Pre-Conditional Voluntary Offers

PRE-CONDITIONAL VOLUNTARY OFFERS

by

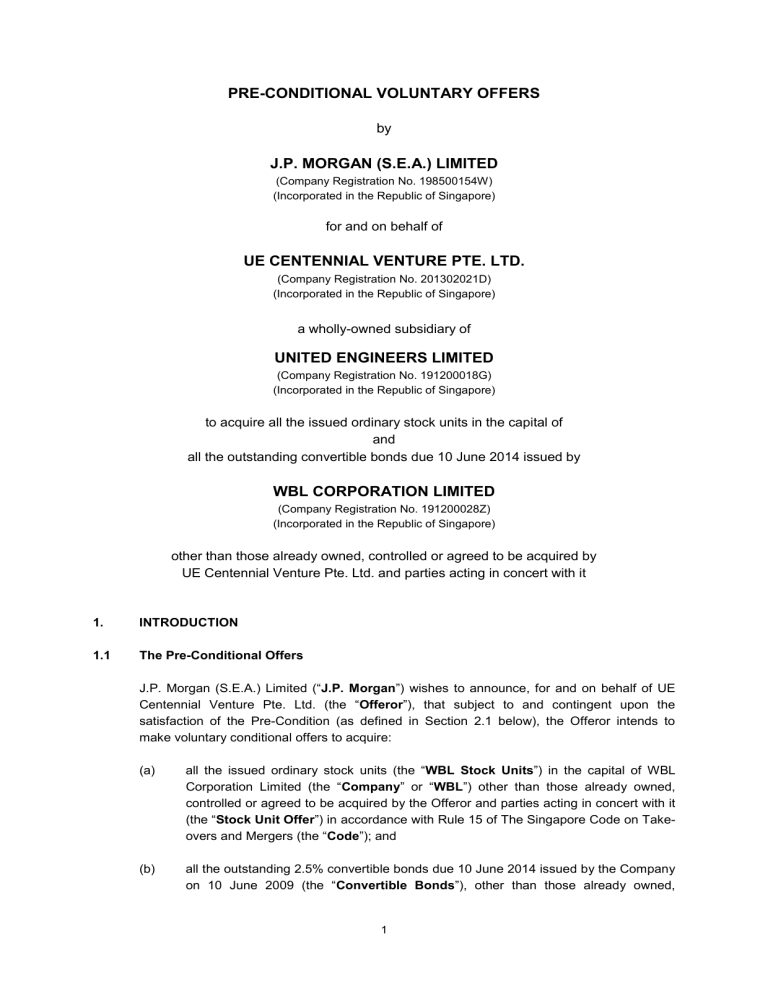

J.P. MORGAN (S.E.A.) LIMITED

(Company Registration No. 198500154W)

(Incorporated in the Republic of Singapore)

for and on behalf of

UE CENTENNIAL VENTURE PTE. LTD.

(Company Registration No. 201302021D)

(Incorporated in the Republic of Singapore)

a wholly-owned subsidiary of

UNITED ENGINEERS LIMITED

(Company Registration No. 191200018G)

(Incorporated in the Republic of Singapore)

to acquire all the issued ordinary stock units in the capital of and all the outstanding convertible bonds due 10 June 2014 issued by

WBL CORPORATION LIMITED

(Company Registration No. 191200028Z)

(Incorporated in the Republic of Singapore)

other than those already owned, controlled or agreed to be acquired by

UE Centennial Venture Pte. Ltd. and parties acting in concert with it

1.

1.1

INTRODUCTION

The Pre-Conditional Offers

J.P. Morgan (S.E.A.) Limited (“ J.P. Morgan ”) wishes to announce, for and on behalf of UE

Centennial Venture Pte. Ltd. (the “ Offeror ”), that subject to and contingent upon the satisfaction of the Pre-Condition (as defined in Section 2.1 below), the Offeror intends to make voluntary conditional offers to acquire:

(a)

(b) all the issued ordinary stock units (the “ WBL Stock Units ”) in the capital of WBL

Corporation Limited (the “ Company ” or “ WBL ”) other than those already owned, controlled or agreed to be acquired by the Offeror and parties acting in concert with it

(the “ Stock Unit Offer ”) in accordance with Rule 15 of The Singapore Code on Takeovers and Mergers (the “ Code ”); and all the outstanding 2.5% convertible bonds due 10 June 2014 issued by the Company on 10 June 2009 (the “ Convertible Bonds ”), other than those already owned,

1

1.2

controlled or agreed to be acquired by the Offeror and parties acting in concert with it

(the “ Convertible Bonds Offer ”) in accordance with Rule 19 of the Code,

(collectively, the “ Offers ”).

The Offeror is a wholly-owned subsidiary of United Engineers Limited (“ UE ”), a Singaporeincorporated company listed on the Main Board of the Singapore Exchange Securities

Trading Limited (the “ SGX-ST ”). Further information on the Offeror and UE is set out in

Section 5 below.

The Offers will not be made unless and until the Pre-Condition is satisfied or waived.

Accordingly, all references to the Offers in this Announcement refer to the possible

Offers which will only be made if and when such Pre-Condition is satisfied or waived.

Stockholders of the Company (the “Stockholders”) and holders of the Convertible

Bonds (the “Bondholders”) should exercise caution and seek appropriate independent advice when dealing in the WBL Stock Units and the Convertible Bonds.

Aggregate Holding

As at 29 January 2013, the Offeror and the Concert Party Group (as defined in Section 10.4

below) own or control an aggregate of:

(a) 103,996,633 WBL Stock Units, representing approximately 38.29% of the total number of issued WBL Stock Units

1

; and

(b) S$12,804,133 in principal amount of Convertible Bonds which are convertible into

WBL Stock Units representing approximately 1.99% of the enlarged total number of

WBL Stock Units

2

.

2.

