KUMPULAN GUTHRIE BERHAD

advertisement

KUMPULAN GUTHRIE BERHAD

(Company No.: 4001P)

(Incorporated in Malaysia)

INTERIM REPORT ON CONSOLIDATED RESULTS

FOR THE YEAR ENDED 31 DECEMBER 2005

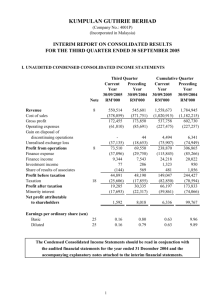

I. UNAUDITED CONDENSED CONSOLIDATED INCOME STATEMENTS

Note

Revenue

Cost of sales

Gross profit

Operating expenses

On disposal of discontinuing

operations

Net unrealised exchange gain/(loss)

Profit from operations

Finance expense

Finance income

Investment income

Share of results of associates

Profit before taxation

Taxation

Profit after taxation

Minority interest

Net profit attributable

to shareholders

Fourth Quarter

Current

Preceding

Year

Year

31/12/2005 31/12/2004

RM'000

RM'000

8

8

18

Earnings per ordinary share (sen)

Basic

27

Diluted

27

Cumulative Quarter

Current

Preceding

Year

Year

31/12/2005 31/12/2004

RM'000

RM'000

573,601

(354,026)

219,575

(98,602)

730,662

(481,157)

249,505

(120,029)

2,132,274

(1,374,941)

757,333

(326,077)

2,515,607

(1,663,372)

852,235

(340,164)

(251)

21,799

142,521

(42,099)

5,980

278

378

107,058

(30,856)

76,202

(33,694)

(7,893)

121,583

(36,361)

10,290

400

1,044

96,956

18,938

115,894

(55,219)

4,243

(54,108)

381,391

(157,944)

30,198

1,601

859

256,105

(113,706)

142,399

(93,555)

9,546

(82,842)

438,775

(121,627)

30,312

1,350

2,900

351,710

(61,983)

289,727

(129,285)

42,508

60,675

48,844

160,442

4.24

4.20

6.06

6.01

4.87

4.83

16.01

15.90

The Condensed Consolidated Income Statements should be read in conjunction with

the audited financial statements for the year ended 31 December 2004 and the

accompanying explanatory notes attached to the interim financial statements.

1

KUMPULAN GUTHRIE BERHAD

(Company No.: 4001P)

(Incorporated in Malaysia)

II. CONDENSED CONSOLIDATED BALANCE SHEETS

Note

Property, plant and equipment

Land held for property development

Investment in associated companies

Concession asset

Other investments

Long-term trade receivables

Advances for plasma and KKPA projects

Deferred tax assets

Goodwill on consolidation

9

Current assets

Property development costs

Inventories

Trade and other receivables

Short-term investments

Deposits, bank balances and cash

Current liabilities

Trade and other payables

Borrowings

Taxation

Deferred income

Net Current Assets

Financed by:

Capital and Reserves

Share capital

Reserves

Minority interest

Long-term and deferred liabilities

Borrowings

Deferred income

Deferred tax liabilities

Retirement benefits

Net tangible assets per share (RM)

Unaudited

as at

31/12/2005

RM'000

Audited

as at

31/12/2004

RM'000

5,363,625

399,074

13,795

585,742

2,550

41,423

195,777

261,510

6,863,496

5,583,147

343,790

14,141

657,193

2,550

61,968

35,211

219,616

276,696

7,194,312

392,092

191,066

522,235

22,866

709,067

1,837,326

336,825

204,550

611,730

35,690

851,289

2,040,084

498,708

426,570

25,635

8,330

618,552

804,257

40,852

5,687

959,243

878,083

7,741,579

1,469,348

570,736

7,765,048

1,006,939

1,852,094

2,859,033

1,536,534

1,005,419

1,944,130

2,949,549

1,541,987

2,620,673

1,785

708,170

15,384

3,346,012

7,741,579

2,502,855

9,922

750,797

9,938

3,273,512

7,765,048

2.58

2.66

The Condensed Consolidated Balance Sheets should be read in conjunction with

the audited financial statements for the year ended 31 December 2004 and the

accompanying explanatory notes attached to the interim financial statements.

2

KUMPULAN GUTHRIE BERHAD

(Company No.: 4001P)

(Incorporated in Malaysia)

III. CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2005

Share

Capital

RM'000

Twelve Months Ended

31 December 2004

At 1 January 2004

Issue of shares pursuant to the Second

Employees' Share Option Scheme

Foreign exchange differences

Transfers (from)/to reserves

Profit for the year

Dividend paid/payable

At 31 December 2004

Twelve Months Ended

31 December 2005

At 1 January 2005

Issue of shares pursuant to the Second

Employees' Share Option Scheme

Foreign exchange differences

Transfers (from)/to reserves

Profit for the year

Dividend paid/payable

At 31 December 2005

Share

Premium

RM'000

<----------------Non-distributable----------------->

Revaluation

Capital

Exchange

Reserve

Reserve

Reserve

RM'000

RM'000

RM'000

<-------Distributable---------->

Capital

Revenue

Reserve

Reserve

RM'000

RM'000

Total

RM'000

1,001,207

1,687

734,065

11,201

292,441

43,104

988,512

4,212

-

4,785

-

(18,510)

-

-

(219,965)

-

-

18,510

160,442

(72,142)

1,005,419

6,472

715,555

11,201

72,476

43,104

1,095,322

2,949,549

1,005,419

6,472

715,555

11,201

72,476

43,104

1,095,322

2,949,549

1,520

-

1,706

-

(16,298)

-

(77,357)

-

-

1,006,939

8,178

699,257

(4,881)

43,104

(445)

10,756

The Condensed Consolidated Statement of Changes in Equity should be read in conjunction with the audited financial statements

for the year ended 31 December 2004 and the accompanying explanatory notes attached to the interim financial statements.

