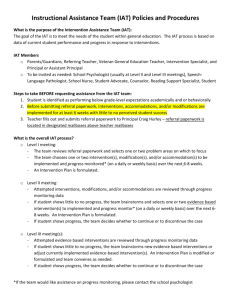

IAT Questions and Answers

advertisement

IAT Questions and Answers Who is impacted? Any customer that initiates ACH, this could also be a vendor that initiates ACH transactions on a customers behalf. How does it impact my processing? Initially, Eastern Bank will not be offering the IAT SEC code, so if you have a transaction that qualifies as an IAT according to the guidelines in this documentation, you must find an alternative method to process the payment. Some alternatives are a wire transfer or a check. How do I know if IAT applies? Review the guidelines included in this documentation, if you are unclear if a specific transaction would qualify as an IAT you can contact our Business Service team on 1-800-3338000 and we will help you make the determination. What will happen if I don’t comply? If you continue to process your payment with the existing SEC code and it meets the criteria of an IAT, there is a potential that the payment will be returned by the receiving institution and monetary fines may be assessed. What happens if I take no action? There is a potential that you may not be impacted by this change in the NACHA operating rules, however if you do not review your transactions and a payment does fall into the IAT category it could potentially be returned by the receiving financial institution and monetary fines may be assessed. What is an SEC code? SEC stands for Standard Entry Class, these are the categories that you classify your ACH transactions. The most common SEC codes are PPD, PPD+, CCD, CCD+, and CTX. IAT is simply a new SEC code. Why is NACHA changing the rules? This new rule will allow the identification of international transactions by requiring that IAT entries include specific data elements defined by the Bank Secrecy Act’s (BSA) “Travel Rule.” This will make it easier for depository financial institutions to comply with U.S. laws, such as requirements by the Office of Foreign Assets Control (OFAC). For more information on OFAC refer to www.treasury.gov/ofac or for BSA refer to www.occ.treas.gov/bsa. If after a review of all my payments I have payments that would be classified as IAT what should I do? First, complete the IAT Transaction Analysis Checklist and return it to Eastern Bank. Then select an alternative payment method (check or wire transfer) and remove the payment from your ACH batch. If after a review of all my payments I have none that appear to be classified as IAT what should I do? Simply complete the IAT Transaction Analysis Checklist indicating that this new rule does not apply, return it to Eastern Bank, and you are done. Please keep in mind the IAT rules outlined in this documentation also apply to payments you may initiate in the future. Once I have completed my review of all my existing ACH transactions to determine if any meet the IAT criteria, will I need to think about IAT ever again? Yes, you should always think about the rules surrounding IAT to see if any payments you may establish in the future would qualify as an IAT transaction. This would apply to any new vendor payments, pension payments, payroll or any ACH transaction you may create in the future. Can I still use the CBR and PBR (Cross Border Payments) SEC Codes? No, any payment that you send today as a CBR or PBR, automatically classifies as an IAT. You will need to find an alternative payment method such as wire or check. Does IAT impact all classes of payments? Yes, IAT applies to vendor, miscellaneous, salary, benefit, pension etc. What if I am the recipient of an IAT, how will it impact the posting to my Eastern Bank account? Keep in mind that there is required special handling of these transactions (as outlined in the NACHA operating rules) that could potentially delay the crediting of funds to your account. In some of the enclosed documentation it states that if there are standing instructions at the domestic recipient bank to further forward the funds on to a foreign financial institution the transaction would be an IAT. What if I am not aware of the banking arrangements between the recipient and their financial institution? To ensure that the payment is processed, err on the side of caution and consider the payment as an IAT when 1) payment is issued to a domestic financial institution and 2) recipient’s mailing address is outside the territorial jurisdiction of the U.S. Will Eastern eventually be processing IAT transactions? Yes, we are working with our various vendors to be able to offer IAT through TreasuryConnect. Where can I get additional information on IAT? There are several web sites that have extensive information regarding IAT, the most reliable ones are the NACHA web site at www.nacha.org and the Federal Reserve’s web site which is www.frbservices.org