, as well as increased shareholder value. Best regards, Thomas K. Brown Chief Executive Officer Second Curve Capital, LLC OPTIONAL WORKSHOP THE “ASK TOM” DINNER Join Tom Brown and your peers for great food and even better conversation. Take advantage of the opportunity to “Ask Tom” questions and join in the discussion. If you enjoy Tom’s annual Analyst’s View of Retail Financial Services, you will love this entertaining and educational gathering. This is truly an event not to be missed. See agenda page for more information. SUNDAY, FEBRUARY 26TH 2:00-5:00 OPTIONAL WORKSHOP Delivering Service- The Ritz-Carlton Style Please check back cover for further details. www.sourcemediaconferences.com/conferences/Retail06 • 800-803-3424 • 212-803-6093 SUNDAY, FEBRUARY 26TH CLIENT MANAGEMENT TRACK 1:00 REGISTRATION OPENS Sponsored by: 2:00-5:00 OPTIONAL WORKSHOP Delivering Service- The Ritz-Carlton Style Christoph Hilscher Assistant Director Human Resources RITZ-CARLTON David Davis Executive Vice President, Regional Retail Executive COMPASS BANK Ric Carey Executive Vice President UMPQUA BANK YOU NEED TO REGISTER TO ATTEND THE WORKSHOP PLEASE CHECK BACK COVER FOR DETAILS. 5:00 KEYNOTE ADDRESS First Horizon expanded from Tennessee’s largest bank to a premier nationwide financial provider over the past 15 years. The company has achieved strong earnings growth and was recently inducted into Fortune’s Hall of Fame for making the list of “100 Best Companies to Work For in America” annually since 1998. Ken Glass will focus on First Horizon’s superior employee and customer value strategies and their execution. J. Kenneth Glass Chairman, President and Chief Executive Officer FIRST HORIZON NATIONAL CORPORATION 6:00-7:15 NETWORKING RECEPTION IN EXHIBIT HALL MONDAY, FEBRUARY 27TH 7:15-7:45 CONTINENTAL BREAKFAST 7:45-8:00 CHAIRMAN’S OPENING REMARKS Thomas K. Brown Chief Executive Officer SECONDCURVE CAPITAL 8:00 KEYNOTE ADDRESS Richard Davis, president and chief operating officer of U.S. Bancorp, will discuss current and future challenges and opportunities for our industry and for large banks in particular. He will look at the implications of ongoing industry consolidation and increased competition, the revolution in the payments arena, and opportunities for distinctive revenue growth. U.S. Bank is the nation’s sixth-largest financial services company. U.S. Bank operates the fourth-largest branch network and the third-largest ATM network. Richard Davis President and Chief Operating Officer US BANCORP 9:00 KEYNOTE ADDRESS Joe Moglia has led Ameritrade to three straight record years of profitability. His commitment to clients and shareholders has transformed the Company into an industry leader. The acquisition of TD Waterhouse will create a new TD Ameritrade that provides a full spectrum of investing services, including an extensive branch network. Joe Moglia Chief Executive Officer AMERITRADE 10:00-10:45 NETWORKING AND REFRESHMENT BREAK IN EXHIBIT HALL 10:45 KEYNOTE ADDRESS Joseph C. Guyaux, president of The PNC Financial Services Group and head of its retail banking business, will discuss opportunities for growth in a challenging environment. Specifically, he will review the successes, failures and opportunities in acquiring, growing and retaining customer relationships, with a particular emphasis on the client experience. Guyaux serves as chairman of the Consumer Bankers Association. Joe Guyuax President PNC FINANCIAL SERVICES GROUP 11:45 THE ANALYST’S VIEW OF RETAIL FINANCIAL SERVICES A yearly exclusive at the Best Practices in Retail Financial Services Symposium, Tom Brown will provide his unique insight on the best and not so best practices of financial institutions. This annual session is one that raises many eyebrows and is one you surely won’t want to miss. Thomas K. Brown Chief Executive Officer SECOND CURVE CAPITAL, LLC 2:00 LEVERAGING CUSTOMER VISITS The millions of customer visits that occur annually are a huge potential asset for each bank. Branch visitors have been trained, however, to be transaction-driven. This session presents innovative