2.1

PRE-CONDITION TO THE MAKING OF THE OFFERS

The Pre-Condition

Based on the relative figures computed on the basis of Rule 1006 of the listing manual of the

SGX-ST (the “ Listing Manual ”), the Offers, if made, will constitute a “major transaction” under Chapter 10 of the Listing Manual from the perspective of UE. Accordingly, the making of the Offers and the posting of the formal offer document containing the terms and conditions of the Offers (the “ Offer Document ”) to the Stockholders and the Bondholders will be subject to and contingent upon, and will only take place following the satisfaction or waiver of the following condition:

1

2

Unless otherwise stated, references in this Announcement to the total number of issued WBL Stock Units are based on 271,618,457 WBL Stock Units in issue as at 29 January 2013.

References in this Announcement to the enlarged total number of WBL Stock Units are based on 281,342,021

WBL Stock Units. This figure has been arrived at on the basis set out in Section 6.

2

2.2

All resolution(s) as may be necessary or incidental to approve and undertake the

Offers and the acquisition of any WBL Stock Units and Convertible Bonds pursuant to or in connection with the Offers or otherwise having been passed at a general meeting of UE (or any adjournment thereof) (the “ Pre-Condition ”).

Formal Offer Announcement

If and when the Pre-Condition is satisfied or waived, J.P. Morgan, for and on behalf of the

Offeror, will announce the firm intention on the part of the Offeror to make the Offers (the

“ Formal Offer Announcement ”). The Offer Document will thereafter be despatched to the

Stockholders and the Bondholders not earlier than 14 days and not later than 21 days from the date of the Formal Offer Announcement, if any.

However, in the event that the Pre-

Condition is not satisfied or waived by the Offeror on or before 31 May 2013 or such later date as the Offeror may determine in consultation with the Securities Industry

Council (the “SIC”), the Offers will not be made and J.P. Morgan will issue an announcement, for and on behalf of the Offeror, confirming that fact as soon as reasonably practicable.

3.

3.1

THE OFFERS

Principal Terms of the Stock Unit Offer

Subject to and contingent upon the satisfaction or waiver of the Pre-Condition and the terms and conditions to be set out in the Offer Document, the Offeror will make the Stock Unit Offer for all the WBL Stock Units other than those already owned, controlled or agreed to be acquired by the Offeror and parties acting in concert with it (the “ Offer Stock Units ”) in accordance with Rule 15 of the Code on the following basis:

(a) Stock Unit Offer Price.

The consideration for each Offer Stock Unit will be as follows:

(b)

(c)

For each Offer Stock Unit: S$4.00 in cash (the “Stock Unit Offer Price”)

No Encumbrances.

The Offer Stock Units are to be acquired fully paid and free from all claims, charges, equities, liens, pledges and other encumbrances and together with all rights, interests, benefits, entitlements and advantages attached thereto as at the date of this Announcement and hereafter attaching thereto, including the right to all dividends, rights and other distributions (collectively, the

“ Distributions ”) (if any), the Stock Units Record Date for which falls on or after the date of this Announcement. For the purpose of this Announcement, “ Stock Units

Record Date ” means, in relation to any Distributions, the date on which Stockholders must be registered with the Company or with The Central Depository (Pte) Limited, as the case may be, in order to participate in such Distributions.

Adjustments for Distributions.

Without prejudice to the generality of the foregoing, the Stock Unit Offer Price has been determined on the basis that the Offer Stock

Units will be acquired with the right to receive any Distributions, the Stock Units

Record Date for which falls on or after the date of this Announcement. In the event of any such Distribution, the Stock Unit Offer Price payable to a Stockholder who validly

3

(d)

(e)

(f) accepts or has validly accepted the Stock Unit Offer (if made) shall be reduced by an amount which is equal to the amount of such Distribution as follows, depending on when the settlement date in respect of the Offer Stock Units tendered in acceptance by Stockholders pursuant to the Stock Unit Offer (if made) (the “ Offer Settlement

Date ”) falls:

(i)

(ii) if the Offer Settlement Date falls on or before the Stock Units Record Date, the Offeror will pay the relevant accepting Stockholders the unadjusted Stock

Unit Offer Price of S$4.00 in cash for each Offer Stock Unit, as the Offeror will receive the Distribution in respect of such Offer Stock Units from the

Company; and if the Offer Settlement Date falls after the Stock Units Record Date, the Stock

Unit Offer Price payable for such Offer Stock Units tendered in acceptance shall be reduced by an amount which is equal to the Distribution in respect of such Offer Stock Units, as the Offeror will not receive such Distribution from the Company.

No Adjustments for FY2012 Dividend.

At the annual general meeting of the

Company on 18 January 2013, the Stockholders approved the payment of a taxexempt (one-tier) final dividend of S$0.05 per WBL Stock Unit for the financial year ended 30 September 2012 (the “ FY2012 Dividend ”) payable on 18 February 2013 to

Stockholders on the Register of Members on 24 January 2013 (the “ FY2012

Dividend Record Date ”). For the avoidance of doubt, the Stock Unit Offer Price of

S$4.00 in cash for each Offer Stock Unit will not be adjusted for the FY2012

Dividend as the FY2012 Dividend Record Date falls before the date of this

Announcement.

Conversion Stock Units.

The Stock Unit Offer, if and when made, will be extended on the same terms and conditions to:

(i) all new WBL Stock Units unconditionally issued or to be issued pursuant to the valid conversion prior to the close of the Stock Unit Offer of any of the

Convertible Bonds; and

(ii) all new WBL Stock Units unconditionally issued or to be issued pursuant to the valid exercise prior to the close of the Stock Unit Offer of any options to subscribe for new WBL Stock Units granted under any employee share scheme of the Company (the “ Options ”),

(collectively, the “ Conversion Stock Units ”).

For the purposes of the Stock Unit Offer, the expression “ Offer Stock Units ” shall include such new Conversion Stock Units.

Minimum Acceptance Condition.

