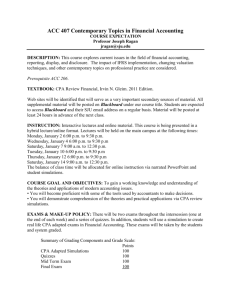

Accounting and Financial Management

advertisement

Master of Accounting & Financial Management Program The Master of Accounting & Financial Management program (availability varies by location; Master of Science in Accounting & Financial Management program in New York) emphasizes coursework – taught from the practitioner’s perspective – focusing on applying concepts and skills in areas including financial accounting and reporting, managerial accounting, external and operational auditing, and taxation. The program provides students with knowledge, skills and competencies needed for career success and advancement in the areas of finance, financial management, financial analysis and accounting. Graduates prepare to meet the following outcomes: CPA Exam-Preparation Emphasis – All Students Except Those Planning to Sit for the CPA Exam in Texas The MAFM program with CPA exam-preparation emphasis requires successful completion of 45 semester-credit hours, including credits earned in the accounting foundations courses and in coursework distributed as outlined below. • Demonstrate in-depth knowledge of accounting theory and apply that knowledge to specific accounting practices in a global economy. • Demonstrate professional oral and written communication skills through written reports, research projects, business plans and oral presentations. • Demonstrate effective collaboration with diverse populations in multiple settings. • Conduct quantitative and qualitative business analyses, evaluate outcomes, and make recommendations for effective legal and ethical business decisions. CPA Emphasis-Specific Courses Demonstrate competence in using appropriate software applications to develop analyses and solutions in support of business needs. ACCT559Advanced Financial Accounting and Reporting Issues • To tailor the MAFM program to their professional interests and goals, students select one of three emphases: Certified Public Accountant, Certified Fraud Examiner or Finance. The CPA emphasis includes coursework preparing students for a professional certification exam. Students must declare an emphasis prior to graduation; successful completion of an emphasis is noted on transcripts. Total program length varies based on the number of courses taken per eight-week session. Courses are distributed as outlined below. Additional information is available in Programmatic Accreditation and Recognition. Accounting Foundations Courses all six required by all MAFM students ACCT504Accounting and Finance: Managerial Use and Analysis Students who are licensed CPAs or who have passed applicable parts of the CPA exam are exempt, as appropriate, from ACCT591, ACCT592, ACCT593 and ACCT594 (see Course Exemptions). Students are granted these exemptions in addition to those allowed as described in Credit for Previous College Coursework, Course Waivers and Course Exemptions. five required ACCT555 External Auditing - or MGMT597Business Law: Strategic Considerations for Managers and Owners ACCT600Financial Management Capstone: The Role of the Chief Financial Officer FIN515 Managerial Finance FIN516 Advanced Managerial Finance CPA Exam-Preparation Courses all four required ACCT591 CPA Exam Preparation: Auditing and Attestation ACCT592CPA Exam Preparation: Business Environment and Concepts ACCT593CPA Exam Preparation: Financial Accounting and Reporting ACCT594 CPA Exam Preparation: Regulation ACCT505 Managerial Accounting Elective Course(s) ACCT550 Intermediate Accounting I three credit hours required ACCT551 Students may choose any course(s) for which they meet the prerequisite(s). See Course Offerings and Course Descriptions. Intermediate Accounting II ACCT553Federal Taxes and Management Decisions ACCT557 Intermediate Accounting III Accounting & Financial Management 24 Students who hold an undergraduate accounting degree may be eligible to waive one or more of the accounting foundations courses; however, each course waived must be replaced with an elective course as noted in the section describing their chosen emphasis (also see Course Waivers). MAFM students may waive a maximum of six courses. CPA Exam-Preparation Emphasis – All Students Planning to Sit for the CPA Exam in Texas CFE Focus Courses The MAFM program with CPA exam-preparation emphasis requires successful completion of 45 semester-credit hours in coursework distributed as outlined below. Students planning to sit for the CPA exam in Texas should note that a significant percentage of coursework must be completed successfully onsite. ACCT571 Accounting Information Systems SEC571 Principles of Information Security and Privacy CPA Emphasis-Specific Courses SEC575 Information Security Law and Ethics all six required SEC581 Legal and Ethical Issues in Security Management ACCT530 Accounting Ethics and Related Regulatory Issues SEC582 Security Risk Analysis and Planning ACCT540 Accounting Research SEC583 Security Administration and Operation ACCT555 External Auditing SEC584 Forensic and Business Investigations Techniques ACCT559Advanced Financial Accounting and Reporting Issues SEC594 Global and Domestic Security Management ACCT600Financial Management Capstone: The Role of the Chief Financial Officer Finance Emphasis MGMT550Managerial Communication CPA Focus Courses any three required ACCT560 Advanced Studies in Federal Taxes and Management Decisions ACCT564 International Accounting and Multinational Enterprises ACCT567 Governmental and Not-for-Profit Accounting any four required ACCT573 Accounting Fraud Criminology and Ethics MGMT597Business Law: Strategic Considerations for Managers and Owners The MAFM program with Finance emphasis requires successful completion of 45 semester-credit hours, including credits earned in the accounting foundations courses and in coursework distributed as outlined below. Finance Emphasis-Specific Courses all five required ACCT600 Financial Management Capstone: The Role of the Chief Financial Officer FIN515 Managerial Finance FIN516 Advanced Managerial Finance CFE Emphasis FIN560 Securities Analysis The MAFM