3

16,743

48,844

(65,229)

1,095,680

3,072,217

8,997

(219,965)

160,442

(72,142)

3,226

(77,357)

48,844

(65,229)

2,859,033

KUMPULAN GUTHRIE BERHAD

(Company No.: 4001P)

(Incorporated in Malaysia)

IV. CONDENSED CONSOLIDATED CASH FLOW STATEMENTS

Cumulative Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

Cash Flows from Operating Activities

Cash from operations

Interest paid

Tax paid

Tax refunded

Net cash from operating activities

Cash Flows from Investing Activities

Property development activities

Concession asset

Property, plant and equipment

- purchases

- disposals

Investments

- purchases

- disposals

Purchase of shares from minority shareholders

Proceeds from disposal of subsidiary companies

Dividend received from investments

Interest received

Interest paid

Net cash used in investing activities

Cash Flows from Financing Activities

Drawdown of borrowings

Repayment of borrowings

Payment to hire purchase and lease creditors

Dividends paid

Fixed deposits pledged

Proceeds from issuance of shares under the Second ESOS

Net cash (used in)/from financing activities

690,206

(77,850)

(176,453)

55,896

491,799

1,063,387

(82,570)

(134,825)

2,849

848,841

(10,881)

(56,205)

(5,868)

(460,020)

(147,492)

5,515

(241,262)

4,170

(16,334)

26,706

(3,047)

9,951

1,192

24,854

(49,610)

(215,351)

(25,252)

10,099

688

1,059

34,554

(43,691)

(725,523)

1,776,415

(2,014,484)

(1,000)

(153,096)

21,850

3,226

(367,089)

1,126,621

(476,851)

(1,890)

(223,778)

(800)

8,997

432,299

Net (decrease)/increase in cash and cash equivalents

(90,641)

555,617

Cash and cash equivalents at 1 January

795,426

252,921

Effects of Changes in Exchange Rates

(7,164)

Cash and cash equivalents at 31 December

697,621

(13,112)

795,426

The Condensed Consolidated Cash Flow Statements should be read in conjunction with

the audited financial statements for the year ended 31 December 2004 and the

accompanying explanatory notes attached to the interim financial statements.

4

KUMPULAN GUTHRIE BERHAD

(Company No.: 4001P)

(Incorporated in Malaysia)

PART A - EXPLANATORY NOTES PURSUANT TO MASB 26

1. Basis of Preparation

The interim financial statements have been prepared in accordance with MASB 26, "Interim Financial

Reporting" and paragraph 9.22 of the Listing Requirements of Bursa Malaysia Securities Berhad.

The accounting policies and methods of computation adopted by the Group for the interim financial

statements are consistent with those adopted in the annual financial statements for the year ended 31

December 2004.

2. Auditors'

Report

Preceding

Annual

Financial

Statements

The The

Profit

For

Prior

other

before

the

change

change

to

income

1financial

finance

January

January

in

inon

ofaccounting

accounting

cost,

RM96.839

year

2001,

2001,

depreciation

ended

the

dividends

policy

policy

million

difference

31 on

December

has

and

is

proposed

dividends

mainly

been

amortisation,

between

applied

2001,

comprises

after

has

thebeen

the

cost

exceptional

retrospectively

balance

Directors

of

of

applied

unrealised

acquisition

sheet

items

retrospectively

have

in is

the

date

forex

ofadopted

arrived

subsidiary

financial

were

gainafter

in

the

accrued

ofthe

statements.

companies

RM78.693

change

deduction

financial

as in

a

The auditors' report on the financial statements for the year ended 31 December 2004 was not qualified.

3. Comments

About

Seasonal

Cyclicalhave

Factors

The valuation

of land

and or

buildings

been brought forward, without amendment from the

The businesses of the Group is affected by the seasonal production of fresh fruit bunches.

4. Material Items that Affect the Financial Statements

There were no material items that affect the financial statements for the year ended 31 December 2005

other than the disposal of the Group's entire shareholdings in Guthrie Medicare Products (NS) Sdn. Bhd.,

a wholly-owned subsidiary involved in the manufacturing of rubber gloves and Healthline Products Ltd.,

a wholly-owned subsidiary in the United Kingdom involved in the trading of healthcare products. The

disposals resulted in a gain of RM4.24 million which is recognised in the income statement as a gain on

disposal of discontinuing operations.

5. Changes in Accounting Estimates

There were no changes in estimates of amounts reported in prior interim periods of the current financial

period or in prior financial years that have a material effect in the current quarter.

