Net Interest Margin Securities

advertisement

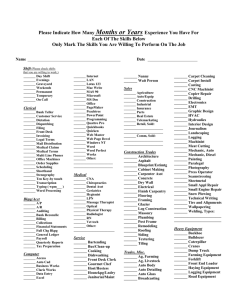

Methodology Dominion Bond Rating Service DBRS Rating Criteria - U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) DECEMBER 2005 MARC DALY SHARON MCGARVEY, CFA, CPA DBRS Rating Criteria – U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) EXECUTIVE SUMMARY This methodology describes DBRS’s approach to rating auto NIMs (“Net Interest Margin Securities”). Auto NIMs are certificated securities where the holder has a claim on the transaction’s residual cash flow. NIM technology first emerged in the public mortgage market in 1987. After substantial growth in issuance, NIMs are now an established sub-sector of the mortgage market. Like mortgage NIMs, auto NIMs involve securitizing the net interest proceeds (also known as excess spread) or residual cash flow that remains in a transaction after: (1) paying interest on the underlying ABS securities; (2) paying the trustee, servicer, and other expenses; and (3) absorbing collateral losses. Similar to mortgage NIMs, auto NIMs enable issuers to monetize residual cash flow upfront. As with other auto ABS transactions, the key assumptions that impact a NIM rating are: (1) the credit quality of the collateral pool and the corresponding expected loss levels, (2) the timing of expected losses, (3) prepayment speeds, and (4) interest rate stress scenarios. OVERVIEW OF AUTO NIMS What is a NIM? A NIM is essentially an Interest Only (“IO”) strip, with its cash flow derived from a transaction’s net interest proceeds. A NIM principal balance is created by discounting the net interest proceeds, or excess spread, at a risk-adjusted rate. In structuring a NIM, stressed residual cash flows are recharacterized into components that pay both principal and interest to the NIM holder. Structural Nuances of Auto NIMs In many mortgage NIM transactions, the issuer posts the required collateral upfront; therefore, the targeted overcollateralization (“OC”) for the transaction is fully funded at deal inception. This feature reduces structural risk: excess spread from the mortgage collateral is immediately available to amortize the NIM and need not be re-directed to build OC. Typically, auto ABS transactions are structured such that excess spread is used to absorb pool losses and to build OC (or reserve accounts) to their required levels before it can be released to the transaction’s residual or NIM holder. As excess spread may not be immediately available to amortize an auto NIM, DBRS may request that auto issuers: • Include an interest reserve fund account: For transactions where the OC is not funded upfront, DBRS, under certain circumstances, may require a reserve account. The purpose of the reserve fund is to provide greater assurance of timely principal and interest payments to the NIM holder. • Limit the maturity of the NIM: DBRS may require that the NIM maturity be limited to a certain time frame. This would enable the NIM holder to receive a majority of its cash flow sooner, before the transaction has hit its peak loss period. Auto • Adjust the size of the NIM balance: DBRS may determine that under certain circumstances a reduction in the size of the proposed NIM balance may be warranted. What Motivates NIM Issuers and Investors? The auto ABS sector can be broken into two core subsectors: prime and subprime. The prime sector consists of high-quality receivables, originated primarily by the auto captive finance companies. Historically, credit losses have been low on prime pools; therefore, these loans command lower coupons. In prime ABS transactions, subordination serves as the primary source of credit enhancement. Although excess spread levels are lower in these transactions, prime issuers can still benefit from issuing NIMs. NIMs enable issuers to monetize residual cash flows upfront which can generate additional liquidity for their balance sheets. Collateral in the subprime sector is originated primarily by specialty finance companies and regional banks. Given the higher loss levels and lower borrower credit quality associated with subprime loans, these loans have higher coupons than their prime counterparts. Therefore, auto loan transactions collateralized by subprime pools typically have higher levels of excess spread than transactions collateralized by prime loans. In fact, excess spread comprises a relatively larger component of credit enhancement for subprime transactions than for prime transactions. Consequently, NIMs may lend themselves more easily to the subprime sector. Within the mortgage market, subprime NIM transactions are more commonplace than prime NIM transactions. DOMINION BOND RATING SERVICE Information comes from sources believed to be reliable, but we cannot guarantee that it, or opinions in this Methodology, are complete or accurate. This Methodology is not to be construed as an offering of any securities, and it may not be reproduced without our consent. DBRS Rating Criteria – U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) - Page 2 RATING CRITERIA COMPONENTS – NIMS I. COLLATERAL POOL LOSS EXPECTATION As with all auto ABS transactions, establishing an expected net loss valuation for the loan collateral pool is crucial in determining both credit enhancement and bond ratings. Since an auto NIM is simply a securitization of a residual cash flow from an auto loan pool, it is subject to the same base case collateral loss assumption used to rate the other, more senior tranches in the securitization. Stress factors are then applied to the base case loss assumption based on the desired rating for the NIM. The key factors impacting expected losses on auto loan collateral pools are summarized below, while Appendix A provides further details on how these factors are analyzed and assessed within the DBRS ratings process. Borrower characteristics: Specific