Syllabus - Yale School of Management

advertisement

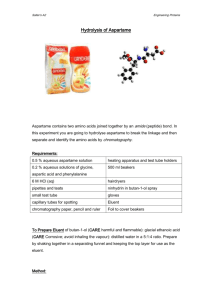

Syllabus for 882: ADVANCED NEGOTIATION This course was previously known as the Negotiation Extension. In addition to covering advanced topics, this course provide just the additional credit hours (0.32) to bring the 0.18 credits earned in the core up to 0.5 credits, which is the equivalent of a regular Fall 1 course. For joint JD/MBA students, the completion of this extension will give you the allow us to give you a law school grade for a law school negotiation course. (The alternative is to take the Fall 2 negotiation elective.) The course meets four times on Monday evenings, each for three hours. The first session is the Monday immediately after the end of the core course. There is one negotiation case, but no videos. Class AN1 – Monday, October 5: Claiming Value (DC) Note: This class meets from 6:00–9:00 pm in 4410. Topics: Avoiding Difficult Conversations Where Smart People Get It Wrong Haggling for a Sweet Deal Sugar Bowl Readings: None. The reading for the last class may prove useful for this class, but they are optional today: Shell, Chapters 7–10, Bargaining for Advantage, pp. 117–175, 2006. Class AN2 – Monday, OCT 12: (BN) Topics: Multi-person negotiations and the Shapley Value Negotiating without power Strikes and Lockouts Virtual Strike Who is at the Table? Mediation Case studies: Bitter Competition (at end of reading list) Citi versus Saudi (at end of reading list, just before Bitter Competition) Optional Readings: Kenneth Feinberg: “Mediation – A Preferred Method of Dispute Resolution.” Ian Ayres and Barry Nalebuff, “The Virtues of a Virtual Strike,” Forbes, 11/25/02. This session will cover a variety of topics. A first topic looks at a multi-person negotiation. Our discussion of the pie emphasized the symmetry of the situation when there are two parties. How does this notion of the pie extend to the case where there are more than two people? The second topic concerns negotiating a contract when one is in a potentially weak position. This is the Bitter Competition case. We will also consider the role of mediators in helping parties reach an agreement. The preparation for that discussion is the Citi versus Saudi case that appears after the description of session 4. Preparation for discussion of Multi-Person Negotiation Here are two bargaining problems to think about. I’ll ask you think about these two problems before our class discussion. This isn’t a trick question. There’s an answer to that is intuitive. You don’t have to turn this in. I just want you to be prepared for our discussion. (i) How would you split the cost of a runway among three airlines? In this situation, Airline A needs a runway of length 1, B needs one of length 2, and C needs one of length 3. The case with only two airlines is pretty straightforward. Can you apply the same solution when there are three airlines? (ii) Another way to solve the runway problem is to imagine the airlines arrive in a random order. When an airline arrives, it has to build the rest of the runway that it needs (if that hasn’t already been built). For example, if the airlines arrive in the order (2, 1, 3), then airline 2 builds a runway of length 2, airline 1 doesn't have to build anything as the runway is already long enough for it, and airline 3 needs to spend 1 to lengthen the runway to a distance of 3. What is the cost allocation when you consider the six different possibilities for the order of how the airlines could arrive? Preparation for the Bitter Competition Case The first three questions are background. They are the warm up to the material we want to cover. Note that an abridged version of the case (which is all you need) is at the end of this reading list. 1. Why is HSC tying to get into the aspartame business? 2. How, as HSC, do you expect NutraSweet to respond to your entering the European and Canadian markets? 3. As HSC, would you enter the market? Now to the harder question. Let’s assume that you (as HSC) are going to enter the market. 1. How much do you expect to make? Think about your negotiations with Coke and Pepsi. 2. How do you create pie? 3. With that in mind, how should you go about entering the market? These are for preparation and you do not need to turn in your answers. Class AN3 – Monday, October 26: Creating Value (DC) Topics: Advanced Integration Advanced Logrolling Job Negotiations Case Study: Internship Web survey due Readings: Shell, Chapters 7–10, Bargaining for Advantage, pp. 117–175, 2006 . Class AN4 – Monday, November 2: Resolving Disputes and Power (BN) Topics: Power: Turning Weakness into Strength Resolving Disputes Settlement Escrows Final-offer Arbitration Single Negotiation Text Case study: Viking Investments Readings: Young, Negotiation Analysis, Chapter 3 (Steven Brams, Marc Kilgour, and Samuel Merrill III: “Arbitration Procedures”) Raiffa, The Art and Science of Negotiation, Ch. 