chapter 5 - Pakistan Telecommunication Authority

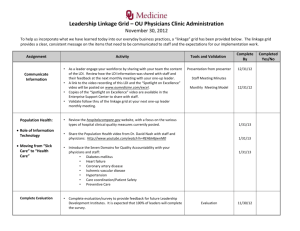

advertisement

Long Distance International O verview affordable tariffs for large number of countries. PTCL also reduced its tariffs at the end of 2006 The Long Distance and International (LDI) and now international direct dialing facility is segment has been evolved after the available on every PTCL connection and call deregulation of Pakistan telecom sector in booking is no more required. Similarly 2004. Since then the LDI segment has international dialing facility from mobile undergone significant changes in terms of its number has also revolutionized the LDI structure, calling rates and increased choice to segment. telecom consumers. PTA awarded 14 licenses for Long Distance and International services The sector witnessed blooming health wherein till 2007 to local companies. Out of these 14 LDI telecom consumers enjoyed international licensees only Multinet has not started its dialing as low as Rs.2/- minute (to specific services as yet, although the company has laid countries). However, hyped up market and its OFAN across the country. Rest of 13 stringent competition led to filtration and companies are operational. LDI companies companies who had been involved in price including Wateen, Circlenet, Link Direct, and discrimination/predatory pricing finally had World Call have laid or in the process of laying to suffer in terms of financial loss. Due to this their own networks (OFAN). Wateen Telecom, aggressive competition it is becoming which has its network across the country, now increasingly difficult for operators to sustain claims to have largest WiMax network across their financial health and growing pressures the world. 3 out of 6 cellular operators have from the market. Companies have started also acquired LDI licenses and are now routing looking for foreign investment to survive in the their total mobile traffic through their own market e.g. Worlcall has sold some of its shares LDI's. The LDI operators are performing to Oman telecom, also 30% shares of Burraq aggressively in the local market by offering have been acquired by Qatar Telecom. These Pakistan Telecommunication Authority 62 Long Distance & International changes in the market also show increasing inertest of UAE based telecom companies in the telecom market of Pakistan. The incumbent operator PTCL being the owner of essential facilities, that all LDI's required before establishing their own network, had been taking advantage of its position. Figure - 31 Point of Presence (LDI) Since the company is working both in wholesale and retail market for LDI services therefore it remained one of the 127 140 116 120 most threatening competitor to all LDI operators with an edge to cross subsidize 100 and underselling all new LDI operators. 80 Similarly operator's dependence on 60 PTCL for facilities including internat- 40 ional circuits, the Digital Interface Units 20 and access networks is also eroding the 0 76 2004-05 LDI market. LDI operators are also 2005-06 2006-07 vulnerable to grey traffic menace, when Authority in the process to look into technical solution of this menace. Grey traffic although gives handsome profits to illegal operators but by bypassing national gateways it causes revenue loss to the government and the LDI operators. New established companies are establishing their networks across the country where new players in this regard the companies have 127 total points of presence (PoP). Last year there were 116 PoPs in all. Currently Woldcall, Callmate and Burraq have maximum PoPs in the local LDI market.. Optic Fiber Access Network Today the LDI industry in Pakistan is reshaping through enhanced use of enabled optic fiber media for delivering seamless high capacity services. The domestic long distance capacity in Pakistan has substantially increased with three LDI operators laying OFAN across the country including Multinet, Wateen, and Link Direct. The optical fiber laid by Malaysian based company Multinet, spans over a total of 4100 Km distance with a 48 63 Pakistan Telecommunication Authority Figure - 32 Geographical Coverage by Wateen • Wateen Long Haul Providing connectivity Mardan from Karachi to Peshawar. Peshawar • Five Rings of 24 Core Fiber • Kohat DWDM Deployment of 160 Lambda Capable Equipment Ahmedbanda Nowshera Abbotabad • Taxila Mandi Bahauddin Khushab 71 Sites for Add/drop functionality Bannu Mianwali Karak D I Khan Bhakkar Quetta Sialkot Sargodha Wagah Gujranwala