Exchange Settlement Account System (ESAS) Report to Account

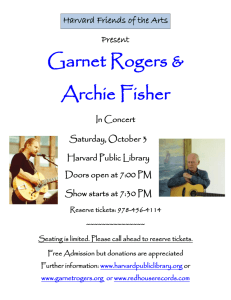

advertisement

ed iv Ar ch Exchange Settlement Account System (ESAS) Report to Account Holders Year ended 30 June 2014 Reserve Bank of New Zealand August 2014 Reserve Bank of New Zealand: ESAS System Annual Report 2014 1 Table of contents 3 Management commentary 4 Key statistics 5 Risk management 7 Financial performance 8 Plan for 2014-15 9 Ar ch iv ed System overview Directory Exchange Settlement Account System (ESAS) System Operator: Reserve Bank of New Zealand Email: rtgshelpdesk@rbnz.govt.nz Telephone: (64) (4) 471 3918 (64) (4) 471 3712 Fax: Website: www.rbnz.govt.nz/markets_and_payment_operations/esas/ ISSN Copyright © 2014 Reserve Bank of New Zealand 2 Reserve Bank of New Zealand: ESAS System Annual Report 2014 System overview About ESAS ESAS is New Zealand’s principal high-value payments system which is used to settle payment instructions between accountholders. The system is charged with providing an efficient and safe process for the real time electronic settlement of payments between accountholders. The Reserve Bank has provided ESAS as a real-time gross settlement system since 1998. Accountholders electronically submit instructions to debit an account and credit another account using an authorised electronic submitting mechanism. Authorised submitting mechanisms include closed user groups which utilise the SWIFT electronic messaging system, the NZClear system and direct entry of transaction details to ESAS. The system is available for use by accountholders for 23.5 hours each business day. Each business day commences at 9.00am on a working day and ends at 8.30am the following working day. A payment will be settled (i.e. funds are transferred from one ESAS accountholder’s exchange settlement ed account to another ESAS accountholder’s exchange settlement account) once a transaction instruction is authenticated, the payment instruction is authorised by the payer and the payer has sufficient funds in their exchange settlement account to effect the transaction. Once a transaction is settled it cannot be revoked. The ESAS system is operated by the Reserve Bank. The Reserve Bank’s Financial Services Group iv (“FSG”) is responsible for the administration of the operational aspects of the System. FSG is headed by Mike Wolyncewicz, the Reserve Bank’s Chief Financial Officer, and day-to-day business support is provided by the Payment and Settlement Services Team within FSG that is managed by the Manager of Payments Ar ch and Settlement Services, Nathan Lewer. FSG reports on the operation of ESAS to Mr. Geoff Bascand, Deputy Governor and Head of Operations. The Reserve Bank’s Knowledge Services Group (“KSG”) supports the telecommunications network and related security features utilised by the system. Software support, software development and operational support services are provided by Datacom Systems (Wellington) Limited (“Datacom”). The aggregate level of liquidity in the ESAS system is managed by the Reserve Bank’s Financial Markets Department (“FMD”). FMD injects or withdraws liquidity from the system by undertaking transactions such as foreign currency swap transactions, reverse repurchase agreements and issuance of Reserve Bank Bills. FMD’s objective is to ensure that there is adequate aggregate liquidity in the system to ensure the efficient operation of payment operations while also maintaining short-term wholesale interest rates at levels close to the Official Cash Rate. Typically aggregate system liquidity is maintained in the range of $6 billion to $8 billion. ESAS is a designated settlement system under Part 5C of the Reserve Bank Act 1989. The regulator is the Prudential Supervision Department of the Reserve Bank. Institutional arrangements are in place to ensure that dealings between the Financial Services Group and the Prudential Supervision Department occur on an arm’s length basis. Reserve Bank of New Zealand: ESAS System Annual Report 2014 3 Management commentary Year ended 30 June 2014 Key performance indicators are: Key performance indicator 2014 2013 • System availability (%) 99.78 99.85 10,443 9,411 3,162 2,305 100 100 • Average daily transactions • Revenue ($000) Customer satisfaction - meets or exceeds expectations (%) The system was available to users 99.78% of core hours which was down on the 99.85% achieved in 2013. This was largely due to two incidents arising from software faults which prevented members who were ed not already in the system from being able to log in. However, automated processing was able to continue for members as transactions are submitted to the system via the SWIFT interface and the business impact of these outages was limited. No extensions to processing cut-off deadlines were required. A thorough postincident follow-up process occurs after each incident to ensure the root cause is understood and actions, iv such as systems or process