Statements on Management Accounting

BUSINESS PERFORMANCE MANAGEMENT

TITLE

Developing Comprehensive

Competitive Intelligence

CREDITS

This statement was approved for issuance as a

Statement on Management Accounting by the

Management Accounting Committee (MAC). The Institute

of Management Accountants (IMA) extends appreciation

to The Society of Management Accountants of Canada

(SMAC) for its collaboration in creating this SMA, and to

Robert A. Howell, DBA, clinical professor of management

accounting at Thunderbird—The American Graduate

School of International Management and president of

Howell Management Corporation, who drafted the manuscript. Representatives of the Consortium for Advanced

Manufacturing—International (CAM-I) contributed as well

to the project.

Published by

Institute of Management Accountants

10 Paragon Drive

Montvale, NJ 07645-1760

www.imanet.org

IMA offers special thanks to Randolf Hoist, SMAC

Manager, Management Accounting Guidelines, for his continuing oversight and to the members of the focus group

that helped shape the final document, including MAC

chairman Alfred M. King and MAC member Dennis C. Daly.

Copyright © 1996

Institute of Management Accountants

All rights reserved

Statements on Management Accounting

BUSINESS PERFORMANCE MANAGEMENT

Developing Comprehensive

Competitive Intelligence

TABLE OF CONTENTS

I. Rationale . . . . . . . . . . . . . . . . . . . . . . . 1

II. Scope . . . . . . . . . . . . . . . . . . . . . . . . . 1

III. Defining Competitive Intelligence

Programs . . . . . . . . . . . . . . . . . . . . . . . .2

IV. Objectives of Competitive

Intelligence Programs . . . . . . . . . . . . . . .3

V. The Role of the Management

Accountant . . . . . . . . . . . . . . . . . . . . . . .3

VI. The Competitive Intelligence Process . . . .4

VII. Tools and Techniques for Developing

Competitive Intelligence . . . . . . . . . . . . . .9

Strategic Analysis Techniques . . . . . . .10

Industry Classification Analysis . . . . . . .11

Core Competencies and

Capabilities Analysis . . . . . . . . . . . . . . .13

Resource Analysis . . . . . . . . . . . . . . . . .14

Future Analysis . . . . . . . . . . . . . . . . . . .15

Product-Oriented Analysis Techniques . .15

Reverse Engineering/Teardown Analysis . .15

Customer-Oriented Analysis Techniques .16

Customer Value Analysis . . . . . . . . . . .17

Value Chain Analysis . . . . . . . . . . . . . .19

Competitive Benchmarking . . . . . . . . . .21

Financial Analysis Tools . . . . . . . . . . . .22

Traditional Ratio Analysis . . . . . . . . . . .22

Sustainable Growth Rate Analysis . . . . .22

Disaggregated Financial Ratio Analysis . .24

Competitive Cost Analysis . . . . . . . . . .24

Behavioral Analysis Techniques . . . . . .25

Shadowing . . . . . . . . . . . . . . . . . . . . . .25

VIII. Implementing a Competitive

Intelligence Program . . . . . . . . . . . . . . .26

IX. Organizational and Management

Accounting Challenges . . . . . . . . . . . . . .30

X. Conclusion . . . . . . . . . . . . . . . . . . . . .31

Bibliography

Exhibits

Exhibit 1:

Exhibit 2:

Exhibit 3:

Exhibit 4:

Exhibit 5:

Exhibit 6:

Exhibit 7:

Exhibit 8:

Levels of Intelligence-Gathering . . .2

The Competitive Intelligence

Process . . . . . . . . . . . . . . . . . . . .5

Industry Life Cycles . . . . . . . . . .10

Marks & Spencer's Competitive

Advantage . . . . . . . . . . . . . . . . .13

Customer Value Triad . . . . . . . . .16

Customer Value Map:

Luxury Cars . . . . . . . . . . . . . . . .18

The Value Chain Concept . . . . . .20

Calculating Sustainable

Growth Rate . . . . . . . . . . . . . . .23

BUSINESS PERFORMANCE MANAGEMENT

I . R AT I O N A L E

For a number of years, many firms have focused

on the marketing principle of “knowing and

satisfying customers at a profit.” This focus has

led these firms to consider new customer opportunities, modify channels of distribution, develop

new products, and reorganize and restructure to

achieve these objectives.

In strong markets, such customer-focused actions

can and did lead to growth and profitability. Today,

these same firms realize that they cannot

increase growth and profitability without a strong

understanding of every aspect of their competitors’ business and activities.

Most companies have informally monitored their

competitors for some time. They know something

of their competitors’ management, markets and

customers, products and services, facilities,

technologies and finances. However, fewer firms

have applied their knowledge of their competitors

in a proactive, disciplined, systematic fashion to

achieve a competitive advantage.

Instead, what competitor intelligence they have

is often informal, scattered, anecdotal, and falls

far short of its potential value. Although considerable data may exist on market shifts, customer

needs, and competitors’ capabilities and

actions, few firms try hard enough to coordinate

such information into competitive intelligence

that they can act upon.

As the business world gets more competitive,

such informal information-gathering is no longer

adequate for proactive companies. With business

more complex and the economic climate so uncertain, these corporations are becoming far more

sophisticated at scrutinizing the competition.

They seek out more information, and spend more

time and effort analyzing it. As these companies

have discovered, an effective competitive

intelligence program is absolutely necessary for

success in today’s—and tomorrow’s—competitive

environment.

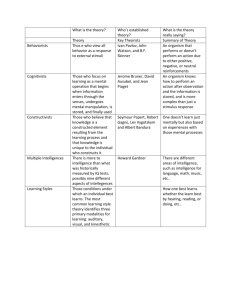

II. SCOPE

This guideline is primarily focused on competitor

analysis and synthesizing that analysis into competitive intelligence. Although broader intelligence

also must be done by an entity and is mentioned

in several places, this guideline is not about

broad business intelligence. Exhibit I suggests

a relationship between these three types of

intelligence-gathering—competitive analysis, competitive intelligence and business intelligence.

In Exhibit I, competitor analysis occupies the

bottom of the inverted pyramid because of its

narrow focus on an individual competitor profile.

A competitor profile is a package of information

about a specific competitor at a specific time.

The profile typically includes an overview of

a competitor, its key executives, important

markets and product lines, underlying operations

and technology, and financial performance. It

would include an analysis to enable a company

to interpret how the competitor’s strengths and

weaknesses, resource availability and strategic

direction would affect it.

In the middle of the pyramid, competitive

intelligence has a broader scope because it

assimilates all of the competitor analysis. At the

top of the pyramid is the broadest degree of intelligence-gathering, business intelligence, which

includes environmental scanning (including such

issues as economic conditions, social change,

technological developments, and political and

regulatory events); market research and analysis;

and competitive intelligence.