strategies for disrupting the "errand mentality" and strengthening brand equity among customers at precisely the point where they form their future purchase decisions. Cindy Flynn, Senior Vice President, Marketing, CITIZENS FINANCIAL Leila Carr, Senior Executive Vice President, Retail, SYNOVOUS 2:45 POSITIONING BRAND TO STEAL MARKET SHARE This session presents an innovative brand perspective that targets both the precepts of the customer and the positioning of brand within the financial market space. Using the brand as a prime reference, the audience will be educated and directed toward branding that steals valuable, coveted market share from the competition. Tom Dougherty, Partner, Senior Strategist, STEALING SHARE, INC. Jill L. Wyman, Senior Vice President of Sales and Marketing, FIRST FINANCIAL BANK 3:30-4:00 NETWORKING AND REFRESHMENT BREAK IN EXHIBIT HALL 4:00 TALK IS CHEAP! A fun, practical and motivational session that will teach managers how to lead their employees to dramatic improvement. David Davis, Executive Vice President, Regional Retail Executive, COMPASS BANK 4:45 MOST CUSTOMERS DON'T WANT JUST ONE BANK According to an A.T. Kearney study, financial institutions must achieve organic growth rates of at least 6 to 8% annually to achieve superior shareholder value. This panel will provide unique insight into which financial institutions have a strong hold on their customers (customer momentum) as well as a significant portion of their personal balance sheets (wallet momentum). Andrew Green, Vice President and Practice Leader, Financial Institutions A.T. KEARNEY Rajnish Bharadwaj, Senior Vice President, Corporate Development and Strategic Initiatives, WACHOVIA 5:30-7:00 CONFERENCE CONCLUDES FOR THE DAY FOLLOWED BY A POOLSIDE RECEPTION PRODUCT DEVELOPMENT TRACK 2:00 BEST OF THE BEST WHEN IT COMES TO SMALL BUSINESS BANKING The small business owner needs time saving, efficient, fair prices and credible advice in buying and maintaining financial services. Personal recognition and service can be important. Find out how one successful small business bank pulls this together. Barbara Hoose, Executive Vice President, UNION BANK OF CALIFORNIA 2:45 REACHING THE HISPANIC CUSTOMER Hispanics are among the fastest-growing upwardly mobile segments in the U.S. The FDIC predicts that Hispanics will account for more than 50% of retail banking growth over the next decade. Banks have taken notice of this segment’s economic shift and are actively reaching out via culturally focused partnerships with Latino nonprofits and community organizations. Laura Sonderup, Director of US Hispanic Marketing, HEINRICH Chan Peterson, Executive Vice President, Community Banking, BANCO POPULAR NORTH AMERICA Liliana Salas-Gripp, Vice President, National Alliances Manager, Diverse Growth Segments, WELLS FARGO CORPORATION 3:30-4:00 NETWORKING AND REFRESHMENT BREAK IN EXHIBIT HALL 4:00 BEYOND FREE CHECKING Free checking emerged as a powerful tool in customer acquisition several years ago, but its ability to move market share has diminished as institutions widely adopted the product and it became commonplace. What will it take to develop the next great promotional product and, equally importantly, what can be done to elevate free checking’s weak profitability dynamics? Robin Foote, Managing Director, NOVANTAS LLC Additional Speaker to be Announced 12:30-2:00 LUNCHEON FOR ALL PARTICIPANTS www.sourcemediaconferences.com/conferences/Retail06 • 800-803-3424 • 212-803-6093 PRODUCT DEVELOPMENT TRACK 4:45 SHIFTING FROM AN EMPHASIS ON SERVICE AND A LIMITED PRODUCT EMPHASIS TO DEEPER RELATIONSHIP SALES - Why no one else can do selling for them - Why they cannot seem to do it for themselves - What exactly is involved in "professional selling" - What senior management must do to overcome roadblocks to selling and a sales culture Moderator: Charles Wendel President FINANCIAL INSTITUTION CONSULTING Additional Panelists to be Announced 5:30-7:00 CONFERENCE CONCLUDES FOR THE DAY FOLLOWED BY A POOLSIDE RECEPTION MONDAY, FEBRUARY 27TH (CONTINUED) 7:15 THE “ASK