The Stock Unit Offer, if and when made, will be conditional upon the Offeror having received, by the close of the Stock Unit Offer, valid acceptances in respect of such number of Offer Stock Units which, when taken together with the WBL Stock Units owned, controlled or agreed to be acquired by the

Offeror and parties acting in concert with it (either before or during the Stock Unit

4

3.2

Offer and pursuant to the Stock Unit Offer or otherwise), will result in the Offeror and parties acting in concert with it holding such number of WBL Stock Units carrying more than 50% of the voting rights attributable to the issued WBL Stock Units as at the close of the Stock Unit Offer.

Accordingly, the Stock Unit Offer will not become or be capable of being declared unconditional as to acceptances until the close of the Stock Unit Offer, unless at any time prior to the close of the Stock Unit Offer, the Offeror has received valid acceptances in respect of such number of Offer Stock Units which, when taken together with the WBL Stock Units owned, controlled or agreed to be acquired by the

Offeror and parties acting in concert with it (either before or during the Stock Unit

Offer and pursuant to the Stock Unit Offer or otherwise), will result in the Offeror and parties acting in concert with it holding such number of WBL Stock Units carrying more than 50% of the voting rights attributable to the maximum potential stock capital of the Company. For these purposes, the “ maximum potential stock capital of the

Company ” means the total number of WBL Stock Units which would be in issue had all the outstanding Convertible Bonds and the Options which are convertible or exercisable prior to the close of the Stock Unit Offer been validly converted or exercised (as the case may be) as of the date of such declaration.

As at 29 January 2013, the Concert Party Group owns or controls an aggregate of

103,996,633 WBL Stock Units, representing approximately 38.29% of the total number of issued WBL Stock Units. Accordingly, the WBL Stock Units of the Concert

Party Group will be aggregated with any WBL Stock Units of the Offeror (including any Offer Stock Units tendered in acceptance of the Stock Unit Offer) for the purpose of determining whether the minimum acceptance condition is met, and therefore whether the Stock Unit Offer has become unconditional.

(g) Revision of Terms of the Stock Unit Offer.

The Offeror reserves the right to revise the terms of the Stock Unit Offer in accordance with the Code.

Principal Terms of the Convertible Bonds Offer

In addition to extending the Stock Unit Offer, if and when made, to all Conversion Stock Units unconditionally issued or to be issued pursuant to the conversion prior to the close of the

Stock Unit Offer of any Convertible Bonds, the Offeror also intends to make the Convertible

Bonds Offer for all the Convertible Bonds other than those already owned, controlled or agreed to be acquired by the Offeror and parties acting in concert with it (the “ Offer

Convertible Bonds ”) in accordance with Rule 19 of the Code and subject to and upon the following principal terms and conditions:

(a) Condition of Convertible Bonds Offer.

The Convertible Bonds Offer will be subject to and conditional upon the Stock Unit Offer (if and when made) becoming or being declared unconditional in all respects and the Convertible Bonds continuing to be transferable and convertible into Conversion Stock Units . If the Stock Unit Offer lapses or is withdrawn or if the relevant Offer Convertible Bonds cease to be transferable or convertible into Conversion Stock Units, the Convertible Bonds

Offer shall lapse accordingly.

5

(b)

(c)

(d)

(e)

Convertible Bonds Offer Price.

The offer price for each in principal amount of the

Offer Convertible Bonds (the “ Convertible Bonds Offer Price ”) tendered in acceptance of the Convertible Bonds Offer will, in accordance with Note 1(a) on Rule

19 of the Code, be the “see-through” price, which is equal to the Stock Unit Offer

Price multiplied by the number of Conversion Stock Units into which such principal amount of Offer Convertible Bonds may be converted (rounded down to the nearest

Conversion Stock Unit) (the “ Conversion Ratio ”). In the event the Conversion Ratio is or will be adjusted in accordance with the terms and conditions of the Convertible

Bonds, the Offeror reserves the right to adjust the Convertible Bonds Offer Price subject to consultation with the SIC.

No Encumbrances.

The Offer Convertible Bonds are to be acquired fully paid and free from all claims, charges, equities, liens, pledges and other encumbrances and together with all rights, interests, benefits, entitlements and advantages attached thereto as at the date of this Announcement and hereafter attaching thereto, including the right to all interest, payment, rights or other distributions (if any), the Bonds

Record Date for which falls on or after the date of this Announcement but excluding any payment of interest, the Bonds Record Date for which falls on or before the relevant settlement date in respect of the Offer Convertible Bonds tendered in acceptance by a Bondholder pursuant to the Convertible Bonds Offer (“ Excluded

Interest Payment ”). For the purpose of this Announcement, “ Bonds Record Date ” means, in relation to any interest, payment, rights or other distributions, the date on which Bondholders must be registered with the Company or with The Central

Depository (Pte) Limited, as the case may be, in order to participate in such interest, payment, rights or other distributions.

In the event of any such interest, payment, right or other distribution or if any right arises for any reason whatsoever (other than the Excluded Interest Payment) on or after the date of this Announcement for the benefit of a Bondholder who validly accepts or has validly accepted the Convertible Bonds Offer, the Offeror reserves the right to reduce the Convertible Bonds Offer Price payable to such accepting

Bondholder by the amount of such interest, payment, right or other distribution, subject to consultation with the SIC.

Revision of Terms of the Convertible Bonds Offer.

The Offeror reserves the right to revise the terms of the Convertible Bonds Offer in accordance with the Code, including a revision of the Convertible Bonds Offer Price in accordance with Rule 19 of the Code in the event the Stock Unit Offer Price is revised by the Offeror.

Stock Unit Offer and Convertible Bonds Offer Mutually Exclusive.

For the avoidance of doubt, whilst the Convertible Bonds Offer is conditional upon the Stock

Unit Offer becoming or being declared unconditional, the Stock Unit Offer will not be conditional upon acceptances received in relation to the Convertible Bonds Offer. The

Stock Unit Offer and the Convertible Bonds Offer are separate and mutually exclusive. The Convertible Bonds Offer does not form part of the Stock Unit Offer and vice versa .

