Oil Slick - BMO Nesbitt Burns

advertisement

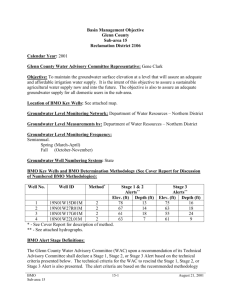

A look ahead at the Canadian and American economies November 13, 2014 Oil Slick United States Booming shale energy output, global growth concerns and a surprising price cut by Saudi Arabia have slashed world oil prices 25% since June to four-year lows. That’s not great news for the tight oil industry and two states, Texas and North Dakota, in particular. However, most shale energy drilling will continue unless prices drop further. As well, the production foregone in an industry that accounts for less than 1% of GDP is more than offset by the impact of lower energy costs on consumer spending, corporate profits and global demand. In all, lower oil prices could lift U.S. GDP about 0.2% in the year ahead. However, a stronger greenback and milder global outlook prompted us to trim our growth forecast to 3.0% in 2015. The economy is on a higher growth track, led by an 8% advance in business spending in the past year. Not surprisingly, firms are also hiring at the fastest rate since 2006, with 2¼ million jobs added this year. Payrolls have risen more than 200,000 in each of the past nine months, a streak unmatched in two decades. The unemployment rate has fallen to six-year lows of 5.8%, below long-term norms. A jump in full-time positions and more jobs in high-paying industries are supporting income and spending, lifting auto sales and consumer confidence to pre-recession levels. However, households are still holding back somewhat due to soft wage growth. Meantime, last year’s sizeable fiscal drag from tax hikes and sequestration has faded, while municipal governments are spending more and cutting taxes. The recovery in housing markets has resumed in response to lower mortgage rates and a recent easing in lending standards, though price appreciation has slowed. After expanding 3.5% in Q3 (with a big assist from defense spending), real GDP likely slowed to 2.8% in Q4. However, this still tops average 2.1% growth in the first four years of the expansion. ECONOMIC RESEARCH 1-800-613-0205 • www.bmocm.com/economics Sal Guatieri, Senior Economist 416-359-5295 sal.guatieri@bmo.com HIGHLIGHTS Lower oil prices will help the U.S. economy but hinder Canada’s expansion Cheaper fuel, record stock prices and low interest rates should propel the U.S. economy 3% in 2015 A weaker outlook for oil-rich Alberta prompts a slight downgrade for Canadian growth, but a sagging loonie will help The Fed has stopped easing policy, and will likely start raising rates in mid-2015 A dovish Bank of Canada will lag the Fed’s tightening cycle Higher U.S. interest rates will further weaken the Canadian dollar The Republicans’ strong showing in the Midterm Elections could support business confidence and investment. By regaining control of Congress, the GOP will have a firmer platform to reform corporate tax laws, reinstate the bonus depreciation allowance on capital equipment, build the Keystone XL pipeline, repeal the oil export ban, and pass key trade deals with Asia and Europe. While it’s unclear whether a more equal division of power will lead to more productive legislation or to further gamesmanship and gridlock, recent conciliatory comments from both parties are encouraging. If both sides can work together on issues that have some bipartisan support, such as corporate tax reform and trade agreements, then the chance A Publication of BMO Capital Markets Economic Research • Douglas Porter, CFA, Chief Economist, BMO Financial Group Page 2 of 7 of renewed showdowns over the continuing resolution to fund the government, debt ceiling and budget deficit should diminish. Inflation continues to retreat amid falling gasoline prices, a stronger dollar, and intense retail competition. The CPI rose 1.7% y/y in September, while the PCE price index (the Fed’s preferred inflation guide) climbed 1.4%. While inflation is expected to remain low in 2015, an upturn to 2% is expected due to perkier wages. Tentative evidence suggests wages are responding to lower unemployment and isolated labour shortages. The employment cost index rose 2.8% annualized in the past two quarters, the fastest pace in six years. However, provided that wage growth doesn’t exceed combined increases in inflation and productivity, it is more likely to support demand than stoke inflation. The Fed had few qualms about ending its asset purchase program in October. During QE3’s two-year lifespan, five million jobs were