1

BUSINESS PERFORMANCE MANAGEMENT

E X H I B I T 1 : L E VE L S O F I N TE L L I G E N CE-G AT HE R I N G

EXHIBIT 1. LEVELS OF INTELLIGENCE-GATHERING

Broadest scope, including environmental

scanning, market research and analysis,

and competitive intelligence

Business

Intelligence

Broad scope, assimilating all of the

competitor intelligence

Competitive

Intelligence

Narrow focus on an individual competitor profile

Competitor

Analysis

The concepts, tools, techniques and implementation steps in this guideline apply to all

organizations that produce and sell a product or

service in a highly competitive environment,

as well as:

l

l

l

l

l

large and small organizations;

public and private entities;

enterprises in all business sectors;

all management levels; and

all levels of the firm.

This guideline will help management accountants and others:

l

l

understand how competitive intelligence

relates to the organization’s goals, strategies

and objectives;

explain the benefits of implementing a competitive intelligence process;

l

l

l

l

understand the steps required to implement

an effective competitive intelligence program;

understand the tools and techniques for conducting a systematic, formal and disciplined

competitive intelligence process;

appreciate the organizational and managerial

accounting challenges in implementing new

and improved competitive intelligence

approaches; and

broaden management awareness and obtain

support for a competitive intelligence effort.

I I I .D E F I N I N G C O M P E T I T I V E

INTELLIGENCE PROGRAMS1

Competitive intelligence programs are the

foundation on which organizational objectives,

strategies and tactics are built, assessed and

modified. They permit organizations to assess

both their industry life cycle and the capabilities

1 Much of this material is based on The Society of Competitive

Intelligence Professionals. 1993. Global Perspectives on

Competitive Intelligence.

2

BUSINESS PERFORMANCE MANAGEMENT

of current and potential competitors in order to

maintain or develop a competitive advantage.

Competitive intelligence programs provide input

for such decisions as which products, markets

and business lines to invest in and develop, which

to acquire or develop joint ventures around, and

which to divest themselves of or exit.

While there are many different ways of designing

and implementing competitive intelligence

programs, all have common elements:

l

l

l

l

l

competitive intelligence programs focus on

industries and on creating competitor profiles,

particularly identifying organizational and

performance implications of industry changes

and of competitors’ actions and reactions;

gathered data (many unorganized, disconnected

and unevaluated bits of input) become competitive intelligence (data that are organized and

evaluated so that a firm gains new, different

insights about its competition);

while individuals and/or units are formally

charged with intelligence responsibilities,

every organizational member is an intelligence

antenna;

competitive intelligence programs evolve to

address changing critical issues and to permit

organizational renewal; and

competitive intelligence programs are not

industrial espionage. Rather, they are the process

of gathering, analyzing and using publicly available data. Obtaining confidential competitive

information by nefarious means, and acting in

clearly unethical or even illegal ways, is not

competitive intelligence.

I V. O B J E C T I V E S O F C O M P E T I T I V E

INTELLIGENCE PROGRAMS

Organizations continually seek new ways to

achieve sustainable competitive advantage and

to counter aggressive competition. Proactive

organizations recognize the advantage to be

gained from an organized competitive intelligence program. In the Japanese semiconductor

industry, for example, large organizations such

as Mitsubishi, Mitsui, Sumitomo and Marubeni

maintain intelligence departments that rival the

U.S. Central Intelligence Agency in ability and

accuracy. In the U.S., competitive intelligence

programs are a popular tool among companies

such as IBM Corp., Texas Instruments, Inc.,

CitiCorp, AT&T Inc., U.S. Sprint, McDonnell

Douglas Corp., and 3M.

Organizations develop competitive intelligence

programs with the following objectives in mind:

l

l

l

l

to provide an early warning of opportunities

and threats, such as new acquisitions or

alliances and future competitive products and

services;

to ensure greater management awareness of

changes among competitors, making the

organization better able to adapt and respond

appropriately;

to ensure that the strategic planning decisions

are based on relevant and timely competitive

intelligence; and

to provide a systematic audit of the organization’s competitiveness that gives the CEO an

unfiltered and unbiased assessment of the

firms relative position.

V. T H E R O L E O F T H E M A N A G E M E N T A C C O U N TA N T

Competitive intelligence is a process of gathering

data, creating information and making decisions.

Management accountants are trained to gather

data, assimilate data into information and make

decisions based upon information, frequently

with their management counterparts.

3

BUSINESS PERFORMANCE MANAGEMENT

Competitive intelligence may also be viewed as a

competitiveness audit, a concept that management accountants are familiar with. Management

accountants’ training and experience make them

well-suited to the requirements of the competitive

intelligence process.

Management accountants may be actively

involved in introducing a competitive intelligence

process in several ways:

l

l

l

l

l

l

l

l

identifying the need for a new or improved

competitive intelligence process;

educating top management and other senior

managers about that need;

developing a plan along with cross-functional

team members for designing, developing and

implementing the new, improved competitive

intelligence practice, including its underlying

architectures;

identifying the appropriate tools and techniques

for conducting competitor analysis;

providing financial input, analysis and expertise

to the competitive intelligence effort;

contributing to and using competitive intelligence

in target costing;

ensuring that the competitive intelligence

efforts are tied to the firm’s goals, strategies,

objectives and internal processes, as appropriate; and,

continually assessing the new, improved competitive intelligence process and its implications

for the organization, and continually improving

the process.

VI.THE COMPETITIVE

INTELLIGENCE PROCESS

An effective competitive intelligence process allows

the appropriate members of a firm to actively and

systematically collect, process, analyze, disseminate and assimilate competitor information so

that they can respond appropriately.

There are many approaches to creating competitive intelligence. Corporate experience suggests

that several elements are critical to an effective

intelligence process. These include:

l

l

l

l

l

l

l

define the business issue(s);

determine the sources of competitive data;

gather and organize the data;

produce actionable intelligence;

communicate results and findings;

provide input into the strategic planning

process; and

provide feedback and re-evaluate.

A model of the steps of the typical competitive

intelligence process is illustrated in Exhibit 2.

The following paragraphs describe each of

the steps.

Define The Business Issue(s)

The first step of a competitive intelligence

process is to define the business issue(s). What

kind of intelligence is expected and for whom?

How will they use the competitive intelligence?

When do they need it?

Surveying senior management to determine the

subject and purpose of the needed information

makes it more likely that the information will be

collected systematically, with priorities set by the

users of the data and not its producers.

Examples of typical business issues are:

l How can our product or service be differentiated? How can we add customer value by doing

something better than or different from our

competitors? How can perceived quality be

enhanced?

l Can we employ synergy, focus or a preemptive

move to gain advantage?

l What alternative growth directions should be

considered? How should they be pursued?

4

BUSINESS PERFORMANCE MANAGEMENT

EXHIBIT 2: TH E COMPETITIVE INTELLIGENCE PRO CESS

EXHIBIT 2. THE COMPETITIVE INTELLIGENCE PROCESS

PLAN

DO

CHECK

ACT

Define

the Business

Issue(s)

Determine

Sources of

Competitive

Data

Strategic

Planning

Process

Strategic

Intelligence

Gather/

Organize

the Data

Produce

Actionable

Intelligence

Tactical

Intelligence

Communicate

Results &

Findings

Data

l

l

Information

What investment level is most appropriate for

each market?

