CONTENTS

advertisement

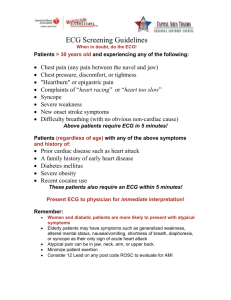

ECG – The Association of European Vehicle Logistics CONTENTS NEWS FROM BRUSSELS ECG publishes a new version of ‘Finished Vehicle Logistics by Rail in Europe’ book AUTOMOTIVE INDUSTRY Kia signs deal to bring new port operation to Stallingborough Carmakers localise engine production in Russia EUROPE Issue 15.36, 7th –11th September 2015 REST OF THE WORLD 2 2 2 2 3 4 Renault begins export through Valencia port 4 Channel Tunnel ‘massively underused for rail freight’ 4 Truck fuel-economy standards needed, says German Environment Agency 5 5 Daimler and Renault-Nissan break ground for new jointventure plant in Mexico 5 Renault aims to take lead from PSA in post-sanction Iran 7 India announces second 10-year Automotive Mission Plan 8 NYK signs deal to develop Ro-Ro in Saudi; JLR pulls plans on plant there 9 PRESS RELEASES 9 ABP celebrates the start of 2015 London International Shipping Week 9 Ro-Ro traffic: HAROPA accommodates the « new generation » vessel of Höegh Autoliners 10 ECG & other industry events ►ECG Eastern Regional Meeting, on 17h September, Istanbul, Turkey ► Shortsea Europe Conference, 23-24th September, Bremen, Germany ECG members are eligible for a preferential rate when registering at the event (€545 as opposed to €695). Interested members should contact Wiliam Bixby and quote the ECG/INV reference code. More information here. ► ECG Maritime & Ports Working Group Meeting, 29-30th September, Port of Bristol, UK ►ECG Land Transport Working Group Meeting, on 30h September, Frankfurt, Germany ►ECG Annual Conference, on 15-16th October, Vienna, Austria ► ECG Quality Working Group Meeting, 3rd November, Brussels, Belgium ►ECG Academy Alumni Meeting, on 6th November, Berlin, Germany ►ECG UK & Ireland Regional Meeting, on 12th November, London, UK ►Automotive Supply Chain Global Awards, on 12th November 2015, London, UK NEWS FROM BRUSSELS ECG publishes a new version of ‘Finished Vehicle Logistics by Rail in Europe’ book (Source: ECG, 9th September 2015) ECG published this week a new version of its publication ‘Finished Vehicle Logistics by Rail in Europe’ (version 2) on its website. This publication was made under the auspices of the ECG Land Transport Working Group. The first draft of this book was prepared last year. Since then the document has expanded significantly, covering various rail topics that range from history of railways in Europe to technical specifications of FVL wagons, logistics activities by rail. It also encompasses topics related to EU and national regulations for the rail transport, a list of existing national and international rail organisations, etc. The book finishes with a comprehensive glossary of rail freight terminology as well as railway maps for each EU and some non-EU countries. The final pages contain useful links and references for further information related to rail transport. The newly updated and extended version 2, now available on the ECG website, contains an additional section dedicated to rail noise and wagon brake systems. This part briefly covers the EU and national regulations regarding rail noise, sources and measurement of rail noise, various solutions for its reduction, and, finally, a brief overview of composite brake block systems. You may download this document free of charge from the ECG website. In case you would like to purchase a hard copy of the ‘Finished Vehicle Logistics by Rail in Europe’ for the price of €50, please complete the order form and send it to the ECG Secretariat. AUTOMOTIVE INDUSTRY Kia signs deal to bring new port operation to Stallingborough (Source: Automotive Purchasing, 8th September 2015) A multi-million pound 10 year deal has been signed by Kia Motors UK and Paragon to operate a key automotive storage and preparation centre at Stallingborough, North East Lincolnshire to handle and process up to 120,000 cars every year. The operation will move from the existing site in Killingholme by December 2015, expecting to employ 150 staff – these include existing Paragon and GBA staff but will also create new roles and opportunities for the local area. The specialist facilities will allow Kia vehicles to be fitted out to buyers’ specification before distribution to Kia’s 185 UK dealers. Injecting millions into the future of Stallingborough, the purchase will see the development of 88 acres of land to a fully functioning compound for automotive storage, preparation and distribution. The purchase of the land totals £9m, which will involve re-development and extension of the existing workshop and bodyshop to encompass state of the art facilities spanning over 75,000 square feet. “The port on the Humber is a strategic and extremely important part of Kia’s UK car import and distribution,” said Yaser Shabsogh, Commercial Director of Kia. “The facilities which will be available for us to process our cars will be fantastically state of the art, and will allow us to ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 2 ECG Academy Course 10 will start in October! keep delivering