Without prejudice to the foregoing, if a Bondholder converts his Convertible Bonds in order to accept the Stock Unit Offer in respect of the Conversion Stock Units arising pursuant to such conversion, he may not accept the Convertible Bonds Offer in

6

3.3

respect of such Convertible Bonds. Conversely, if a Bondholder wishes to accept the

Convertible Bonds Offer in respect of his Convertible Bonds, he may not convert those Convertible Bonds in order to accept the Stock Unit Offer in respect of such

Conversion Stock Units arising pursuant to such conversion.

No Options Proposal

Based on the latest information available to the Offeror, there are no outstanding Options granted under the WBL Executives’ Share Option Scheme (the “ WBL Share Option

Scheme ”) as at 29 January 2013. In addition, pursuant to the rules of the WBL Share Option

Scheme, the Options (if any) are not transferable by the holders thereof. In view of the foregoing, the Offeror will not make an offer to acquire the Options. For the avoidance of doubt, the Stock Unit Offer will be extended to all Conversion Stock Units unconditionally issued or to be issued pursuant to the valid exercise of the Options (if any) on or prior to the close of the Stock Unit Offer.

4.

NO CHAIN OFFERS FOR DOWNSTREAM ENTITIES

Based on information in the annual report of the Company for the financial year ended 30

September 2012, the Company has controlling interests in the following subsidiaries:

(a) an effective equity interest of 57% in Multi-Fineline Electronix, Inc., a company incorporated in the state of Delaware, United States of America, and listed on the

NASDAQ; and

(b) an equity interest of 77% in MFS Technology Ltd, a company incorporated in

Singapore and listed on the Main Board of the SGX-ST,

(collectively, the “ Downstream Entities ”).

By a letter dated 24 January 2013, the SIC has ruled that the Offeror will not be obliged by virtue of the Offers, if and when made, to make mandatory offers for the Downstream Entities pursuant to the chain principle set out in Note 7 on Rule 14.1 of the Code in the event the

Offeror and parties acting in concert with it acquire statutory control of the Company pursuant to the Stock Unit Offer.

5.

5.1

INFORMATION ON THE OFFEROR AND UE

Information on the Offeror

The Offeror is a company incorporated in Singapore on 18 January 2013 and is a direct wholly-owned subsidiary of UE. Its principal activities are those of an investment holding company. As at the date of this Announcement, the Offeror has an issued share capital of

S$1.00 comprising one issued ordinary share.

The directors of the Offeror are Mr Jackson Chevalier Yap Kit Siong and Mr Wong Hein Jee.

7

5.2

Information on UE

UE is a company incorporated in Singapore and is listed on the Main Board of the SGX-ST.

The principal activities of UE include those of a holding company and property owner and the provision of management services. UE and its subsidiaries (collectively, the “ UE Group ”) are primarily engaged in integrated property services, engineering and construction businesses.

As at 29 January 2013, UE has an issued and paid-up ordinary share capital of approximately

S$339,291,837 comprising 305,648,074 issued stock units and an issued and paid-up preference share capital of S$875,000 comprising 875,000 issued cumulative preference shares and a market capitalisation of approximately S$1,011.1 million.

The directors of UE are Mr Tan Ngiap Joo, Mr Jackson Chevalier Yap Kit Siong, Mr Chew

Leng Seng, Mr Norman Ip Ka Cheung, Mr Koh Poh Tiong, Dr Michael Lim Chun Leng, Dr Tan

Eng Liang and Mr David Wong Cheong Fook.

6.

INFORMATION ON THE COMPANY

The Company is a leading multinational conglomerate incorporated in Singapore and listed on the Main Board of the SGX-ST. The principal activities of the Company are that of an investment holding company and the provision of management services to related companies. The WBL group’s key business areas include the following:

(a) Automotive.

Leading automotive dealer and distributor in the region. Represents 11 luxury car brands in Singapore, Malaysia, The People’s Republic of China (“ PRC ”),

Hong Kong, Indonesia and Thailand;

(b)

(c)

Property.

Well-established property development business in the PRC through property division, Huaxin International. Existing property projects are largely strategically located in Chengdu, Chongqing, Suzhou, Shanghai and Shenyang;

Technology.

Comprises mainly 2 key subsidiaries in the flexible printed circuit sector: NASDAQ-listed Multi-Fineline Electronix Inc. (57% effective interest), and

SGX-ST-listed MFS Technology Ltd (77% stake). Both are major players in the flexible printed circuit industry and are major suppliers of integrated flexible printed circuits and assembly solutions for mobile phones and tablets; and

(d) Engineering and Distribution.

Portfolio of businesses includes silica mining, supplying construction materials, automotive parts distribution, equipment distribution,

LPG distribution, engineering services and systems integration services.

Based on a search conducted at the Accounting and Corporate Regulatory Authority of

Singapore on 29 January 2013, the Company has an issued and paid-up share capital of approximately S$477,643,856 comprising 271,618,457 issued WBL Stock Units.

Based on the unaudited consolidated financial statements of the Company and its subsidiaries for the financial year ended 30 September 2012 as announced by the Company on 14 November 2012, there were outstanding Convertible Bonds which, if converted, would give rise to 10,440,035 WBL Stock Units. Assuming the full conversion of such outstanding

8

Convertible Bonds, the enlarged total number of WBL Stock Units would be 281,342,021.

The directors of the Company are Mr Norman Ip Ka Cheung, Mr Benjamin C. Duster, IV, Dr

Peter Eng Hsi Ko, Mr Mark C. Greaves, Mr Lai Teck Poh and Mr Kyle Lee Khai Fatt. Mr

Norman Ip Ka Cheung is also a director of UE.

7.

RATIONALE FOR THE OFFERS AND THE OFFEROR’S INTENTIONS

UE and the Offeror believe that the Offers would enable the UE Group to:

(a) expand and diversify the UE Group’s development property portfolio and to a lesser extent, its investment property portfolio by acquiring an interest in an attractive mix of properties under development;

(b)

(c)

(d)

(e) gain exposure to long-term growth opportunities in the property market of PRC; harness synergies, particularly between properties, construction and engineering, which should strengthen the UE Group’s presence across the infrastructure value chain; acquire an interest in the Company’s automotive business which can be another potential engine of growth for the UE Group as well as an additional source of recurring income; and explore opportunities to enhance value across the Company’s diverse portfolio of businesses.