What strategies best suit our strengths, objectives

and organization?

Tactical intelligence focuses on business issues,

such as the competitor, customer and supplier

actions, that can have an impact on the business

today, next month and next quarter. Such intelligence is usually developed at the business unit

or business sector level.

In contrast, strategic intelligence helps steer

the overall direction of the business. Strategic

intelligence, though often fed by tactical information, should come from the senior levels of the

company.

Provide

Feedback

Re-evaluate

Intelligence

Determine the Sources of Competitive Data

After the business issues have been identified

and the project delineated, the key sources of

competitive data can be identified and utilized,

which typically include:

l

l

l

l

internal staff;

published information;

third-party interviews; and

commissioned research.

Internal Staff—Data that most organizations

already possess about their competitors is often

important. According to some estimates, a firm

already possesses as much as 80 percent of

what it would ever need to know. For example,

marketing, sales and service staff are always

aware of market behavior and trends, and of how

competitors are creating them or usually

5

BUSINESS PERFORMANCE MANAGEMENT

responding to them. The distribution function

comes into contact with intermediaries in distribution channels. Production managers might see

competitors at capital equipment trade shows;

design and development personnel may

encounter competitors’ technical staff at professional meetings; and finance and accounting

staff might see their counterparts at conference

or seminar presentations that provide potential

insights. But because these data are usually

dispersed throughout the organization or are not

integrated or are not timely enough, most firms

underutilize or even miss them.

Published Information—Plenty of published

information about competitors might already be

gathered throughout a firm but not yet integrated.

For example, mandatory financial filings such as

annual reports and Securities Exchange

Commission filings are readily available. If a

competitor has an active public information

office, the company might produce a lot of material

that provides useful insight. Clipping services

can be utilized to glean articles appearing in the

trade press. Patents and technical articles written

by competitors’ staff members can signal their

technical direction. For example, Intel monitors

competitors’ progress in developing eight-inch

silicon wafers by keeping track of scientific literature. Intel staffers in Tokyo and California sift

the thousands of technical papers published in

Japan each year and translate the most interesting

into English. As well, security analysts’ reports

may provide third-party perspectives on a competitor’s performance, position and likely direction.

Dispersed throughout an organization, these

kinds of information may tell little; compiled,

integrated and analyzed, they might present a

much clearer picture.

Third-Party Interviews—Organizations regularly

contact external groups and individuals that also

encounter its competitors. Customers are the most

obvious, direct and useful example. If customers

have been approached by competitors, they will

likely share new insights about the competitors’

efforts with their original supplier. Similarly, competitors’ customers might share information about

the perceived advantages provided by competing

companies’ products and services. Other useful

third parties include distributors who carry or are at

least aware of competitors’ products and services;

common suppliers or suppliers who might have

been approached by the competition; former

employees of competitors; trade associations;

trade press; and financial analysts.

Commissioned Research—Instead of collecting

their own data, some organizations buy information from market research companies. Small

market research firms can provide a wealth of

continuous information about publicly held

companies for a modest fee ($3,000 - $5,000

annually). Most of this information is either in

the public domain or regularly reported in the

financial press and includes: patents filed,

lawsuits, new plants or plant expansions and

closings, biographical information on company

executives, overall or individual product sales

data, new product announcements, etc. A case

can be made for using outside research as

insurance alone, even if the small or mediumsized company is doing some of its own

competitive research. Senior executives preoccupied with operating matters stand a good

chance of missing important items. In addition,

they cannot assume that they will always find out

what is going on in the marketplace from their

own people.

Gather and Organize the Data

It is important to organize competitive data so

that they can be logically stored and retrieved.

One useful framework includes a major category

6

BUSINESS PERFORMANCE MANAGEMENT

for broad industry data, another for data collected

on each competitor being tracked, and a third for

competitive data that relate to specific areas

that management is particularly concerned

about in its own firm.

For the industry database, organizations typically

track the forces that influence industry performance and prospects, including economic

conditions, social change, technological developments, legislation and regulations, customer

buying patterns and supplier trends. Industry

sales, industry concentration and relative market

share in all product markets, operating profits,

after-tax profits, return on assets and other

financial performance measures should also be

monitored. The resulting system should permit

a company to monitor changes in industry

structure and attractiveness, ensuring that it can

continually capture and track relevant data.

The next level of data in the competitive intelligence system usually relates to the specific

competitors that are being tracked. The intent

is to develop a comprehensive profile of the

particular competitor. This kind of information

includes a general description of the competitor;

a timeline of the critical events in its history;

key executive profiles; issues of organization,

management style and culture; the company’s

approach to markets and key customers; an

explanation of the company’s businesses, product

lines and products; R&D and technology performance and direction; manufacturing operations;

thorough financial analysis; and other critical

information or issues that provide additional

insight or understanding of the competitor.

More and more companies are taking aggressive

approaches to data collection. For example,

Kodak maintains a database of news articles

and summaries of competitive studies available

to any employee in its network. Abbott

Laboratories distributes competitive report

forms to generate intelligence gathered from

corporate reports. Hewlett-Packard has established a network of e-mail contacts to collect

critical information.

There probably are some critical success factors

that relate to a specific industry—quick

response to customer needs, new product

development performance, low-cost operations,

financial acumen—which drive an industry’s and

individual firm’s success. These critical areas

should receive particular attention as the data

are being gathered and disseminated. At the

same time, organizations must be careful not

to focus so exclusively on the perceived critical

success areas that they overlook other emerging

important areas.

For example, it is critical that organizations do

not spend all of their time gathering data about

current competitors. They also need to allocate

some time to looking at who their competitors

might be in five years. By doing so, organizations

may be able to prevent their potential competitors

from gaining a foothold.

Produce Actionable Intelligence

After all of the data have been gathered, an

important step is to check and verify these data

with both line and staff managers. Obtaining

their acceptance before proceeding to the next

step avoids having the data support conclusions

that line or staff managers oppose. If they have

accepted the data, these people will usually be

less able to resist their logical implications. For

example, at Southwestern Bell, management

requires all non-published information to be

considered mere rumors—unless it can be

independently verified. Once verified, the data

can be analyzed.

7

BUSINESS PERFORMANCE MANAGEMENT

Criteria for evaluating whether the organization

can act upon its competitive intelligence are:

l

l

l

l

l

l

l

Have the conclusions been challenged and

tested?

Have the underlying assumptions, uncertainties

and limitations been identified?

Have implications been developed?

Are the data presented in an effective format

for planning?

Do they meet users’ needs?

Have alternative findings/views been identified?

Can management act while there is still time

to make a difference?

Communicate Results and Findings

Disseminating competitive intelligence closes

the loop between those who collect and analyze

competitive information and those who use it to

make decisions.

There are several ways of presenting and disseminating competitive intelligence throughout a

firm. One way is to gather all such information

into a competitor profile report for distribution

throughout the organization, in part or in whole,

on a need-to-know basis.

A more dynamic approach is to create a competitive intelligence center for maintaining and

updating information about competitors and

about the firm’s own competitive intelligence

efforts. Appropriate executives can then convene

meetings and hold discussions based on the

competitive information presented.

