UNILEVER

advertisement

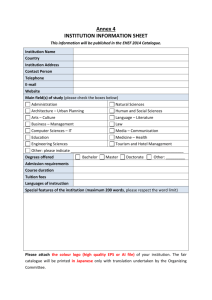

26 UNI March 2016 Fully listed companies Company REFS - Really Essential Financial Statistics UNILEVER PRICE (p) 4000 3500 12 EPIC: 3 1/9p Ords vs FTSE All-Share vs norm eps 13 14 15 16 17 18 ACTIVITIES ANALYSIS (15AR) 3000 2750 2500 2250 2000 1750 1500 1M 3M 6M 1Y 1000 HIGH LOW AVE PER Personal Care Foods Home Care Refreshment Asia/ AMET RUB Americas Europe RELATIVE % 1250 2429 1994 17.0x 2885 2319 21.4x 2729 2306 20.8x 3015 2524 27.0x 3148 2763 22.8x Beta rel SECTOR: Personal Goods. ACTIVITIES: Unilever PLC is a supplier of fast moving consumer goods. Its areas of operations are Personal Care, Home Care, Foods and Refreshment.. DIRS: Mr. N M A Treschow (ch)*, Ms. Ann M Fudge (vch)*, Mr. P Polman (ceo), Ms. Mary Ma*, Ms. T Hixonia Nyasulu*, Mr. V A Colao*, Prof Louise Fresco*, Mr. J Rishton*, Ms. Laura M L Cha*, N S Andersen*, Mr. F Sijbesma*, Dr. Judith Hartmann*. HEAD OFF: 100 Victoria Embankment, London, EC4Y 0DY. Tel: +44 2078225252 REG OFF: Port Sunlight, Wirral, Merseyside, CH62 4ZD. REGISTRAR: Computershare Investor Services PLC BROKERS: Deutsche Bank AG London; UBS Investment Bank. FINANCIAL ADVISERS: Deutsche Bank AG London; UBS Investment Bank. AUDITORS: KPMG. OUTLOOK: (6-Mar-15) AR: ceo - ’...we are well placed to continue delivering our objectives of volume growth ahead of our markets, steady and sustainable improvements in core operating margin, and strong cash flow’. (23-Jul-15) Prelim: no outlook statement. (15-Oct-15) 3rd Qtr: no outlook statement. (23-Feb-16) AR: ceo - ’...which gives me further confidence that we can continue to deliver on our objective of consistent top and bottom line growth, to the benefit of our long-term shareholders and the many others who rely on Unilever’. NEWSFLOW: (1-Apr-14) Interview: At the company’s AGM to be held on 14 May 2014, special resolutions to empower the directors to allot shares for cash and to make market purchases of Ords in the capital of the company, will be proposed.. (14-May-14) AGM: At the company’s AGM held on 14 May 2014, all resolutions including special resolutions to empower the directors to allot shares for cash and to make market purchases of Ords in the capital of the company, were duly passed.. (22-May-14) Ann: The company has signed an agreement for the sale of its North America pasta sauces business under the Ragu and Bertolli brands to Mizkan Group for a total cash consideration of approximately $2.15 billion. The annual turnover for Ragu and Bertolli is more than $600m. The transaction includes two production facilities a sauce processing and packaging facility in Owensboro, Kentucky, and a tomato processing facility in Stockton, California.. (29-Jul-15) Ann: The company has priced a dual-tranche $1.00 billion bond on the US market. $500m 2.10% fixed rate notes are due 30 July 2020, with a further $500m 3.10% fixed rate notes due 30 July 2025. The bond offering is scheduled