5

6. Debt and Equity Securities

There were no issuance and repayment of debt and equity securities, share buy-backs, share cancellations

or shares held as treasury shares and resale of treasury shares for the year ended 31 December 2005,

except for the following:

(a) Equity Securities

During the year, the Company issued 1,520,000 new ordinary shares of RM1 each pursuant to the

Second Employees' Share Option Scheme ("Second ESOS") at option prices between RM1.94 and

RM2.41 per share. The total cash proceeds arising from the exercise of options under the Second

ESOS amounted to RM3,226,698. The issued and paid-up share capital of the Company was

increased from 1,005,419,300 ordinary shares of RM1 each to 1,006,939,300 ordinary shares of

RM1 each. Share premium arising from the issue amounted to RM1,706,698.

(b) Debt Securities

On 15 December 2005, the Company issued RM150 million nominal value of Underwritten

Murabahah Commercial Papers (CP) at a discount with maturity period of six months and at a profit

rate of 3.80% per annum. The initial utilisation of the issuance’s proceeds is to part finance the

repayment of the Short-Term Loan Facility of the Company and to finance its general working

capital requirement.

7. Dividend Paid

An interim

(2004:

5 sen

per financial

share, less

tax)

amounting

to RM28.99

A finaldividend

dividend of

of 45 sen

sen per

per share, less tax in

respect

of the

year

ended

31 December

2002

million (2004: RM36.07 million) was declared on 29 August 2005 and was paid on 13 October 2005.

8. Segment Information

Segment information is presented in respect of the Group's business segments.

Fourth

Quarter

The valuation of land and buildings have been

brought

forward, withoutCumulative

amendmentQuarter

from the

Current

Preceding

Current

Preceding

Year

Year

Year

Year

31/12/2005

31/12/2004

31/12/2005

31/12/2004

RM'000

RM'000

RM'000 net profit

RM'000

The purchase of the additional shares has no

significant impact

on the consolidated

for the

Revenue:

Plantation

- Malaysia

141,605

176,316

690,277

723,711

- Indonesia

261,304

195,861

852,250

823,587

402,909

372,177

1,542,527

1,547,298

Agricultural services

6,358

4,933

21,476

22,143

Property development

131,887

266,284

395,132

563,550

Manufacturing

22,435

30,620

106,502

121,886

General trading

43,727

39,572

227,199

Investment and others

10,012

12,921

27,065

33,531

573,601

730,662

2,132,274

2,515,607

6

Fourth Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

Profit from Operations:

Plantation Malaysia

Plantation Indonesia

Agricultural services

Property development

Manufacturing

General trading

Investment and others

Unrealised exchange gain/(loss)

12,933

50,665

63,598

3,132

73,454

(1,329)

(647)

(17,486)

120,722

21,799

142,521

Cumulative Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

42,975

(17,690)

25,285

3,009

123,488

(1,177)

436

(21,565)

129,476

(7,893)

121,583

141,028

145,982

287,010

15,286

168,542

(11,914)

(3,310)

(20,115)

435,499

(54,108)

381,391

192,999

145,624

338,623

14,098

173,196

(8,992)

4,030

662

521,617

(82,842)

438,775

9. Carrying Amount of Revalued Assets

The valuation of property, plant and equipment in the financial statements have been brought forward

without amendment from the financial statements for the year ended 31 December 2004.

10. Material Events Subsequent to the End of the Financial Period

There were no material events subsequent to the end of the current quarter.

11. Changes in the Composition of the Group

On 6 July 2005, the Group completed the disposal of all the issued and outstanding shares in Guthrie

Medicare Products (NS) Sdn. Bhd. and Healthline Products Limited (HPL), two wholly-owned

subsidiary companies involved in the manufacturing of rubber gloves and trading in healthcare products

respectively.

Consequent upon the sale of the entire shareholdings of HPL, the following companies, which are whollyowned subsidiaries of HPL, have also ceased to be subsidiaries of the Company:

a) Guthrie Medizinische Produkte Gmbh;

b) Guthrie SARL; and

c) Guthrie Medicare Products Limited

7

On 6 September 2005, the following dormant subsidiaries of the Group were dissolved by the Registrar

of the Companies House of United Kingdom:

a) GADSA Limited;

b) Guthrie Estates Limited; and

c) Guthrie Agricultural Development for Africa Limited.

Other than the above, there were no changes in the composition of the Group.

12. Changes in Contingent Assets and Contingent Liabilities

The valuation of land and buildings have been brought forward, without amendment from the

As at the date of this announcement, there were no material changes in contingent assets and contingent

liabilities since the last annual balance sheet date, as at 31 December 2004.

The valuation of land and buildings have been brought forward, without amendment from the

13. Capital Commitments

Capital commitments not provided for in the financial statements are as follows:

RM'000

Property, plant and equipment:

Approved and contracted for

Approved but not contracted for

Concession asset

10,119

298,687

30,444

339,250

PART B - EXPLANATORY NOTES PURSUANT TO APPENDIX 9B OF THE LISTING

REQUIREMENTS

BURSA

MALAYSIA

SECURITIES

BERHAD

The During

Write

interim

value

valuation

of

down

financial

the

property,

ofOF

nine

ofland

inventories

report

months

plant

andshould

and

buildings

period,

toequiment

be

netread

there

realisable

have

in

were

been

the

conjunction

financial

value

write

brought

of

down

with

statements

RM1.45

forward,

the

of assets

audited

million

without

is aamounting

financial

brought

attributable

amendment

forward

statements

to toof closure

balance,

RM8.827

from

of the

of

14. Review of Performance

The Group recorded a pre-tax profit of RM256.1 million for the year ended 31 December 2005, a drop of

RM95.6 million or 27.2% as compared to that of the previous year of RM351.7 million. Whilst the

performance of Plantation Indonesia and property development has sustained, the performance of the

Group for the year was affected to a large extent by lower contributions from Plantation Malaysia and

higher finance expense.

