- MBTA.com

advertisement

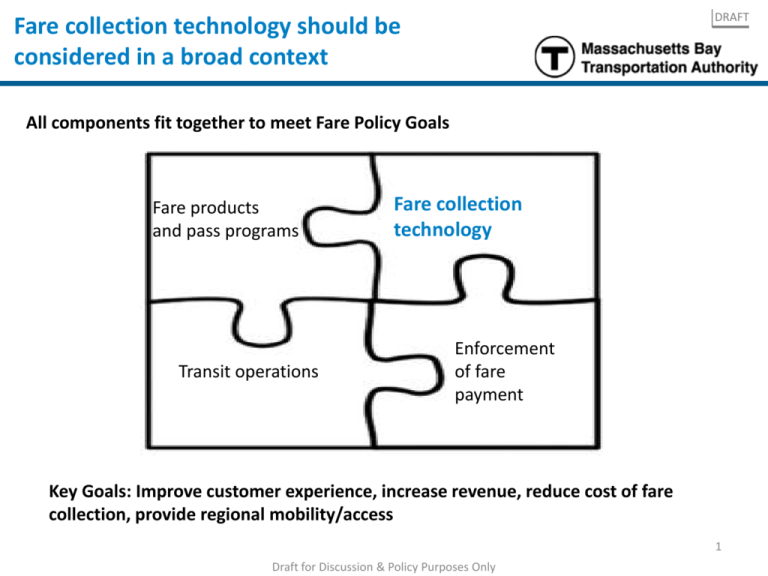

DRAFT Fare collection technology should be considered in a broad context All components fit together to meet Fare Policy Goals Fare products and pass programs Transit operations Fare collection technology Enforcement of fare payment Key Goals: Improve customer experience, increase revenue, reduce cost of fare collection, provide regional mobility/access 1 Draft for Discussion & Policy Purposes Only DRAFT To achieve the best fare collection system in the long term we are answering these questions A Fare media, hardware, validation, and enforcement: what fare media should be available to the customer, what type of hardware should we use, and how do we confirm travel is valid? Move toward open payment system with hardware that reads multiple fare media (mobile, contactless credit card and Charliecard) B Payment, value storage, and products: where and how is value stored, and how are payments processed? Do we continue to encourage pass usage and increase bulk pass sales? Account based system with value stored in accounts, not on fare media; passes likely to remain key product for foreseeable future C Revenue management: should we be in the business of managing cash? Cash management is not central to the MBTA’s mission, explore BIG QUESTION: which business model should we pursue? Does the MBTA serve as the integrator or do we hire an outside firm? partnering with third party provider, direct remaining resources to core services D System operation and maintenance: who should maintain hardware and software assets, are these MBTA core competencies? Hardware and software maintenance is too complex, commonly managed by a systems integrator through an SLA arrangement Draft for Discussion & Policy Purposes Only 2 DRAFT We own and operate our current system, but much of it is tied to our primary vendor Component: A Fare media, hardware, validation, and enforcement Current MBTA system Current business model ▪ ▪ Mag-stripe tickets, Charlie cards, CR mTicket Gate systems, fare vending machines, cash on board, and handheld devices Charlie card tap, ticket swipe, and rail conductor manual check Limited enforcement after initial validation ▪ Purchase at fare vending machines, pay cash on board, corporate pass program, CR mTicket Value stored on media (no accounts) Variety of passes and products ▪ ▪ ▪ ▪ Payment, value storage, and products ▪ C Revenue management – cash and credit ▪ ▪ Cash collected and counted by MBTA Credit cards processed by Vantiv (third party) ▪ D System operation and maintenance ▪ Hardware maintenance (e.g. gates) across system done in house Software maintenance and database admin done in-house Software updates done by vendor ▪ B ▪ ▪ ▪ ▪ Draft for Discussion & Policy Purposes Only ▪ ▪ ▪ In-house: fare media; hardware (relies heavily on S&B) Third party: CR mobile app (pilot – upgrading to contract would reduce $) In-house: all payment portals except mTicket Third party: mTicket, corporate tickets mailed by Edenred In-house: cash processing Third party: credit card processing In-house: hardware /networks maintenance, software maintenance and admin. Third party: software updates 3 DRAFT Cost of Collection: MBTA is forecast to spend $34M in FY16 on AFC maintenance and money room/cash collection $40M $3.9M 30 20 $1.7M $33.6M $10.9M $17.1M 10 0 Total headcount Retirement eligible AFC Maintenance Money Room & Vault Agents Fare Systems AFC Revenue Operations Total Costs 69 83 5 8 165 8 29 0 0 37 Note: The MBTA counts cash for the cities of Boston, Cambridge and the Mass Turnpike and receives a total of $400K per annum for this service, which is not reflected above. Net of this $400K, the total Money Room expense would be $8.2M. Money Room expense above also includes cost of MBTA transit police detail / OT to support Money Room security Draft for Discussion & Policy Purposes Only 4 DRAFT Cost of