Chiniot Lahore Jhang Faisalabad Raiwind Kasur Gojra Pattoki T T Singh Sahiwal Okara Pakpattan Chichawatni Layyah Arifwala Khanewal Kot Addu Qureshi Chowk Mach D G Khan Burewala Multan Vehari Muzaffargarh Mailsi Fazilpur Sibbi Lodhran Rojhan Khandkot Dera Murad Jamali Jacobabad Bahawalpur Liaquatpur Rahim Yar Khan Dharki Shikarpur Sukkur Larkana Amirabad Dadu Nawabshah Kalri Jamshoro Nooriabad Karachi Thatta Hyderabad Islamabad Gujar Khan Jhelum Kharian Gujrat Long Distance & International Figure - 33 fiber DWDM and laid in a configNetwork Coverage by Multinet uration of four self healing rings. This configuration inherently improves 4,100 Km Optical Fiber Cable Network: redundancy of the installed system 48 fibers Four Self-Healing Rings with the advantage that each ring of DWDM based system the deployed system can be isolated in the event of occurrence of fault or any serious damage to laid fiber at a point within the network. The maintenance team can easily isolate the damaged section for required repair work without causing any interruption of service. There is also an SDH-10 G / IP-10 G ring layout IP/MPLS enabled ports at various Figure - 34 locations with nodal points. Link Network Coverage by Link Direct Direct another LDI operator, which is a sister concern of Pakistan’s largest Mobile operator Mobilink, has also laid its own optic fiber access network across the country in order to cater for Mobile traffic requirements. The deployed network has similar configuration to networks of PTCL and Multinet in multi-ring manner. In addition to the above Wateen Telecom, a subsidiary of Warid Pakistan has deployed an extensive long haul network providing connectivity from Karachi to Peshawar. There are five rings of 24-core fiber with DWDM deployment of 160 lambda cable equipment at 7 sites with add/drop functionality. It is expected that network laid by these three companies would give comfort to the increasing telecom traffic and will help in reducing telecom prices overall. Km TA 41 11 9 50 K m Km X IL A MARDAN PESHAWAR ISLAMABAD 93 K m 11 7 DWDM RING NO . 01 - A K m L ac h i 112 K m JHELUM SIALKOT 5 8 Km BANNU 72 K m RA GUJ MANDI BAHAUDDIN 71 K m Shahbaz Khel m 75 K SARGODHA K m 11 3 K m FAISALABAD 64 Km Km 5 DWDM RING NO . 01 - B 87 AL A A NW G U JR 9 D . I. KHAN T 70 K m m 75 K LAHORE 45 K m 1 2 1 K m Retra 115 OKARA Km RAIWIND 41 K m Mian Channu 1 14 K m K m 81 SAHIWAL K m 10 2 105 K m MULTAN K m D . G . KHAN 11 8 94 K m . O K m N 03 GN O. RIN DM 90 K m Jamshoro Nooriabad NAWAB SHAH HYDERABAD m 90 K Km 109 K m Morro 1 04 K m 90 KARACHI m 7 K 80 K m Km Kalari 11 SUKKUR 74 K m Ranipur 93 K m 1 18 DW 100 K m Km Dherki Km DADU 1 05 G IN R M W 84 38 1 28 K m 99 K m R .Y .KHAN D 67 K m LARKANA Liaqatpur D Kandhkot SHIKARPUR 80 K m BAHAWALPUR 02 Fazilpur 90 K m Rojhan 99 K m Thatta Pakistan Telecommunication Authority 64 Long Distance & International LDI Financials The LDI market is growing every year, as the companies are establishing their own networks and reducing their dependence on PTCL backbone. Similarly few LDI companies have sold their shares Table - 18 Investment by LDI Operators (2006-07) to foreign investors. This has brought in more FDI in the country. US$ Million Worldcall has sold its 60% shares worth US$ 220 million to Omantel Burraq and Burraq telecom has sold its 30% shares worth US$ 220 million to Qtel. Only last year total investment in the LDI sector was around US$ 51 million, which grew to US$ 603 million in 2007. Main contributor to this huge investment was Multinet and Link Direct as both companies have laid down their own OFAN. Dancom telenor Wateen World Call Link Direct Wise Com Multinet Total 12 2 23 1 0 494 3 68 603 With increasing business and large shift in traffic patterns, the LDI operators' revenues have also increased. The LDI operators cumulative revenues in 2006 was Rs. 13,235 million which grew to Rs. 15,275 million, showing a growth of 15% in the year 2006-07. Although profitability of the companies was already not very well in the last year but this year the profitability has decreased further. The main factors contributing to lower turnover this year may be low tariffs and increased cost of operations in highly competitive market where present international incoming traffic is terminated (illegally) at lower than decided rates by the regulator. Figure -35 Revenues by New LDI Operators (2007) 5,000 Rs. Million Total = 15,275 4,389 4,500 4,000 3,500 3,000 2,574 2,307 2,500 1,885 2,000 1,500 746 1,000 915 1,068 537 65 