16: The Arbitration of Disputes Gertner & Miller, “Settlement Escrows,” Journal of Legal Studies, 1995, 87–122 Citi Versus Saudi: A Mediation Problem You have been asked to help mediate a dispute between Citibank and Saudi Arabia. The nature of the dispute revolves around land and a branch office that Citibank owned and that the Saudis appropriated via eminent domain. You spent the first day listening to the arguments and positions of each side. In your view, Citibank seems to be almost completely in the right. While you don’t think the Saudis have done anything either immoral or unethical, you do not find their position persuasive in the least. Citibank came into the mediation process asking for $20M in damages, while the Saudis’ initial proposal was to pay nothing. You explained that both parties need to make compromises in order to reach an agreement, and after a day of going back and forth, the Saudis offered $1M and Citibank lowered its demand to $19M. Encouraged by this progress, you continued the mediation process for another day but no more concessions were made. Even so, they genuinely wanted to continue and you agreed (after all, they were paying you a very comfortable daily fee). After the fourth day, people were becoming quite frustrated. Neither the Saudis nor those from Citibank had moved at all from their respective $1M and $19M positions. But at least you had gained their confidence and both sides saw you as a fair and open-minded mediator. To resolve the dispute, they asked if you would change your role and become an arbitrator. Each side would make one (and only one) settlement offer to you. You would be bound to pick one of the offers without making any adjustment— a process generally called “final offer” or “baseball” arbitration. The parties agreed in advance to accept whatever you decided. You are generally opposed to acting as an arbitrator. (Why might that be the case?) But, as a favor to these two sides, you agreed under one condition: that you could adjust the offer you picked (up or down) by up to $1M. The two sides consented to this request. The offers came in: Citibank asked for $10M and the Saudis offered $7M. What do you do and why? Come to class prepared to discuss your answer. Bitter Competition: The Holland Sweetener Company versus NutraSweet In late 1986, the Holland Sweetener Company (HSC), based in Maastricht, the Netherlands, was preparing to enter the European and Canadian aspartame markets. Aspartame, a low-calorie, high-intensity sweetener, had been discovered in 1965 by G.D. Searle & Co., a U.S. pharmaceuticals company. After having secured a number of patents on its discovery, Searle had gone on to develop markets for aspartame as a food and beverage additive. By 1986, NutraSweet, the operating entity set up by Searle to build the aspartame business, had reached sales of $711 million. Now, NutraSweet’s patents in the European and Canadian markets were due to expire as of 1987, although the U.S. market would remain protected until December 1992. Winfried Vermijs, president of HSC, reviewed his company’s strategy for competing in the aspartame business. Price and volume forecasts had been prepared for the European and Canadian aspartame markets. On price, two scenarios were being entertained: “normal competition” and “price war.” Vermijs wondered which scenario was the more likely. Aspartame High-intensity sweeteners had a long history. In Roman times, grape juice was boiled down in lead pans to produce sapa, a sweet compound used for everything from a food additive to an oral contraceptive. Presaging concerns over the safety of modern high-intensity sweeteners, use of sapa unfortunately led to neurological damage or even death. Discovered in 1879, the oldest high-intensity sweetener still in use was saccharin, a petroleum derivative about 300 times as sweet as sugar (sucrose) of equal weight. In the 1960s, Abbott Laboratories developed cyclamate (30 times as sweet as sugar) but, following studies suggesting a link to cancer, the Food and Drug Administration (FDA) banned cyclamate in 1970. In 1977, the FDA tried to ban saccharin as well, but the resulting public outcry caused Congress to intervene and declare a moratorium. Manufacturers of saccharin were, however, required to place notices on labels, warning consumers of the possible increased cancer risk. Apart from the safety issue, many people found saccharin to have a slightly bitter, metallic, aftertaste. Aspartame was a white powder consisting of L-aspartic acid and L-phenylalanine, two naturally occurring optically active amino acids, together with a small amount of methanol. It had the same caloric content as sugar of equal weight, but was 180 times as sweet. Unlike sugar, aspartame did not promote tooth decay. The main drawbacks of aspartame were that it became unstable when exposed to high temperatures (as in baking) and that it had a limited shelf life in