changes, are agreed and implemented. Overall transactions volumes continue to grow, partly reflecting higher use of the Settlement before Ar ch Interchange (SBI) interface. The 2013/14 year has seen a significant lift in costs due to charges for SWIFT’s support service which had previously been waived, and also as a result of an increase in IT costs for work performed to improve system security and to implement changes necessary to respond to updates and changes made to software products which the system utilises. As a result, from 1 July 2013 the Bank increased the ESAS fees in order to fully recover the cost of operating the system, as provided for in the ESAS Terms and Conditions. In 2014/15, the Bank will continue a programme of work to further improve systems security. The major development initiative involves completing the replacement of CASmf software which interfaces ESAS with SWIFT. Satisfactory progress is being made on this project and we expect industry testing will be undertaken in the December quarter. During the 2013/14 financial year the Bank commenced a payment systems strategic review, with a key objective to develop a roadmap for the systems prior to undertaking further major technology investments. An industry consultation paper was issued in May 2014, with submissions due by 18 July 2014. The consultation paper set out the Bank’s vision and suggested key principles for development of its payment system operations, and asked for feedback on those matters as well as the Bank’s involvement in securities settlement operations. The Bank will report back to stakeholders in coming months summarising the submissions and consulting further on the proposed roadmap. 4 Reserve Bank of New Zealand: ESAS System Annual Report 2014 Key statistics There are three primary interfaces or “Accountholder Submitting Systems” which are used by ESAS Accountholders to submit payment instructions to ESAS: • directly from the NZClear system. • via the SWIFT system where members of the Assured Value Payment “AVP” closed user group use ESAS to pay other members of that closed user group. The Reserve Bank is the administrator of the AVP closed user group. • via the SWIFT system where members of the Settlement Before Interchange “SBI” closed user group use ESAS to pay other members of that closed user group. Payments NZ Limited is the administrator of the SBI closed user group. Once an SBI settlement has been effected in ESAS, a confirmation is sent to SWIFT which then allows an associated interchange file containing underlying payment details to be Transactions – All ed released to the destination bank. There is steady growth in the volume of transactions submitted to ESAS. The daily average value of transactions passing through the system declined markedly immediately post the period of iv the Global Financial Crisis in 2008 to 2010. This Ar ch decline is in common with that experienced by other Transactions – Sourced from SWIFT “AVP” central banks which operate RTGS systems. More recently, the decline has abated and average daily transaction values have been more stable Transactions submitted to ESAS via the main SWIFT closed user group known as “AVP” dominate overall ESAS activity, both in terms of volumes and values. Transaction numbers are growing at a steady rate and the average daily value of AVP transactions appear to no longer be declining. Reserve Bank of New Zealand: ESAS System Annual Report 2014 5 The SBI interface to ESAS commenced Transactions – Sourced from SBI operation in February 2012. Volumes are growing slowly as banks submit more files to ESAS during the banking day. Transactions sourced from the NZClear system Transactions –Sourced from NZClear reflect high NZClear turnover in recent years which results from high activity on the New Zealand share iv ed market. Ar ch System outages year ended 30 June (hours: mins) 2010 2011 2012 2013 2014 Application – all users 1:47 1:58 1:36 1:20 0:07 Application – subset of all users 0:10 1:22 0:50 4:45 8:32 Connectivity 1:17 0:02 0:00 0:00 0:00 • The system was available 99.78% during core support hours (2013: 99.85%). • There were two main outages totalling 512 minutes, but the business impact of these incidents was very limited because automated processing was able to continue. All incidents are followed up in order to minimise the chance of recurrence. Customer satisfaction 2010 2011 2012 2013 2014 • The 2014 annual customer satisfaction Exceed expectations 68% 89% 82% 79% 81% survey showed that customer satisfaction Meet expectations 30% 11% 18% 21% 19% 2% 0% 0% 0% 0% 100% 100% 100% 100% 100% Does not meet expectations 6 remains at a high level. Reserve Bank of New Zealand: ESAS System Annual Report 2014 Risk management The internal controls of the ESAS system are audited each year by PricewaterhouseCoopers (“PwC”), as required by the ESAS Terms and Conditions. PwC act on behalf of the Reserve Bank’s external auditor, the