borrower characteristics, such as credit score and debt-to-income ratios, directly correlate to loan default frequency. Borrowers with lower credit scores tend to default at higher rates. DBRS uses a granular approach to determine default frequencies based on borrower characteristics. Loss severities: Auto vehicle recoveries are directly correlated to used-vehicle supply and demand dynamics. In a weaker economy, demand for new cars tends to decline, which supports used-vehicle prices except in a severe economic downturn. Conversely, as the economy strengthens, demand for used vehicles decreases, weakening vehicle recovery values. Additionally, manufacturer incentive programs can impact the supply of used vehicles to the marketplace. New-vehicle incentive programs that cause excessive trade-ins can result in an oversupply of used vehicles. The effect of this used-vehicle market disequilibrium is lower used-vehicle recovery values and, therefore, higher loan loss severities. Loan characteristics: Specific loan characteristics, such as loan seasoning, loan-to-value ratio (“LTV”), and loan term affect both default frequency and loss severity. Highly seasoned loans tend to have a lower default risk than newly originated loans. Higher LTVs correlate with both higher default risk (greater borrower leverage) and higher loss severity, particularly when higher LTV loans are longer term (greater than 60 months). This higher loss severity occurs because principal amortization is “stretched” out farther on a longer term loan. Since an auto is a depreciating asset, this exacerbates the time that it takes for a borrower to build an “equity” position (current value of the vehicle less the loan balance) in the vehicle. Originator underwriting: Poor and inconsistent underwriting standards cause a higher frequency of defaults. Firms that have decentralized underwriting procedures require a more careful analysis to ensure adherence to firm underwriting guidelines. Servicer quality: The ability of the servicer to minimize loan defaults and delinquencies while maximizing collateral liquidation values is crucial to a pool’s loss performance. Servicers must possess adequate financial resources to remain current with technology and to maintain strong operational practices. While servicers who have experienced financial difficulty in the industry are a limited set, collateral deterioration has often been accompanied by servicer difficulties. Historical analysis: To assist in projecting expected cumulative losses, DBRS reviews static pool loss data from an originator’s portfolio. Static pool data best reflects an originator’s net loss performance, since the use of portfolio data will dilute loss ratios during periods of rapid portfolio growth. DBRS looks for a minimum of three to five years of historic data. More extensive historical data allows DBRS to better assess collateral trends and performance. DBRS Rating Criteria – U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) - Page 3 II. LOSS TIMING CURVE As a residual cash flow or first loss piece, an auto NIM’s performance will be highly sensitive to the timing of actual collateral losses. To the extent that collateral losses occur early in the life of a transaction (more front-loaded), excess spread will be used to offset losses before any payments are made to the NIM holder. Therefore, high upfront losses in a transaction will adversely impact NIM cash flows. Conversely, if losses occur later in a transaction’s life, auto NIM cash flows are less impacted because: (1) OC or reserve accounts typically funded from excess spread may have reached their required amounts, providing more credit support to the NIM holder, and (2) a NIM’s expected average life is much shorter than the average life of the collateral pool. In order to address the risk that losses may occur more rapidly in the early stages of a transaction’s life, DBRS uses a stressed, front-loaded loss timing curve. DBRS created a conservative, loss timing base curve using historical data on various issuers. The analysis reviewed the actual timing of issuers’ portfolio losses over several vintages as well as credit tiers, from prime to subprime. DBRS’s loss curve is presented in Exhibit I below and reflects the following key features: • • • The loss curve spans four years, Losses are concentrated between months 12 and 24, and Losses are front-loaded, peaking just after the end of the first year. Exhibit I Loss Timing Curve 4.0000% 3.5000% Period % of Loss 3.0000% 2.5000% 2.0000% 1.5000% 1.0000% 0.5000% 0.0000% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 Months from Origination DBRS will use this loss-timing curve as the base reference curve for all auto loan transaction, including NIMs. As with other transactions, DBRS will determine whether adjustments to the curve may be necessary to properly reflect an issuer’s pool characteristics and loss timing patterns. DBRS Rating Criteria – U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) - Page 4 III. PREPAYMENTS Prepayments (“prepays”) occur when loans are paid off before their scheduled maturities. Prepayments are either voluntary or involuntary—occurring when a borrower defaults and the vehicle is liquidated, with proceeds remitted to the transaction. Prepayment speed measures the rate at which prepayments occur within auto ABS transactions. In an auto securitization, prepayments reduce the dollar amount of excess cash flow available to a residual or a NIM holder. Thus, if prepays occur at a higher rate than expected, payments to a NIM holder may be impaired. Relative to the mortgage sector, prepayment speeds in the auto sector are less volatile. Voluntary prepays are generally independent of interest rate movements as most borrowers do not refinance their auto loans. Prepay speeds may slow during a weak economy as borrowers defer their purchase of