Investments worth over Rs 14000 cr lined up in auto

Investments worth over Rs 14,000 cr lined up in auto industry

Car makers plan to develop new products, diesel engine manufacturing facilities

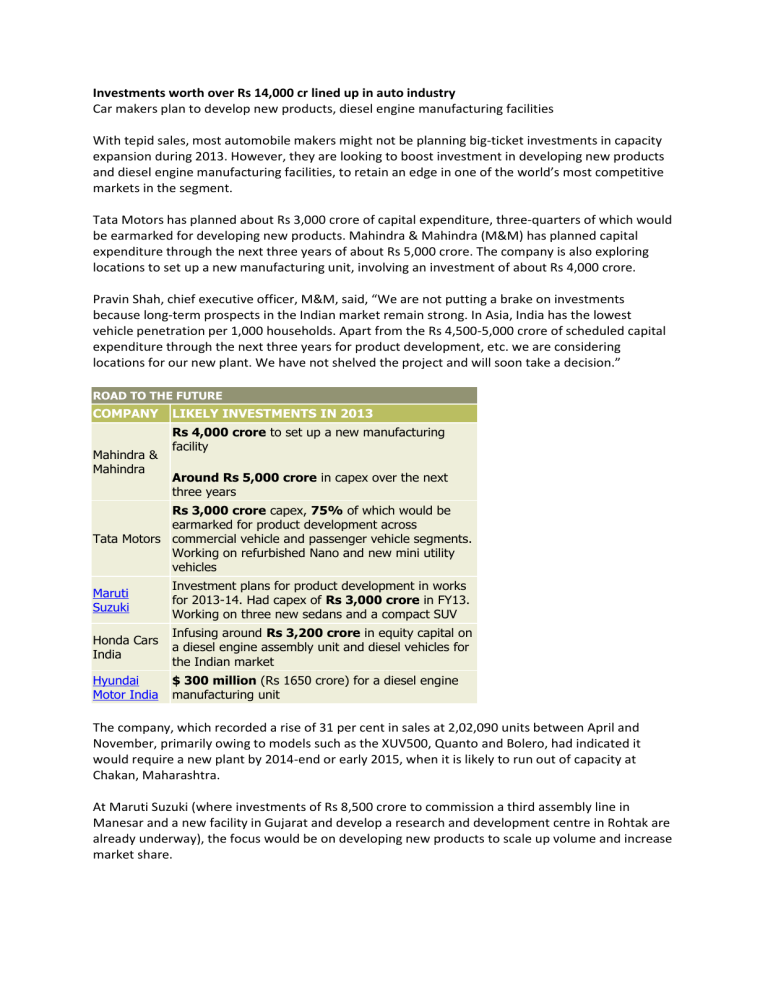

With tepid sales, most automobile makers might not be planning big-ticket investments in capacity expansion during 2013. However, they are looking to boost investment in developing new products and diesel engine manufacturing facilities, to retain an edge in one of the world’s most competitive markets in the segment.

Tata Motors has planned about Rs 3,000 crore of capital expenditure, three-quarters of which would be earmarked for developing new products. Mahindra & Mahindra (M&M) has planned capital expenditure through the next three years of about Rs 5,000 crore. The company is also exploring locations to set up a new manufacturing unit, involving an investment of about Rs 4,000 crore.

Pravin Shah, chief executive officer, M&M, said, “We are not putting a brake on investments because long-term prospects in the Indian market remain strong. In Asia, India has the lowest vehicle penetration per 1,000 households. Apart from the Rs 4,500-5,000 crore of scheduled capital expenditure through the next three years for product development, etc. we are considering locations for our new plant. We have not shelved the project and will soon take a decision.”

