EC201 Intermediate Macroeconomics EC201 Intermediate

advertisement

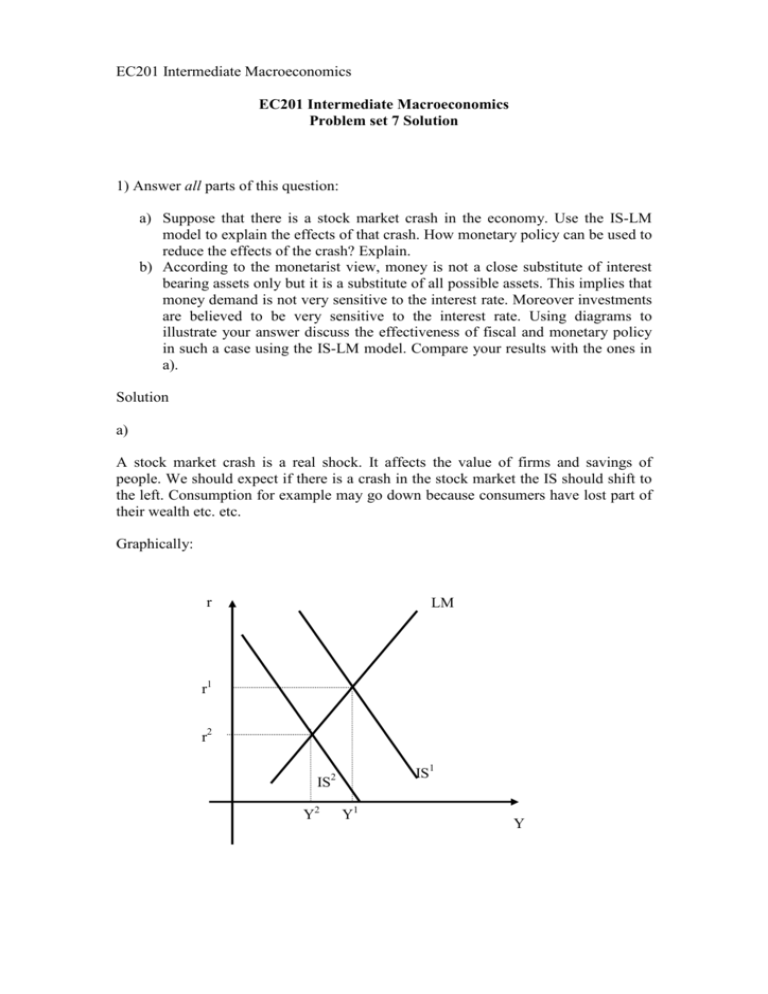

EC201 Intermediate Macroeconomics EC201 Intermediate Macroeconomics Problem set 7 Solution 1) Answer all parts of this question: a) Suppose that there is a stock market crash in the economy. Use the IS-LM model to explain the effects of that crash. How monetary policy can be used to reduce the effects of the crash? Explain. b) According to the monetarist view, money is not a close substitute of interest bearing assets only but it is a substitute of all possible assets. This implies that money demand is not very sensitive to the interest rate. Moreover investments are believed to be very sensitive to the interest rate. Using diagrams to illustrate your answer discuss the effectiveness of fiscal and monetary policy in such a case using the IS-LM model. Compare your results with the ones in a). Solution a) A stock market crash is a real shock. It affects the value of firms and savings of people. We should expect if there is a crash in the stock market the IS should shift to the left. Consumption for example may go down because consumers have lost part of their wealth etc. etc. Graphically: r LM r1 r2 IS1 IS2 Y2 Y1 Y The crash in the stock market shifts the IS curve from IS1 to IS2. This results in a decrease in equilibrium output from Y1 to Y2, and also in the equilibrium interest rate. We have a recession in the economy. What the central bank can do is to increase money supply so that interest rate will decrease further trying to boost investment expenditure and so output. Graphically: r LM LM1 r1 r2 r3 IS1 IS2 Y2 Y1 Y Money supply increases to the LM shifts to the right to LM1. There is an excess of money supply in the money market and so the interest rate will fall. In the goods market Investment expenditure will increase so that output will increase. In principle we can go back to the original equilibrium of output while the equilibrium interest rate is now much lower (r3) (if that is consistent with a positive interest rate). Therefore in principle monetary policy can be used to offset completely the negative effects of the shock on output. Notice the difference with the case illustrated in Lecture 9. In that lecture the idea was: suppose that the economy can be hit by a real shock. We don’t know in advance if the shock is good or bad. However if the economy may face a real shock (good or bad) the best thing to do is to keep constant money supply and let the interest rate fluctuating. This policy, once a shock hits the economy, will minimise the output variability. Here we know exactly what shock is hitting the economy (in this case a crash in the stock market) and so we can move money supply and the interest rate to offset the effects of the shock. b) According to monetarists money is not just a substitute for financial assets but it is a substitute for any possible assets (real, like a house, a car etc. etc. and financial). This implies that money demand would not be very sensitive to changes in the interest rate since money demand should respond to changes of all relative prices not only to the interest rate. Money here is not only demanded for transactions as assumed by the theory of liquidity preference. Money demand is broader here. Therefore, the LM curve will be quite steep. Moreover, monetarists assume that investments are sensitive to the interest rate. In this case we have the following results: i) Monetary policy is really effective; ii) Fiscal policy is not effective and the crowding out is almost complete; Fiscal policy: LM r IS2 2 r r1 IS1 2 Y1 Y Y An increase in government expenditure (or a decrease in taxes) results mainly in a high equilibrium interest rate while the increase in output is very limited. Crowding out is particularly strong. Why? An increase in G increases Y in the goods market. The increase