expertly designed, quality vehicles to our dealerships up and down the UK.” Mark Hindley, Commercial Director of Paragon added, “We are delighted to have this opportunity to develop a flagship technical centre for Kia Motors UK, which will process up to 120,000 new and used vehicles each year. This partnership will allow us to invest in facilities and people in the North East, to provide an excellent service and one which is hugely important of the UK’s car import structure.” Carmakers localise engine production in Russia This practice oriented course takes place over five modules, 24 days of intensive training. The modules are held at different locations in Europe (Vienna, Bremen, Barcelona, Edlbach and Lago Maggiore) to give the participants practical insights. It is targeted at both experienced practitioners and new entrants to the supply chain management. Benefits: Acquiring a vast wealth of knowledge in an accelerated timeframe, but in as much depth as it is required Unique networking opportunities. Each course brings together around 20 individuals representing companies from across Europe The course culminates in the award of a Certificate in Automobile Logistics Management, which is an accredited qualification. For more information please have a look at the ECG website and contact info@ecgassociation.eu (Source: Automotive Logistics News, 8th September 2015) Despite the continued slump in the Russian automotive market, a number of foreign OEMs are localising engine production in the country. Volkswagen and Ford have opened facilities in Russia in the last weeks and Mazda’ joint venture with Russian OEM Sollers has signed a memorandum with the government to establish an engine plant in the Far East region of the country. The various moves come ahead of the demands made under Decree 166, the agreement foreign carmakers have made with the Russian government to increase local content in at least 30% of vehicles made in Russia by next year. Volkswagen is making 1.6-litre engines at its newly constructed $279m facility in Kaluga and plans to introduce the EA211 gasoline engine in the near future. The carmaker has completed the plant within three years following its announcement back in 2012. Production capacity is set for approximately 150,000 engines a year for instalment in VW brand and Skoda models, including the VW Polo and the Skoda Rapid, which are made in Kaluga at VW’s nearby assembly plant. The engines will also be used in the VW Jetta and Skoda Octavia and Yeti models, built with Russian carmaker GAZ at the companies’ joint venture plant in Nizhny Novgorod. “With our new, modern engine plant, we will be supplying engines produced locally for our vehicles manufactured in Kaluga and Nizhny Novgorod,” said Marcus Osegowitsch, General Manager of Volkswagen Group Rus. “We will therefore not only be increasing the local content of our cars, we will also be making them more affordable for our Russian customers.” The new engine plant has an area of 32,000m2 and is to produce up to 600 modern 1.6-litre gasoline engines of the newly developed EA211 series per day. The move to locally produce engines means VW is fulfilling its obligation to supply at least 30% of the vehicles it makes in Russia with engines made in the country. Meanwhile, Ford has started production of 1.6-litre Duratec engines at its newly constructed $275m engine plant in Elabuga. They will be installed in models including the Ford Fiesta, Focus and EcoSport, which are built by Ford’s joint venture with Sollers in Russia. The facility has an annual capacity of up to 105,000 units, with the possibility for further expansion of up to 200,000 engines a year. As with VW’s output, at least 30% of Russian-built Ford vehicles will be equipped with the locally-built engines. “Our main target in line with our long-term localisation strategy was to launch engine production with a significant level of localisation,” said Adil Shirinov, Executive Director and CEO of Ford Sollers. “We are proud to say that we are not only sourcing main parts from Russian companies, but they also are manufactured from local raw materials. We are fully committed to this strategy which is key for our business in the current environment.” Ford Sollers now produces seven vehicles in Russia. As well as the EcoSport, Kuga and Explorer, it launched production of the all-new Mondeo, new Focus, new Fiesta and new Transit earlier this year. The Ford Sollers Elabuga Engine Plant occupies 42,600 m2 and is located in the Alabuga special economic zone, next to one of the three Ford Sollers vehicle assembly plants in Russia. There is a further plant in Elabuga and another in Vsevolozhsk. Mazda and Sollers, meanwhile, have announced memorandum of understanding with the Russian government to set up an engine plant at the site of their joint venture plant in Vladivostok in the Far East region. Mazda Sollers Manufacturing Rus has produced around 80,000 vehicles since it began operations in 2012. “We are pleased to have been able to make a contribution to this region by creating