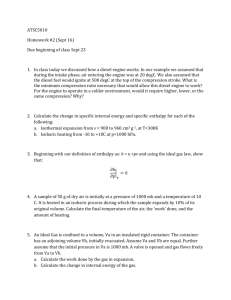

ROAD TO THE FUTURE

COMPANY LIKELY INVESTMENTS IN 2013

Rs 4,000 crore to set up a new manufacturing facility

Mahindra &

Mahindra

Around Rs 5,000 crore in capex over the next three years

Tata Motors

Rs 3,000 crore capex, 75% of which would be earmarked for product development across commercial vehicle and passenger vehicle segments.

Working on refurbished Nano and new mini utility vehicles

Maruti

Suzuki

Honda Cars

India

Hyundai

Motor India

Investment plans for product development in works for 2013-14. Had capex of Rs 3,000 crore in FY13.

Working on three new sedans and a compact SUV

Infusing around Rs 3,200 crore in equity capital on a diesel engine assembly unit and diesel vehicles for the Indian market

$ 300 million (Rs 1650 crore) for a diesel engine manufacturing unit

The company, which recorded a rise of 31 per cent in sales at 2,02,090 units between April and

November, primarily owing to models such as the XUV500, Quanto and Bolero, had indicated it would require a new plant by 2014-end or early 2015, when it is likely to run out of capacity at

Chakan, Maharashtra.

At Maruti Suzuki (where investments of Rs 8,500 crore to commission a third assembly line in

Manesar and a new facility in Gujarat and develop a research and development centre in Rohtak are already underway), the focus would be on developing new products to scale up volume and increase market share.

“Next year would not be a boom time for industry. The passenger vehicle industry is expected to grow seven per cent. There is enough capacity; most of our investments would be earmarked for the development of new products,” said R C Bhargava, chairman, Maruti Suzuki India. Though he declined to share the details of product and investment plans for next year, industry sources specified the company was working on three new sedans across the entry-level, mid-size and premium segments, as well as a compact sports utility vehicle, expected to hit the roads by 2015. For the current financial year, the company had earmarked capital expenditure of Rs 3,000 crore.

To arrest sliding sales, Tata Motors, too, has returned to the drawing board to design and develop a new line of products to increase volumes in the domestic market. Apart from a refurbished version of the Nano (a diesel version of which is expected soon), mini sport-utility vehicles are also on the cards. “Directionally, for the next four to five years, Tata Motors’ capital expenditure, on an average, would be about Rs 3,000 crore a year. Slightly more than half of this would be towards passenger vehicles. In terms of the product research and development spread, which would include new products, improvements, innovations and technologies and manufacturing capability, about 75 per cent would be towards product development,” said a spokesperson at Tata Motors.

To keep pace with the rapid demand for diesel vehicles in the domestic market, Volkswagen, Honda

Cars, Hyundai Motor and Toyota Kirloskar Motor are considering investing in diesel engine manufacturing facilities.

R Sethuraman (director, finance & corporate affairs), Hyundai Motor India Limited, said, “We have announced an investment of $300 million (about Rs 1,650 crore) in a flexible engine plant. With the addition of this plant, we will be able to manufacture both petrol and diesel engines and service the requirements for the domestic market and exports.”

Next year, Volkswagen is likely to invest about euro 40 million (Rs 280 crore) in a diesel engine unit.

Toyota would decide on a similar facility after Budget 2013-14. Shekhar Vishwanathan, vicechairman (external affairs), Toyota Kirloskar, said, “There is enough capacity available in the market.

While investments would be made in the industry for de-bottlenecking manufacturing units, increasing localisation levels and developing new products, brand new production lines of 1,00,000-

2,00,000 units are unlikely to be added. The Union budget would play a huge role as a catalyst. If some direction emerges on the pricing of diesel and petrol, it would be a positive step. Only after that can we take a decision on a diesel engine manufacturing unit.”

Though Honda Cars India declined to specify investment plans for diesel engine assembly operations, it is learnt the company is infusing about Rs 3,200 crore in equity capital to introduce small cars and diesel variants in the Indian market. Jnaneswar Sen, senior vice-president (sales and marketing), said, “Our diesel engine plant would become operational with the introduction of our first diesel product, Amaze, next year.”

Courtesy: Business Standard