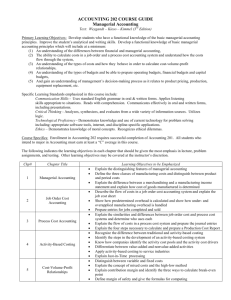

Chapter 5 Activity-based Cost Systems

advertisement

Chapter 5 Activity-based Cost Systems See also: Kaplan/Atkinson 3rd ed. Ch.4 Cooper/Kaplan: Cost and Effect, Harvard Business School Press 1998 1 Example of misleading traditional cost system Cole Corporation manufactures two types of lenses for automobile rear lights out of plastic material – a normal lens (NL) and a complex lens (CL). lenses are molded using machines redesigned according to the requirements of the customers (model changes) To cost products, Cole currently uses a single indirect-cost rate job costing system. The cost objects are the total costs of manufacturing and distributing 80,000 normal lenses (NL) and 20,000 complex lenses (CL). 2 Application to two products Normal Lenses (NL) Complex Lenses (CL) Direct materials $1,520,000 $ 920,000 Direct mfg. labor 800,000 260,000 Total direct costs $2,320,000 $1,180,000 Direct cost per unit: $2,320,000 ÷ 80,000 $1,180,000 ÷ 20,000 = $29 = $59 total direct labor hrs. 36,000 14,000 Indirect costs direct manufacturing labor hrs. Indirect cost rate = $2,900,000 50,000 $2,900,000 ÷ 50,000 = $58 3 Product cost Normal Lenses (NL) Complex Lenses (CL) Direct costs + Allocated costs = cost per unit Selling price: Margin Margin %age $2,320,000 (= 36,000 × $58) $2,088,000 $4,408,000 $1,180,000 (=14,000 × $58) $ 812,000 $1,992,000 $4,408,000 ÷ 80,000 $1,992,000 ÷ 20,000 = $ 55.10 $ 60 $ 4.90 8.2% = $ 99.60 $142 $ 42.40 29.9% 4 Refining a Costing System Guidelines Direct-cost tracing – Classify as many of the total costs as direct costs as is economically feasible. Indirect-cost pools – Expand the number of cost pools until each of these pools is homogeneous. Cost-allocation basis – Identify the preferred costallocation base for each indirect-cost pool. 5 Activity-Based Costing System ABC systems refine costing systems by focusing on individual activities as the fundamental cost object. ABC calculates the costs of individual activities and assigns costs to cost objects such as products and services on the basis of the activities undertaken to produce each product or service. 6 Activity-based Costing: the fundamental idea: Indirect labor Resource: Prepare tooling # setups × × # setup hrs. Product, Customer: Set up machines # maint. hrs. Cost driver rate: Maintain machines # moves Activity cost driver: Move materials # receipts Activity: Inspect incoming materials × × × 7 General Procedure Determine the set of activities j performed in each department (cost center) determine a Cost Driver for each activity j measuring the causal relationship between resource consumption of the activity and its utilization by products or customers assign (budgeted) resource costs to activities j each activity is assigned a cost pool Cj 8 General Procedure (cont’d) determine the total level xj of budgeted utilization of the activity C determine the cost driver rate = j xj Determine (actual) usage xjl of cost driver j by each user l Activity-based cost assignment to user l: Σj xjl Cj xj 9 Key step: Assigning resource costs to activities Resource costs per activity is an important piece of information to management This is usually done by interviews with department managers on activities performed the proportion of working time usually spent on each activity no excessive precision required 10 Activity-Based Costing System A cross-functional team at Cole Corporation identified key activities: Design products and processes Set up molding machine Operate machines to mold lenses Maintain the machines Set up batches of finished lenses for shipment. Distribute lenses to customers. Administer and manage all processes at Cole. 11 Setup data for the normal lens and the complex lens Quantity produced No. produced/batch Number of batches Setup time per batch Total setup hours NL 80,000 250 CL 20,000 50 320 2 hrs 640 400 5 hrs 2,000 Total setup costs are $409,200 (Cost pool) Setup cost per hour: $409,200 ÷ 2,640 hrs = $155 (cost driver rate) Cost allocation using setup-hours: $155 × 640 = $ 99,200 $155 × 2,000 = $310,000 12 Cost allocation using direct manufacturing labor-hours Setup cost per direct manufacturing labor hour $409,200 ÷ 50,000 = $8.184 (cost driver rate) NL: CL: $8.184 × 36,000 $8.184 × 14,000 = $294,624 = $114,576 Compared to: $ 99,200 $310,000 13 Separate cost driver rates for committed and flexible cost Resources Driver expense activity level rate Committed Flexible C1j C2j total C1j + C2j Budgeted xj = capacity C1j / xj C2j / xj xj (expected) C1j C2j xj + xj ≠ C1j + C2j xj + xj in general 14 Cost Hierarchies 1 2 3 4 ABC systems commonly use a four-level cost hierarchy to identify cost-allocation bases: Output unit-level cost Batch level costs Product-sustaining costs Facility-sustaining costs 15 Functions of activities Unit level activities (sales volume-related) batch level activities (related to # of batches of saleable output) product-sustaining (activities enabling the production of saleable output) • customer sustaining (activities enabling to sell products to individual customers or markets) (Costs that may be assigned only to broader output categories) 16 Cost hierarchy Output Unit-Level Costs Batch-Level Costs resources sacrificed on activities that are related to a group of units of product(s) or service(s) rather than to each individual unit of product or service. • Setup hours • Procurement costs Product-Sustaining or service-sustaining costs resources sacrificed on activities performed on each individual unit of product or service. • Energy • Machine depreciation • Repairs