TOM” DINNER NEW! Join Tom Brown and your peers for great food and even better conversation. Take advantage of the opportunity to “Ask Tom” questions and join in the discussion. If you enjoy Tom’s annual Analyst’s View of Retail Financial Services, you will love this entertaining and educational gathering. This is truly an event not to be missed. You need to register to attend the dinner. Please see registration page for more details. TUESDAY, FEBRUARY 28TH 7:30-8:00 CONTINENTAL BREAKFAST DISTRIBUTION TRACK 2:00 DISTRIBUTION STRATEGIES AT WACHOVIA Learn from two industry leaders how to create cross channel synergy between distribution networks in the retail and small business areas of the bank. John Witter, Head of Distribution, WACHOVIA CORPORATION Will Howle, Head of Small Business Banking, WACHOVIA CORPORATION 2:45 IMPROVING THE ATM CUSTOMER EXPERIENCE Even though transaction volumes have been flat over the past several years, ATMs are still a critical service channel for financial institutions. - What steps should banks take to ensure the consistency of the ATM experience across their networks? - What are customers seeking with respect to additional ATM functions? -How can enhanced functionality help banks differentiate their ATM customer experience? - How can banks maximize the value of enhancements to their ATM networks? Moderator: Chris Gill, Senior Manager, COVE CONSULTING Panelists: Lori Murray, Senior Vice President of Retail Distribution and Operations, HUNTINGTON NATIONAL BANK Shelly M. Chandler, ATM Service Excellence Director, General Banking Group Distribution, WACHOVIA CORPORATION 3:30-4:00 NETWORKING AND REFRESHMENT BREAK IN EXHIBIT HALL 4:00 IN-STORE BANKING: THE FACTS, THE MYTHS AND THE FUTURE Of all retail banking channels, in-store banking continues to generate the most amount of impassioned debate. Some banks consider it to be the cornerstone of their sales culture development and distribution strategy, while others believe that it is a high cost method of transaction processing. Hear leading industry experts share their experiences with this channel, how in-store branches can become the sales and service champions of your organization and what banks can do to best leverage the unique and powerful relationship of partnering with retailers. Moderator: Maragret Kane,Chief Executive Officer, KANE BANK SERVICES Panelists: Wil Hileman, Executive Vice President, SUNTRUST Dave Martin, Executive Vice President, Chief Training Consultant, NCBS Andrew Mastorakis, Executive Vice President, Retail Banking TRI-COUNTIES BANK Shannon Nadasdy, Director, Financial Services, SAFEWAY 4:45 BEST PRACTICES FOR CONTACT CENTERS - Moving to a Voice over IP technology in financial services - The benefits, results and approaches for moving to an IP contact center - The impact IP has on geograpy and managing call traffic across the network Lydia Barron, Managing Director and Division Information Officer, Enterprise Contact Center Technology, WACHOVIA CORPORATION 8:00-8:15 CHAIRMAN’S RECAP OF DAY ONE 8:15 KEYNOTE ADDRESS How do you compete in an increasingly competitive, commoditized market? Narrow your focus, get personal and branch out. Freeman will discuss NetBank’s effort to build a big bank experience for its targeted customers using bytes and other people’s bricks. NetBank currently boasts the second largest bank-operated ATM network in the U.S. and an overnight deposit solution through the 3,900 locations of The UPS Store®. Doug Freeman Chief Executive Officer NETBANK 9:15 FEATURED ADDRESS In this session, you will learn about: - What makes TCF different - TCF Banks new branch expansion - What products and services work for them - Why TCF is the leader in convenience Mr. Neil Brown President and Chief Financial Officer TCF BANK 10:15-11:00 NETWORKING AND REFRESHMENT BREAK IN EXHIBIT HALL 11:00 OPERATIONALIZING BRANCH ENTREPRENEURSHIP Many organizations talk about “entrepreneurship” on the frontlines as a mechanism to deliver a differentiated experience and to implement “empowered behavior; however most have no way to harness the