Print ready PDF - Parsons Behle & Latimer

advertisement

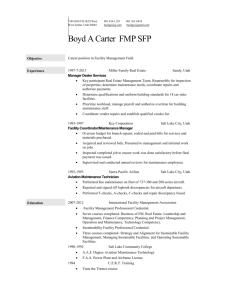

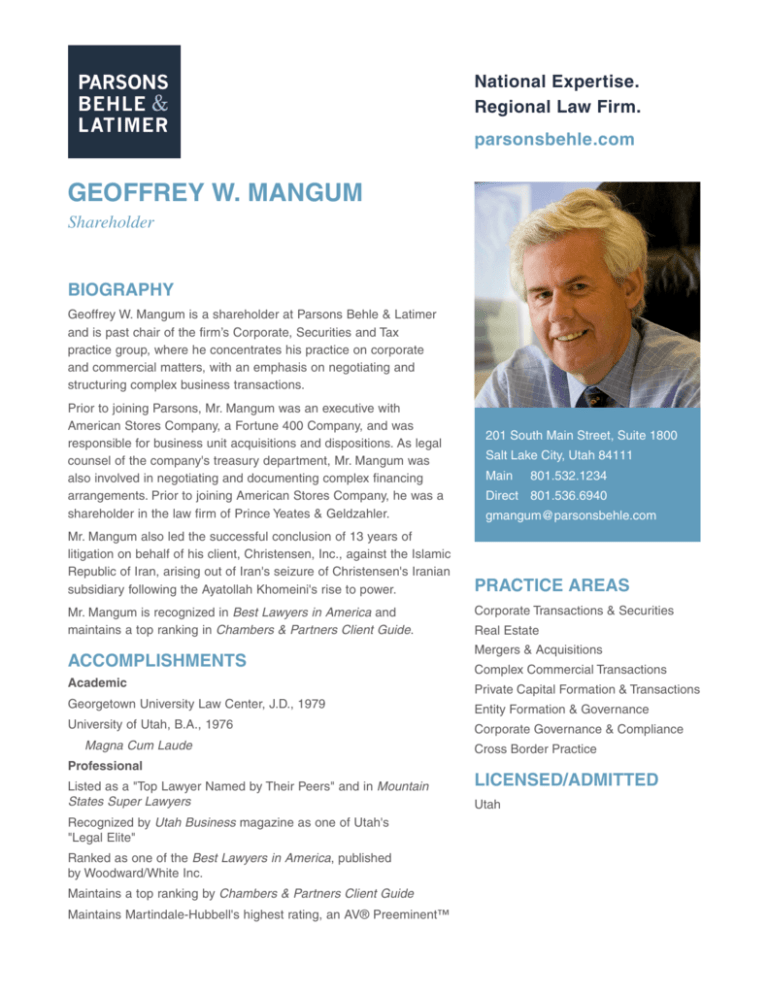

National Expertise. Regional Law Firm. parsonsbehle.com GEOFFREY W. MANGUM Shareholder BIOGRAPHY Geoffrey W. Mangum is a shareholder at Parsons Behle & Latimer and is past chair of the firm’s Corporate, Securities and Tax practice group, where he concentrates his practice on corporate and commercial matters, with an emphasis on negotiating and structuring complex business transactions. Prior to joining Parsons, Mr. Mangum was an executive with American Stores Company, a Fortune 400 Company, and was responsible for business unit acquisitions and dispositions. As legal counsel of the company's treasury department, Mr. Mangum was also involved in negotiating and documenting complex financing arrangements. Prior to joining American Stores Company, he was a shareholder in the law firm of Prince Yeates & Geldzahler. Mr. Mangum also led the successful conclusion of 13 years of litigation on behalf of his client, Christensen, Inc., against the Islamic Republic of Iran, arising out of Iran's seizure of Christensen's Iranian subsidiary following the Ayatollah Khomeini's rise to power. Mr. Mangum is recognized in Best Lawyers in America and maintains a top ranking in Chambers & Partners Client Guide. ACCOMPLISHMENTS Academic Georgetown University Law Center, J.D., 1979 University of Utah, B.A., 1976 Magna Cum Laude Professional Listed as a "Top Lawyer Named by Their Peers" and in Mountain States Super Lawyers Recognized by Utah Business magazine as one of Utah's "Legal Elite" Ranked as one of the Best Lawyers in America, published by Woodward/White Inc. Maintains a top ranking by Chambers & Partners Client Guide Maintains Martindale-Hubbell's highest rating, an AV® Preeminent™ 201 South Main Street, Suite 1800 Salt Lake City, Utah 84111 Main 801.532.1234 Direct 801.536.6940 gmangum@parsonsbehle.com PRACTICE AREAS Corporate Transactions & Securities Real Estate Mergers & Acquisitions Complex Commercial Transactions Private Capital Formation & Transactions Entity Formation & Governance Corporate Governance & Compliance Cross Border Practice LICENSED/ADMITTED Utah G E O F F R E Y W. M A N G U M • PA R S O N S B E H L E & L AT I M E R ASSOCIATIONS Professional American Bar Association, Member Utah Bar Association, Member Community University of Utah World Leaders Forum Advisory Cabinet, Member (2011 - Present) Kingsbury Hall Presents Board of Trustees, Member (2011 - Present) Utah Council for Citizen Diplomacy Board of Trustees, Member (2011 - Present) PRESENTATIONS "Directors & Officers Liability Insurance Briefing" (2011) "Foreign Corrupt Practices Act," The Doe Run Company, St. Louis, MO (March 13, 2008) "Mergers and Acquisitions Due Diligence," Association for Corporate Growth, Utah Chapter, 2008 Capital Connection Conference (February 12, 2008) "The Business Judgment Rule and The Role of Board Minutes," Association for Corporate Growth, Utah 2007 Capital Connection Conference (February 01, 2007) "Preparing Your Company For Sale," Association for Corporate Growth, Utah 2005 Capital Connection Conference (June 16, 2005) "The Role of In-House Counsel," Utah Bar Association, Corporate Counsel Section (November 02, 2004) "Transactional