collection: Operational overview AFC maintenance ($17M): 69 employees, 8 retirement eligible ▪ Charged with maintaining and fixing AFC hardware ▪ Hardware includes retail vending machines, fare gates and boxes, and other related equipment ▪ Work across all MBTA stations and bus facilities Money room & vault agents ($11M): 83 employees, 29 retirement eligible ▪ Collect currency and transport funds in armored cars from stations to central facility ▪ Count and process cash funds for deposit in banks ▪ Includes armored cars, armed revenue agents, and counting staff ▪ Provide counting and processing services for other select municipalities and the turnpike ▪ Vault agents (14 employees) work in bus ops and move cash from buses into safes Fare systems ($4M): 5 employees, 0 retirement eligible ▪ Maintain and update AFC software in conjunction with S&B ▪ Ensure cards / tickets, gates, and fare boxes interact appropriately with system back end AFC revenue operations ($2M): 8 employees, 0 retirement eligible ▪ Manage fulfillment of wholesale card and pass distribution with vendors ▪ Oversee credit card processing (third party) and refund activities ▪ Limited retail operations for special pass programs Draft for Discussion & Policy Purposes Only 5 Best in class transit systems typically outsource AFC maintenance and cash collection and manage vendor through “% Up-Time” service-level-agreements (SLAs) DRAFT Most modern transport authorities rely on third parties to provide AFC maintenance and cash collection services and manage their vendors through an SLA standard (focused on up-time) ▪ The Chicago Transport Authority (CTA) has an exclusive partner while Transport of London (TFL) uses multiple outside vendors and some internal staff to manage ▪ Scheidt & Bachmann (S&B), the MBTA’s current provider, provides these services to other transit authorities and could serve as a potential partner By partnering with a third party, the MBTA could improve gate and FVM availability and usage: ▪ At each station, gates and fare vending machines average between 2 and 5 failures per month ▪ For safety reasons, when gates fail, they fail open. In 2014, there were 1,742 work orders to address open gates (total 660 gates) MBTA (Current Process) AFC Maintenance Cash Collection Scheidt & Bachmann (MBTA AFC vendor partners w/) Chicago Transport Authority Transport for London PAAC (Pittsburg, PA) S&B partners w/ sub contractors Heavy rail – third party Tube – staff & vendor 6 Draft for Discussion & Policy Purposes Only DRAFT Alternative models range across a spectrum of business models Turnkey partnership Open architecture with diversified suppliers + Examples: Cubic provides all fare collection, payment, and revenue management TFL designed and operates an open system that uses hardware and software from multiple vendors ▪ A Fare media, hardware, validation, and enforcement ▪ B Payment, value storage, and products ▪ ▪ Value resides in accounts Open payments (tap credit card at gate); ticket vending machine; online top up; auto-reload; mobile C Revenue management – cash and credit ▪ Cubic reimbursed for CC fees, cash on bus retrieved by CTA ▪ ▪ Heavy rail – third party Tube – staff & vendor ▪ Cubic maintains system and AFC operations ▪ Cubic and TFL both maintain portions of the system D System operation and maintenance Open fare media policy. Ventra Card and tickets. Cash still accepted on buses Vendor manages system and associated risks, but this may come with a price premium and reduced flexibility ▪ ▪ ▪ ▪ Oyster card; gates at all stations and farebox taps on buses No cash on buses Cubic provides hardware Value resides in accounts Open payments (tap credit card at gate); ticket vending machine; online top up; auto-reload Likely lower-cost and modular, resulting in faster delivery and more flexibility; requires strong internal project management ability Draft for Discussion & Policy Purposes Only 7