Auditor-General. The scope of this audit includes the controls performed by the Reserve Bank’s third party independent service provider, Datacom. The Auditor’s annual assurance report is addressed to the Governor of the Reserve Bank and is reviewed by the Reserve Bank’s Audit Committee, with external auditors, Reserve Bank governors and management in attendance. A copy of the assurance report is sent to accountholders, and is published on the Bank’s website. ESAS is also subject to internal audit by the Reserve Bank’s Audit Services division. The main elements of risk management for the System entail: procedures and controls are adhered to; • measures to manage operational risk, as described below; • business continuity plans are in place and tested regularly; and • ongoing oversight and audit of operations ed • Managing operational risk in the Reserve Bank is seen as an integral part of day-to-day operations. Operational risk management includes Bank-wide corporate policies that describe the standard of conduct required of staff, a number of mandated requirements (e.g. a project management template), and specific iv internal control systems designed around the particular characteristics of various Reserve Bank activities. The Reserve Bank has a small office in Auckland. As a result, day-to-day operating activities are shared Ar ch between staff based in Auckland and those based in Wellington. Staff in the Auckland office will provide on-going continuity of business operations should a region-wide disaster impact ESAS’s Wellington staff. A second computer site is located in Auckland and is used alternately with the Wellington computers for live production. Reserve Bank of New Zealand: ESAS System Annual Report 2014 7 Financial performance A short-form Statement of Financial Performance for the ESAS business is: 20142013 $000$000 Income 3,1622,305 Expenses 3,1282,278 Net profit 1 3427 As noted above, the Bank incurred higher IT costs in respect of the ESAS system due to work performed to improve system security and to implement changes necessary to respond to updates to software products ed which the system utilises, and also due to new costs incurred in respect of SWIFT support. The system is becoming more expensive to maintain and the Bank is giving thought to undertaking major reinvestment and as noted above, an initial consultation has been undertaken with accountholders and other stakeholders. Members were advised of the expected financial impact of the cost of replacing the CASmf software iv which is the primary interface between ESAS and SWIFT. These costs will be amortised and recovered from members when the new software goes live, which, subject to testing, is scheduled to occur in the December quarter. Ar ch The ESAS business is attributed costs by the Reserve Bank. This includes charges for use of the Reserve Bank’s resources, such as staff, occupancy, internal audit, governance, accounting and information technology. Indirect costs incurred by the Reserve Bank are allocated to the ESAS System based on estimated costs that the business would incur on a stand-alone basis. The ESAS business is operated as a division of the Reserve Bank. The above figures are extracted from the Reserve Bank’s accounting records. Income and expenditure for the ESAS business is calculated using the accounting policies specified in the Reserve Bank’s financial statements. Under the ESAS terms and conditions, the Bank may only recover the costs of operating the system. The small net profit recorded reflects project costs related to the SBI development which were expensed in earlier years for financial reporting but which are being recovered via fees charged over 5 years. 1 8 No provision for tax has been made on reported net profit as the Reserve Bank is exempt from liability for income tax. Had the Bank been liable for income tax, a tax charge of $9,520 (2013: tax of $7,560) would have been reported, and the net return after tax would have been a reported profit of $24,480 (2013: $19,440). Reserve Bank of New Zealand: ESAS System Annual Report 2014 Plan for 2014-15 ESAS’s plan for the Year Ended 30 June 2015 The following project work is planned: • Continue work on enhancing system security. • Undertake a modest programme of enhancements and fine tune daily operations (continuous process improvement). • Upgrade SWIFT interface software to replace CASmf. • Continue the payment systems strategic review and develop a roadmap for the Bank’s payment systems operations. • Publish a self-assessment for ESAS against the Principles for Financial Market Infrastructures. As part of business as usual we will target to: Have the system available for members for at least 99.90 percent of core business hours. • Have the system subject to an external audit. • Survey accountholders’ satisfaction levels and report back to accountholders by May 2015. Ar ch iv ed • Reserve Bank of New Zealand: ESAS System Annual Report 2014 9