employment and helping to develop a culture of monozukuri, or manufacturing,” said Mazda’s representative Director, ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 3 Now available! The ECG Survey of Vehicle Logistics 2014-2015 President and CEO, Masasmichi Kogai, at the signing of the agreement last week. “This success has been possible thanks not only to our great partnership with Sollers but also to the continued support of the Russian government, the Primorsky region and the government of Japan.” EUROPE Renault begins export through Valencia port Combines global and European data and information on the automotive industry in general, and the finished vehicle logistics sector in particular The only publication for the European Vehicle Logistics sector, also covering Russia, Turkey and Ukraine Find more information and order your copy here! (Source: Automotive Logistics News, 8th September 2015) Renault has begun exporting its Kadjar model through the Port of Valencia, on Spain’s Mediterranean coast, for the first time. Manufacture of the Kadjar takes place at Renault’s Venta de Baños plant at Palencia, in north central Spain, with consignments shipped to the coast by rail via Madrid. The first shipment, which was undertaken by Transfesa, consisted of 20 car carriers loaded with 200 units. Once at Valencia, the Kadjars were exported to a number of destinations around the Mediterranean. Valencia continues to report burgeoning finished vehicles traffic. In 2014, for example, the port handled 2,195 Renault units for the entire year, while for the first six months of the current year this had increased to 2,953 units, equivalent to growth of 58%. The vast bulk of Renault vehicles built in Spain do, nevertheless, logically still move through ports on the northern coast, such as Santander and Vigo. Also at Valencia and Sagunto, which is managed by the same port authority, first half traffic was up 29.95% compared to the same period in 2014, with a total of 348,041 units passing through both ports. Separately, national rail carrier Renfe Mercancías has put into regular daily service a 600-metre long car carrier train between Renault’s Palencia factory and the Port of Santander. Block trains now consist of 20 rather than 18 wagons, which can carry an additional 20 units, up 15% in terms of capacity than previously. The improved service was developed as part of the sales push put behind the Kadjar by Renault, according to Renfe. In October, Renfe hopes to launch a second daily train of the same length. Channel Tunnel ‘massively underused for rail freight’ (Source: Lloyd Loading List, 9th September 2015) Unaffordable infrastructure charges are holding back the “fantastic potential” for Channel Tunnel rail freight services and causing the massive under-utilisation of its international freight train capacity, the UK’s Freight Transport Association (FTA) claims. The FTA’s rail freight policy manager, Chris MacRae, told Lloyd’s Loading List.com: “Eurotunnel appears to charge for freight train access on the basis of recovering the entire sunk capital cost of the assets. This means that the rate paid by rail freight operators - and which inevitably is passed on to their customers - is far higher than, for example, Network Rail in the UK would charge for an equivalent 40kilometre train journey. This the fundamental reason why relatively little rail freight (as opposed to road-borne freight transported on shuttle trains) has been carried through the Channel Tunnel since it opened over 20 years ago, and well below forecast.” MacRae said there was a long-running issue over how Eurotunnel operates its charging structure. “This hinges around whether the Channel Tunnel should be classed as ‘special infrastructure’, or should it be viewed as being within the scope of the EU’s freight train access charging scheme? This is a point of contest and there have been legal ‘infraction’ proceedings taken by the European Commission against the French and British governments.” Eurotunnel’s management has responded in the past 18 months by making the Tunnel more accessible financially to operators through producing some headline cuts in freight track access charges and also providing incentives for start-up schemes for new services. “All this has been very welcome but it hasn’t addressed the fundamental underlying issue of the ‘architecture’ of Eurotunnel’s actual charging scheme,” said MacRae. “There has been growth in rail freight train traffic through the Tunnel, but this has been from a very small base. “Neither would Eurotunnel’s ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 4 Version 5 of the ECG Operations Quality Manual for PCs and LCVs are available online! pricing policies appear to address the imbalance between inbound traffic (to the UK) with trains returning outbound (to the mainland Europe) empty. Normal economic sense would dictate that when you have a seriously under-utilised asset, you need to find ways of getting considerably more use of it and, by doing so, generate greater revenue. But this is not happening