CORPORATES

Volkswagen Aktiengesellschaft

ISSUER IN-DEPTH

Sweeping Corporate Governance

Reforms Remain At the Discretion of

Controlling Shareholders

27 OCTOBER 2015

RATINGS

Volkswagen

Aktiengesellschaft

Long-Term Issuer Rating

A2

Senior Unsecured MTN

(P)A2

Commercial Paper

P-1

Outlook

Negative

KEY METRICS:

Volkswagen Aktiengesellschaft

2013

Debt/EBITDA

2014

Emissions crisis highlights serious corporate governance problems at Volkswagen

Aktiengesellschaft (VW, A2 negative). These deficiencies include ineffective internal

controls to uncover improper activity and poor risk management by VW’s management

and supervisory boards. Sweeping governance reforms could limit the damage to VW’s

once-solid reputation, which threatens to hurt earnings and cash flows.

»

Management reshuffle is positive but high turnover creates risks. In our opinion,

the management shake-up (which started with the 25 September appointment of the

group's new CEO Matthias Müller) will empower VW's brands and improve regional

coordination across the organisation. These changes should also help address the

company’s organisational complexity, which we have viewed as a long-standing credit

negative. However, a turnover of this magnitude creates risks, and additional changes

following the conclusion of an internal investigation may put added stress on the quality

and depth of the senior management team.

»

Lack of independent voices persists on supervisory board. The relative lack of

independent voices on the supervisory board is a governance weakness for VW because it

can result in less diversity of opinion and weaker management supervision than in other

large, rated diversified global corporations. Of the 10 supervisory board members who

represent shareholders, there is only one independent director. Moreover, the board’s

newly elected chairman is previous CFO Hans Dieter Pötsch. The company’s decision to

have two insiders occupy its top two posts (the other being CEO Matthias Müller, the

former head of Porsche) suggests no drastic change in corporate culture, which we think

investors expect given the magnitude of the crisis. In addition, the lack of independent

external views may also raise questions about the objectivity of the internal probe.

LTM

6/30/15

2.1x

2.0x

2.0x

36.2%

29.3%

38.7%

Free Cash Flow/

8.7%

8.0%

Debt

Source: Moody's Financial Metrics

12.5%

Retained Cash

Flow/Debt

»

ANALYST CONTACTS

Christian Plath

+1 212 553 7182

VP-Sr Credit Officer

christian.plath@moodys.com

Yasmina Serghini-Douvin 33-1-5330-1064

VP-Sr Credit Officer

yasmina.serghini-douvin@moodys.com

Matthias Hellstern

49-69-70730-745

MD-Corporate Finance

matthias.hellstern@moodys.com

Philipp L. Lotter

44-20-7772-5427

MD – EMEA Corporate Finance

philipp.lotter@moodys.com

MOODY'S INVESTORS SERVICE

»

CORPORATES

Three controlling shareholders to determine extent of corporate governance reforms. VW’s relatively complex corporate

governance structure is dominated by three controlling shareholders: Porsche Automobil Holdings SE (which is wholly-owned by

the founding Porsche/Piëch families), the state of Lower Saxony and Qatar Investment Holdings. These parties play the most active

roles in VW’s governance. In the past, we have viewed the ownership as a potential source of stability for creditors, allowing the

company to take a longer-term view on strategy and operations. But their interests may not always be totally aligned with each

other or those of the company’s creditors and are therefore a source of potential conflict.

Emissions crisis points to serious shortfalls in oversight

VW's emissions crisis has brought to light serious corporate governance issues within the company that we view as a credit negative.

The governance deficiencies include ineffective internal controls to uncover improper activity and poor risk management by VW’s

management and supervisory boards. The emission crisis might cause lasting damage to VW’s once-solid reputation with adverse

effects on its future earnings and cash flows. This drove our decision to change the outlook on the company’s ratings to negative from

stable on 24 September 2015.

Recent events suggest manipulation of emissions data in some of VW’s diesel-engine vehicles. On the back of these events, we

consider that the company may enhance its internal control processes, strengthen risk oversight and improve corporate governance.

This will help improve, and avoid further blemishes on, the company’s image and reputation. Such measures are critically important

because we think that the biggest risk VW faces is damage to its global reputation and credibility.

VW has begun to take several proactive remedial actions, including a number of management and organizational changes and

launching an internal investigation that is being conducted by a prominent US law firm. The company has indicated that it expects the

investigation will take several months.

The supervisory board has also created a special board committee that will oversee the investigation. The committee will report

regularly to the full supervisory board and will be able to call upon additional external consultants and experts at any time, in line with

leading practices for these types of investigations. The investigation will establish how widespread malpractices have been within the

company. The probe will help the supervisory board understand the extent of the reforms required to improve VW’s internal processes.

The board might then, at its sole discretion, act on and implement any or all of the investigation's findings and recommendations.

