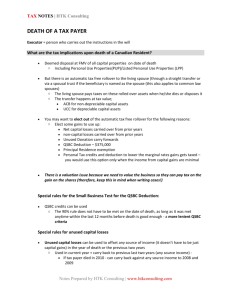

CRA RRSP Guide

advertisement