and it is weighing heavily on the development of cross-Channel rail freight.” He continued: “FTA and its members remain committed to the increasing use of rail freight, including on cross-Channel routes, and therefore support further policy work to assist in finding a stable and supportive commercial charging regime to support this. This is reflected in our ‘Agenda for More Rail Freight’ policy, which we have previously shared with the Office of Rail Regulation (ORR).” Truck fuel-economy standards needed, says German Environment Agency Written by the Quality Working Group and the H&H Working Group composed of OEMs and LSPs. The manuals can be downloaded from here For comments or inquiries please contact: info@ecgassociation.eu (Source: Transport & Environment, 7th September 2015) Germany’s federal environment agency, UBA, has backed calls for truck fuel efficiency standards, saying ‘a much more intensive discussion about CO 2 standards for heavy goods vehicles’ and ‘ambitious regulation’ are required. Citing ever-greater volumes of goods being transported by road and the trend towards more powerful and heavier vehicles, the agency said the transport sector must step up its efforts on climate action. The UK, Belgium and the Netherlands have also joined Germany’s call to set CO2 limits for new trucks. Road traffic accounted for 95% of the transport sector’s greenhouse gas emissions in Germany, according to UBA, while road freight traffic increased by about 31% between 2000 and 2013. Trucks and buses accounted for around 30% of the world’s road transport CO2 in 2012. Due to growing traffic and improvements in passenger cars and vans by 2030 this will increase to almost 40%. According to the International Transport Forum, emissions by trucks and buses are on their way to become the biggest source of transport emissions globally. Pressure has been building on the EU to act on lorry fuel efficiency standards since the US authorities announced new targets for CO2 reductions from its fleet. The US Environmental Protection Agency in June proposed a 24% improvement in truck fuel economy by 2027, on top of limits introduced in 2011. Under the new US proposal, trucks there – which now average 33-36l/100km – will overtake Europe’s in the early 2020s and average less than 26.7l/100km by 2027. The EPA estimates this second phase of standards will save US truck owners €150bn in fuel costs over the lifetime of the vehicles. T&E said EU inaction threatened Europe’s technology leadership as the new US standard will bring forward the rollout of advanced technology in America, such as waste heat recovery systems being developed in Europe by Bosch, as well as better tires, more efficient transmission and hybrid engines. Access to Europe’s truck CO2 test procedure VECTO, which is being finalised by the European Commission, must be opened to truck users, transport industry and green groups have warned. If the software simulation is to have a real impact on the market, truck users need to have access to it, according to the eight groups in a letter to Commission officials. Access to VECTO would enable truck buyers to compare how their preferred vehicles and fuel saving technologies perform on their specific routes or journeys, increasing comparability, choice and competition. However, truck manufacturers vehemently oppose it, claiming such a move would disclose commercially sensitive information. REST OF THE WORLD Daimler and Renault-Nissan break ground for new jointventure plant in Mexico (Source: Automotive Purchasing, 4th September 2015) Daimler and the RenaultNissan Alliance have broken ground for their joint-venture manufacturing complex, COMPAS (Co-operation Manufacturing Plant Aguascalientes), in ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 5 Briefing paper on the sulphur content in marine fuels updated As the Regulation on sulphur content in marine fuels came into force on 1st January, ECG has updated its Briefing paper to better inform our readers. The new rules affect companies that operate routes in the Sulphur Emission Control Areas (SECAs), i.e. the North Sea with the English Channel and the Baltic Sea. In these zones the sulphur content of the fuel may not surpass 0.1% which is a great technical and financial challenge for these operators. The Briefing paper contains IMO and EU regulatory background and analysis of the latest developments, as well as a glossary of terms. Download your copy from the ECG Website ! Mexico, for next-generation premium compacts. “Today marks an important milestone for the partnership between Daimler and the Renault-Nissan Alliance. This new joint plant will help both partners serve their respective customers faster and with more flexibility. As Mercedes-Benz’ first production location for compact cars in the NAFTA region, it will also significantly enlarge our footprint here,” said Markus Schäfer, Member of the Divisional Board of Mercedes-Benz Cars, Production and Supply Chain Management. “On our end, while sharing high efficiency and flexibility in the joint venture, we will