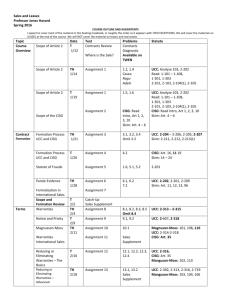

SiSU: - Open Price Terms in the CISG, the UCC and Mexican

advertisement