soft drinks. Aspartame had been discovered by accident. In 1965, James Schlatter, a research scientist at G.D. Searle & Co., a pharmaceuticals company based in Skokie, Illinois, was working on a project to develop an anti-ulcer drug. While experimenting with L-aspartic acid and L-phenylalanine, he happened to lick his finger to pick up a piece of paper and noticed a sweet taste. He later coined the term “aspartame” for the combination of amino acids. NutraSweet1 G.D. Searle & Co. was formed in 1908, although the company’s roots could be traced back to 1888. From its upper Midwest beginnings, Searle grew to become a Fortune 500 pharmaceuticals company in 1968. Following its serendipitous discovery of aspartame, the company had an opportunity to strike out in a new direction. Searle secured two key patents on aspartame. The “use” patent, obtained in 1970, covered any use of aspartame as a sweetening ingredient. The “blend” patent, obtained in 1973, covered combinations of aspartame and saccharin. Approval from the FDA for the use of aspartame as a food additive was sought the same year.2 After giving a green light to dry use of aspartame (tabletop sweeteners and powdered drinks) in 1974, the FDA withdrew its approval shortly afterwards, pending the results of further tests. Not until July 1981 did the FDA give the final go-ahead for dry use of aspartame. Wet-use approval (soft drinks) came in July 1983. In the wake of the regulatory delays, Searle sought extensions of its two patents. It was successful in getting the use patent extended—to 1987 in Europe, to December 14, 1992 in the United States, and to April 1993 in Australia. An attempt to extend the Canadian use patent, which was due to expire in 1987, was unsuccessful. The blend patent was extended to November 4, 1996 in the United States. Manufacturing To manufacture aspartame on a commercial scale, Searle turned to Ajinomoto, a major Japanese chemicals and food company. Ajinomoto was a leading player in amino acid research and production, dominating the monosodium glutamate (MSG) market. Ajinomoto supplied a chemical coupling process for manufacturing aspartame, as well as the L-phenylalanine input. (The other input, L-aspartic acid, was widely used in pharmaceutical applications and could be obtained from a number of sources.) Searle agreed to pay Ajinomoto royalties for access to the process technology, and the two parties further agreed to share information on subsequent process improvements. A cross-licensing deal was also struck under which Ajinomoto was given exclusive access to the Japanese aspartame market—where it went on to sell aspartame under the brand names Pal Sweet and Pal Sweet Diet. Searle retained sole rights to the North American market. It took two to three years to bring aspartame production up to speed. (Once operational, however, a facility had to be run at or near to design capacity. Interruptions to production were prohibitively expensive due to significant mothballing and debugging costs.) Minimum efficient scale was of the order of 2,000 tonnes annual capacity, while plant construction costs exceeded 1Some material in this section is taken from “The NutraSweet Company: Technology to Tailormake Foods,” Harvard Business School Case Services (589-050), 1988, and Sweet Success: How NutraSweet Created a Billion Dollar Business, by Joseph McCann, Homewood: Irwin, 1990. 2Under FDA rules, an applicant had to establish the “added value” of a new product. However, only the efficacy of a new product, and not its cost, entered into the added value assessment. Thus the criterion for approval of a high-intensity sweetener was that it be provably superior to existing sweeteners as an aid to dieting. $100 million. With shipping costs for aspartame around 15-20 cents per lb, NutraSweet and Ajinomoto concentrated production in a limited number of facilities (see Table 1). Table 1 xxx NutraSweet and Ajinomoto Production Facilities Company NutraSweet Ajinomoto Facility University Park, IL Augusta, GA Harbor Beach, MI Tokyo, Japan Annual capacity (tonnes) 2,000 3,000 n/a 2,000 Source: Chemical Marketing Reporter and Financial Times (various issues), casewriter estimates The NutraSweet-Ajinomoto method of manufacturing aspartame was covered by process patents extending through the late 1990s. With a continuing program of process improvement and capital investment in place, NutraSweet and Ajinomoto aimed to increase the efficiency of their manufacturing operations over time. By 1992, NutraSweet would be proclaiming that it had cut its manufacturing costs by 70% over the previous decade.3 Market Development Having spent nearly $80 million in start-up costs (excluding investments in plant), Searle launched its first aspartame product, the tabletop sweetener Equal, in October 1981. At that time, the U.S. tabletop sweetener market totaled about $110 million. It was dominated by one brand, Sweet ‘N Low, a