add Mercedes-Benz specific technology as well as further training and assistance by our global lead plant for compact cars in Rastatt, Germany. This proven approach will guarantee that our quality here in Aguascalientes will be the same as at the other locations of our global compact car production network in Europe and China.” Compas is 50:50 owned by Daimler and Nissan. The partners will invest a total of $1bn in the joint venture which will oversee the construction and operation of the state-of-the-art manufacturing plant. “This new plant represents yet another example of the growing collaboration between the Renault-Nissan Alliance and Daimler. Mexico is a global benchmark for quality and efficiency and is a major reason why Daimler and Nissan have decided to produce the next generations of premium compact cars for Mercedes-Benz and Infiniti here in Aguascalientes. What we are celebrating today has also been made possible through our close collaboration and partnership with both the state and Federal governments,” said Jose Muñoz, Executive Vice President, Nissan and Chairman, Management Committee – Nissan North America. Located near the Nissan Aguascalientes A2 plant, Compas will have an initial annual production capacity of more than 230,000 vehicles and will create about 3,600 direct jobs by 2020. Depending on the market development and customer demand, there will be the potential to add additional capacity. Production of Infiniti vehicles will begin in 2017, while the first Mercedes-Benz vehicles will roll off the line in 2018. In addition to the direct employment it provides, Compas is also expected to generate some 12,000 indirect jobs – largely due to a high localisation rate which will significantly increase the Mexican supply base. Compas is led by an international management team from Daimler and Nissan: Ryoji Kurosawa, CEO, Uwe Jarosch, CFO, and Glaucio Leite, CQO. Aguascalientes Governor Carlos Lozano de la Torre said the new plant will be an important source of jobs for the people of Aguascalientes. “This first stone reaffirms Aguascalientes’s position as a major manufacturing base for the global auto industry. We will continue to encourage public and private partnerships to strengthen our position as a base for the world’s most important industries.” As announced in June 2014, Daimler and the Renault-Nissan Alliance will also co-operate in the development of the nextgeneration premium compact vehicles for the brands Mercedes-Benz and Infiniti. The two partners will closely collaborate at every stage of the product creation process. Brand identity will be safeguarded as the Mercedes-Benz and Infiniti vehicles will clearly differ from each other in terms of product design, driving characteristics, and specifications. Daimler and the Renault-Nissan Alliance will also produce the next-generation premium compact cars at other production locations around the world, including Europe and China. Mexico is already a key location for Daimler with a total of around 8,000 employees. The group has production plants for trucks and buses in Saltillo, Santiago Tianguistenco, and Garcia, a parts distribution centre in San Luis Potosí and a remanufacturing plant, a product delivery centre, and a training centre for passenger cars located in Toluca. Nissan has been producing vehicles in Aguascalientes since 1992 and is known for its award-winning, highly efficient workforce. In November 2013, Nissan opened a second manufacturing complex in Aguascalientes, Aguascalientes A2. Nissan also has a plant in Cuernavaca. Together, the three plants have an annual production capacity of 850,000 vehicles. Nissan is the leading automaker in Mexico, accounting for one in four cars sold. ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 6 Events in Brussels Rail Forum Europe organizes an event ‘On track to COP21: The role of rail in sustainable mobility’ on 14th September The European Transport Forum will be held on 29th September and will focus on ITS and data information exchange while respecting data privacy The European Commission organizes the European Mobility Week on 16-22nd September The European Commission organizes the Conference on Incident Reporting in Land Transport Security at the EU level on 6th October. Two of the four subjects covered will be road and rail cargo theft. ACEA will dedicate its annual conference to HGVs. The ‘Reducing CO2 from Road Transport Together’ event will be held on 3rd December Renault aims to take lead from PSA in post-sanction Iran (Source: Automotive News Europe, 6th September 2015) Renault plans to become the biggest-selling European carmaker in Iran, the Middle East’s largest market, ahead of French rival PSA Peugeot-Citroën, sources say. PSA has been struggling to negotiate a bigger manufacturing deal with partner Iran Khodro, the country’s largest automaker, amid lingering anger over its abrupt 2011 withdrawal. Now Renault plans to use $560m of its cash that had been trapped in Iran to seize the advantage, after July’s international deal to lift sanctions in exchange for