Contributions from Plantation Malaysia declined by RM52 million or 26.9% mainly due to lower

realised palm oil price by 13.7%, at RM1,377 per tonne as compared to RM1,595 per tonne in 2004.

Production of fresh fruit bunches (ffb) increased by 6.5% to 1,521,735 metric tonnes. FFB yield per

mature hectare however, dropped to 17.3 tonnes from 17.7 tonnes in 2004 largely attributable to a high

proportion of recently matured palms (31%).

Contributions from Plantation Indonesia sustained at RM145 million attributable to higher production of

ffb in spite of the lower realised price for palm oil by 13.4%, at RM1,276 per tonne against RM1,473 per

tonne in 2004. Production of ffb for Plantation Indonesia increased by 17.3%, at 2,436,829 metric tonnes

as compared to that for 2004. Plantation Indonesia recorded an ffb yield of 15.8 tonnes, an increase of

18% from the 13.4 tonnes recorded in 2004.

8

The property development operations contributed a pre-tax profit of RM168.5 million, a marginal

decrease by 2.7% as compared to that for 2004 on account of lower progress billings.

The performance of the Group was also affected by a net unrealised exchange loss of RM54.1 million,

and the higher interest cost by RM36.3 million arising from increasing US Dollar LIBOR rates.

15. Comment on Material Changes in Profit before Taxation for the Current Quarter as Compared

with the Immediate Preceding Quarter

For the financial quarter ended 31 December 2005, the Group registered a pre-tax profit of RM107.1

million, as compared to RM44.9 million for the immediate preceding quarter ended 30 September 2005.

The

higher

recorded

for thetocurrent

quarter

RM62.2 million

was mainly

to higher

In view

of profit

the Group's

intention

dispose

thesebyinvestments,

the results

of the due

associated

contributions from Plantation Indonesia by RM19.6 million, on account of higher production of fresh

fruit bunches (ffb), and from property development by RM50.1 million, attributable to increased billings.

Plantation Malaysia registered lower contributions by RM34.8 million as a result of lower poduction of

ffb. The performance for the quarter was further boosted by an unrealised exchange gain of RM21.8

million on the strengthening of Rupiah at year end.

16. Current Year Prospects

The performance of the Group for 2006 is expected to be better than that of 2005 in view of the projected

higher production of fresh fruit bunches and the expected higher palm oil prices. Earnings from property

development is also expected to be sustained.

In conjunction

Additional

provision

with closure

for assets

of operation,

write off of

the

RM1.654

provisionwas

for also

writemade

down during

of plantthe

and

period

machinery

in respect

and

17. Profit

or with

Profit

Guarantee

In Forecast

Additional

conjunction

provision

closure

for

assets

write

off Group

of

the

RM1.654

was

forbut,

also

write

made

down

during

of plant

the

and

period

machinery

in

"Currently

Barring

unforeseen

prices

of circumstances,

palm

oil of

areoperation,

expected

the

toprovision

fluctuate

is expected

to

the

perform

Group's

satisfactorily

average

realised

forrespect

theand

price

year

Not applicable as no profit forecast was published.

There was no sale of unquoted investments and/ or properties outside the ordinary course

9

18. Taxation

Taxation comprises the following:

Fourth Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

Malaysian taxation:

Group Companies

Current period provision

(Over)/Under provision in

prior years

Deferred tax liabilities

Deferred tax assets

Share of taxation of associates

Overseas taxation:

Group Companies

Current period provision

(Over)/Under provision in

prior years

Deferred tax liabilities

Deferred tax assets

TOTAL

Cumulative Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

11,653

26,508

66,758

69,983

(13,067)

3,286

3,752

5,624

5,624

7,183

6,286

(39,055)

922

922

(16,969)

8,337

7,540

65,666

(16)

65,650

7,164

11,798

(38,081)

50,864

(7)

50,857

19,967

(1,082)

52,844

31,430

(2,431)

(3,762)

11,458

25,232

29

(5,858)

(12,949)

(19,860)

(1,778)

(15,554)

12,544

48,056

335

(16,777)

(3,862)

11,126

30,856

(18,938)

113,706

61,983

The effective tax rate of the Group is higher than the statutory tax rate applicable in Malaysia due to

certain expenses being non-allowable for income tax purposes and losses of certain subsidiary companies

not available for relief against Group profit.

19. Sale of Unquoted Investments and Properties

There were no sale of unquoted investments and/or properties outside the ordinary course of business of

the Group for the financial year ended 31 December 2005.