real power of entrepreneurship. It’s a nice idea with no real implementation roadmap. What’s in, what’s out? How can managers be entrepreneurs when they don’t “own” anything? This session will change you mind forever on what entrepreneurship can mean in your organization and how you can harness its power. Moderator: Darryl Demos Chief Executive Officer DEMOS CONSULTING Additional Panelists to be Announced 12:00 BEST PRACTICES FOR COMPLYING WITH FFIEC GUIDANCE ON AUTHENTICATION New FFIEC guidance stipulates that by YE2006, banks implement consumer authentication technologies that match online banking application risk. This panel will explore best practices for compliance with the guidance and will delve into; application risk assessment, authentication options, and building consumer confidence. Avivah Litan, Senior Analyst, GARTNER, INC. Additional Panelists to be Announced 12:45 CONFERENCE CONCLUDES 5:30-7:00 CONFERENCE CONCLUDES FOR THE DAY FOLLOWED BY A POOLSIDE RECEPTION www.sourcemediaconferences.com/conferences/Retail06 • 800-803-3424 • 212-803-6093 32% other SPONSORSHIP OPPOTUNITIES 68% Based on a stellar reputation for unparalleled Bank/Financial C-level interaction & premier content, Institution Symposium registrations grew 20% in 2005. The Best Practices in Retail Financial Services Symposium has been specifically designed to attract senior level bank executives. To find out how to customize a sponsorship/exhibit package which is most appropriate for your institution please contact Adam Dadich at 212 803 6089 or via email at adam.dadich@sourcemedia.com. EVENT SPONSORS Attendees Avaya designs, builds and manages communications networks for more than one million businesses worldwide, including more than 90 percent of the FORTUNE 500(r). Focused on businesses large to small, Avaya is a world leader in secure and reliable Internet Protocol (IP) telephony software applications, systems and services. Driving the convergence of voice and data communications with business applications - and distinguished by comprehensive worldwide services - Avaya helps customers leverage existing and new networks to achieve superior business results Demos Solutions applies the Art and Science of Workforce Optimization (SM) to improve the productivity of leading financial services companies in North America, Australia, Europe and Asia through its unique combination of hands-on consulting and workforce management technologies. Thirty-three percent of the top 100 North American bank branches are covered by Demos Solutions' leading-edge resource planning and scheduling tool, StaffSmart . For more information on Demos Solutions, please visit www.demossolutions.com. InSite is a new global industry resource that will change the way you look at your branches, and forever change the way you merchandise one. From concept through production to completion or any phase in between, InSite provides brand strategy, true retail concept development, branch design, value engineering and merchandising implementation. 26% Dir./AVP/Mgr. With a tradition of service, Kirchman sets the standard for innovative leadership in the banking industry. Helping banks create loyal customers is Kirchman’s core value. With more than 35 years of proven success, Kirchman continues its mission to provide software to better serve bank customers at the point of contact. 34% EVP/SVP/VP 4% CMO/CFO/COO Type of Institution 32% other 68% Bank/Financial Institution John Ryan helps banks capitalize on their greatest retailing asset: Millions of customer visits. We do this in two ways: Analyze each branch in order to target the right improvements in the right places; develop, deploy and manage a toolkit of low-cost, scaleable solutions (ranging from digital merchandising to in-branch events) designed to incite customer buying. EXHIBITORS 13% Pres/CEO 23% Other Attendees 23% Other 26% Dir./AVP/Mgr. 13% Pres/CEO 34% EVP/SVP/VP HYATT GRAND CHAMPIONS RESORT & SPA In this secluded 35-acre enclave, European style with 4% California ambience is complemented by a lush CMO/CFO/COO landscape of