resources sacrificed on activities supporting individual products or services. • Design costs • Engineering costs Facility-Sustaining Costs resources sacrificed on activities that cannot be traced to individual products or services but support the organization as a whole • General administration • Rent • Building security 17 Types of activity cost drivers Accounting cost Number of transactions duration of transaction if time consumed varies among individual instances of the activity intensity or direct charging number of staff of different wage groups assigned to an activity per time unit resources actually used for the individual instance of an activity 18 Appropriate number of cost drivers Small cost pools do not alter unit costs much if additional information has to be acquired on a cost driver consider the information cost and compare it to the benefit of the better decision do not add a cost driver which is an approximate linear combination of cost drivers already used existing cost pools should share in the cost that would be assigned to that pool according to the weights of the linear combination 19 Implementing Activity-Based Costing Step 1: Identify the chosen cost objects. The objective is to calculate the total costs of designing, assembling, and distributing S and C. Step 2: Identify the direct costs of the product. Cole identifies direct materials costs and direct manufacturing labor as direct costs. Cleaning and maintenance costs of $360,000 are also identified as direct costs of the lenses. • Cleaning and maintenance costs of $360,000 are direct batchlevel-costs. • Why? Because these costs consist of workers’ wages for maintenance of machines after each batch of phones is run. The old cost system classified cleaning and maintenance costs as part of the $2,900,000 indirect costs. Recall that indirect costs were allocated to products using direct manufacturing labor-hours. 20 Implementing Activity-Based Costing Description Cost Hierarchy Category Direct materials Unit-level Direct mfg. labor Unit-level Cleaning & Maintenance Batch-level Total direct costs (“,000” omitted) (S) (C) $1,520 920 800 260 160 $2,480 200 1,380 21 Implementing Activity-Based Costing Step 3: Select the cost-allocation bases to use in allocating indirect costs to the products. Activities identified 1 Design 2 Machine setups 3 Manufacturing operations 4 Shipment set up 5 Distribution 6 Administration Cost drivers design hours # of setups units # of orders # of orders H-level 3 2 1 2 2 4 (allocated as percentage to costs assigned according to activity-based method) 22 Implementing Activity-Based Costing Step 4: Identify the indirect costs associated with each cost-allocation base. Overhead costs incurred are assigned to activities, to the extent possible, on the basis of a cause-and-effect relationship. Total setup costs are $409,200. Step 5: Compute the rate per unit of each cost allocation base used to allocate indirect costs to the products. S C 640 2,000 $409,200 ÷ 2,640 = $155 Setup hours: Total 2,640 Step 6: Compute the indirect costs allocated to the products. Total cost of setup activity: S: $155 × 640 = $ 99,200 C: $155 × 2,000 = 310,000 Total $409,200 Other activities treated analogously 23 Implementing Activity-Based Costing Step 7: Compute the costs of the products by adding all direct and indirect costs assigned to them. S and C would show three direct cost categories. 1 Direct materials 2 Direct manufacturing labor 3 Cleaning and maintenance S and C would show six indirect cost pools. 1 Design 2 Machine setups 3 Manufacturing operations 4 Shipment setup 5 Distribution 6 Administration 24 Primary purposes of Activity-based Cost Systems Analysis of decisions on the structure and design of productive system not used for management control purposes more transparency of the factors causing costs phasing out non-value-added activities sporadic stand-alone analyses, not integrated in on-line accounting system otherwise management will have an incentive to choose cost drivers strategically Decision facilitating for Activity-based Management (ABM) 25 Activity-Based Management ABM describes management decisions that use activity-based costing information to satisfy customers and improve profits. – Product pricing and mix decisions – Cost reduction and process improvement decisions – Design decisions 26 ABM decisions Product Pricing and Mix Decisions Cost Reduction and Process Improvement Decisions ABC gives management insight into the cost structures for making and selling diverse products. provides more accurate product cost information and more detailed information on costs of activities and the drivers of those costs. Manufacturing and distribution personnel use ABC systems to focus on cost reduction efforts. Managers set cost-reduction targets in terms of reducing the cost per unit of the cost-allocation base. Design Decisions Management can identify and evaluate new designs to improve performance by evaluating how product and process designs affect activities and costs. Companies can work with their customers to evaluate the costs and prices of alternative design choices. 27 Critique ABC systems are full cost systems: they average costs over products according to cost driver utilization: every individual unit carries the same cost per unit of driver utilized For change management decisions an incremental costing approach is more adequate, when the size of the cost pool will not change proportionally with the cost driver (non-linearities in the cost function) due to fixed costs economies of scale economies of scope 28