created and the unemployment rate fell two percentage points, by all means marking “substantial” progress in labour markets. With slack no longer deemed “significant”, the focus now shifts to when to remove the stimulus. While a “considerable time” could still elapse before we see tighter policy, the Fed has warned markets of the risk of a near-term rate hike should the economy surprise to the upside. Still, no move is expected until June 2015, based on the FOMC members’ rate projections and benign inflation. The first increase in policy rates since 2006 and a gradual tightening course should lift the 10-year Treasury yield from 2.3% currently to 3.0% at the end of 2015 and to 3.7% in late 2016, still low by historical standards. Canada While lower oil prices will support the U.S. expansion, the same cannot be said for Canada. A cutback in oil and gas investment could carve up to 0.2% from GDP growth next year. Alberta will take the brunt of the hit, likely slowing to a sub-3% rate for the first time since the recession. Saskatchewan and Newfoundland will also share the pain. However, the manufacturing-heavy regions in Central Canada will benefit from both lower energy costs and a weaker currency. We therefore shaved our 2015 growth forecast only slightly to 2.4%. This would still mark the best annual performance in three years and a modest pickup from estimated 2.2% growth in the second half of 2014. Exports will drive the expansion, with support from business spending. Goods exports are up 8% in the past year to September amid widespread gains across industries. Meanwhile, imports have moderated as fewer Canadians are shopping stateside. As a result, job growth is picking up (1.0% y/y in October) after slowing earlier this year. Now that the export train has left the station, it won’t be November 13, 2014 Page 3 of 7 long before capital spending (outside of the resource sector) gets pulled along. Announced tax relief by the federal government will also support consumers next year, especially in July when parents will receive retroactive Child Care Benefit payments. Nonetheless, elevated household debt and higher interest rates will act as a moderate brake on spending. Higher interest rates will also cool red-hot housing markets in Calgary, Toronto and Vancouver. While other regions have steadied or weakened this year, notably Atlantic Canada and Quebec, these three cities have strengthened, with sales well above year-ago levels in response to strong demand from immigrants and millennials. Prices have accelerated faster than family income, further straining affordability. Consequently, some correction is anticipated in Toronto and Vancouver when interest rates eventually rise. As a rough guide to potential price declines, if interest rates rose two percentage points in the next three years (while income continued to trend higher), the price of a Toronto bungalow would need to decrease 11% to maintain mortgage service costs at current levels for the typical buyer. While supportive demographics and an influx of foreign wealth should cushion the blow, it’s difficult to see prices staying at current lofty levels if interest rates don’t stay at current crisis levels. Despite a firmer economy and higher inflation, the Bank of Canada has no intention of lifting rates soon. Citing almost one million involuntary part-time workers, the Bank claims the economy’s “considerable” slack will suppress inflation for the next two years. Accordingly, it has downplayed the recent upturn in the CPI to the 2.0% target, citing transitory factors such as higher meat prices and a weaker loonie. Moreover, though acknowledging perkier exports, the Bank still sees global headwinds as a threat. In addition, Governor Poloz believes the consequences of a downward inflation surprise are greater than an upside surprise, implying a bias to avoid tightening prematurely. As a result, we see no rate hike until October 2015, four months after the Fed’s liftoff and five years after the Bank last raised rates. The 10-year Canada yield should climb gradually from 2.0% currently to 2.7% by late 2015 and to 3.3% in late 2016. Sliding oil prices have pulled the Canadian dollar to five-year lows below 88 cents US, with an assist from still-dovish BoC banter. The thrashing likely isn’t over, even if oil prices firm as expected to $85 dollars a barrel by late next year. With the Bank likely to lag the Fed’s tightening cycle, and longer term Canada yields already below