If the Offeror succeeds in the Offers, it plans to participate in a review of the Company’s businesses together with the Company’s board of directors and management with a view to ascertaining the viability of the above rationale before actual implementation.

Stockholders and Bondholders are advised to refer to the investor presentation dated 30

January 2013 released by UE in relation to the Offers (the “ Investor Presentation ”) for further information. A copy of the Investor Presentation is available on www.sgx.com

.

8.

8.1

COMPULSORY ACQUISITION AND LISTING STATUS

Compulsory Acquisition

Pursuant to Section 215(1) of the Companies Act, Chapter 50 of Singapore (the “ Companies

Act ”), if the Offeror receives valid acceptances pursuant to the Stock Unit Offer (or otherwise acquires WBL Stock Units during the period when the Stock Unit Offer is open for acceptance) in respect of not less than 90% of the total number of issued WBL Stock Units

(other than those already held by the Offeror, its related corporations or their respective nominees as at the date of the Stock Unit Offer and excluding any WBL Stock Units held in treasury), the Offeror would have the right to compulsorily acquire all the WBL Stock Units of

Stockholders who have not accepted the Stock Unit Offer (the “ Dissenting Stockholders ”), at a price equal to the Stock Unit Offer Price.

9

8.2

Dissenting Stockholders have the right under and subject to Section 215(3) of the Companies

Act, to require the Offeror to acquire their WBL Stock Units in the event that the Offeror or its nominees acquire, pursuant to the Stock Unit Offer, such number of WBL Stock Units which, together with the WBL Stock Units held by the Offeror, its related corporations or their respective nominees, comprise 90% or more of the total number of issued WBL Stock Units

(excluding WBL Stock Units held in treasury). Dissenting Stockholders who wish to exercise such right are advised to seek their own independent legal advice.

Under the Concert Party Group Confirmations (as defined in Section 10.4 below), the Concert

Party Group has confirmed that they will not sell, during the period of the Offers, any of their

WBL Stock Units amounting to approximately 38.29% of the total number of issued WBL

Stock Units, whether pursuant to the Offers or otherwise. As the Concert Party Group will not accept the Stock Unit Offer in respect of their WBL Stock Units, it is envisaged that the

Offeror would not become entitled to exercise the right of compulsory acquisition under

Section 215(1) of the Companies Act pursuant to acceptances of the Stock Unit Offer. In relation to Section 215(3) of the Companies Act, Dissenting Stockholders are advised to seek their own independent legal advice.

Listing Status

Pursuant to Rule 1105 of the Listing Manual, upon an announcement by the Offeror that acceptances have been received pursuant to the Stock Unit Offer that bring the holdings owned by the Offeror and parties acting in concert with it to above 90% of the total number of issued WBL Stock Units (excluding WBL Stock Units held in treasury), the SGX-ST may suspend the trading of the WBL Stock Units and the Convertible Bonds on the SGX-ST until such time it is satisfied that at least 10% of the total number of issued WBL Stock Units

(excluding WBL Stock Units held in treasury) are held by at least 500 Stockholders who are members of the public. Rule 1303(1) of the Listing Manual provides that if the Offeror succeeds in garnering acceptances exceeding 90% of the total number of issued WBL Stock

Units (excluding WBL Stock Units held in treasury), thus causing the percentage of the total number of issued WBL Stock Units (excluding WBL Stock Units held in treasury) held in public hands to fall below 10%, the SGX-ST will suspend trading of the WBL Stock Units and the Convertible Bonds at the close of the Stock Unit Offer.

In addition, under Rule 724 of the Listing Manual, if the percentage of the total number of issued WBL Stock Units (excluding WBL Stock Units held in treasury) held in public hands falls below 10%, the Company must, as soon as practicable, announce that fact and the SGX-

ST may suspend the trading of all the WBL Stock Units and the Convertible Bonds. Rule 725 of the Listing Manual states that the SGX-ST may allow the Company a period of three months, or such longer period as the SGX-ST may agree, to raise the percentage of WBL

Stock Units (excluding WBL Stock Units held in treasury) in public hands to at least 10%, failing which the Company may be delisted from the SGX-ST.

It is not the intention of the Offeror to preserve the listing status of the Company.

In the event that the trading of WBL Stock Units and the Convertible Bonds on the SGX-ST is suspended pursuant to Rule 724 or Rule 1105 of the Listing Manual, the Offeror has no intention to undertake or support any action for any such listing suspension by the SGX-ST to be lifted.

10

9.

FINANCIAL ASPECTS OF THE STOCK UNIT OFFER

The Stock Unit Offer Price of S$4.00 for each Offer Stock Unit represents:

(a) a premium of approximately 19.0% over the adjusted cash offer price of S$3.36 for each WBL Stock Unit extended under the mandatory conditional offer by Standard

Chartered Bank for and on behalf of The Straits Trading Company Limited (“ STC ”) to acquire all the issued WBL Stock Units other than those already owned, controlled or agreed to be acquired by STC and parties acting in concert with it (the “ STC Offer ”), after adjusting for the FY2012 Dividend as stated in the announcement of the STC

Offer dated 16 January 2013;

(b) a premium of approximately 14.0% over S$3.51, being the last transacted price of the

WBL Stock Units on the SGX-ST on 23 November 2012, being the last full market day preceding the date of announcement of the STC Offer on which the WBL Stock Units were traded on the SGX-ST (the “ Unaffected Date ”);

(c)

(d) a premium of approximately 13.3% over S$3.53, being the volume weighted average price (“ VWAP ”) of the WBL Stock Units on the SGX-ST over the one-month period prior to and including the Unaffected Date; a premium of approximately 12.0% over S$3.57, being the VWAP of the WBL Stock

Units on the SGX-ST over the three-month period prior to and including the

Unaffected Date;

(e) a premium of approximately 14.9% over S$3.48, being the VWAP of the WBL Stock

Units on the SGX-ST over the six-month period prior to and including the Unaffected

Date; and

(f) a premium of approximately 22.0% over S$3.28, being the VWAP of the WBL Stock

Units on the SGX-ST over the 12-month period prior to and including the Unaffected

Date.