10

20. Quoted Securities

Capital commitments not provided for in the financial statements as at 30 September 2002

(a)

Total purchases and sales of quoted securities are as follows:

Fourth Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

Purchase consideration

Sale proceeds

Gain on disposals

(b)

2,124

1,754

(139)

3,454

3,230

127

Cumulative Quarter

Current

Preceding

Year

Year

31/12/2005

31/12/2004

RM'000

RM'000

5,869

6,755

206

9,603

5,324

863

Investments in quoted securities, other than securities in existing subsidiaries, as at 31 December

2005 are as follows:

At Cost

RM'000

Investments in quoted securities in Malaysia

21,433

At Book

Value

RM'000

12,699

At Market

Value

RM'000

13,963

The

segment

information

for

the

financial

period

ended

30

June

2002

are

as

follows:

Total

purchases

sales

of

quoted

securities

are

as

follows:

The

As

There

The

Based

There

The

at

view

results

general

Group

valua

operations

the

were

are

were

is

on

of

date

adate

no

an

of

no

plan

registered

the

trading

no

property,

the

dividend

approval

of

changes

of

this

issuance

Group's

to

Group

the

clear

announcement,

segment,

paid

aletter

plant

Group

in

for

profit

approximately

intention

the

and

during

the

(Surat

and

composition

are

particularly

before

repayment

period

equiment

the

not

Izin

to

the

period

affected

under

dispose

Peruntukan

1,500

contingent

of

in

of

reported.

the

review

the

overseas

debt

of

hectares

by

these

Group

financial

RM493.255

any

liabilities

Penggunaan

and

is

or

attributable

investments,

for

seasonal

operations,

of

equity

statements

land

ofexpected

million

financial

the

securities,

for

Tanah)

or

Group

largely

the

were

cyclical

the

for

is

period

next

a

the

dated

results

are

adversely

to

brought

share

factors,

the

period

3

as

ended

21

years,

follows:

gain

of

buy-backs,

September

forward

ended

affected

the

30

other

ofstarting

June

RM422.333

associated

than

balance,

30

by

2002.

share

1999

from

June

the

The

IIn

As

Not

The

There

During

Subsequent

n addition,

the

On

The

Highlands

at

Investments

applicable

results

Group's

Group

the

opinion

was

20

were

proposed

the

November

no

the

of

registered

nine

registered

to

performance

&

no

the

of

as

sale

results

Lowlands

30

in

months

this

the

no

issuance

sale

Group

quoted

September

ofand

profit

Directors,

announcement,

2002,

a

unquoted

of

a

of

profit

the

turnover

ended

Berhad,

for

securities,

forecast

shares,

for

and

Group

Kumpulan

the

before

2002

the

other

30

investments

repayment

period

and

awas

iftaxation

year

for

September

subsidiary

and

other

taxation

completed,

there

than

the

profit

published.

Guthrie

under

to

2002

current

than

stated

are

the

before

and/

of

of

no

is

2002,

securities

date

review

RM505.603

Berhad

debt

is

Kumpulan

above,

period

expected

or

changes

taxation

not

of

properties

the

securities,

is

this

announced

as

no

in

attributable

issued

report,

in

compared

existing

to

Guthrie

million

item,

for

contingent

be

outside

the

and

share

transaction

to

408,000

better

for

subsidiaries

third

Berhad,

that

largely

paid-up

make

to

the

the

the

assets

buy-backs,

quarter

its

than

period

ordinary

options

any

same

announced

to

wholly-owned

capital

or

that

the

or

and

event

significant

ended

period

liabilities

granted

gain

course

of

of

share

of

the

2001,

30

on

of

a

The

A

The

Duly

depositor

Malaysian

Shares

segment

completed

shall

transferred

deposited

bought

information

Central

transfers

qualify

on

into

Depository

the

into

for

for

received

Kuala

entitlement

the

the

Depositor's

financial

Lumpur

Sdn.

by

the

only

Bhd.

period

Company's

Stock

Securities

in

Securities

will

respect

ended

Exchange

not

be

Account

Share

of:

Account

30

accepting

June

on

Registrar,

before

aabefore

2002

cum

any

are

12:30

entitlement

12:30

Malaysian

request

as

follows:

p.m.

p.m.

for

on

basis

Share

on

deposit

35other

October

according

Registration

of

shares

2000

to

in

21. A

Status

of

Corporate

Proposals

Duly

The

For

A

If

Duly

The

The

During

depositor

approved

final

depositor

Malaysian

Shares

On

As

the

completed

Annual

Malaysian

Shares

operations

completed

dividend

at

the

24

third

24

the

shall

October

General

by

shall

bought

transferred

period,

deposited

bought

October

quarter

date

Central

members

Central

transfers

of

qualify

of

transfers

qualify

6of

the

on

sen

on

there

2001,

Meeting

this

ended

Depository

the

into

2001,

Depository

for

Group

the

into

for

per

received

at

announcement,

received

entitlement

was

Kuala

athe

the

Kuala

entitlement

the

share,

the

the

30

wholly-owned

ofare

aDepositor's

Depositor's

Depositor's

the

forthcoming

a

Depositor's

Depositor's

September

Depositor's

Lumpur

Sdn

wholly-owned

Lumpur

by

write

Sdn.

not

less

Company

bythe

only

Berhad

affected

the

only

tax,

Berhad

down

Company's

Stock

the

Stock

in

Company's

Securities

subsidiary

Securities

in

was

Annual

Securities

2001,

Securities

respect

will

transaction

will

respect

ofby

Exchange

will

declared

Exchange

subsidiary

be

inventories

not

there

any

General

not

held

Share

of:

Account

be

of:

Account

of

Account

Share

seasonal

be

Account

accepting

is

on

the

has

on

on

accepting

on

a

Registrar,

Thursday,

Wednesday,

Meeting

26

of

Company,

a

of

been

net

Registrar,

before

before

cum

before

February

before

cum

the

RM1.45

before

or

pre-acquisition

any

completed

cyclical

entitlement

of

any

12.30

entitlement

Company,

Malaysian

12:30

27

12:30

request

12.30

the

12.30

Haron

Malaysian

27

request

2002

million

June

Company

p.m.