Some companies hold periodic competitive debriefings for senior management in order to discuss the

firm’s principal competitors, their performance, their

possible actions and the implications for the firm.

These gatherings utilize both reports and presentations to stimulate discussion and response.

The key to successful communication of intelligence is to focus on the competitive issues that

matter most, and on how to gather and apply the

information to quickly and expediently address

these issues.

For example, Coming and Xerox will reverseengineer a competitor’s product and then

communicate the findings to a broad audience,

knowing that an engineer will use the resulting

intelligence differently than will a marketer.

Corning’s management realizes that the entire

corporation will benefit from the information in

the end. When Kraft realized that much of its

competitive data was squirreled away throughout

the corporation, it decided to audit and index

these “hidden” resources so all managers could

benefit from them. Canon knows that much of

its market knowledge lies outside Japan and

has decided to translate critical technical and

competitor information into Japanese, thus making

it accessible to all company management.

Provide Input into the Strategic

Planning Process

Strategic planning is an integrative activity. It

pulls together information from throughout the

organization, and, at its best, helps create a

cohesive direction for the organization. Unless

competitive intelligence becomes one of the

key components of strategic planning, the intelligence process will have failed to achieve its

purpose or to justify the necessary investment.

What organizations need is a concise version of

what the data say and mean. Beyond simply

regurgitating public data, the analysis must

extend into original research and assess the likely effects of the data on business strategy.

By providing management with implications and

strategic alternatives, competitive intelligence

8

BUSINESS PERFORMANCE MANAGEMENT

can be effectively integrated into the strategic

management process.

Provide Feedback and Re-evaluate

A key feature of an effective competitive intelligence process is its feedback mechanism.

Users need to evaluate the relevance, timeliness

and comprehensiveness of the material.

Feedback often helps clarify users’ needs, identify missing information and suggest new areas

of investigation.

VII. TOOLS AND TECHNIQUES

FOR DEVELOPING COMPETITIVE

INTELLIGENCE

Just as competition has increased for most firms

during the past 50 years, so there has been an

evolution of thought, practice, and tools and

techniques that support competitive intelligence

efforts. These tools and techniques can be

categorized as strategic, product-oriented,

customer-oriented, financial and behavioral.

Strategic Analysis Techniques

Companies typically make superior profits either

by entering a profitable industry or by establishing a competitive advantage over their rivals.

Their strategy is usually defined by the answers

to two basic questions: “Which business should

we be in?” and “How should we compete?”

The answer to the first question defines corporate

strategy, which addresses issues such as diversification, vertical integration, entry and exit, and

the allocation of resources within a diversified

corporation. It emphasizes an in-depth understanding of the market, particularly of competitors

and customers. The goal is not only to gain

insight into current conditions but to anticipate

changes that have strategic implications.

The answer to the second question defines business strategy, or how the firm will compete within

a specific industry or market. If the firm is to win,

or even survive, it must adapt a strategy that

establishes a sustainable competitive advantage.

Strategic analysis has evolved significantly during

the past 30-40 years, in many respects as competition has strengthened and become more

global. Although the strategic analysis tools and

techniques may have originally been developed

to be used within a firm, many are equally

applicable for competitive analysis. Tools and

techniques that formerly were primarily internally

focused have been turned around to focus more

explicitly on the external environment and to

analyze competitors in the same way that a firm

would analyze and evaluate itself.

Organizations use several strategic analysis

techniques in developing competitive intelligence

for their corporate and business strategies.

Besides helping select the correct strategy,

these techniques provide a framework for rational

discussion of alternative ideas and the means to

communicate the strategy throughout the organization. Some of these techniques are:

l

l

l

l

industry classification analysis;

core competencies and capabilities analysis;

resource analysis; and

future analysis.

Industry Classification Analysis

The ability to identify an industry with a group of

similar industries helps organizations to better

understand the nature of their competition and the

sources of competitive advantage in an industry.

Industry classification analysis is a valuable

technique for revealing similarities among industries and for highlighting crucial differences. As

9

BUSINESS PERFORMANCE MANAGEMENT

EXHIBIT 3: INDUSTRY LIFE CY CLES

EXHIBIT 3. INDUSTRY LIFE CYCLES

Growth

Maturity

Decline

Industry Sales

Introduction

Time

such, industry classification is a valuable tool for

developing competitive intelligence.

One key basis for classifying industries is maturity.

Industries typically follow a life cycle that comprises

a number of evolutionary characteristics common

to different industries. The industry life cycle is the

industry equivalent of the product life cycle.

To the extent that an industry produces a range

and sequence of products, an industry life cycle

will likely last longer than that of a single product.

Four stages are typically defined as:

l

l

l

l

introduction;

growth;

maturity; and

decline.

The life cycle and the stages within it are defined

by changes in an industry’s growth rate over

time. The characteristic profile is that of an

S-shaped growth curve as shown in Exhibit 3.

In the introduction stage, the industry’s products

are little known, there are a few pioneering firms

and a few pioneering customers, and market

penetration is initially slow. During the growth

stage, diffusion of information about the products

causes accelerating market penetration. In the

maturity stage, the market approaches saturation, demand shifts from new customers to

replacement demand, and the rate of growth of

industry sales slows. Finally, as the industry

becomes challenged by new industries that

produce technologically superior substitute

products, the industry enters its decline stage.

10

BUSINESS PERFORMANCE MANAGEMENT

The duration of the various phases of the life

cycle varies considerably from industry to industry.

For example, the life cycle of the railroad industry

extended for about 100 years from 1840 before

entering its declining phase. The first Apple

personal computers were assembled in 1976.

By 1978, the industry was in its growth phase

with a flood of new and established firms entering

the industry. Toward the end of 1984, the first

signs of maturity appeared: growth stalled,

excess capacity emerged, and the industry

began to consolidate around a few companies.

Some industries may never enter a declining

phase. For example, industries supplying basic

necessities such as residential construction,

food processing and clothing are likely to remain

mature but are unlikely to enter prolonged

decline. Some industries may experience a

rejuvenation of their life cycle.

Although the life cycle is a common technique of

industry classification used in strategic analysis,

numerous other approaches to classification are

possible. Industries can be classified by type of

customer (producer-good and consumer-good industries); by the primary resources used to compete

(technology-based, marketing-based, or professional

skill-based industries); or by the geographic scope

of the industry (local, national or global).

The critical issue in evaluating the usefulness of

any means of industry classification is whether it

can offer insights into similarities and differences among industries for the purposes of

formulating competitive intelligence corporate

and business strategies.

Core Competencies and Capabilities Analysis

Industry classification analysis is well suited to

describing the what of competitiveness, or what

makes one firm or one industry more profitable

than another. Also, understanding the particulars

of competitors’ costs, quality, customer service

and time to market advantages may still leave the

question of why largely unanswered. For example,

why do some companies seem able to continually

create new forms of competitive advantage while

others seem able only to observe and follow? Why

are some firms competitive advantage creators

and others advantage imitators?