Management changes are positive to date, but high turnover creates risks

In our view, the management shake-up will empower VW's brands and improve regional coordination. For example, key production

functions will be de-centralised at both a brand- and regional-level, in an effort to enhance the company’s agility. The management

changes could also help address the company’s organisational complexity, which we have viewed as a long-standing credit negative.

The management reshuffle also included the appointment of a new CFO, Frank Witter, a former CEO of Volkswagen Financial Services

AG. Bernhard Maier was appointed CEO of Škoda, replacing Winfried Vahland, who took over responsibility for VW’s newly formed

North American region (NAR). However, Mr. Vahland resigned shortly afterwards, although Michael Horn remains president and CEO

of Volkswagen Group of America. Given the challenges facing the company in that region, we consider that VW may announce a new

NAR chief soon.

A newly formed Porsche division (including luxury brands Bentley and Bugatti) was established for the sports car and mid-engine

toolkit, reflecting the company’s intention to articulate its management structure around its modular toolkit strategy. The Volkswagen

passenger car, SEAT and Škoda brands will be represented by one member each on the Group Board of Management, while the

organisation of the Audi brand (including Lamborghini and Ducati), the truck holding, the power engineering and financial services

divisions will remain unchanged.

This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the ratings tab on the issuer/entity page on

www.moodys.com for the most updated credit rating action information and rating history.

2

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

We note that the head of the Volkswagen brand (Herbert Diess, an experienced executive) joined the company recently from

Bayerische Motoren Werke Aktiengesellschaft (BMW, A2 positive) and will lead a new management structure, with four regions each

led by a CEO reporting to him. On 26 October, VW appointed Thomas Sedran to the newly created role of head of group strategy,

effective 1 November. He will report to CEO Matthias Müller. Sedran is a former executive at General Motors Company's (Ba1 stable)

European division Opel, where he was in charge of strategy and operations and was interim CEO in 2012-2013. Since July 2013, he has

served as president and managing director of Chevrolet and Cadillac Europe.

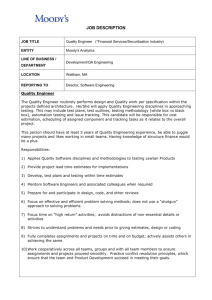

Exhibit 1

In the Wake of the Emissions Crisis, A New Leadership Team

Top Volkswagen executives and the effective dates of their appointments

*Appointment announced before emissions crisis

Source: Volkswagen

On 16 October, the company announced that Christine Hohmann-Dennhardt, a senior executive for integrity and legal affairs at

Daimler AG (A3 positive) will join the group as of 1 January 2016 in a newly created role as the board of management member in

charge of integrity and legal affairs, which we think is a positive step in enhancing the company’s compliance and internal controls

efforts.

However, given the magnitude of the changes, we think it will take time for the new management framework to take shape and

become an integral part of the company's corporate culture. There may be further changes following the conclusion of the internal

investigation, which could put additional stress on the quality and depth of the senior management bench.

Persistent lack of independent external voices on the supervisory board

The relative lack of independent voices on the supervisory board is a governance weakness for VW because it can result in less diversity

of opinion and weaker management supervision than in other large, rated diversified global corporations.

Under German law, companies are governed by a two-tiered board system. A supervisory board of non-executive directors is

responsible for overseeing a management board in charge of day-to-day operations. The management board is composed entirely

of company executives. Volkswagen's supervisory board has 20 members, of which 10 represent the company’s shareholders and 10

represent employees (see the Appendix).

Of the 10 members representing shareholders, the only independent director is Annika Falkengren, president and CEO of SEB (Aa3

stable). The Porsche and Piëch families hold four seats (down from five after Julia Kuhn-Piëch stepped down from the board on 7

October), the Qatar Investment Authority holds two, as does the German federal state of Lower Saxony.

3

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

Previous CFO Hans Dieter Pötsch holds the 10th seat. Mr. Pötsch was elected chairman of the supervisory board on 7 October. In

addition, Porsche SE announced on 17 October that Mr. Pötsch will succeed Martin Winterkorn, VW’s previous CEO, as chairman of the

executive board of Porsche SE, the holding company that controls 52.2% of VW’s voting shares (effective as of 1 November 2015).

Despite the need for independent opinions and fresh perspectives at the highest level of the company following the emissions crisis,

the appointment of the previous CFO as the supervisory board's chairman raises questions from a corporate governance standpoint

because it means that VW’s top two positions will be held by insiders. It also suggests that investors should expect no drastic change in

corporate culture, which we think investors expect, given the magnitude of the crisis.