June

factors,

p.m.

p.m.

p.m.

and

p.m.

and

Estate

2002.

for

basis

on

Share

due

basis

loss

for

Haron

2001.

on

on

deposit

the

Share

subject

on

on

2

4

deposit

26

to

28

October

to

according

of

Development

financial

2according

4Registration

be

June

closure

RM59.400

July

Estate

of

Registration

than

to

held

shares

of

approval

2002

2001

shares

effects

the

on

to

of

tothe

27

in

There were no outstanding corporate proposals at the date of this report.

22. Group Borrowings and Debt Securities

During the third quarter of the year, provision for warranties of RM3.1 million were reversed as a

The Group's borrowings as at 31 December 2005 are as follows:

RM'000

Short-term borrowings

Short-term borrowings denominated in Ringgit Malaysia

- Unsecured

Short-term borrowings denominated in foreign currencies

- Secured

Current portion of long-term loans denominated in Ringgit Malaysia

- Unsecured

Current portion of long-term loans denominated in foreign currencies:

- Secured

Total short-term borrowings

306,676

10,901

16,125

92,868

426,570

11

RM'000

Long-term borrowings

- Secured (denominated in foreign currencies)

- Unsecured (denominated in Ringgit Malaysia)

- Unsecured (denominated in foreign currencies)

497,607

702,875

1,435,640

2,636,122

Borrowings denominated in foreign currencies, in Ringgit Malaysia

equivalent, are as follows:

US Dollar

Indonesian Rupiah

1,989,674

47,342

2,037,016

23. Off Balance Sheet Financial Instruments

(a) Interest Rate Option Contracts

As at 20 February 2006, the Group has entered into the following interest rate swap ("IRS") agreements:

Underlying Loan

Derivative

Product

Notional

Amount

Effective

Period

Purpose

Weighted

Average Rate

Per Annum

USD Term Loan

IRS

USD290

million

28/02/06 to

29/08/12

To convert

floating rate

liabilities into

fixed rate

liabilities

4.8% - 5.0%

for the entire

tenor of the

liability

Ringgit 5-7 Year

Islamic Bond

IRS

RM250

million

19/03/04 to

18/03/11

To convert

fixed rate

liabilities

into floating

rate liabilities

4.34% 5.76%

Any differential to be paid or received on the interest rate swap agreements is recognised as a component

of interest expense over the period of the contracts. Gains or losses on early termination of interest rate

swap contracts or on repayment of the borrowings are taken to the income statement.

There is minimal credit risk as the interest rate swaps were entered into with creditworthy financial

institutions.

(b) Foreign Currency Contracts

As at 20 February 2006, the Group has not entered into any forward sale of foreign currency.

The foreign currency contracts are entered into to hedge the Group's purchases and sales in foreign

The related accounting policies for the off balance sheet financial instruments are as disclosed in the

financial statements for the year ended 31 December 2004.

12

24. Changes

There is in

noMaterial

unusual Litigation

item which has a material impact on any asset, liability, equity, net income

As at the date of this announcement, the

there

contingent

are no changes

liabilities

in of

contingent

the Groupassets

are asorfollows:

liabilities since the

As at the date of this announcement, other than as disclosed below, there have been no changes to the

status of the material litigations as disclosed in the financial statements for the year ended 31 December

2004:

(a)

Breach

of

terms

pursuant

to

afiled

lease

The

The

There

Duly

There

In

A

following

Board

completed

legal

1994,

is

1994,

is

is

is

is

has

suit

is

suit

pending

unusual

pending

pending

apending

a

material

pending

pending

pending

pending

legal

was

declared

legal

was

transfers

filed

filed

suit

legal

item

legal

legal

suit

litigations

legal

legal

legal

on

an

in

against

was

against

received

inwas

action

which

action

1998

action

3interim

action

1998

action

action

May

filed

action

action

are

aagainst

has

a

against

against

2001

subsidiary

against

against

dividend

by

subsidiary

against

arising

against

against

aagreement

against

the

material

against

the

aagainst

acertain

aCompany's

subsidiary

the

subsidiary

the

from

the

of

subsidiary

Company

the

the

company

XX

the

Company

Company

the

Company

impact

the

Company

subsidiary

Company

Company

sen

Company

Group's

company

company

Share

for

in

per

company

on

claiming

1998

for

afor

to

share

any

breach

for

companies

for

to

Registrar,

alleged

recover

acquisitions

for

aCompany,

claiming

for

alleged

for

recover

asset,

an

breach

an

for

damages

(2002:

of

an

specific

alleged

amount

specific

infringement

a

early

liability,

Malaysian

amount

United

damages

claiming

infringement

3

of

early

of

sen),

for

a

performance

possession

breach

plantation

performance

of

United

alleged

Kingdom

possession

equity,

less

approximately

of

damages

for

Share

ofofapproximately

losses

tax

aof

Kingdom

contract

encroachment

net

United

companies

by

registered

aRegistration

absorbing

of

of

United

income

for

the

by

aallegedly

aSale

losses

by

the

the

a

No

In

dividend

1998,

is

two

declared

legal

for

suits

the

were

quarter

filed

ended

30

September

certain

subsidiary

2003.