program with Certified Fraud Examiner emphasis requires successful completion of 45 semester-credit hours, including credits earned in the accounting foundations courses and in coursework distributed as outlined below. FIN561 Mergers and Acquisitions Finance Focus Courses ACCT571 Accounting Information Systems CFE Emphasis-Specific Courses all five required ACCT555 External Auditing ACCT562Auditing: An Operational and Internal Perspective Including Fraud Examination ACCT572 Accounting Fraud Examination Concepts any four required ACCT530 Accounting Ethics and Related Regulatory Issues FIN564 Management of Financial Institutions FIN565 International Finance FIN567 Options and Financial Futures Markets FIN575 Advanced Financial Statement Analysis FIN590 Real Estate Finance ACCT574Forensic Accounting: Ethics and the Legal Environment ACCT600Financial Management Capstone: The Role of the Chief Financial Officer Notes: Students completing degree requirements at a Texas location must fulfill a minimum residency requirement of 36 semester-credit hours at Keller. Foundations of Managerial Mathematics, MATH500, must be completed successfully by students requiring additional mathematics preparation (see Prerequisite Skills Requirements). Credits and degrees earned from this institution do not automatically qualify the holder to participate in professional licensing exams to practice certain professions. Persons interested in practicing a regulated profession must contact the appropriate state regulatory agency for their field of interest. Foundations of Professional Communication, ENGL510, must be completed successfully by students requiring additional development of writing skills (see Prerequisite Skills Requirements). For comprehensive consumer information, visit keller.edu/mafm Accounting & Financial Management 25 Master of Accounting & Financial Management Program, continued General Graduate Certificate Requirements Graduate Certificate in CPA Preparation For students who wish to specialize in accounting or financial analysis without completing the entire MAFM degree program, certificate options are available. Those who have been admitted must inform the chief location administrator/academic advisor of their intent to pursue a certificate by submitting the Graduate Student Certificate Completion Notification form and are eligible to receive their certificate upon: Focusing on professional competency in accounting, Keller’s graduate certificate in CPA preparation is designed for students interested in preparing for the CPA exam while simultaneously completing advanced accounting coursework. • Successfully completing coursework outlined for their certificate. • Satisfying all course prerequisites through practical experience or related coursework. • Achieving a minimum cumulative grade point average of 3.00. • Resolving all financial obligations. Certificate requirements may be satisfied through a maximum of three semester-credit hours of transfer credit, course waivers or course exemptions. A course may be applied to one graduate certificate only. MAFM, MBA and MSAC students interested in earning one of these graduate certificates may do so by completing the requirements as part of their master’s degree program coursework. Graduate Certificate in Accounting To support their career goals, students interested in CPA preparation can focus their studies on either advanced accounting or professional leadership. Graduate Certificate in CPA Preparation – Professional Leadership Track Course requirements for Keller’s graduate certificate in CPA Preparation – Professional Leadership track are: ACCT559 Advanced Financial Accounting and Reporting Issues ACCT564 International Accounting and Multinational Enterprises ACCT571 Accounting Information Systems ACCT574 Forensic Accounting: Ethics and the Legal Environment ACCT591 CPA Exam Preparation: Auditing and Attestation ACCT592 CPA Exam Preparation: Business Environment and Concepts ACCT593 CPA Exam Preparation: Financial Accounting and Reporting Course requirements for Keller’s graduate certificate in Accounting are: ACCT594 CPA Exam Preparation: Regulation FIN512 Entrepreneurial Finance ACCT504Accounting and Finance: Managerial Use and Analysis HRM587 Managing Organizational Change PROJ586 Project Management Systems ACCT505 Managerial Accounting ACCT550 Intermediate Accounting I For comprehensive consumer information, visit keller.edu/gcpap ACCT551 Intermediate Accounting II ACCT553 Federal Taxes and Management Decisions Graduate Certificate in CPA Preparation – Advanced Accounting Track ACCT555 External Auditing - or ACCT559Advanced Financial Accounting and Reporting Issues ACCT557 Intermediate Accounting III For comprehensive consumer information, visit keller.edu/ga Course requirements for Keller’s graduate certificate in CPA Preparation – Advanced Accounting track are: ACCT559 Advanced Financial Accounting and Reporting Issues ACCT560 Advanced Studies in Federal Taxes and Management Decisions Graduate Certificate in Financial Analysis ACCT562 Auditing: An Operational and Internal Perspective Including Fraud Examination Course requirements for Keller’s graduate certificate in Financial Analysis are: ACCT564International Accounting and Multinational Enterprises ACCT504 Accounting and Finance: Managerial Use and Analysis ACCT571 Accounting Information Systems ACCT505 Managerial Accounting ACCT573 Accounting Fraud Criminology and Ethics ACCT553 Federal Taxes and Management Decisions FIN515 Managerial Finance ACCT574Forensic Accounting: Ethics and the Legal Environment FIN516 Advanced Managerial Finance FIN560 Securities Analysis FIN561 Mergers and Acquisitions For comprehensive consumer information, visit keller.edu/gfa ACCT591 CPA Exam Preparation: Auditing and Attestation ACCT592 CPA Exam Preparation: Business Environment and Concepts ACCT593 CPA Exam Preparation: Financial Accounting and Reporting ACCT594 CPA Exam Preparation: Regulation For comprehensive consumer information, visit keller.edu/gcpap See notes on page 25. Accounting & Financial Management 26