The lack of independent external views also raises some questions regarding the objectivity and independence of the internal

investigation underway. The supervisory board’s five-member special committee charged with supervising the investigation is

composed of three employees and two controlling shareholder representatives. In our view, according to leading practice, a fully (or at

least majority) independent audit committee, or another special board committee overseeing investigations could prevent potential

conflicts and better assure a company’s stakeholders (including investors and regulators) that proper remedial actions will be taken if

required.

Three controlling shareholders to determine extent of corporate governance reforms

Three controlling shareholders dominate VW’s relatively complex corporate governance structure. They will determine which corporate

governance reforms to implement, if any.

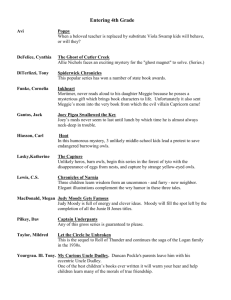

Like many controlled companies, VW has a dual-class share structure with unequal voting rights. Ordinary shares carry one vote per

share and preference shares carry no voting rights, which allows the controlling shareholders to magnify their voting power. As of 31

December 2014, the company’s largest shareholder was Porsche Automobil Holdings SE, which is wholly-owned by the Porsche/Piëch

families. Porsche Automobil Holdings owns a 32.4% economic interest, but controls 52.2% of VW’s voting rights.

The second largest shareholder in terms of voting control was the state of Lower Saxony, which held a 12.4% interest, 20.0% of the

voting rights and special blocking rights for major business decisions. Qatar Investment Holdings is the third major controlling owner,

with a 15.4% economic interest and 17.0% of the voting rights. Other investors, including foreign and domestic institutional investors,

own just under 40.0% of the economic interest, but only 10.8% of the voting rights (see Exhibit 2).

Exhibit 2

Volkswagen's Shareholding Structure and Voting Rights

Source: Volkswagen

4

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

The founding families, labor unions and Lower Saxony play the most active roles in VW’s governance. In the past, we have viewed

the ownership as a potential source of stability for creditors, allowing the company to take a longer-term view on strategy and

operations than is usually the case with widely held firms. For example, VW has pursued a fairly moderate dividend policy in recent

years compared with its rated peers. We also note that, under the leadership of Ferdinand Piëch, VW’s CEO from 1992 until 2002 and

then chairman until earlier this year when he resigned from his position, VW has grown into one of the world’s largest automotive

companies through both organic and external growth.

That being said, the main shareholder groups’ interests may not always be totally aligned with each other, or those of the company’s

creditors, and are therefore a source of potential conflict. For instance, we consider the operating margin of VW’s main brand to be

fairly low due to a less efficient cost structure than some of its peers.

We note that the presence of labor unions and Lower Saxony on the supervisory board can complicate efforts to reduce costs. In the

wake of the emissions crisis, VW has announced additional – though unquantified – measures to improve the competitiveness of its

main brand. The announcement signals a more flexible stance from certain shareholders on the issues of costs and staffing.

Qatar Investment Holding is a long-term, passive shareholder and, as is typical with sovereign wealth funds, does not play an active

role in the corporate governance of portfolio companies other than perhaps for substantial transactions. However, given the steep drop

in value of its holdings as a result of the emissions crisis, it may play a more active role until the crisis subsides.

Domestic and foreign institutional investors do not play a meaningful role in the VW’s governance, given their collective small voting

stake. We therefore do not expect them to be a major catalyst for change on governance matters.

Following a crisis of this magnitude, we would expect at least some turnover on a company’s board of directors and addition of new

independent directors that have neither ties to the alleged wrongdoing, nor to a company’s senior management or main shareholders.

However, we think it will be difficult for the company to make significant changes to the supervisory board, given the practical

limitations of VW’s governance structure and the supervisory board composition requirements under German law.

The addition of new independent directors remains a possibility, but this would increase the total size of the supervisory board to a

level that may become unwieldy, because an equal number of employee representatives would need be added to ensure they comprise

half the members of the supervisory board, as is required by law.

5

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

Appendix

Composition of Volkswagen's Supervisory Board

Member

Elected by

Affiliations

64

<1*

Shareholders

Berthold Huber

Dr. Hussain Ali Al-Abdulla

Akbar Al Bakar

Annika Falkengren

Hans-Peter Fischer

Uwe Fritsch

65

58

N/A

53

56

59

5

5

<1

4

2

3

Employees

Shareholders

Shareholders

Shareholders

Employees

Employees

Babette Fröhlich

Uwe Hück

Louise Kiesling

Olaf Lies

Hartmut Meine

Peter Mosch

Bernd Osterloh

Dr. jur. Hans Michel Piëch

50

53

57

47

63

43

59

74

5

<1

<1

2

5

5

5

5

Employees

Employees

Shareholders

Shareholders

Employees

Employees

Employees

Shareholders

Dr. jur. Ferdinand Oliver Porsche

Dr. rer. Comm. Wolfgang Porsche

54

72

5

5

Shareholders

Shareholders

Stephan Weil

Stephan Wolf

Thomas Zwiebler

56

49

50

2

2

5

Shareholders

Employees

Employees

VW: Chairman Supervisory Board; Porsche Automobil Holding SE: Chairman

Management Board (CEO)**

VW: Deputy Chairman Supervisory Board

Qatar Holding LLC: Vice Chairman

Minister of State, Qatar and Group Chief Executive of Qatar Airways

Skandinaviska Enskilda Banken AB: President and Group Chief Executive

Volkswagen Management Association (VMA): Chairman of the Board of Management

VW: Member of the Supervisory Board and Chairman of the Works Council

(Braunschweig Plant)