An

interim

for

damages/losses

tax

exempt

dividend

suffered

offiled

3in

On

1 no

October

2001,

the

Company

and

acompany

director

of

the

as

the

plaintiffs,

had

There is a pending legal action against a sub-tenant of building premises for outstanding rental. On

27 May 2005, a winding-up order was obtained against the sub-tenant by a third party. Since the subtenant had been wound-up, the Company will proceed to file a Proof of Debt for its claim on the

outstanding rental and damages caused to the building premises.

(b) Breach of contract

There is an outstanding legal suit against the Company and six subsidiary companies in Indonesia

for an alleged breach of contract. On 28 October 2004, the District Court of South Jakarta rejected

the plaintiff's claim in its entirety and decided in favour of the Company and the six Indonesian

subsidiary companies. On 20 January 2005, the plaintiff filed an appeal against the decision of the

District Court. On 25 May 2005, the Court of Appeal of Jakarta rejected the appeal by the plaintiff

and affirmed the decision of the District Court of South Jakarta. On 25 November 2005, the plaintiff

filed a Notice of Appeal to the Supreme Court of Jakarta against the decision of the Court of Appeal.

The Company is opposing the appeal and seeks to uphold the decision of the Court of Appeal.

25. Dividends

The

The

Duly

There

In

following

Board

completed

legal

1994,

isis

has

suit

is

suit

pending

pending

amaterial

pending

pending

was

declared

legal

was

transfers

filed

filed

legal

legal

suit

litigations

legal

on

an

in

against

against

received

in

action

was

action

1998

3interim

1998

May

action

action

filed

are

aagainst

a

against

against

2001

subsidiary

dividend

by

subsidiary

arising

against

against

against

the

against

the

aacertain

Company's

subsidiary

subsidiary

from

of

Company

the

the

company

XX

the

the

the

Company

subsidiary

Company

sen

Company

Group's

company

company

Share

for

in

per

claiming

1998

athe

share

breach

for

companies

Registrar,

acquisitions

for

claiming

for

alleged

for

recover

an

damages

(2002:

of

an

specific

alleged

a

amount

United

damages

claiming

infringement

3early

of

sen),

for

performance

breach

plantation

Kingdom

possession

of

damages

for

Share

of

approximately

losses

tax

of

contract

encroachment

companies

registered

aRegistration

absorbing

of2003

United

for

by

aallegedly

Sale

losses

by

the

the

a

DulyA

Shares

completed

deposited

bought

transferred

transfers

on

into

the

into

the

Kuala

received

the

Depositors'

Depositors'

Lumpur

by

the

Securities

Stock

Company's

Securities

Exchange

Account

Account

Share

on

before

ato

cum

before

12.30

entitlement

4 Malaysian

p.m.

on

onalleged

basis

8less

10

October

Share

October

according

2003

to

in

On

1 October

2001,

the

Company

and

acompany

director

of

Company,

as

the

plaintiffs,

had

filed

(a) A final dividend of 6 sen per share, less 28% tax, has been recommended and is proposed to be paid

on 14 July 2006 (2004: 5 sen per share, less 28% tax).

(b) An interim dividend of 4 sen per share, less 28% tax, was paid on 13 October 2005 (2004: 5 sen per

share, less 28% tax).

(c) The annual gross dividend per share is 10 sen (2004: 10 sen).

(d) The total annual dividend net of tax is RM72,495,00 (2004: RM 72,267,000).

13

26. Notice of Dividend Entitlement

If approved by members at the forthcoming Annual General Meeting of the Company to be held on 22

June 2006, the final dividend of 6 sen per share, less 28% tax, in respect of the financial year ended 31

December 2005 will be payable on 14 July 2006 to shareholders (who are exempted from mandatory

deposit) and depositors registered in the Register of Members and Record of Depositors respectively at

the close of business on 28 June 2006.

A depositor shall qualify for dividend entitlement only in respect of:

(a) Shares deposited into the Depositor's Securities Account before 12.30 p.m. on 26 June 2006 in

respect of shares which are exempted from mandatory deposit; and

(b) Shares transferred into the Depositors' Securities Account before 4.00 p.m. on 28 June 2006 in

respect of transfers; and

(c) Shares bought on the Bursa Malaysia Securities Berhad on a cum entitlement basis according to the

Rules of the Bursa Malaysia Securities Berhad.

27. Earnings per Share

The

Duly

depositor

Malaysian

Shares

Total

completed

purchases

shall

transferred

deposited

bought

Central

transfers

qualify

on

and

Depository

the

into

for

sales

received

the

Kuala

entitlement

the

Depositor's

of

Depositor's

Lumpur

quoted

Sdn.

by

the

only

Bhd.

securities

Company's

Stock

Securities

in

Securities

will

respect

Exchange

not

are

be

Account

Share

of:

Account

as

accepting

follows:

on

Registrar,

abefore

cum

any

12:30

entitlement

12:30

Malaysian

request

p.m.

p.m.

for

on

basis

Share

on

deposit

35proposed

October

according

Registration

shares

2000

tothe

in

AA

Not

The

If

There

depositor

approved

applicable.