saccharin-based product made by the Cumberland Packing Company of Brooklyn, New York. Although it was three times more expensive than Sweet ‘N Low, Searle’s Equal was an immediate success in the marketplace. In December 1982, The NutraSweet Group was established as a separate operating division of Searle.4 Forty-year-old Robert Shapiro, Searle’s general counsel, was brought in as president. Educated at Harvard and Columbia Law School, Shapiro had served on several government advisory committees and had then spent time in the private sector before joining Searle in 1979. Following FDA approval for wet use of aspartame, Shapiro set in motion the now-famous “branded ingredient” strategy. Aspartame, under the brand name NutraSweet, was made available to any interested food or beverage manufacturer. This was backed up with extensive advertising (estimated at $30 million annually) of the brand name directly to end-users, and by cooperative advertising with manufacturers. The company gave discounts of up to 40% off the list price of aspartame to manufacturers who agreed to use 100% aspartame as a sweetener (rather than blends of aspartame and saccharin, say), to make NutraSweet their exclusive worldwide supplier, and to display the NutraSweet trademark and distinctive red-and-white 3Monsanto Company 1992 Annual Report, p. 15. 4From now on the term “NutraSweet” will denote this operating entity. The italicized NutraSweet will be used to refer to branded aspartame. “swirl” logo on their products and in their own advertising. By 1986, the company was claiming that 98% of American consumers recognized its logo.5 The soft drink market was NutraSweet’s primary focus in 1983. The U.S. soft drink industry was dominated by two players, Coca-Cola and Pepsi-Cola, which, between them, accounted for something over 60% of shipments in an industry with annual sales of $26 billion at the retail level. The diet segment accounted for 20% of the U.S. soft drink market and was growing rapidly. To date, saccharin had been used to sweeten diet soft drinks. NutraSweet sold aspartame directly to major buyers such as Coke and Pepsi via secret, negotiated, multi-year contracts. In 1983, the contracted price was around $85-90 per lb. Although this represented a substantial premium over saccharin (which cost around $3 per lb) and even sugar (about 25 cents per lb), aspartame replaced virtually all the U.S. soft drink use of saccharin within two years of its introduction. Pepsi, first to use 100% aspartame in its diet beverages, used its head start over Coke to promote Diet Pepsi against Diet Coke. The 1980s saw intense activity by Coke and Pepsi in the U.S. soft drink market. A memorable episode in the so-called Cola Wars was Coke’s 1985 reformulation of its 99-year-old Coca-Cola brand, from which it beat a hasty retreat in the face of consumer resistance. Pepsi responded to the reformulation with commercials proclaiming: “For 87 years Coke and Pepsi have been eyeball to eyeball. It looks like they just blinked . . . .” Over time, NutraSweet expanded aspartame’s range of applications to include use in powdered drink mixes, frozen desserts, chewing gum, toppings, cereals, and over-the-counter pharmaceuticals, among other products. However, diet soft drinks continued to be the principal use, accounting for about 80% of total sales of aspartame. The tabletop market accounted for another 15% of sales, other food and beverage products the remainder. NutraSweet also looked to develop markets for aspartame outside the United States. Canada was an early target. In 1984, NutraSweet and Ajinomoto set up a 50:50 joint venture, NutraSweet AG, based in Zug, Switzerland, to market NutraSweet to European commercial buyers and the tabletop sweetener (under the name Canderel) to European consumers. As in the U.S., the soft drink industry was the primary focus of efforts to sell aspartame internationally, and Coke and Pepsi were again the major buyers. Unlike the situation in the United States, however, Coke enjoyed a strong lead over Pepsi in most overseas markets. In Europe, Coke was estimated to have a 50% market share and Pepsi a 10% share. In Asia, Coke’s share of the soft drink market stood at 40%; Pepsi again held a 10% share. In Latin America, Coke held a 55% market share and Pepsi a 20% share. Exhibit 1 depicts the growth of the worldwide aspartame market through 1986. In that year, worldwide aspartame prices were around $70 per lb. 5Monsanto Company 1985 Annual Report, p. 19. Acquisition In summer 1985, Searle was acquired by Monsanto Corporation for $2.8 billion. Monsanto, headquartered in St. Louis, Missouri, was a leading U.S. producer of agricultural products, plastics and specialty chemicals, performance materials (such as synthetic fibers), and industrial control equipment. Curiously, the mission of the original Monsanto Chemical Works, formed in St. Louis in 1901, was to challenge the then German monopoly