IG Metall: Department Head for Coordination of Executive Board Duties and Planning

Porsche AG: Chairman of the General and Group Works Council

Textilmanufaktur Backhausen GmbH: Partner and Managing Director

Federal State of Lower Saxony: Minister of Economic Affairs, Labour and Transport

IG Metall: Director of the Lower Saxony and Saxony-Anhalt Regional Office

AUDI AG: Chairman of the General Works Council

VW: Chairman of the General and Group Works Councils

Chairman-Supervisory Board at Porsche Austria GmbH & Co. and ChairmanSupervisory Board at Porsche Piech Holding AG

Familie Porsche AG Beteiligungsgesellschaft: Member of the Board of Management

Porsche Automobil Holding SE and Dr. Ing. h. c. F. Porsche AG: Chairman of the

Supervisory Board

Federal State of Lower Saxony: Minister-President

VW: Deputy Chairman of the General and Group Works Councils

Chairman of the Works Council of Volkswagen Commercial Vehicles

Hans Dieter Pötsch

Age Tenure

* Appointed 7 October 2015; **As of 1 November 2015

Sources: Volkswagen annual report (December 2014), company data and FactSet

6

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

Moody's Related Research

Issuer In-Depth:

»

Volkswagen Aktiengesellschaft - Credit Impact of VW’s Emissions Crisis: A Scenario Analysis, October 2015

»

Moody’s Teleconference, 28 September 2015: Assessing the Credit Implications of Volkswagen’s Emissions Crisis

»

Volkswagen Aktiengesellschaft: FAQ on its Vehicle Emissions Crisis, September 2015

»

Volkswagen Bank GmbH and Volkswagen Financial Services AG: FAQ: Implications of Emission Probe for VW's Car Financing

Entities, September 2015

Sector Comment:

»

ABS - Global: Emissions Issues Are Credit Negative for VW’s Auto ABS Around the World, September 2015

To access any of these reports, click on the entry above. Note that these references are current as of the date of publication of this

report and that more recent reports may be available. All research may not be available to all clients.

7

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

© 2015 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. AND ITS RATINGS AFFILIATES (“MIS”) ARE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE

CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODY’S

(“MOODY’S PUBLICATIONS”) MAY INCLUDE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBTLIKE SECURITIES. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET

VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY’S OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL

FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED

BY MOODY’S ANALYTICS, INC. CREDIT RATINGS AND MOODY’S PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT

RATINGS AND MOODY’S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT

RATINGS NOR MOODY’S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS

AND PUBLISHES MOODY’S PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND

EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS AND MOODY’S PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS FOR RETAIL INVESTORS TO

CONSIDER MOODY’S CREDIT RATINGS OR MOODY’S PUBLICATIONS IN MAKING ANY INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR

OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED

OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE

FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN

CONSENT.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well

as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it

uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However,

MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing the Moody’s Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any

indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any

such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or

damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a

particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory

losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the

avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,

representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH

RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including

corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any rating,

agreed to pay to Moody’s Investors Service, Inc. for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain

policies and procedures to address the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and

rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at

www.moodys.com under the heading “Investor Relations — Corporate Governance — Director and Shareholder Affiliation Policy.”

For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors Service Pty

Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided

only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to

MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly

disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the

creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail clients. It would be dangerous for “retail

clients” to make any investment decision based on MOODY’S credit rating. If in doubt you should contact your financial or other professional adviser.

For Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’s Overseas Holdings

Inc., a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally Recognized Statistical

Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an entity that is not a

NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered with the Japan

Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred

stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any rating, agreed to pay to MJKK or MSFJ (as applicable) for appraisal and rating services rendered by it fees

ranging from JPY200,000 to approximately JPY350,000,000.

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.

8

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS

MOODY'S INVESTORS SERVICE

CORPORATES

AUTHORS

Christian Plath

Yasmina Serghini-Douvin

9

27 OCTOBER 2015

VOLKSWAGEN AKTIENGESELLSCHAFT: SWEEPING CORPORATE GOVERNANCE REFORMS REMAIN AT THE DISCRETION OF CONTROLLING

SHAREHOLDERS