formal gardens and free-form pools. Here, guests are treated to lavish amenities including two 18-hole championship golf courses, the luxurious Agua Serena Spa and impeccable service in the European tradition. www.sourcemediaconferences.com/conferences/Retail06 • 800-803-3424 • 212-803-6093 REGISTER EARLY Last Year’s Symposium Sold Out! Best rates expire January 18th. Register online at: www.sourcemediaconferences.com/conferences/Retail06 February 26-28, 2006 Hyatt Grand Champions Resort & Spa Indian Wells, CA Payments Please make checks payable to “SourceMedia, Inc. C&E” and include the name(s) of the attendee(s) on the face of the check. We accept American Express, Diners Club, Discover, Visa, and MasterCard. Registration fees include all breakfasts, lunches, refreshment breaks, receptions and a copy of the conference workbook. Full Payment must be received 14 days prior to the event. Disclaimers We reserve the right to change or replace speakers without notice. Substitutions and Cancellations Substitutions may be sent at any time. All cancellations must be received in writing at least 14 days prior to the event in order to receive a refund or letter of credit. All refunds are subject to a $250 administration fee. No refunds or letters of credit are available later than 14 days prior to the event. Hotel Accommodations SourceMedia has secured a block of rooms at a special discounted rate. Be sure to mention that you are a SourceMedia event participant. Rooms will be available on a first come first serve basis. Please make your reservations by January 20, 2006. Venue: Hyatt Grand Champions Resort & Spa 44-600 Indian Wells Lane Indian Wells, CA 92210 Phone: 800 233-1234 760 341-1000 Web: grandchampions.hyatt.com Attire: Business Casual Room Rate: $265 Single/Double Ground Transportation Receive a 5% discount from Boston Coach as a SourceMedia, Inc. event participant. Call 800-672-7676. Mention account #31695. Reservations must be made in advance. Please call for pricing and reservations. 4 Easy Registration Methods ■ WEB ■ FAX ■ PHONE ■ MAIL www.sourcemediaconferences.com/conferences/Retail06 800-250-1811 or 212-803-8515 800-803-3424 or 212-803-6093 SourceMedia Inc., C&E PO Box 71911, Chicago, IL 60694 -1911 NAME: TITLE: COMPANY: ADDRESS: CITY: STATE: PHONE: FAX: ZIP: E-MAIL: CHARGE MY CREDIT CARD: ■ American Express ■ Diners Club ■ Discover ■ MasterCard CARD NUMBER: ■ Visa EXP. DATE: SIGNATURE: ■ Check Enclosed : Make checks payable to SOURCEMEDIA INC., C&E. OPTIONAL WORKSHOP Mail checks with completed registration form to: SourceMedia Inc., PO Box 71911, Chicago, IL 60694 -1911 February 26th 2:00-5:00 Ritz Carlton is a leader when it comes to exemplary service and style. Learn how your organization can create sustainable change, out-perform the competition and increase employee and customer loyalty. By the end of the session, participants will know and understand: -How empowerment leads to customer loyalty -How consistency leads to excellent customer service -Effective Human Resources, Training, and Organizational Effectiveness Processes Following this educational seminar, representatives from Financial Institutions who have both participated in this training and believe in the Ritz Carlton-Style, will come together in an open forum. This roundtable will discuss some of the beliefs and theories of this method, such as: -It's the little things that really matter -Alternative words to saying "No" -Take the customer there - don't send them there -Own the problem -Excellent customer service must be defined by the customer not the business -Everyone must be involved - Not just the front line but the back room as well SourceMedia One State Street Plaza, 27th floor New York, NY 10004 Registration Rates Quantity Expires 1/18/06 Early Bird 1 Expires 1/31/06 Early Bird 2 Subtotal Standard Banks & Financial _______ Institutions* $1,095 $1,195 $1,495 _______ All Others $1,495 $1,595 $1,695 _______ Optional Workshop $249 _______ The "Ask Tom" Dinner $50 TOTAL _______ *Bank: This rate applies to employees of FDIC insured commercial banks.