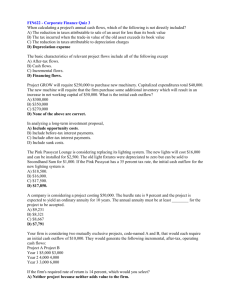

Working Capital Policy - Savannah State University

advertisement

Chapter 14 Working Capital Policy 1 Learning Outcomes Chapter 14 Discuss why working capital is needed and how working capital accounts are related. Describe the cash conversion cycle and how it can be used to better manage working capital activities. Describe the policies that a firm might follow (a) when investing in current assets and (b) when financing current assets. Discuss the advantages and disadvantages of using shortterm financing rather than long-term financing. Describe how working capital management in multinational firms is different from working capital management in purely domestic firms. 2 Working Capital Terminology Working Capital Management The management of short-term (ST) assets (investments) and short-term (ST)liabilities (financing sources) 3 Working Capital Terminology Working Capital A firm’s investment in ST assets: • Cash • Marketable securities • Inventory • Accounts receivable 4 Working Capital Terminology Net Working Capital = Current assets - current liabilities Amount of current assets financed by long-term liabilities 5 Working Capital Terminology Working Capital Policy Target levels for each current asset account How current assets will be financed 6 Working Capital Terminology Working capital only includes current liabilities that are specifically used to finance current assets. Working capital does not include current liabilities that might be due in the current period if they are due from long-term capital decisions, even though these must be considered when assessing the firm’s ability to meet its current obligations. 7 Working Capital Terminology Not Working Capital (Liabilities) Current maturities of long-term debt Financing associated with a construction program that will be funded with the proceeds of a long-term security issue after the project is completed Use of short-term debt to finance fixed assets 8 The Requirement for External Working Capital Financing Seasonal Variations Business Cycles Expansion requires more working capital 9 The Relationships of Working Capital Accounts A decision affecting one working capital account (e.g. inventory) will impact other working capital accounts (e.g. receivables and payables) If a firm’s operations are stable, the balance in accounts receivable and accounts payable can be computed using this equation 10 The Cash Conversion Cycle The length of time from the payment for purchases of raw materials used to manufacture a product until the collection of accounts receivable associated with the sale of the product 11 The Inventory Conversion Period Length of time required to convert materials into finished goods and then to sell those goods The amount of time the product remains in inventory in various stages of completion 12 The Receivables Collection Period Average length of time required to convert the firm’s receivables into cash; also called days sales outstanding (DSO) 13 The Payables Deferral Period Average length of time between the purchase of raw materials and labor and the payment of cash for them 14 The Cash Conversion Cycle Average length of time a dollar is tied up in current assets 15 The Cash Conversion Cycle for Unilate Textiles 16 Working Capital Investment and Financing Policies Two Basic Questions What is the appropriate level for current assets, both in total and by specific accounts? How should current assets be financed? 17 Alternative Current Asset Investment Policies Relaxed Current Asset Investment Policy Relatively large amounts of cash and marketable securities and inventories are carried and sales are stimulated by a liberal credit policy that results in a high level of receivables Restricted Current Asset Investment Policy Holdings of cash and marketable securities and inventories are minimized Moderate Current Asset Investment Policy A policy that is between relaxed and restricted policies 18 Alternative Current Asset Investment Policies 19 Alternative Current Asset Financing Policies Maturity matching (“self-liquidating”) approach Match asset and liability maturities Aggressive approach Finance all temporary assets with short-term, spontaneous debt, and finance all fixed assets and some permanent assets with long-term, non-spontaneous funds Conservative approach Use permanent capital to finance all permanent assets and some seasonal, temporary needs; use spontaneous, shortterm debt to finance the rest of the seasonal needs 20 Maturity Matching, or “Self-Liquidating” Approach A financing policy that matches asset and liability maturities This would be considered a moderate current asset financing policy. 21 Aggressive Approach A policy in which all of the fixed assets of a firm are financed with long-term capital, but some of the firm’s permanent current assets are financed with short-term non-spontaneous sources of funds 22 Conservative Approach A policy in which all of the fixed assets, all of the permanent current assets, and some of the temporary current assets of a firm are financed with long-term capital 23 Advantages of Short-Term Financing Speed A short-term loan can be obtained much faster than long-term credit. Flexibility For cyclical needs, avoid long-term debt • Cost of issuing long-term debt is higher. • Penalties for payoff prior to maturity • Restrictive covenants 24 Advantages of Short-Term Financing Cost of Long-Term versus Short-Term Debt Yield curve is generally upward sloping. Short term interest rates are generally lower than long-term rates. 25 Disadvantages of Short-Term Financing Risk of Long-Term versus Short-Term Debt Short-Term Debt subjects the firm to more risk than long-term debt does. • Short-term interest expenses fluctuate. • Firm may not be able to repay short-term debt and be forced into bankruptcy. 26 Multinational Working Capital Management How Working Capital Policies of U.S. Firms Differ from European Firms: Average cash conversion cycle of European firms more than twice that of U.S. firms. U.S. firms follow more conservative working capital policies than European firms do. 27