There is a need not only to keep score of existing advantage—what they are and who has them

—but to discover the engine that propels the

process of advantage creation. The tools of

industry and competitor analysis are much better

suited to the first task than to the second.

Thus, while it is entirely appropriate to have a

strong end-product focus, this approach should

be supplemented by a core competence focus.

For competitive intelligence purposes, organizations should be viewed not only as a portfolio of

products or services, but also as a portfolio of

core competencies.

Core competence represents the consolidation

of company-wide technologies and skills into a

coherent trust. The key to strategic management

can be management of core competencies rather

than business units, because the sustainable

competitive advantage of business units derives

from core competencies.

According to Prahalad and Hamel (1994), companies possess no more than five or six fundamental competencies. These competencies contribute disproportionately to customer-perceived

value, are competitively unique and can be

applied to various product areas.

For example, consider the core competencies

of Sony in miniaturization, 3M in sticky-tape

11

BUSINESS PERFORMANCE MANAGEMENT

technology, Black & Decker in small motors, and

Honda in vehicle motors and power trains. Each of

these competencies underlies several business

units. NEC has developed fundamental capabilities in several technical areas (semi-conductors,

computing and telecommunications) that it can

combine and recombine in order to achieve an

advantage over competitors that lack similar

fundamental competencies.

A core capability is oriented not to products but

to processes. Thus, a company gains a significant

competitive advantage in its mainstream business

process or processes. In appraising core capabilities, what is important is not just current

competencies in existing activities but a firm’s

potential to expand, develop and redeploy its

core capabilities.

One frequently cited example is Wal-Mart. This

retailer knows exactly which merchandise items

and how many of each have been sold in each of

its stores daily. This information is fed back

through the company’s information system to its

suppliers. The suppliers can rapidly ship replacement merchandise through Wal-Mart’s distribution systems in order to avoid losing out on

sales. This highly effective and efficient supplierto-–customer chain makes it difficult for WalMart’s competitors to compete effectively.

Competencies and capabilities represent two

different but complementary dimensions of an

emerging paradigm for corporate strategy. Both

concepts emphasize “behavioral” aspects of

strategy, unlike traditional structural models.

But, while core competence emphasizes technological and product expertise at specific points

along the value chain, capabilities are more

broadly based and encompass the entire value

chain. Capabilities are visible to the customer,

unlike core competencies. The combination of

core competencies and capabilities can give a

firm an important competitive advantage.

Developing competitive intelligence based solely

on an analysis of competitor core competencies

and capabilities, however, may not suffice. By

themselves, core competencies and capabilities

fail to explain the management of core and secondary processes, structure and culture. For

example, 3M might have developed non-woven

technology as a core competency, but not enough

to make it a product leader in tapes and soap

pads. Likewise, suggesting that Wal-Mart’s success stems solely from its logistics competence

is simplistic; success is usually multifaceted.

Resource Analysis2

Developing competitive intelligence based on

analyzing core competencies and capabilities

may overlook some important ways in which

organizations develop diversification strategies

that make sense. For example, core competencies

and capabilities assume that the roots of competitive advantage are inside the organization and

that the adoption of new strategies is constrained

by the current levels of a firm’s resources.

A resource-based framework combines the internal

analysis of phenomena within organizations with

the external analysis of their industry and their

competitive environment. The resource-based

framework analyzes organizations as distinct

collections of physical assets (such as plants or

equipment) and intangible resources (such as

brand names or technological know-how).

Thus, competitive advantage is attributed to the

ownership of a valuable resource that enables

the organization to perform activities better or at

a lower cost than its competitors. Marks and

2 Much of this material is based on Collis and Montgomery

1995.

12

BUSINESS PERFORMANCE MANAGEMENT

Spencer, for example, possesses a range of

resources that yield it a competitive advantage in

British retailing. This is illustrated in Exhibit 4.

It is important for organizations to avoid analyzing

resources in isolation since their value is

determined in the interplay with market forces. A

resource that has a value in a particular industry

or at a particular time might not have the same

value in a different industry or time.

These are:

l

l

l

For a resource to qualify as the basis for an

effective strategy, a number of questions should

be asked about its value in the external market.

Is the resource difficult to copy? Inimitability is

at the heart of value creation because it limits

competition. If a resource is inimitable, then

any profit stream it generates is more likely to

be sustainable.

How quickly does this resource depreciate?

The longer lasting a resource is, the more

valuable it will be.

Who captures the value that the resource

creates? Not all profits from a resource automatically flow to the organization that “owns”

the resource. Typically, the value is subject to

EXHIBIT 4: MARKS & SPENCER’S COMPETITIVE ADVANTAGE

EXHIBIT 4. MARKS & SPENCER’S COMPETITIVE ADVANTAGE

Resource

Tangible

Intangible

Capabilities

+

+

+

+

+

Competitive Advantage

in Great Britain

Freehold locations

1% occupancy costs versus a

3% to 9% industry average

Brand reputation

Customer recognition with

minimal advertising

No promotional sales

Employee loyalty

Lower labor turnover

8.7% labor costs versus 10%

to 20% industry average

Supplier chain

Lower costs and higher

quality of goods sold

Managerial judgement

Fewer layers of hierarchy

Source: Collis and Montgomery, 1995.

Source: Collis and Montgomery, 1995.

13

BUSINESS PERFORMANCE MANAGEMENT

l

bargaining among customers, distributors,

suppliers and employees.

Can a unique resource be replaced by a different

resource?

The best of a firm’s resources are often intangible,

not physical. Hence the current emphasis on the

softer aspects of corporate assets—the culture, the

technology and the transformational capabilities.

Future Analysis

Developing competitive intelligence about current

markets and industries is certainly useful. Just

as important are thoughtful inquiries about

events and forces that will determine the future.

The question that goes unasked at many

organizations is: What emerging trends and

unanticipated developments could reshape our

business? Forecasts might offer early warnings,

but some firms allow the process to become

nothing more than an exercise in extrapolating

recent history. While the notion that the future

will be more or less like the past can be comforting,

simple projections of the present are often well

off the mark.

Hamel and Prahalad (1994) suggest that effective

future analysis involves more than good scenario

planning or technology forecasting, though

scenarios and forecasts are often useful building

blocks. Nor is it about developing contingency

plans around a few most likely scenarios. For

example, in unstructured industries the number

of future permutations is so great that any traditional scenario-planning process would be hard

pressed to represent the range of potential outcomes. Whereas scenario planning may be

useful for considering the consequences of oil

price changes, it may not be much help finding

the first winning applications for interactive

television or entirely new applications for genetic

engineering.

Future analysis asks critical questions about the

future, such as:

l

l

l

l

l

Which customers will be served in the future?

Through what channels will customers be

reached in the future?

Who will be competitors in the future?

What will be the basis for the firm’s competitive

advantage in the future?

What skills or capabilities will make the firm

unique in the future?

Future analysis enables decision-makers and

planners to grasp the long-term requirements to

sustain competitive advantage.