in Y increases money demand in the money market. Now there is an excess of money demand in the money market. The interest rate must increase to restore the equilibrium. Since money demand is not very sensitive to the interest rate, the increase in the r needed to restore the equilibrium is particularly large, so the interest rate increases substantially. Since investments are particularly sensitive to the interest rate, the big increase in the interest rate depresses substantially private investment and so crowding out is quite strong here. Monetary policy: an increase in money supply will create an excess of money supply in the money market. The interest rate must decrease. However, since investments are very sensitive to the interest rate, a small decrease in the interest rate will increase investment substantially in the goods market. This is turn will increase output. The increase in output will increase money demand and this will reduce the excess of money supply restoring the equilibrium in the money market. Here monetary policy is very powerful, since it affects substantially the level of output. LM2 LM1 r r2 IS r1 Y1 Y2 Y According to Keynes instead the opposite should be true. Fiscal policy should be very effective while monetary policy has limited power. This is an empirical issue. In 1970 a research by Andersen and Carlson1 tried to answer the question. They estimated using US data the following regression: 4 4 i =0 i =0 ∆Yt = c + ∑ m i ∆M t −i + ∑ ei ∆G t −i In practice they wanted to see how changes in money supply ∆M t −i in and in government expenditure ∆Gt −i can create changes in current output ∆Yt . Notice that also changes in previous periods (t-i) are considered (this is to test if changes in, for example, last year money supply has an effect on this year output etc. etc.) The equation above is now known as the “St. Louis Model”. They found that all the m i where different from zero and significant, while the ei where insignificant and so close to zero. Thus according to this result monetary policy was very powerful since it had a significant impact on output while government expenditure did not have any significant impact on output. This result would then imply that the monetarist view should be the correct one. However, if you try to estimate the same equation using a different sample you may find different results. Indeed this has been done. This is to say that the empirical evidence is still inconclusive. 1 Anderson L.C. and K.M. Carlson (1970) “A Monetarist Model for Economic Stabilization”, Federal Reserve Bank of St. Louis Review, n. 52, pp. 7-25. 2) (Taylor Rule in the IS-LM model) Consider an economy where the central bank pursue a Taylor Rule and not a monetary targeting strategy (meaning we replace the LM curve with the TR curve). The Taylor Rule is given by: i = i + β (Y − Y ) Where i is the nominal interest rate, i is the natural interest rate, (Y − Y ) is the deviation of real output from the natural level and β is a positive constant that measures the sensitivity of the interest rate setting to output deviations. a) Assume that output is at the natural level; show graphically what the implication for the TR curve of an increase in the sensitivity to output deviations is. b) Consider an increase in government expenditure in the IS-TR model. Using diagrams to illustrate your answer show what happens to output and the interest rate when the TR schedule is horizontal. What are the main differences with the case where the TR schedule is upward sloping? Solution a) When the central bank’s sensitivity to the output gap rises, the TR schedule becomes steeper. Why? As β increases, central bank cares more about output deviations. For example, suppose that Y becomes lower than the natural level; then the central bank decreases the interest rate (according to the Taylor Rule) by a large amount in order to