Investments

A

An

The

Shares

effective

Annual

final

special

was

interim

annual

total

dividend

shall

by

General

bought

transferred

no

deposited

annual

tax

tax

members

dividend

gross

profit

qualify

in

rate

exempt

quoted

on

of

Meeting

dividend

of

dividend

and/or

6into

into

the

for

into

of

sen

the

at

dividend

securities,

entitlement

2Kuala

the

the

Group,

the

sen

per

of

loss

net

per

Depositor's

forthcoming

the

Depositor's

share,

per

Lumpur

of

relating

share

of

Company

excluding

tax

share,

other

only

sen

less

is

is

Stock

RM57,617,000

per

in

than

to

8Securities

less

tax,

Annual

Securities

sen

respect

will

gain

the

share

Exchange

securities

has

tax

be

(2000

sale

on

General

was

been

held

has

of:

exceptional

Account

Account

-of

paid

11

(2000

been

on

recommended

in

on

unquoted

sen).

Wednesday,

existing

Meeting

on

abefore

recommended

before

-cum

before

RM87,626,000).

2 items,

November

subsidiaries

entitlement

of

investments

12:30

12:30

the

and

is

27higher

Company

June

p.m.

is

p.m.

2001

and

proposed

basis

and

2001.

than

on

is

and/or

on

(2000

associated

26

to

28

according

the

be

June

to

properties

-of

statutory

tax

held

be

to

2001

paid

exempt

on

to

be

on

27

in

Fourth Quarter

Cumulative Quarter

Current

Current

Preceding

The basic earnings per share have been

calculatedPreceding

based on profit

attributable to

ordinary

Year

Year

Year

Year

31/12/2005

31/12/2004

31/12/2005

31/12/2004

(a) Basic

Profit attributable to

shareholders (RM'000)

42,508

60,675

48,844

160,442

Weighted average number of

ordinary shares in issue ('000)

1,003,227

1,002,056

1,003,227

1,002,056

Basic earnings per share (sen)

4.24

6.06

4.87

16.01

The basic earnings per share have been calculated based on profit attributable to ordinary

(b) Diluted

Profit attributable to

shareholders (RM'000)

Weighted average number of

ordinary shares in issue ('000)

Adjustment for share options ('000)

Weighted average number of

ordinary shares for diluted

earnings per share ('000)

42,508

60,675

48,844

160,442

1,003,227

8,849

1,002,056

6,832

1,003,227

8,849

1,002,056

6,832

1,012,076

1,008,888

1,012,076

1,008,888

4.20

6.01

4.83

15.90

Diluted earnings per share (sen)

14

28. Authorised for Issue

The interim financial statements were authorised for issue by the Board of Directors in accordance with a

resolution of the directors on 27 February 2006.

The

Duly

depositor

Malaysian

Shares

completed

shall

transferred

deposited

bought

Central

transfers

qualify

on

into

Depository

the

into

for

received

the

Kuala

entitlement

the

Depositor's

Depositor's

Lumpur

Sdn.

by

only

Bhd.

Company's

Stock

Securities

in

Securities

will

respect

Exchange

not

be

Account

Share

of:

Account

accepting

on

Registrar,

before

abefore

before

cum

any

12:30

entitlement

12:30

Malaysian

request

p.m.

p.m.

for

on

basis

Share

on

deposit

35

5deposit

October

according

Registration

of

shares

2000

tothe

in

The

AA

Duly

The

A

If

depositor

approved

depositor

interim

Shares

Annual

Malaysian

completed

shall

shall

financial

by

transferred

bought

General

deposited

transferred

deposited

members

Central

qualify

transfers

qualify

on

Meeting

reports

into

the

into

for

into

Depository

into

for

at

received

entitlement

Kuala

the

entitlement

the

the

the

of

has

Depositor's

Depositor's

forthcoming

the

Depositor's

Lumpur

been

Sdn.

Company

bythe

only

only

the

prepared

Bhd.

Stock

Securities

in

Company's

Securities

in

Annual

Securities

respect

will

respect

will

Exchange

be

not

inGeneral

held

of:

Account

accordance

of:

Account

Account

be

Account

Share

on

accepting

on

Wednesday,

Meeting

aRegistrar,

before

before

cum

before

with

any

entitlement

of

12.30

12.30

12:30

12:30

MASB

the

Malaysian

request

27Company

p.m.

p.m.

June

p.m.

p.m.

26

basis

on

on

for

2001.

on

on

Interim

Share

3

26

to

28

October

according

be

June

Registration

Financial

held

of

2001

shares

on

to

27

in

27 February 2006

Kuala Lumpur

By Order of the Board

Moriami Mohd

Company Secretary

******************************

The

There

This

In May

The

preceding

isnet

carrying

is

not

2002,

no

increase

applicable

material

audited

the

value

Group

during

changes

to

on

annual

the

land

had

the

Group.

financial

completed

in

period

held

estimates

forisstatements

development

mainly

theindisposal

respect

duewere

tois

ofexchange

not

based

aamounts

piece

subject

on

ofadjustment

reported

the

land

to any

valuation

known

qualification.

in on

prior

asinvestment

incorporated

Haron

interimEstate

periods

in in

Salim

for

the

of

a

15