Apple Computer is an example of a company that

demonstrated substantial ability in the area of

future analysis. In the 1970s, it looked

forward to a world with “a computer for every

man, woman, and child.” This was at a time when

computers were most often found in specially

built rooms deep in the bowels of corporate

office buildings, and the idea of a kid having a

computer was laughable. The result was the

Apple II, the first truly successful mass-market

computer, which was introduced in 1977, four

years ahead of the IBM PC.

The significant Japanese quality advantage in

the North American automobile market is

attributable to effective future analysis.

Japanese car makers did not start out with a

quality advantage. Japanese auto companies

realized decades ago through their competitive

intelligence that new and formidable competitive

weapons would be needed to beat U.S. car

companies in their home market. The new

weapons they set about developing were quality,

cycle time and flexibility. Twenty years later,

Toyota’s foresight had become GM’s implementation priorities.

14

BUSINESS PERFORMANCE MANAGEMENT

Product-Oriented Analysis Techniques

The pursuit of a sustainable advantage is typically

the focus of corporate strategy. But advantages

last only until competitors have duplicated or

outmaneuvered them. Protecting advantages

has become increasingly difficult. Once the

advantage is copied or overcome, it is no longer

an advantage. It is now a cost of doing business.

Ultimately, innovators are only able to exploit

their advantage for a limited time before

competitors launch a counterattack. Then the

original advantage begins to erode and a new

initiative is needed.

Over time, organizations are forced to shift their

cost (and price) and quality positions. Industries

readjust their minimum acceptable level of quality

and maximum acceptable price required to be a

player in the marketplace.

Revolutions in quality raise standards, and then

new revolutions shatter those standards.

Innovations in product or process technology

drive dramatic improvements in quality or reductions in cost. Since these cycles of change are

growing progressively shorter, it is important for

firms to regularly and systematically monitor

competitors’ products.

One product-oriented intelligence technique that

some companies have used for years and that

more companies are emulating is reverse

engineering/teardown analysis.

Reverse Engineering/Teardown Analysis

Using reverse engineering/teardown analysis,

a firm acquires competitors’ products, then

dismantles them in an attempt to understand

their components, how they were made, what

manufacturing processes and equipment were

involved, and their quality characteristics and

cost estimates. Done well, this technique helps

organizations understand competitors’ products

and processes.

Both Xerox and Chrysler have successfully

deployed reverse engineering/teardown analysis.

During the late 1970s and early 1980s, Xerox

faced fierce competition from lower-priced, higherquality Japanese copiers made by such manufacturers as Canon and Ricoh. Xerox tore down and

analyzed those competitors’ products, and

learned how they were designed, developed and

produced. Xerox was able to demonstrate its

own shortcomings and establish a plan to regain

leadership of the copier market.

Similarly, Chrysler acquires competitors’ automobiles, then slowly and deliberately tears them

down. By studying the product, the company

gains new insights from Toyota, Honda, Ford and

other leading competitors. For example, Chrysler

placed greater emphasis on noise abatement,

an area in which several Japanese car manufacturers have outperformed the company.

One criticism of reverse engineenng/teardown

analysis is that the technique fails to account for

differences in the competitor’s manufacturing

process. These differences significantly alter

how the product is manufactured and, as a

result, its costs. Suppose a firm uses a traditional,

functional manufacturing process while its

competitor utilizes a flow-oriented, just-in-time

process. Any assumptions that the firm makes

about manufacturing processes and costs may

be invalid.

Many companies have traditionally limited their

use of reverse engineering/teardown analysis to

manufacturing in order to understand bills of

material, manufacturing processes and their

related product costs. Some companies now

take a broader cross-functional approach to com-

15

BUSINESS PERFORMANCE MANAGEMENT

EXHIBIT 5: CU STOMER VA LU E TRIAD

EXHIBIT 5. CUSTOMER VALUE TRIAD

Competition

Customer

Value

Price

Product

Quality

Service

Quality

Source: The Society of Management Accountants of Canada. 1995.

Monitoring Customer Value. Hamilton, ON: The Society of Management Accountants of Canada.

Source: The Society of management Accountants of Canada. 1995. Monitoring Customer Value.

Hamilton, ON: The Society of Management Accountants of Canada.

petitor product analysis. They hope to better

understand a competitor’s total value chain,

including design and development, material

sourcing versus in-house manufacturing, the

nature of the manufacturing process, distribution,

sales, product quality and field service implications.

Customer-Oriented Analysis Techniques

An important success factor for firms is the

ability to deliver better customer value than the

competition. Customer value can usually be

achieved only when product quality, service

quality, and value-based prices are in harmony

and exceed customer expectations. This is

illustrated in Exhibit 5.

Failing to meet customer expectations in any

of the three areas leaves organizations in a

situation of not having delivered good customer

value. For example, if an organization offers poorquality products or poor-quality service, then the

price should fall. If an organization sets a price

too high for a given level of product and service

quality, sales should suffer. Providing great

product quality and poor service quality will not

maximize customer value.

There are many examples of firms that paid dearly

for neglecting this point. For example, in the

early ‘80s, Xerox had problems with two of the

three areas of the customer value triad. The

quality of Xerox copiers did not deteriorate; in

16

BUSINESS PERFORMANCE MANAGEMENT

fact, there were product improvements and new

product introductions while market position

was declining.

that is relevant. Knowing how well a competitor is

achieving customer value requires assessing that

competitor’s customers.

However, the relative quality of Xerox copiers

compared to competitive products was declining.

Competitors not only closed the technological

gap but also passed Xerox in some product lines

and created a technological gap of their own.

Since the relative quality of Xerox copiers had

deteriorated, there was no longer any justification for premium prices. Customers exercised

their economic power and bought the products

that represented the best value.

There are a number of customer value monitoring

tools and techniques including customer contact,

customer value surveys, customer value analysis

and customer value management.

The result for Xerox was a 50 percent loss of

market share and a $500 million decline in profits.

Once Xerox corrected the problems and maximized customer value, it regained a leadership

position in the industry.

Organizations use several competitive intelligence

techniques to help them determine how they are

delivering customer value relative to their competitors. Some of these techniques are:

l

l

l

customer value analysis;

value chain analysis; and

competitive benchmarking.

Customer Value Analysis

In many markets, customers take low price and

high quality for granted. The current battlefield in

sophisticated markets, and the next one in

developing markets, is superior customer value.

Understanding where one’s competitors stand in

terms of providing superiorcustomer value is a

critical aspect of competitor analysis and

competitive intelligence.

Since customers determine anticipated benefits

and costs, it is the customer’s perception of each

Customer contact can be reactive, when the

customer initiates contact with the supplier

organization, by contacting a salesperson or by

phoning or writing to a customer service department; or proactive, when the organization initiates

the contact to obtain advice and information that

might not show up through customer inputs.

Customer value surveys are more formal

processes used to understand customer value.

For example, Roadway Express conducts quarterly

telephone surveys of 1,000 randomly selected

users of long-haul and less-than-truckload services

with the goal of understanding customer satisfaction and quality service from the customer’s

perspective. The interview centers on five significant dimensions: capabilities to perform the

service, competitive pricing, interactions

between the customer and the transportation

supplier, transit times and a general comfort

level with the transportation company. Companywide regional and local performance are

compared and contrasted.