bring back Y to the natural level. This means that the TR curve is quite steep. Graphically, starting with a given TR curve, an increase in β will mean that the TR curve rotates anti-clockwise, but around which point? We know that if Y is at the natural level, then the central bank will set the interest rate at its neutral level i . This corresponds to point A in the figure below. It follows that a change of responsiveness to the output gap is represented by a rotation of TR around point A. b) When the TR is horizontal it means that β = 0 , the central bank does not care about output gap and so the interest rate is always at the natural level: i = i . If G increases, IS shifts to the right, output increases but the interest remains constant. How the central bank keeps the interest rate constant? The increase in G increases Y in the goods market. The increase in Y increases money demand in the money market. Now there is an excess of money demand in the money market. Without any intervention by the central bank the interest rate will increase to restore equilibrium. For the interest rate to remain constant the central bank must accommodate that increase in money demand by increasing money supply. Now money supply is endogenous and it changes in order to restore the equilibrium in the money market. When TR is positively sloped, an increase in G increases output but also the interest rate like in the usual IS-LM model. However the mechanism is now different. Suppose we start at point A where output is at the natural level. The increase in G increases Y in the goods market and so now the output gap increases. The increase in Y increases money demand in the money market. Now there is an excess of money demand. Without any intervention of the central bank the interest rate will increase to restore equilibrium. Since the central bank cares about output gap now, it will increase the interest rate according to the Taylor Rule in order to reduce the output deviation and so it will move money supply in such a way that the interest rate will be the one implied by the Taylor Rule. Money supply is again endogenous. Notice that here we have crowding out (interest rate goes up and investment goes down), but now it is the central bank that creates the crowding out effect by increasing the interest rate according to the Taylor Rule. 3) Consider the following modified version of the IS-LM model: C = 150 + 0.5(Y − T ) T = G = 300 I = 150 + 0.3Y − 10000 ρ ρ =i+x D M = 2Y − 20000 i P M = 2600 P a) Assume that the spread x is zero. Derive the IS relation and find the equilibrium level of output (Y) and the interest rate (i) implied by the IS-LM model. b) Now assume that there is a fall in the firm’s capital with the result that x is increased to 0.5%. What happens to the cost of bank loans? Calculate the new equilibrium in the IS-LM model. Briefly explain your findings. Solution a) When x = 0 the IS equation is: Y = 150 + 0.5Y − 150 + 300 + 150 + 0.3Y − 10000 i Solving that for i: 10000 i = 450 − 0.2Y i = 0.045 − 0.00002 Y The LM curve is: 2600 = 2Y − 20000 i . Solving that for i: i = −0.13 + 0.0001Y The equilibrium is found by solving the two equations (IS and LM) simultaneously: Y * = 1458 .3 i * = 0.016 b) Now x =0.5%, or x =0.005. The cost of bank loans increases. The IS becomes: Y = 150 + 0.5Y − 150 + 300 + 150 + 0.3Y − 10000 i − 50 Solving that for i: i = 0.04 − 0.00002 Y The LM is the same as before: i = −0.13 + 0.0001Y The equilibrium is now: Y * = 1416 .7 i * = 0.012 Output decreases since investment decreases (the cost of bank loan has increased since x has increased). The equilibrium interest rate also decreases. Graphically, this is equivalent to a shifts to the left of the IS curve along a given LM curve. In equilibrium the value of ρ is: ρ * = i * + x = 0.012 + 0.005 = 0.017 . The cost of bank loan increases in equilibrium (from 0.016 to 0.017).