to close on 31 July 2015.. +0.2 +12.4 +18.6 +18.0 Exane BNP Paribas Morningstar Inc Numis Securities Ltd Shore Capital Date 23-Nov-15 19-Jan-16 20-Jan-16 26-Feb-16 Consensus 1m change 3m change Rec BUY HOLD ADD BUY Pretax £m 5653 4232 + 6040 + 6230 + 6034 +204 +306 % % % % % % % T/O 38 24 19 19 42 33 25 Pr 48 31 10 11 40 30 30 0.91 SHARE CAPITAL, HOLDINGS, DEALINGS 1283m 3 1/9p Ords (Dirs 0.02% [d]). Mr. N M A Treschow (ch)* k Ms. Ann M Fudge (vch)* k Mr. P Polman (ceo) k Ms. Mary Ma* n Ms. T Hixonia Nyasulu* n Ms. Laura M L Cha* n 15.0 5.00 297 3 + 400 750 208 PRICE (NMS 0.8) 4-MAR-16 3109p market cap position index £39,903m 13th FTSE 100 norm eps (pr) 149p turnover (15AR) £39,318m pretax (15AR) £5,329m m s DY (pr) % 3.14 PER (pr) PEG (pr) GR (pr) ROCE MARGIN x f % % % GEAR % 78.7 PBV PTBV PCF PSR PRR x x x x x 20.8 na 11.8 97.7 14.1 3.50 –5.62 17.0 2.25 119 nav ps (15AR) 888p net cash ps (15AR) na year ended 31 Dec 2011 2012 2013 2014 2015 2016E 2017E turnover £m 38813 41625 41699 37847 39318 depreciation £m 860 972 964 1119 1011 int paid (net) £m 367 311 327 285 298 IFRS3 pretax £m 5216 5298 5957 5974 5329 norm pretax £m 5358 5358 5478 4939 5398 6034 6445 turnover ps £ 13.8 14.7 14.7 13.3 13.8 op margin % 14.3 13.4 13.6 13.5 14.1 ROCE % 81.1 109 94.3 99.4 97.7 ROE % 27.1 24.7 25.4 23.9 27.8 IFRS3 eps p 122 122 139 140 127 norm eps p 127 121 122 104 130 148 156 norm eps growth % -4.97 -4.24 +0.82 -15.2 +24.9 +14.0 +5.44 tax rate % 26.5 26.4 26.4 28.2 27.6 norm per x 24.0 21.0 19.9 provisional peg f 0.96 1.50 3.66 cash flow ps p 153 185 178 146 183 capex ps p 58.6 61.4 59.8 56.3 53.9 dividend ps p 76.6 77.3 89.2 90.6 87.3 96.3 104 dps growth % +8.56 +0.94 +15.4 +1.60 -3.74 +10.4 +8.42 dividend yield % 2.81 3.10 3.36 dividend cover x 1.78 1.62 1.43 1.20 1.47 1.54 1.49 shrholders funds £m 11939 12483 12011 10667 11395 net borrowings £m 8388 6133 7410 7933 8967 net curr assets £m -3039 -2975 -4405 -5700 -5412 ntav ps p -210 -180 -192 -519 -553 2016 ESTIMATES Broker ULVR Eps p 137 147 + 146 + 150 + 148 +3.63 +10.3 Dps p 87.7 6584 + 95.8 + 101 + 96.3 +3.72 +6.44 2017 ESTIMATES Pretax £m 6190 - Eps p 149 - Dps p 92.6 - 6445 + 6759 + 6445 +194 +255 156 + 164 + 156 +3.19 +6.53 101 + 107 + 104 +4.35 +4.90 GEARING, COVER (15AR) intangibles net gearing % cash % gross gearing% under 5 yrs % under 1 yr % quick ratio current ratio interest cover Incl 78.7 14.9 93.6 93.6 30.3 r r x Excl neg neg neg neg neg 0.42 0.63 14.3 KEY DATES next AR year end int results int xd (21.1p) 3rd qtr results int xd (22.59p) year end prelim results fin xd (23p) annual report next agm 31-Dec-16 23-Jul-15 6-Aug-15 15-Oct-15 29-Oct-15 31-Dec-15 19-Jan-16 4-Feb-16 23-Feb-16 20-Apr-16 (c) 2016 JD Financial Publishing. Whilst compiled from factual information extracted from sources believed to be reliable, the publishers do not accept responsibility and expressly disclaim liability for errors, omissions or mis-statements herein. Data provided by MorningStar..