Wateen Callmate Link Direct World Call Wise Com Burraq Dancom Pakistan Telecommunication Authority telenor 227 DV com 192 294 Telecard 109 Redtone 32 4B gentle 0 circle net 500 Long Distance & International Wateen's turnover this year was more than Rs 4,000 million, which is highest in the LDI market followed by Callmate and Link Direct. Multinet did not generate any revenue since the company has not started its commercial operation as yet. LDI Tariffs Financial year 2006-07 has witnessed stability in terms of tariffs reduction. National and international long distance tariffs which were Rs. 42 and Rs. 74 in 1995-96 have been drastically reduced to Rs. 2.30 per minute. PTCL is offering same national and international long distance tariff of Rs. 2.30 per minute. Figure -36 PTCL Tariffs over the years 1996-2007 80 74.0 70 Nationwide 60 International 50 42.0 40 39.0 30 23.0 21.0 17.0 20 10.0 10 6.0 4.6 2.3* 2.3** 2.3 0 1995-96 2002-03 2003-04 2004-05 2005-06 2006-07 *Minimum ** Maximum Same trend has also been witnessed in calling card segment. In 2005-06, the calling card operators were offering 150 long distance minutes which in Rupee terms turned out to be Rs. 0.53 per minute whereas during this year, the minimum tariff of calling card is Rs. 1.07 per minute. In addition, the calling card operators have also levied daily deduction charges on their cards which range from Rs. 0.62 to Rs. 6.00 per day. PTCL international tariffs dropped by about 90% in last 4 years while NWD tariffs declined by 62% in the same period. Now analyst are of the view that regulator should have some floor price make the business viable and to avoid consulted in the sector. The calling cards tariffs of LDI operators, tariffs of PTCL, World Call, and Burraq have remained quite consistent during last year. However, tariffs of Wisecom, Callmate and Wateen have shown a considerable drop. Wisecom, Wateen and Callmate are offering lowest tariffs of Rs. 1.07/m, Rs.1.58/m, and Rs.1.42/m on outgoing calls for specific countries. Table - 19 Calling Card Tariffs Burraq Combo NWD Calls Daily Deduction Wisecom GTO Batooni AKC 1.42 2.52 1.66 3.98 1.99 1.58 1.07 1.25 1.66 4.20 3.33 3.15 3.5 7.46 6.93 3.15 5.41 3.50 4.00 0 0 0 0 7.56 2.84 2.52 0.29 0 0 2.10 to 3.60 NWD Mobile Wateen PTCL Callmate World Call WOL ARY VIVA Telips Calling Cards Hello Pakistan Telecommunication Authority 66 Long Distance & International Traffic Analysis Since the end of PTCL's monopoly number of LDI operators have joined the market, the traffic trends in the country have changed dramatically. The international traffic has increased significantly as the tariffs have been dropped to the minimum due to large variety of calling cards and ease of access from any PTCL number in addition to Local Loop and mobile operators. Average duration of an incoming call has also been increased to 6.2 minutes per call. Although the international traffic terminated on incumbents network is still higher than the rest of LDI operator's traffic however, the incumbent is loosing its international traffic share in favor of other LDI operators. Incoming Traffic Overall the international incoming traffic in the country has shown an increase of 54% in 2007 whereas this increase was 118% during 2006. PTCL had major share in the total incoming traffic in the country with more than 2631.3 million minutes with total of 53% market share in total incoming minutes. Rest of the LDI operators had almost 2,219 million minutes of cumulative incoming traffic. Companies including Wateen, Burraq, callmate had significant increase in their total incoming traffic. DVcom, Redtone and Worldcall experienced negative growth in the year 2007. Figure - 37 International Incoming Traffic Company wise Share* (2006) Circlenet 4.8% Wisecom 2.6% (2007) Circlenet 2% Telenor 0.4% Wisecom 3% Dancom 2% Wateen 5.0% Dancom 1.7% Callmate 6% Telecard 0.3% Buraq Telenor LDI Link Direct 2% 1% Wateen 10% 4B Gentel 0% Callmate 9% 5.2% DVCom 5.1% Redtone 1.4% Worlcall 7.1% PTCL 55.3% NTC 5.1% PTCL 53% Telecard 2% *Estimates Buraq 7% DVCom 3% Redtone 0% Worlcall 6% In 2004 and 2005 the international incoming traffic on fixed network was higher than that of mobile networks, however with increase in mobile connections in the last two years there has been a shift in the incoming traffic from fixed to mobile networks. Today more than 57% of incoming international traffic comes on mobile networks where as only 43% is terminated on fixed networks. Out of total 4,842 million international