Note:

The figures set out above in relation to the last transacted price of the WBL Stock Units on the Unaffected

Date and the VWAP of the WBL Stock Units are based on data extracted from Bloomberg LLP.

10.

DISCLOSURES OF STOCKHOLDINGS AND DEALINGS

10.1

Holdings and Dealings

The Appendix to this Announcement sets out, based on the latest information available to the

Offeror:

(a) the number of Relevant Securities (as defined in Section 10.2(a) below) owned, controlled or agreed to be acquired by:

(i) the Offeror and its directors;

11

(ii)

(iii)

(iv)

UE and its directors; the wholly-owned subsidiaries of UE; certain persons presumed to be acting in concert with the Offeror, namely:

(1)

(2)

(3)

Oversea-Chinese Banking Corporation Limited (“ OCBC ”) and its wholly-owned subsidiaries (the “ OCBC Group ”);

Great Eastern Holdings Limited (“ GEH ”) and its wholly-owned subsidiaries (the “ GEH Group ”); and the Lee Family

3

, the Lee Family Companies

4 and certain directors and shareholders of the Lee Family Companies (collectively, the “ Lee

Group ”); and

(v) J.P. Morgan,

(collectively, the “ Relevant Persons ”) as at 29 January 2013; and

(b) the dealings in the Relevant Securities by the Relevant Persons from 30 October

2012 (being three months immediately preceding the date of this Announcement) to the date of this Announcement (the “ Reference Period ”).

10.2

No Other Holdings and Dealings

Save as disclosed in this Announcement, as at 29 January 2013 and based on the latest information available to the Offeror, none of the Relevant Persons:

(a) owns, controls or has agreed to acquire any (i) WBL Stock Units, (ii) Convertible

Bonds, (ii) securities which carry voting rights in the Company, or (iii) convertible securities, warrants, options (including Options) or derivatives in respect of the WBL

Stock Units or securities which carry voting rights in the Company (collectively, the

“ Relevant Securities ”); and

(b) has dealt for value in any Relevant Securities during the Reference Period.

10.3

Other Arrangements

Save as disclosed in this Announcement, as at 29 January 2013 and based on the latest information available to the Offeror, none of the Relevant Persons has:

3

4

For the purposes of this Announcement, “ Lee Family ” means Messrs Lee Seng Gee, Lee Seng Tee and Lee Seng

Wee and their immediate family members.

For the purposes of this Announcement, “ Lee Family Companies ” means Island Investment Company (Private)

Limited, Kota Trading Co. Sdn Bhd, Lee Foundation, Lee Foundation States of Malaya, Lee Latex (Pte) Limited,

Lee Plantations (Pte) Ltd, Lee Rubber Company (Pte) Limited, Selat (Pte) Limited, Singapore Investments (Pte)

Limited and Tropical Produce Company (Pte) Ltd, being companies in which the Lee Family has direct and indirect interests and which hold WBL Stock Units and/or stock units in UE.

12

(a) (i) granted any security interest relating to any Relevant Securities to another person, whether through a charge, pledge or otherwise, (ii) borrowed any Relevant Securities from another person (excluding borrowed securities which have been on-lent or sold), or (iii) lent any Relevant Securities to another person; and received any irrevocable undertaking from any party to accept or reject the Offers.

(b)

10.4

Confirmations of the Concert Party Group

Confirmations have been obtained from the OCBC Group, the GEH Group, the Lee Group and Mr Wong Hein Jee (who is a director of the Offeror) (collectively, the “ Concert Party

Group ”) who collectively own or control an aggregate of (i) approximately 38.29% of the total number of issued WBL Stock Units; and (ii) S$12,804,133 in principal amount of Convertible

Bonds which are convertible into WBL Stock Units representing approximately 1.99% of the enlarged total number of WBL Stock Units, inter alia , that they will not be selling during the period of the Offers any of their Relevant Securities whether pursuant to the Offers or otherwise (the “ Concert Party Group Confirmations ”). The Concert Party Group collectively owns or controls in aggregate approximately 34.70% of the total number of issued ordinary stock units in the capital of UE and are presumed to be acting in concert with the Offeror under the Code. For the purposes of this Announcement, references to “parties acting in concert” with the Offeror shall include certain persons presumed to be acting in concert with the Offeror in accordance with the Code.

10.5

Further Enquiries

In the interests of confidentiality, the Offeror has not made enquiries in respect of certain other parties who are or may be presumed to be acting in concert with the Offeror in connection with the Offers (if and when made). Similarly, J.P. Morgan has not made enquiries in respect of certain parties who are or may be presumed to be acting in concert with J.P.

Morgan in connection with the Offers (if and when made). Further enquiries will be made of such persons and the relevant disclosures will be made in due course and in the Offer

Document.

11.

OFFER DOCUMENT

If and when the Offers are made, the Offer Document enclosing the relevant form(s) of acceptance will be despatched to Stockholders and Bondholders not earlier than 14 days and not later than 21 days from the date of the Formal Offer Announcement, if any.

Stockholders and Bondholders are advised to exercise caution when dealing in the WBL Stock Units and the Convertible Bonds.

12.

OVERSEAS STOCKHOLDERS AND OVERSEAS BONDHOLDERS

12.1

Overseas Jurisdictions

This Announcement does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any security, nor is it a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of the securities referred to in this

13

Announcement in any jurisdiction in contravention of applicable law. The Offers, if and when made, will be made solely by the Offer Document and the relevant form(s) of acceptance accompanying the Offer Document, which will contain the full terms and conditions of the

Offers, including details of how the Offers may be accepted.

