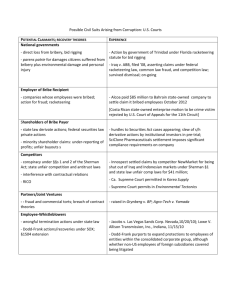

Guidelines to Prevent Bribery of Foreign Public Officials

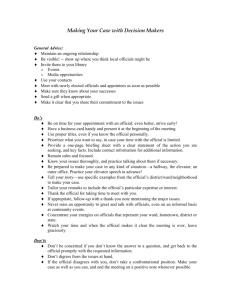

advertisement