nuclear curbs on Tehran, people familiar with the matter said. “Our strategy is to be the biggest carmaker in the country,” said a Renault source with knowledge of the discussions. “PSA has made a lot of statements (about Iran). Chickens shouldn’t be counted before they are hatched.” With 80 million consumers and 1.1 million cars sold in 2014, Iran has potential for rapid growth. The lifting of international sanctions may begin as soon as March, the UK’s Foreign Minister said last week, opening the way for investment. For Renault and Nissan, its alliance partner, Iranian production would bolster an already strong presence in emerging markets. Reclaiming Iran is even more critical for PSA, racing to expand outside Europe after a brush with bankruptcy. The company said recently it was counting on Iran for about 400,000 annual vehicle sales by 2020. PSA remains in talks “with various partners including Iran Khodro” on a manufacturing venture, a spokesman said. Renault declined to comment. The tussle pits PSA CEO Carlos Tavares against his former boss, Renault CEO Carlos Ghosn, for the main prize - a major manufacturing deal with Iran Khodro. Under earlier agreements with both French carmakers, the Iranian company builds Renault and Peugeot models from complete knock-downs kits (CKD). PSA’s Iran sales peaked at 458,000 vehicles, nearly 30% of the market, before it halted deliveries four years ago under pressure from then-partner General Motors. PSA now tolerates Iran Khodro’s “unauthorized” assembly of Peugeots from grey-market parts. But their estrangement is a gift to Renault, Volkswagen and other rivals now poised to muscle in. VW said in July that it is in talks to enter Iran. “Peugeot must know that it must account for its past behaviour,” Iran Khodro chief Hashem Yakke-Zare told state-owned PressTV in late July, adding that the carmaker “will not be our main partner.” Renault has been working behind the scenes to fill that vacancy, company sources said, and sees potential for annual production of 400,000 cars in Iran by 2020. “Unlike PSA we have always remained in Iran,” a Renault source said. “Loyalty should pay.” Renault is also touting lower-cost vehicle platforms that its rivals mostly lack. VW has been struggling for years to develop dedicated emerging-market cars, while PSA’s equivalent line-up will not begin to reach showrooms before 2019. Industry forecaster IHS Automotive expects Renault to claim as much as 12% of a transformed Iranian market in 2020, two or three percentage points ahead of PSA. Renault’s extensive line-up of affordable cars is “best positioned for Iran,” IHS analyst Michel Jacinto said. Under existing partnerships with Iran Khodro and smaller player SAIPA, Renault is preparing CKD production of its Sandero small car and Logan pickup while discussing a full manufacturing investment to include an SUV just launched in India. Financial sanctions that had stranded Renault’s Iranian earnings now offer a head start, by keeping rivals out until the embargoes are lifted in coming months. “Rather than repatriating the cash, the idea is to make the most of it,” another Renault source said. One possibility is “to buy a chunk of an Iranian company”, he added - an option that was rejected as too risky when last considered more than a decade ago. Renault and PSA executives are expected to join a French business delegation visiting Iran 21st-23rd September. The French government, a major shareholder in both carmakers, has “put the case for the two groups” to Iranian leaders, Foreign Minister Laurent Fabius said on 30th July. While Renault’s plans were “positively welcomed,” Tehran officials still criticise PSA for its earlier retreat, Fabius said. “So that may prove more difficult.” ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 7 ECG Office Mike Sturgeon Executive Director T: +32 2 706 8282 Mike.sturgeon@ecgassoci ation.eu Cliona Cunningham External Relations Manager T : +32 2 706 8285 cliona.cunningham@ecgas sociation.eu Oleh Shchuryk Research & Projects Manager T: +32 2 706 8279 oleh.shchuryk@ecgassocia tion.eu Szilvi Kiss Research & Projects Manager T: +32 2 706 8284 szilvi.kiss@ecgassociation. eu Sercan Iscan Communications and Events Officer T: +32 2 706 8280 info@ecgassociation.eu India announces second 10-year Automotive Mission Plan (Source: Automotive Logistics News, 9th September 2015) At last week’s annual convention of the Society of Indian Automobile Manufacturers (SIAM), the Indian government revealed preliminary details of its second Automotive Mission Plan (AMP). The plan, which was reported in The Economic Times, covers the 2016-2026 period and aims to achieve a fourfold growth in the industry over that time to reach between $260-300bn. The plan also aims to make India among the top three automotive industries in the world with passenger car sales predicted to reach between 9.4m-13.4m by 2016 (it is currently the fifth largest automotive market). According to forecasts from analyst PwC, over the next 10 years light vehicle assembly in India is set to increase by almost 