new vehicles. However, prepay speeds may increase as a loan ages, due to a rise in a borrower’s equity in a vehicle or in response to aggressive manufacturer incentive programs. DBRS uses a base case auto prepayment curve for all auto transactions, including NIMs. From this base case curve, DBRS then applies stressed payment vectors based on tranche rating. DBRS developed its base curve by reviewing voluntary prepayment performance over the past five years from issuers’ portfolios—from prime through subprime. To be conservative, DBRS stressed the base case voluntary prepayment vector to ensure that auto transactions, including NIMs, can withstand faster than historical speeds. The base case, BBB, and AAA prepay curves are indicated below in Exhibit II. DBRS will determine whether additional adjustments to the curve may be necessary to properly reflect an issuer’s specific prepay performance. Exhibit II Prepayment Vectors 1.95% Voluntary ABS Speed 1.85% 1.75% 1.65% 1.55% 1.45% 1.35% 1.25% AAA Vector 1.15% BBB Vector 1.05% Base Vector 0.95% 0.85% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 Period IV. INTEREST RATE RISK Auto ABS transactions are typically “naturally” hedged as both the collateral and bonds are generally fixed-rate. However, occasionally, auto ABS transactions include the issuance of a floating rate tranche that is backed by fixedrate collateral, creating interest rate risk for the transaction. In a rising interest rate environment, excess spread will decrease; interest payments on the floating rate bonds will increase as interest rates rise while collateral coupons remain fixed. The reduction in excess spread from interest rate movements may adversely affect the performance of a NIM issued in connection with the transaction. Therefore, DBRS evaluates the impact of interest rate risk and basis risk mismatch on an auto transaction’s cash flow criteria similar to the analytics applied to evaluating these risks in mortgage transactions. See Appendix B for further details on the DBRS process to analyze and stress transactions for interest rate risk and basis risk mismatch. DBRS Rating Criteria – U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) - Page 5 V. OTHER Seasoned Pools The DBRS loss timing and prepayment assumptions may be adjusted based on the seasoning of the underlying collateral. To reflect the impact of seasoning on these pools, prepayments and loss timing assumptions will be modeled using points further out on these curves. That notwithstanding, DBRS assumes that the expected loss for the collateral pool will be allocated over the remaining term of the underlying transaction. Transaction Triggers As part of its analysis of an auto NIM transaction, DBRS performs its standard review of the underlying securitization, including the impact of any triggers on the re-direction of excess spread, and if it is already closed, current pool performance. As an example, DBRS reviews whether the underlying transaction relies more heavily on OC or excess spread, and whether the OC has been sufficiently eroded to pose a risk to the consistency of the excess cash flow. DBRS reviews a transaction’s payment waterfall and structural features to ensure an acceptable flow of funds to the NIM holder. Servicer Due to the leveraged nature of the NIM security as a firstloss piece, the NIM holder is more dependent upon the servicer’s performance than other investors in the transaction. As an example, the amount of loan modifications and extensions that servicers permit may reduce and delay cash flows to the transaction—if repossession is ultimately the only remedy for delinquencies. However, to the extent that loan modifications and extensions actually reduce defaults, cash flows to the transaction may be maximized by following such a servicing strategy. In order to assess the servicer’s capabilities and related impact on NIM cash flows, DBRS reviews the servicer’s collection, loss mitigation, loss severity rates, and repossession procedures, as well as the servicer’s overall efficiency and operational strength. CONCLUSION DBRS considers many factors when analyzing auto NIM securitizations. The primary rating factors are the absolute level and timing of net losses, prepayment speeds, and interest rate stresses. DBRS relies upon its existing auto securitization criteria (see Appendix A) as the basis of its rating criteria for auto NIM transactions. DBRS will continue to update this methodology as market conditions deem necessary. DBRS Rating Criteria – U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) - Page 6 APPENDIX A DBRS’s rating criteria for auto loan transactions are summarized in the following reports: “DBRS Rating Criteria for Auto Loan-Backed Transactions,” dated June 2, 2004, and “Update – U.S. Auto Loan Rating Criteria – December 2005.” These reports, when combined, constitute DBRS’s most current criteria for rating U.S. auto loan transactions and address key factors and assumptions in the rating process, including: • • • • • • Evaluation of vehicle recovery values and recovery rates used in the analysis, Determination of base case expected loss levels, Allocation of the timing of losses, Prepayment assumptions, Impact of servicing on ratings analysis, and Assessment of an issuer’s loan program, including origination guidelines. DBRS Rating Criteria U.S. Auto Asset-Backed Securities: Net Interest Margin Securities (NIMs) - Page 7 APPENDIX B DBRS evaluates the impact of interest rate mismatch risk and basis risk on an auto transaction’s cash flow using criteria similar to those applied to evaluate these risks in mortgage NIM transactions. Page two of the report, “DBRS Rating Methodology for U.S. Residential MortgageBacked Securities: Net Interest Margin Securitizations – July 2005,” discusses the process DBRS uses to evaluate interest rate mismatch risk and basis risk.