U.S. rates, the loonie could weaken to 85 cents by late 2015. November 13, 2014 Page 4 of 7 November 13, 2014 Forecasts CANADA 2014 2015 ANNUAL 2014 I II III IV I II III IV 2013 1.0 3.6 2.2 2.1 2.3 2.5 2.7 2.6 2.0 2.3 2.4 1.3 3.7 2.3 1.6 1.9 2.1 2.2 2.0 2.5 2.5 2.1 -2.5 1.8 1.3 1.7 2.3 4.3 3.7 4.2 2.6 -0.3 2.7 Consumer Price Index (y/y % chng) 1.4 2.2 2.1 1.9 1.7 1.5 1.8 2.4 0.9 1.9 1.8 Unemployment Rate (%) 7.0 7.0 6.9 6.6 6.6 6.5 6.4 6.4 7.1 6.9 6.5 Housing Starts (000s : a.r.) 175 197 199 188 189 186 184 181 188 190 185 -48.1 -47.5 -43.9 -54.3 -49.0 -46.2 -43.9 -40.9 -60.3 -48.5 -45.0 Overnight Rate 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.25 1.00 1.00 1.05 3-month Treasury Bill 0.87 0.93 0.94 0.89 0.89 0.89 0.89 1.15 0.97 0.91 0.96 10-year Bond 2.47 2.35 2.14 2.00 2.02 2.12 2.29 2.55 2.26 2.24 2.25 90-day 82 90 91 87 87 79 56 59 91 88 70 10-year -30 -27 -35 -30 -31 -32 -33 -35 -9 -30 -33 -2.1 4.6 3.5 2.8 2.9 3.0 2.8 2.7 2.2 2.2 3.0 Consumer Spending 1.2 2.5 1.8 2.8 3.2 3.3 3.0 2.9 2.4 2.2 2.9 Business Investment (non-residential) 1.6 9.7 5.5 5.0 4.7 4.7 4.5 4.4 3.0 5.9 5.1 Consumer Price Index (y/y % chng) 1.4 2.1 1.8 1.7 1.8 1.8 2.0 2.2 1.5 1.7 2.0 Unemployment Rate (%) 6.7 6.2 6.1 5.8 5.6 5.4 5.2 5.0 7.4 6.2 5.3 Housing Starts (mlns : a.r.) 0.93 0.99 1.02 1.06 1.18 1.27 1.31 1.31 0.93 1.00 1.27 Current Account Balance ($blns : a.r.) -408 -394 -367 -391 -402 -412 -427 -439 -400 -390 -420 Fed Funds Target Rate 0.13 0.13 0.13 0.13 0.13 0.21 0.46 0.71 0.13 0.13 0.38 3-month Treasury Bill 0.05 0.03 0.03 0.02 0.02 0.10 0.33 0.56 0.06 0.03 0.25 10-year Note 2.76 2.62 2.50 2.30 2.33 2.44 2.63 2.90 2.35 2.55 2.57 US¢/C$ 90.6 91.7 91.8 88.7 87.8 86.8 85.8 85.1 97.1 90.7 86.4 C$/US$ 1.103 1.090 1.089 1.127 1.139 1.153 1.166 1.175 1.030 1.103 1.158 ¥/US$ 103 102 104 111 113 114 115 117 98 105 115 US$/Euro 1.37 1.37 1.32 1.26 1.27 1.25 1.24 1.22 1.33 1.33 1.25 US$/£ 1.66 1.68 1.67 1.61 1.61 1.60 1.58 1.57 1.56 1.65 1.59 Real GDP (q/q % chng : a.r.) Consumer Spending Business Investment (non-residential) Current Account Balance ($blns : a.r.) 2015 Interest Rates (average for the quarter : %) Canada/U.S. Interest Rate Spreads (average for the quarter : bps) UNITED STATES Real GDP (q/q % chng : a.r.) Interest Rates (average for the quarter : %) EXCHANGE RATES (average for the quarter) Note: Shaded areas represent BMO Capital Markets forecasts Page 5 of 7 November 13, 2014 FINANCIAL STRESS STILL LOW CREDIT RISK ALSO LOW United States (as of November 11, 2014) United States (ppts) VIX 2 Ted Spread 1 500 100 400 80 300 60 200 40 100 20 Corporate Bond Spreads 1 5 4 3 0 2 0 07 08 09 10 11 12 13 14 15 1 1 07 08 09 10 11 12 13 14 15 2 3-mnth Eurodollar minus 3-mnth T-bills (bps) 07 1 CBOE market volatility index 08 09 10 11 12 13 14 After a recent brief spike higher Complacency setting in? CANADIAN DOLLAR TO WEAKEN FURTHER OIL PRICES HIT BY SUPPLY GLUT (US¢ : as of November 12, 2014) Commodity price range since start of 2014 Canadian Dollar Materials & Foodstuffs Metals & Energy (as of November 11, 2014) (as of November 11, 2014) 110 Lumber Parity 100 15 15-year BoA Merrill Lynch AA Corporate Yield less 10-year Treasury Yield 90 Soybeans (US$/bu) 88.39¢ Gold 328.50 [current] (US$/ 1000 sq ft) 297.00 (US$/oz) 369.80 1156.50 1142.00 Oil 10.09 8.83 15.29 (US$/bbl) 1385.00 77.94 77.19 107.62 80 Wheat (US$/bu) 70 forecast 60 03 04 05 06 07 08 09 10 11 12 13 14 15 7.42 Corn (US$/bu) Natural Gas 4.63 4.17 (US$/mmbtu) 4.25 3.56 Copper 3.40 2.79 (US$/lb) 4.99 6.15 3.03 2.92 3.37 Grain prices dampened by bumper crop; Gold sold ECONOMIES ON FIRMER TRACK U.S. CONSUMER SPENDING TO PICK UP (y/y % change) (y/y % change) Real GDP Real Personal Consumption Expenditures 6 6 Canada 4 Canada 4 2 2 0 0 -2 -4 -6 12 Canada 1.9 US 2.3 00 02 13 2.0 2.2 04 14 2.3 2.2 15 2.4 3.0 06 -2 U.S. 08 10 forecast 12 14 U.S. -4 00 02 04 06 08 10 forecast 12 Canadian spending to moderate 14 Page 6 of 7 November 13, 2014 EXPORTS TO BOOST CANADIAN INVESTMENT U.S. HOME PRICE GROWTH MODERATING (y/y % change) Existing Homes (y/y % change : 3-month m.a.) Real Non-Residential Business Investment Prices Sales 30 80 Canada 20 20 Canada 60 15 Canada 10 10 40 U.S. 0 5 20 -10 0 -5 0 U.S. -10 -20 -20 forecast -30 00 02 04 06 08 10 12 -15 U.S. -40 14 -20 00 02 04 06 08 10 12 14 00 02 04 06 08 10 12 14 U.S. JOBLESS RATE BACK TO NORMAL LEVELS INFLATION HAS STEADIED (percent) Consumer Price Index (y/y % change) Unemployment Rate United States Canada 14 6 6 12 Headline forecast Canada