194% to reach 10.8m units, putting it in third place in terms of production behind China and the US. PwC’s forecasts for light vehicle sales, meanwhile, show an increase of almost 238% between 2015 and 2025 to reach 10.2m units, again a third place position behind China and the US. However, it is noticeable that in both cases, India’s increase is by far the biggest, with China’s increase in both production and sales over the coming decade around the 50% mark and the US way down, with a 5.7% increase in assembly over the period and a 9% increase in sales. To support India’s growth the government said it would be investing to improve infrastructure and also looking to increase exports to between 35-40% of overall output. The second phase of the AMP will also aim to increase annual commercial vehicle sales to between 2m-4m units, up from 700,000 last year, and grow tractor sales from 600,000 to between 1.5m-1.7m units over the same period. On the inbound side the government plans will seek a reduction in import duties on raw materials and, as well as implementing the much anticipated Goods and Service Tax (GST) Bill. In December last year, the Indian government approved the constitutional amendment bill, and plans to roll out the tax from April 2016. GST will rationalise state and central indirect taxes into a harmonised goods and services tax, and create a unified market, which will help allow seamless movement of goods across states, an especially important move for the automotive logistics industry that will hopefully also reduce business costs. According to industry analyst, IHS Automotive, while preliminary details and figures have been released, the plan lacks clarity in the form of policy direction and real-time benefits for the Indian carmakers. A number of those carmakers that were approached on the implications of the plan were unwilling to comment. Neither was SIAM. There are a number of economic issues, including investment in infrastructure, that need to be addressed in India, though ironically, it is a lack of public infrastructure that has been fuelling car sales. “India’s growth story rests on internal consumption to a great extent while exports, amid a lack of favourable trade agreements with key economies, largely depend on the labour and material cost advantage,” said IHS Automotive in a briefing. “The country’s domestic market suffers from high inflation and interest rates, but growing urbanisation and lack of public infrastructure have been fuelling domestic demand for vehicles, particularly in the passenger vehicle segment.” The AMP was launched into its first phase in 2006 for an initial 10-year period with the aim of making India a favourable production location for global vehicle manufacturers. The plan focused on boosting competitiveness in the domestic vehicle manufacturing industry and the flow of technology, demand, brand building and infrastructure, amongst other areas. Between 2005 and 2015 Indian vehicle production jumped by 189.6% to 3.8m vehicles last year from 1.3m in 2005, according to figures from PwC. Sales in the country increased by 156% to 3.04m last year, up from 1.18m in 2005. Tom Antonissen EU Affairs Adviser T: +32 2 706 8283 tom.antonissen@ecgassoc iation.eu ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 8 NYK signs deal to develop Ro-Ro in Saudi; JLR pulls plans on plant there (Source: Automotive Logistics News, 9th September 2015) Global shipping line, NYK, has signed a joint venture with the owner and developer of King Abdullah port in Saudi Arabia – Ports Development Company (PDC) – to build a Ro-Ro terminal there. Due to be fully operational in the third quarter of 2016, KAP RoRo Terminal will be the first terminal dedicated to Ro-Ro cargo in the country and NYK’s first automotive logistics facility in the Middle East region. The terminal will have capacity to handle 600,000 vehicle units a year according to NYK, which it said would address increasing demand from a growing market in the Middle East. NYK did not provide further details on the development other than to say it would continue to respond to customers’ demands in the Middle East regain as part of its ‘More Than Shipping 2018’ management plan. There was no word either on which carmakers were expected to be principal customers for services through the terminal from next year. One carmaker who it appears will not be using it for exports though is Jaguar Land Rover, following reports that it is pulling plans on building a facility in the country. According to The Financial Times the carmaker’s plans to build a factory have been “quietly scrapped”. Last year JLR signed a letter of intent with the Saudi government’s National Industrial Clusters Development Programme to examine the financial viability of building cars in the Middle East. That followed the carmaker signing a preliminary agreement with the Saudi Ministry of Commerce to build a plant there to produce 50,000 Land Rovers a year from 2017. “Jaguar Land Rover continues to have ambitious plans for growth globally and regularly reviews