Customer value analysis is a more formal

process utilizing a set of tools to better understand markets and customers. Applied to a

competitor’s customers it can provide significant

insight into how well a competitor is achieving

customer value.

For example, one important customer value

analysis technique is a customer value map.

17

BUSINESS PERFORMANCE MANAGEMENT

Organizations use customer value maps to

illustrate how a customer decides among

contending suppliers. It shows which companies

might be expected to gain market share and

why. Suppliers usually gain market share when

their relative quality performance is superior

and their relative price point is lower.

the relative price information was derived using

a market-perceived price profile methodology.

Running from the lower left on the customer

value map to the upper right is the fair-value line,

which indicates where quality is balanced

against price. Competitors below and to the right

of the line are in a strong share-gaining position.

Competitors above and to the left of the line are

in a share-losing position.

An organization can use its customer value map

to compare itself to competitors and to compare

the value positions of each of its internal

businesses. Exhibit 6 shows a customer value The Lexus LS 400 is considered to have higher

map for one set of competitors. This exhibit performance but also higher price; the Acura

combines relative quality and price information Legend, lower performance and lower price. The

on a two-dimensional, four-box grid. Using the Lexus LS 400’s higher performance relative

BMW 5-Series as the baseline, luxury cars are to its higher price actually makes it a better

compared to the two dimensions of performance customer value than the BMW 5-Series. The

and price. The relative performance information Acura’s combined lower performance and lower

comes from E

aX

Consumer

rating

H I B I T Reports

6 : C US

T Oscheme;

M E R VAprice

LU Emake

M AitPa: poorer

L UX Ucustomer

RY C Avalue.

RS

EXHIBIT 6. CUSTOMER VALUE MAP: LUXURY CARS

Higher

Inferior

customer value

Fair-value

line

Relative price

1.25

BMW

5-Series

1.00

Lexus

LS 400

Lincoln

Continental

Acura

Legend

0.75

Lower

60

Superior

customer value

80

100

Relative performance: Overall score

Information for relative performance based on Consumer Reports ratings, April 1993.

Source: Gale, 1994.

Source: Gale, 1994.

18

BUSINESS PERFORMANCE MANAGEMENT

Customer value management is the idea that

as much data as can be gathered about

one’s customers need to be brought together,

brought alive, and made an integral part of

the management process and used to drive

organizational behavior.

For example, a company that has always understood that firms succeed by providing superior

customer value is Milliken & Co. A key reason

Milliken achieves quality leadership and premium

prices in an amazingly wide array of niches is

because, since 1985, it has regularly deployed a

systematic measurement of customer satisfaction and customer-perceived quality relative to

competitors for all of its fifty-plus business units.

It tracks such things as lead time, on-time delivery,

order-fill rate, etc. Milliken executives use the

information in two ways—to create pressure to

improve and to provide insights on how to do so.

Business-unit managers use their data to align

Milliken’s products, services and processes ever

more closely to the marketplace.

Value Chain Analysis

The idea of a value chain was first suggested by

Michael Porter (1985) as a way of presenting the

building of value (as related to the end customer) along the chain of the activities that go to

make up the final offering to the customer.

Porter describes the value chain as the internal

processes or activities a company performs “to

design, produce, market, deliver and support its

product.” He further states that “a firm’s value

chain and the way it performs individual activities

are a reflection of its history, its strategy, its

approach to implementing its strategy, and the

underlying economics of the activities themselves.”

John Shank and Vijay Govindarajan (1993)

describe the value chain in broader terms than

does Porter. They state that “the value chain for

any firm is the value-creating activities all the

way from basic raw material sources from component suppliers through to the ultimate end-use

product delivered into the final consumers’

hands.” This description views the firm as part of

an overall chain of value-creating processes for

the end customer.

The value-creating processes within a firm

(e.g., R&D, design production, etc.) and the larger

value chain for its industry are illustrated

in Exhibit 7.

Value chain analysis is used by organizations to

develop an understanding of the sources of

competitive advantage in a particular industry,

as well as to assess their own unique

competitive position in providing customer

value. For example, the value chain can be a

useful competitive intelligence framework for

disaggregating a firm into distinct activities

in order to identify:

l

l

l

l

l

factors that determine the costs of performing

different activities and their relative importance;

why a firm’s costs differ from those of its

competitors, and vice-versa;

which activities a firm and its competitors

perform efficiently or inefficiently;

how costs in one activity influence costs in

another activity; and

which activities a firm or its competitors

should undertake itself and which activities

it should contract out.

By analyzing how a firm or a competitor creates

value for customers and by systematically

appraising how each activity helps differentiate

the company, the value chain permits an organization to match demand- and supply-side

sources of differentiation advantage.

19

BUSINESS PERFORMANCE MANAGEMENT

VALUE

E X HEXHIBIT

I B I T 7 :7.T THE

H E VA

L U E CHAIN

C HA I NCONCEPT

C ON C E PT

Industry Value Chain

Firm X

Firm Y

Supplier

Value Chain

R&D

Firm Z

Value Chain

Design

Distribution

Value Chain

Production

Buyer

Value Chain

Marketing

Distribution

Disposal/

Recycle

Value Chain

Service

Value Chain of Firm Z

The end-use consumer pays for profit margins throughout the value chain

Source: Porter, 1985.

Source: Porter 1985.

Breaking down the industry value chain can

reveal which activities are the most (and least)

critical to competitive advantage (or disadvantage). The experience of the Swiss watchmakers

is a good illustration. The Swiss firms were

relatively small, labor-intensive assemblers who

made good profits for many years before the

advent of low-cost, mass-produced watches in

the 1970s. Their first reaction to the increased

competition was to restructure their industry to

gain economies of scale similar to their global

competitors.

However, they failed to realize that manufacturing

was not their critical problem, since this set of

activities added only a small proportion of the

value of the final product. Far more significant

were downstream activities in the output logistics,

marketing, sales and service areas. An inexpen-

sive watch was not enough: the Swiss had to

lower their costs of distribution and service.

Their eventual and hugely successful answer

was the Swatch, which was inexpensive, virtually

indestructible, and could be distributed through

a wide variety of low-cost channels from department stores to discount houses.

In order to decide which elements of the value

chain to focus upon, companies must determine

who the customers are and what they want from

the product. How does the customer choose

from among competitors, i.e., what is the

cost/benefit of the product to the customer?

Competitive Benchmarking

Competitive benchmarking is a widely used

competitive intelligence technique. It consists of

organizations carefully studying other organiza-

20

BUSINESS PERFORMANCE MANAGEMENT

tions’ performance in an aspect of their business,

with a view to improving their own performance.

Benchmarking is a customer-driven commitment

to continuous improvement, linking customer

value requirements to business strategies.

Benchmarks can be divided into two categories:

l

l

what is to be measured; and

who is to be measured.