The release, publication or distribution of this Announcement in certain jurisdictions may be restricted by law and therefore persons in any such jurisdictions into which this

Announcement is released, published or distributed should inform themselves about and observe such restrictions.

Copies of this Announcement and any formal documentation relating to the Offers are not being, and must not be, directly or indirectly, mailed or otherwise forwarded, distributed or sent in or into or from any jurisdiction where the making of or the acceptance of the Offers would violate the law of that jurisdiction (“ Restricted Jurisdiction ”) and will not be capable of acceptance by any such use, instrumentality or facility within any Restricted Jurisdiction and persons receiving such documents (including custodians, nominees and trustees) must not mail or otherwise forward, distribute or send them in or into or from any Restricted

Jurisdiction.

The Offers (unless otherwise determined by the Offeror and permitted by applicable law and regulation) will not be made, directly or indirectly, in or into, or by the use of mails of, or by any means or instrumentality (including, without limitation, telephonically or electronically) of interstate or foreign commerce of, or any facility of a national, state or other securities exchange of, any Restricted Jurisdiction and the Offers will not be capable of acceptance by any such use, means, instrumentality or facilities.

12.2

Overseas Stockholders and Overseas Bondholders

The availability of the Stock Unit Offer and the Convertible Bonds Offer, if and when made, to

Stockholders or, as the case may be, Bondholders whose addresses are outside Singapore as shown in the register of members of the Company, the register of Bondholders of the

Company or in the records of The Central Depository (Pte) Limited (as the case may be)

(each, an “ Overseas Stockholder ” or “ Overseas Bondholder ”, as the case may be) may be affected by the laws of the relevant overseas jurisdictions in which they are located.

Accordingly, Overseas Stockholders and Overseas Bondholders should inform themselves of, and observe, any applicable requirements.

For the avoidance of doubt, the Stock Unit Offer and the Convertible Bonds Offer, if and when made, will be open to all Stockholders holding Offer Stock Units or, as the case may be, all

Bondholders, including those to whom the Offer Document and the relevant form(s) of acceptance may not be sent. Further details in relation to Overseas Stockholders and

Overseas Bondholders will be contained in the Offer Document.

12.3

Copies of Offer Document

Where there are potential restrictions on sending the Offer Document and the relevant form(s) of acceptance accompanying the Offer Document to any overseas jurisdictions, the Offeror and J.P. Morgan each reserves the right not to send these documents to Overseas

Stockholders and Overseas Bondholders in such overseas jurisdictions. Subject to compliance with applicable laws, any affected Overseas Stockholder or Overseas Bondholder

14

may, nonetheless, attend in person and obtain a copy of the Offer Document and the relevant form(s) of acceptance from the office of the Company’s share registrar, Tricor Barbinder

Share Registration Services at 80 Robinson Road #02-00, Singapore 068898. Alternatively, an Overseas Stockholder or Overseas Bondholder may, subject to compliance with applicable laws, write to the Company’s share registrar at the above-stated address to request for the

Offer Document and the relevant form(s) of acceptance to be sent to an address in Singapore by ordinary post at his own risk.

13.

RESPONSIBILITY STATEMENT

The directors of the Offeror and the directors of UE (including those who may have delegated detailed supervision of this Announcement) have taken all reasonable care to ensure that the facts stated and all opinions expressed in this Announcement are fair and accurate and that no material facts have been omitted from this Announcement, and they jointly and severally accept responsibility accordingly.

Where any information has been extracted or reproduced from published or otherwise publicly available sources (including, without limitation, information relating to the Company and STC), the sole responsibility of the directors of the Offeror and the directors of UE has been to ensure, through reasonable enquiries, that such information is accurately and correctly extracted from such sources or, as the case may be, accurately reflected or reproduced in this Announcement.

Issued by

J.P. MORGAN (S.E.A.) LIMITED

For and on behalf of

UE CENTENNIAL VENTURE PTE. LTD.

30 January 2013

IMPORTANT NOTICE

This Announcement should be read in conjunction with the Investor Presentation, a copy of which is available on www.sgx.com.

All statements other than statements of historical facts included in this Announcement are or may be forwardlooking statements. Forward-looking statements include but are not limited to those using words such as

“expect”, “anticipate”, “believe”, “intend”, “project”, “plan”, “strategy”, “forecast” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “may” and “might”. These statements reflect the

Offeror’s and/or UE’s current expectations, beliefs, hopes, intentions or strategies regarding the future and assumptions in light of currently available information. Such forward-looking statements are not guarantees of future performance or events and involve known and unknown risks and uncertainties. Accordingly, actual results or outcomes may differ materially from those described in such forward-looking statements. Stockholders and investors should not place undue reliance on such forward-looking statements, and none of the Offeror, UE or

J.P. Morgan undertakes any obligation to update publicly or revise any forward-looking statements, subject to compliance with all applicable laws and regulations and/or rules of the SGX-ST and/or any other regulatory or supervisory body or agency.

15

APPENDIX

DISCLOSURE OF HOLDINGS AND DEALINGS IN THE RELEVANT SECURITIES

1.

1.1

1.2

1.3

HOLDINGS IN THE RELEVANT SECURITIES HELD BY THE RELEVANT PERSONS AS

AT 29 JANUARY 2013

The Offeror, UE and UE’s wholly-owned subsidiaries

As at 29 January 2013, the Offeror, UE and UE’s wholly-owned subsidiaries do not own or control any Relevant Securities.

Directors of the Offeror

Save as disclosed below, none of the directors of the Offeror own or control any Relevant

Securities as at 29 January 2013:

(a) WBL Stock Units

Name

Wong Hein Jee

Total

No. of WBL Stock Units

133,000

133,000

%

0.05

0.05

(b) Convertible Bonds

Name

Wong Hein Jee

Total

Principal amount of

Convertible Bonds (S$)

22,099

22,099

Directors of UE

Saved as disclosed below, none of the directors of UE own or control any Relevant Securities as at 29 January 2013:

WBL Stock Units

Name

Norman Ip Ka Cheung

Total

No. of WBL Stock Units

14,655

14,655

% n.m.