Headline 10 8 2.1% 3 33-Year Low forecast Core Core 6 1.7% 3 0 0 1.7% 2.0% 4 U.S. forecast 2 70 75 80 85 90 95 00 05 10 -3 15 -3 07 09 11 13 15 07 09 11 FED ON HOLD UNTIL JUNE 2015, BOC WILL LAG LONG-TERM RATES TO RISE SLOWLY (% : as of November 12, 2014) (% : as of November 12, 2014) Overnight Rate 13 15 10-Year Bonds 6 7 forecast 6 forecast U.S. 5 5 4 4 3 Canada 3 3.00% 2.30% Canada 2 2 U.S. 1% 45-Year Low 1 1.0% 0%–0.25% 0 01 03 05 07 09 11 13 15 2.65% (year end 2.33% 2.00% ’15) Canada 2.04% (year end Canada-U.S. Spread -29 bps ’14) U.S. 1 0 07 08 09 10 11 12 13 14 15 Page 7 of 7 November 13, 2014 General Disclosure “BMO Capital Markets” is a trade name used by the BMO Investment Banking Group, which includes the wholesale arm of Bank of Montreal and its subsidiaries BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. in the U.K. and BMO Capital Markets Corp. in the U.S. BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. and BMO Capital Markets Corp are affiliates. Bank of Montreal or its subsidiaries (“BMO Financial Group”) has lending arrangements with, or provide other remunerated services to, many issuers covered by BMO Capital Markets. The opinions, estimates and projections contained in this report are those of BMO Capital Markets as of the date of this report and are subject to change without notice. BMO Capital Markets endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, BMO Capital Markets makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to BMO Capital Markets or its affiliates that is not reflected in this report. The information in this report is not intended to be used as the primary basis of investment decisions, and because of individual client objectives, should not be construed as advice designed to meet the particular investment needs of any investor. This material is for information purposes only and is not an offer to sell or the solicitation of an offer to buy any security. BMO Capital Markets or its affiliates will buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. BMO Capital Markets or its affiliates, officers, directors or employees have a long or short position in many of the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. The reader should assume that BMO Capital Markets or its affiliates may have a conflict of interest and should not rely solely on this report in evaluating whether or not to buy or sell securities of issuers discussed herein. Dissemination of Research Our publications are disseminated via email and may also be available via our web site http://www.bmonesbittburns.com/economics. Please contact your BMO Financial Group Representative for more information. Conflict Statement A general description of how BMO Financial Group identifies and manages conflicts of interest is contained in our public facing policy for managing conflicts of interest in connection with investment research which is available at http://researchglobal.bmocapitalmarkets.com/Public/Conflict_Statement_Public.aspx. ADDITIONAL INFORMATION IS AVAILABLE UPON REQUEST BMO Financial Group (NYSE, TSX: BMO) is an integrated financial services provider offering a range of retail banking, wealth management, and investment and corporate banking products. BMO serves Canadian retail clients through BMO Bank of Montreal and BMO Nesbitt Burns. In the United States, personal and commercial banking clients are served by BMO Harris Bank N.A., Member FDIC. Investment and corporate banking services are provided in Canada and the US through BMO Capital Markets. BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A, BMO Ireland Plc, and Bank of Montreal (China) Co. Ltd. and the institutional broker dealer businesses of BMO Capital Markets Corp. (Member SIPC), BMO Nesbitt Burns Securities Limited (Member SIPC) and BMO Capital Markets GKST Inc. (Member SIPC) in the U.S., BMO Nesbitt Burns Inc. (Member Canadian Investor Protection Fund) in Canada, Europe and Asia, BMO Capital Markets Limited in Europe, Asia and Australia and BMO Advisors Private Limited in India. “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited, used under license. “BMO Capital Markets” is a trademark of Bank of Montreal, used under license. "BMO (M-Bar roundel symbol)" is a registered trademark of Bank of Montreal, used under license. ® Registered trademark of Bank of Montreal in the United States, Canada and elsewhere. TM Trademark Bank of Montreal © COPYRIGHT 2014 BMO CAPITAL MARKETS CORP. A member of BMO Financial Group