Negotiations and Problem Solving Seminar," Sundance, Utah (October 25, 2002) REPRESENTATIVE MATTERS • Represented Albertson's in its sale of two California bakery facilities to Interstate Brands Corporation • Represented Idaho Fresh-Pak, Inc. in the purchase of various potato processing facilities, agricultural real estate and equipment from Magic Valley Foods, Inc., Magic West Inc. and R.J.T. Farming • Represented DFG, Inc. in the sale of its Smith Sport Optics manufacturing division to Smith Sports Optics • Represented the shareholders of DFG Inc. in the sale of the company to Scott U.S.A. • Represented ClearOne Communications, Inc. in its acquisition of MagicBox, Inc. • Represented ClearOne Communications, Inc. in the sale of its conferencing services division • Represented ClearOne Communications, Inc. in the sale of ClearOne Communications of Canada, Inc. • Represented ClearOne Communications, Inc. in connection with its acquisition, through a reverse triangular merger, of Netstream, Inc. • Represented ClearOne Communications, Inc. in its acquisition of the assets of VCON Video Conferencing Ltd. (Cross-border transaction) • Represented ClearOne Communications, Inc. in its acquisition of Sabine, Inc. • Represented ClearOne Communications, Inc. in its acquisition of Spontania (Cross-border transaction) • Represented ClearOne Communications, Inc. in the sale of its telemarketing division to American Teleconferencing Services, Ltd. • Represented American Stores Company in the conversion of the company into a Delaware limited liability company involving loan covenant negotiations with over 9 major national and international lenders • Represented American Stores Company in its acquisition of a California home health care chain, including underlying real estate G E O F F R E Y W. M A N G U M • PA R S O N S B E H L E & L AT I M E R • Represented American Stores Company in its sale of photo finishing operations, including underlying real estate to Qualex, Inc., a subsidiary of Eastman Kodak. This also involved transferring 600 employees to Qualex in order to provide continued service to the company’s 1,700 stores • Represented American Stores Company in its sale of five milk processing and ice cream plants, including underlying real estate to Dean Foods Company, including entering into a long-term cost-based milk and ice cream supply contract for American Stores Company • Represented American Stores Company in its sale of bakery facilities, including underlying real estate, to Earthgrains Baking Companies, Inc. and Lewis Baking Company, including entering into long-term costbased supply contracts with the purchasers • Represented American Stores Company in its purchase of 11 Snyder Drug stores, including underlying real estate • Represented American Stores Company in its creation of a $1.5 billion credit facility and numerous other $200 million plus facilities • Represented American Stores Company in its $1 billion issuance of commercial paper • Represented Hemasource in connection with its acquisition by a private equity search fund • Represented West Coast Energy Inc. in the sale of a major U.S. compressed natural gas service company • Represented LeGrand Johnson Construction Company and its majority shareholders in connection with the sale of the company to Summit Materials