incoming minutes 67 Pakistan Telecommunication Authority Long Distance & International Figure - 38 International Incoming Traffic (Fixed & Mobile) (2006-07)* more than 2,700 million minutes were on mobile networks and approximately 2,095 million minutes were terminated on fixed networks. (Million Minutes) (517%) 3,000 2,747 Fixed Mobile 2,500 (43%) Millionminutes 2,095 An analysis of the incoming traffic of (51%) 2,000 1,608 (49%) LDI operators from January 2007 to 1,500 1,545 (92%) (89%) 1,180 June 2007 revealed that more than 70 860 1,000 %international traffic to Pakistan is (41%) 500 (8%) 287 96 coming from USA, 10% from UK, 8% 0 from Saudi Arabia and 2% from each 2003-04 2004-05 2005-06 2006-07 *2007 traffic Estimates UAE, Germany, Malaysia and Egypt Only in 6 months there were around 124.2 million minutes terminated in Pakistan from USA. Similarly analyzing the city wise data Karachi received maximum international calls followed by Islamabad, Lahore and Gujarat. Since Karachi is the business capital of Pakistan therefore it is the main recipient of international traffic. Figure - 39 Top Ten Countries Originating Traffic (New Major LDIs) 140 124.2 (Million Minutes) 120 Million minutes 100 80 60 40 17.3 13.6 20 3.5 2.9 2.8 2.8 1.3 1.1 0.7 0 UAE Egypt Germany Malaysia Aus Norway Japan 5,000,000 1,411,797 4,672,817 4,777,799 5,870,669 10,000,000 6,266,172 12,349,137 15,000,000 7,561,430 Figure - 40 Top Ten Cities by Traffic Termination (New Major LDIs) 13,438,051 20,000,000 Saudi Arabia 15,307,207 25,000,000 UK 20,282,653 USA Karachi Islamabad Lahore Gujrat Sialkot Gujranwala Jhelum Faislaabad Peshawar Multan Pakistan Telecommunication Authority 68 Long Distance & International International Outgoing Traffic Conclusion Figure - 41 International Outgoing Traffic 1,271.1 1,400 1,200 Million Minutes The international outgoing traffic in Pakistan had remained low before deregulation. With a number of new operators and increasing competition the result is increase in international outgoing traffic. Decreasing tariffs have played major role in increasing the international outgoing tariff. In addition calling card facility by number of operators and very low tariffs for specific countries have revolutionized international calling in Pakistan. In 2006 the total reported outgoing minutes from Pakistan were 405.1 million which grew to 1271 million in 2007, showing a humongous growth, this number does not include outgoing minutes via illegal sources. Since a large portion of international outgoing calls is unreported and termed as gray traffic 1,000 800 405.1 600 400 200 148.3 96.1 0 2003-04 2004-05 2005-06 2006-07 Figure - 42 International Outgoing Traffic Share by Cellular Operators (2007) Warid 16% Telenor 6% Mobilink 50% Paktel 2% Ufone 25% Instaphone 1% With current scenario of decreasing LDI tariffs, inaccessibility to essential facilities by SMP operator and gray traffic LDI operators need to diversify their business in order to stay in the market. The increased cutthroat competition in LDI market has pushed some companies into financial frenzy as already witnessed foreign companies are showing interest in LDI business and are injecting money, however the operators still need to diversify the business. Teleporting and satellite facilities could be one source of income to the LDI operators if they sign agreements with the international teleport operators. It will generate income for the LDI business by facilitating the international traffic routed through Pakistan. Post-paid calling is also popular in many of the developed countries. This service could also help the LDI companies in getting permanent customers. Similarly international callback services allow consumers to make calls from outside the country at long distance rates that are 69 Pakistan Telecommunication Authority Long Distance & International often much lower than rates charged in foreign countries. Such services are good for businesses with offices outside the country, government agencies, banks, as well as individual consumers who are traveling abroad. Two other significant developments that are expected to benefit the LDI operators' international incoming business relate to reduction in Access Promotion Contribution and procurement of Traffic Monitoring System. It is expected that as a result of reduction in APC and installation of Traffic Monitoring System the grey traffic would be further curbed and result in increase revenue opportunities of LDIs. Pakistan Telecommunication Authority 70