hold on the saccharin market. Now, with the purchase of Searle, NutraSweet became a wholly owned subsidiary of Monsanto. Since the acquisition, Monsanto had been writing off the cost of the aspartame patents via a $173 million annual charge against NutraSweet’s earnings. The amortization charge would end with the U.S. expiration of the use patent in 1992. The Holland Sweetener Company In April 1985, the Holland Sweetener Company (HSC) was formed in Maastricht, the Netherlands, as a joint venture between Tosoh Corporation and DSM to enter the aspartame market. Headquartered in Tokyo, Japan, Tosoh had begun business in 1935 as a producer of soda ash and caustic soda. The company had since grown to become a diversified manufacturer of basic chemicals, intermediates, and downstream products, as well as scientific instruments and ceramics. Based in Heerlen, the Netherlands, DSM was a chemicals group with interests in plastics, synthetic rubber, fine chemicals, fertilizers, resins, consumer products, and oil and natural gas exploration and development. The company had begun as “Dutch State Mines” around the turn of the century, but over time had been migrating into downstream businesses. Since 1986, DSM had been publicly traded, with the Dutch government retaining a one-third interest. Tosoh brought to the hook-up with DSM a patented process for manufacturing aspartame that employed a natural catalyst to solve the problem of achieving a precise coupling between the aspartic acid and phenylalanine inputs. The Tosoh process was capable of using either Lphenylalanine or D,L-phenylalanine (a mixture of the D- and L-isomers) as base feedstock. HSC claimed that its method of producing aspartame would be less costly and more flexible than NutraSweet’s, although this was disputed. DSM’s contribution to the joint venture was raw material supply and traditional chemical processes (courtesy of its Fine Chemicals Division), and knowledge of the European marketplace. Heading up HSC was Winfried Vermijs, a 50-year-old chemical engineer who had been with DSM since 1961. Vermijs had begun his career working on process development in DSM pilot plants. After a stint as a plant manager in the 1970s, he had returned to research and development activities for several years before taking on general management responsibility as president of HSC. In February 1986, HSC began work on a 500-tonne aspartame plant in Geleen, the Netherlands, with a view to challenging NutraSweet in Europe and Canada once NutraSweet’s patents expired there in 1987. The company received a D.Fl. 35 million ($17 million) loan from the European Investment Bank towards the project. In preliminary discussions with potential customers, HSC discovered that NutraSweet had signed Coke and Pepsi to exclusive, multi-year contracts. It decided to lodge a complaint with the European Commission, charging that the contracts were anti-competitive. Joining HSC in the complaint was the Irish company Angus Fine Chemicals. New Sweeteners In addition to aspartame, saccharin, and cyclamate, several other high-intensity sweeteners were on the market or in various stages of regulatory review. Acesulfame-K had been discovered in 1967 and was now being sold in Europe. It was 200 times sweeter than sugar and was heat-stable, which gave it an advantage over aspartame in shelfstable products and in baking. Acesulfame-K was manufactured by Hoechst, a major German chemicals company. Sucralose, a heat-stable compound 500 times sweeter than sugar, was derived from sucrose by a patented chlorination process developed in 1976 by the British sugar company Tate & Lyle and researchers at Queen Elizabeth College in London. Johnson & Johnson, the U.S. consumer products company, had entered a licensing agreement with Tate & Lyle and, through its McNeil Specialty Products division, hoped to market sucralose in the United States and Japan under the brand name Splenda. Alitame, a heat-stable product 2,000 times sweeter than sugar, was made by the U.S. pharmaceuticals company Pfizer. A petition for FDA approval was submitted in 1986. There were also several naturally-derived high-intensity sweeteners. Stevioside, made from the leaves of the South American Stevia plant, was in demand in Japan. Thaumatin, genetically engineered to replicate proteins found in berries of certain West African plants, was being used as a sweetener in Japan, Brazil, and the U.K. Neither sweetener had yet been approved in the United States. One trend expected to strengthen if a wider range of high-intensity sweeteners became available was blending. Researchers had found that combining sweeteners could have a synergistic effect: the blend was sweeter and might have a better taste profile for certain applications than either sweetener separately. U.S. health authorities also encouraged a multiple-sweetener approach on the grounds that it reduced the health risks from any one product.