opportunities to secure further manufacturing capacity in a range of markets,” said the company in a statement sent to Automotive Logistics. “Our manufacturing plans for UK, China, Brazil and Europe are our main focus and priority at this time.” PRESS RELEASES ABP celebrates the start of 2015 London International Shipping Week (Source: ABP, 8th September 2015) Associated British Ports (ABP) hosted a major reception on the eve of 7th September to celebrate the start of the 2015 London International Shipping Week. Held at Westminster Abbey, the event was attended by more than 200 guests from across the shipping and maritime industry. Guests included the Secretary of State for Transport Rt Hon Patrick McLoughlin MP, and Shipping Minister, Robert Goodwill MP. Speaking at the event, ABP Chief Executive James Cooper praised the government for its support of London International Shipping Week. “ABP is proud to continue to support an initiative that showcases Britain’s expertise in the maritime sector to a global audience. The Department for Transport deserves great credit for its commitment to London International Shipping Week.” Mr Cooper also welcomed the Government’s Maritime Growth Study: “Over the longer term, ports and maritime should be at the heart of the Government’s productivity and growth agenda. “It is vital that we build on this study, and build a momentum that makes sure ports and maritime remain a driving force in boosting productivity and growth across the UK.” The event also saw the launch of Maritime Nation by Brian Johnson, Solent LEP Director: “Britain has a great history as a Maritime Nation. For years our maritime industries have had a central role in delivering the nation’s trade and prosperity. They are an important part of our history, but they are also an essential part of our future. “Through a shared platform, the ambition of Maritime Nation is to strengthen the UK’s position as a global leader in marine and maritime, maximising investment in the sector to increase productivity and growth across our entire economy.” Speaking after the event, the Secretary of State for Transport Rt Hon Patrick McLoughlin MP, said: “London International Shipping Week is an opportunity to remind the world of the benefits Britain offers, whether it’s our world-leading ports, maritime business services or skilled workforce. We are determined to ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 9 grow our share of the global maritime sector, helping talented people find careers in its industries and attracting companies to do business in the UK. “Our maritime history is something Britain can be proud of, but the sector is taking us into the future. I want Britain to feel the benefit of its international reputation by driving economic growth and increasing jobs. We have already seen millions invested in the UK, demonstrating the central place Britain already holds in the industry.” Ro-Ro traffic: HAROPA accommodates the « new generation » vessel of Höegh Autoliners (Source: HAROPA, 4th September 2015) On Monday, 7th September, the Ro-Ro terminal in Le Havre will welcome the M/V Höegh Target, the first of a series of six Post-Panamax vessels that the ship-owner Höegh Autoliners has planned to build within the next 18 months. With a carrying capacity of 8,500 CEU (Car Equivalent Units), the vessel is now the largest PCTC (Pure car & truck carrier) worldwide; it has a deck space of 71,400 m2, a stern ramp capacity of 375 tons and a door 6.50 m high. According to Steinar Løvdal, Head of Capacity Management with Höegh Autoliners, “The launch of the Höegh Target is a milestone in the company’s history. This is the first Post-Panamax PCTC we have and the New Horizon design truly represents state-of-the-art engineering.” “This call of the world largest Ro-Ro vessel confirms our port as the largest French platform for the import/export of new vehicles” Hervé Cornède, Commercial and Marketing Director of HAROPA, likes to say, reminding the “quality” initiative launched on the terminal of Le Havre: “showing their will in terms of quality and security, all stakeholders of the Ro-Ro sector prepare together – and with the support of ECG - a guide to good practices for vehicle handling”. The port also aims to develop on secondhand, “high & heavy” machines, heavy trucks and industrial projects markets; all of them using Ro-Ro shipping services. The business offer of Höegh Autoliners via HAROPA - Port of Le Havre covers several continents. Every ten days, a service of the shipping line serves the South-African countries as well as those in Oceania. Twice a month, a service connects the ports in the Mexican Gulf and the Caribbean Islands and another heads for ports in the Middle-East up to India, with possibilities of connection with Far-Eastern countries. As for the Höegh Target, its first trips will be on the South Africa/Indian Ocean/Oceania route. ECG - The Association of European Vehicle Logistics, Diamant Building, Bd. Reyers 80, 1030 Brussels Tel: +32-2-706-82-80, info@ecgassociation.eu; www.ecgassociation.eu 10