EDARAN Annual Report 2014

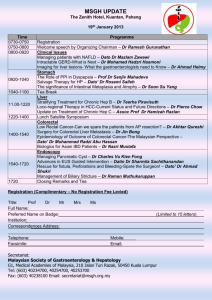

advertisement