5 n.m.

5 “n.m.” means not meaningful.

16

1.4

The OCBC Group, the GEH Group and the Lee Group

The holdings of the OCBC Group, the GEH Group and the Lee Group in the Relevant

Securities as at 29 January 2013 are set out as follows:

(a) WBL Stock Units

Name

OCBC Group

Oversea-Chinese Banking

Corporation Limited

Orient Holdings Private Limited

Sub-Total

No. of WBL Stock Units

15,859,237

2,195,025

18,054,262

%

5.84

0.81

6.65

GEH Group

The Great Eastern Life Assurance

Company Limited

The Great Eastern Trust Private

Limited

The Overseas Assurance

Corporation Ltd

Sub-Total

40,201,284

3,214,359

5,823,368

49,239,011

14.80

1.18

2.14

18.13

6

Lee Family

Lee Seng Wee

7

Lee Yuen Shih

Lee Tih Shih

Sub-Total

Lee Family Companies

Island Investment Company (Private)

Limited

Kota Trading Co. Sdn Bhd

Lee Foundation

Lee Foundation States of Malaya

Lee Plantations (Pte) Ltd

Selat (Pte) Limited

Singapore Investments (Pte) Limited

Tropical Produce Company (Pte) Ltd

Sub-Total

1,548,723

1,260

1,000,000

2,549,983

105,377

256,845

2,172,287

11,386,618

136,990

1,943,405

1,002,857

1,612,011

18,616,390

0.57

n.m.

0.37

0.94

0.04

0.09

0.80

4.19

0.05

0.72

0.37

0.59

6.85

6

7

In this Announcement, any discrepancies between the amounts listed and the totals shown thereof are due to rounding. Accordingly, figures shown as totals in this Announcement may not be an arithmetic aggregation of the figures that precede them.

Includes 401,126 WBL Stock Units held by his spouse.

17

(b)

Name

Certain directors and shareholders of the Lee Family Companies

(excluding members of the Lee

Family and the Lee Family

Companies which could be corporate shareholders, whose holdings have been disclosed above)

Hoe Mei Ling Susan

Hoe Su Ling Anne

8

Hoe Wei Ming John

9

Hoe Wei Yen David

Lee Seok Chee

Eng Hsi Ko Peter, Lee Seok Chee and Eng Siu-Lan Sybil (held under

HL Bank Nominees)

Eng Siu Sien Lisa

10

Eng Siu Lan Sibyl

11

Eng Hsi Ko Peter

12

Huang Thiay Sherng

Chong Kwok Kian

Tan Khiam Hock

Teo Kim Yam

Fong Soon Yong

Sub-Total

No. of WBL Stock Units

2,700

3,600

4,500

2,700

5,057,500

3,772,925

373,468

4,884,414

924,396

109,003

27,802

5,746

33,233

202,000

15,403,987

Total 103,863,633

Convertible Bonds

Name

GEH Group

The Great Eastern Life Assurance

Company Limited

The Great Eastern Trust Private

Limited

The Overseas Assurance

Corporation Ltd

Sub-Total

Principal amount of

Convertible Bonds (S$)

8,770,573

701,268

1,270,468

10,742,309

%

0.14

1.80

0.34

0.04

0.01

n.m

0.01

0.07

5.67

38.24

n.m.

n.m.

n.m.

n.m.

1.86

1.39

8

9

10

11

12

Includes 900 WBL Stock Units held on trust for her child.

Includes 1,800 WBL Stock Units held by his children.

Includes 5,000 WBL Stock Units held by her spouse.

Includes 129,659 WBL Stock Units held under a joint account with her spouse and 164,534 WBL Stock Units held by her spouse.

Includes 45,135 WBL Stock Units held by his spouse.

18

Name

Lee Family

Lee Tih Shih

Lee Seok Chee

Eng Siu Sien Lisa

13

Hoe Wei Ming John

14

Hoe Wei Yen David

Hoe Su Ling Anne

15

Hoe Mei Ling Susan

Sub-Total

Principal amount of

Convertible Bonds (S$)

1,750,000

120,750

158,850

3,375

2,025

2,700

2,025

2,039,725

1.5

Total 12,782,034

J.P. Morgan

As at 29 January 2013, J.P. Morgan does not own or control any Relevant Securities.

2.

2.1

2.2

2.3

2.4

DEALINGS IN THE RELEVANT SECURITIES DURING THE REFERENCE PERIOD BY

THE RELEVANT PERSONS

The Offeror, UE and UE’s wholly-owned subsidiaries

The Offeror, UE and UE’s wholly-owned subsidiaries have not dealt for value in the Relevant

Securities during the Reference Period.

Directors of the Offeror

None of the directors of the Offeror have dealt for value in the Relevant Securities during the

Reference Period.

Directors of UE

None of the directors of UE have dealt for value in the Relevant Securities during the

Reference Period.

The OCBC Group, the GEH Group and the Lee Group

Save for the conversion of the Convertible Bonds by the following persons as set out below, the OCBC Group, the GEH Group and the Lee Group have not dealt for value in the Relevant

Securities during the Reference Period.

13

14

15

Includes S$9,000 in principal amount of the Convertible Bonds held by her spouse.

Includes S$1,350 in principal amount of the Convertible Bonds held by his children.

Includes S$675 in principal amount of the Convertible Bonds held on trust for her child.

19

Name Date of conversion

Eng Siu Lan Sibyl

Eng Hsi Ko Peter

14 December 2012

14 December 2012

Khoo

Christine

Yiok Bin 14 December 2012

Principal amount of

Convertible

Bonds (S$)

Conversion price (S$)

150,044

149,850

25,500

2.29

2.29

2.29

Number of

WBL Stock

Units acquired

65,521

65,436

11,135

2.5

J.P. Morgan

J.P. Morgan has not dealt for value in the Relevant Securities during the Reference Period.

20