In deciding what is to be measured, an organization should consider three types of benchmarks:

l

l

l

strategic benchmarks—measure and compare

the relative position of a particular company

within an industry and the result of a company’s

performance at the functional and operational

levels;

functional benchmarks—identify products,

services and work processes. They usually

involve specific business activities within a

given functional area such as manufacturing,

marketing or engineering; and

operational benchmarks—yield the reasons for

a functional performance gap. Organizations

need to understand these benchmarks at the

operational level in order to identify the corrective

actions required to close the performance gap.

In deciding who is to be measured, an organization should consider three types of benchmarks:

l

l

l

competitive benchmarks—identify the products,

services and work processes of an organization’s

direct and strongest competitors in the industry;

internal benchmarks—compare an organization’s

own similar processes, products or services; and

analogous benchmarks—compare performance

to a world-class organization that may occupy a

different industry but performs a similar process.

Effective benchmarking focuses on the effectiveness of a company’s units in delivering a

high-value product. Ineffective benchmarking

focuses solely on the efficiency of the processes

of the functional units, without careful analysis

of what those processes are supposed to

deliver to the customer.

AT&T, for example, has a system that links

benchmarking activities to the processes that

drive performance. At leading AT&T businesses,

the approach is:

l

l

l

understand the needs and perceptions of the

customers that it serves;

pinpoint which processes drive its performance

and benchmark them against competitors on

the quality attributes and subattributes that

drive customer value and market share; and

benchmark the processes that have a major

impact on its competitive position against the

“best of breed.”

It should not be overlooked that the true value

of benchmarking does not lie in determining

current performance levels. If an organization

sets goals against today’s levels, its performance

objectives might target plans that were developed

years ago and are just reaching fruition today.

The true value of benchmarking is that it enables

skilled analysts to determine a competitor’s likely

performance levels in the future.3

Financial Analysis Tools

Financial strength obviously affects a company’s

strategic weaponry and the role that each

product line or division plays in its portfolio.

Thus, few competitor assessments would be

complete without an in-depth financial analysis.

3 For more information on benchmarking, the reader should

refer to The Institute of Management Accountants Statement

on Management Accounting, Effective Benchmarking.

21

BUSINESS PERFORMANCE MANAGEMENT

Several financial analysis techniques can be

utilized within competitive intelligence. Although

these techniques have their limitations, thoughtful

digging and analysis in the absence of hard data

can help a firm understand the economic and

financial characteristics, capabilities and potential

direction of competitors. These techniques

include:

l

l

l

l

traditional ratio analysis;

sustainable growth rate analysis;

disaggregated financial ratio analysis; and

competitive cost analysis.

Traditional Ratio Analysis

The usual starting point for understanding a

competitor’s financial condition and performance

is traditional financial and ratio analysis. Publicly

available data from annual reports, 10Ks, other

SEC filings, Dun & Bradstreet credit ratings, brokerage reports and on-line services are often

readily available.

These analyses usually concentrate upon understanding the composition of a firm’s financing,

the investment of those funds in assets and

their use in several areas: to grow the business;

to generate profits; to provide a satisfactory

return on assets, total capital and shareholders’

equity; and to generate cash. Organizations can

use the analysis to determine historical patterns

and trends, and to make comparisons with other

participants and competitors in an industry.

Traditional financial and common-size ratio analysis measures a firm’s historical financial performance and its financial condition at a specific

time. But this technique can also measure a

firm’s future ability to compete. Its financial

structure can indicate the firm’s ability to raise

new capital. Its historical asset management

performance can suggest how the firm might

manage assets in the future. Its historical

growth, profitability, returns and cash flow

characteristics may indicate the firm’s market

share, its ability to utilize pricing as a competitive

tactic, its cost management practices and

capabilities, and, the firm’s ability to reinvest.

Financial and ratio analysis has its limitations. The

technique is historical: there is no assurance that

the future will resemble the past. More importantly,

it may occur at a level of aggregation that makes it

difficult to understand the performance of specific

businesses, product lines or products. These ratios

are also vulnerable to manipulation through opportunistic accounting practices.

Sustainable Growth Rate Analysis

With increasing global competition, different

national reporting requirements make it difficult,

if not impossible, to develop comparative and

useful competitor financial analysis. And worse,

most financial analysis tools are rooted in the

past: few by themselves are predictive. Yet good

competitive intelligence must alert organizations

to a competitor’s likely future strategies and

actions.

Sustainable growth rate (SGR) analysis is a

dynamic, future-oriented technique that permits

the intelligence analyst to assess how a firm’s

financial practices will affect its ability to grow.

SGR analysis provides an analytical framework

that relates a firm’s sales growth, profitability,

asset requirements and its financial policy. It

determines whether a firm can grow without

affecting its degree of financial leverage, or how

its financial leverage is affected based on a

projected growth rate and other relationships.

SGR analysis is applicable to a wide variety

of reporting formats. It enables comparison of

22

BUSINESS PERFORMANCE MANAGEMENT

EXHIBIT 8: CALCULATING SUSTAI NABLE GROWTH 4

EXHIBIT 8. CALCULATING SUSTAINABLE GROWTH RATE 4

Return on Assets

(ROA)

Return on Equity Before Tax

(ROEBT)

A) EBIT = Margin

Sales

B)

A) EBIT – Interest x Total Assets

EBIT

Equity

Sales

= Asset Turnover

Total Assets

A) Margin x Asset Turnover

= Leverage

B) ROA x Leverage

= ROA

= ROEBT

Return on Equity After Tax

(ROEAT)

A)

Taxes

1 – EBT

Sustainable Growth Rate

(SGR)

A)

= Tax Effect

B) ROEBT x Tax Effect

1 –

Dividends

= Dividend Effect

EAT

B) ROEAT x Dividend Effect

= ROEAT

= SGR

Source: Harkleroad 1993.

Source: Harkleroad 1993.

performance over time to quickly identify

elements of a competitor’s strategy so that their

strengths and weaknesses can be identified.

To calculate an SGR, organizations need the

following information:

l

l

l

l

l

l

earnings (or profit) before interest and taxes;

total assets;

interest;

shareholders equity;

taxes; and

dividends.

Exhibit 8 presents the calculations made to

ascertain the SGR of a firm, predicated on its

profitability, asset requirements and financial

policies. Once an initial calculation has been

made, a firm can use the SGR model to determine the impact of such changes as improved

profitability, improvements in asset management, modifications to the firm’s capital structure policies and changes in dividend policy.

4 Definitions for calculating SGR are: EBT = earnings before

taxes. EAT = earnings after taxes, EBIT = earnings before

interest and taxes.

23

BUSINESS PERFORMANCE MANAGEMENT

Disaggregated Financial Ratio Analysis

Often, publicly available financial information

appears only on a corporation-wide basis. It is

necessary to disaggregate some numbers in order

to understand the economic characteristics and

financial details of a competitor’s business units

or product lines.

For example, a company might learn about another

firm’s overall variable and fixed cost structure and,

hence, its average contribution margin, by comparing changes in costs relative to changes in sales

across different time periods. If sales increased by

6 percent and costs increased by only 3 percent,

the average contribution margin of the business is

about 50 percent (assuming that fixed costs

remain fixed from one period to the next).

A company can utilize line-of-business reporting

to disaggregate a competitor’s total sales, possibly