Liability Driven Investing

WHY LDI NOW?

LDI strategies are attractive now for a number

of reasons, including:

• C

hanges in Financial Reporting

Requirements. Companies are now

required to report the funding status

of defined benefit plans on their

balance sheet, which can lead to high

balance sheet volatility. As the second

phase of financial reporting reforms

are implemented, income statement

volatility may also increase significantly.1

• C

hanges in Pension Funding

Requirements. The Pension Protection

Act of 2006 (PPA) toughened pension

funding rules by imposing a 100%

funding target, shorter amortization

periods, a modified yield curve

approach, and restrictions on the use of

asset smoothing. Subsequent legislation

has provided temporary relief from

some of those requirements.2

• Increased Pension Plan Operations

Complexity. Pension plan operations

are increasingly complex, in part

due to new requirements under PPA

with respect to the time-sensitive

certifications of pension funding ratios

(Adjusted Funding Target Attainment

Percentage or AFTAP) and the

introduction of AFTAP-based pension

plan restrictions, such as lump sum and

accrual restrictions. Therefore, stable

pension funding ratios are important for

plan operations.

Continued on back...

Liability Driven Investing (LDI) is an investment framework that focuses

on managing pension assets in relation to pension liabilities. LDI is

not new; in fact, similar strategies have been used for years under the

name of Asset–Liability Management (ALM). PNC Institutional Asset

Management∑ believes that LDI can be an effective tool in managing

pension plan risks.

A COMPREHENSIVE SOLUTION DESIGNED TO MANAGE PENSION RISKS

PNC Institutional Asset Management believes strongly in pension risk management. Our focus

is on helping clients analyze and manage the underlying risks in their pension plans. As a

complete LDI manager, we have wrapped the functions of a number of key service providers

into one comprehensive solution that may create cost and implementation efficiencies.

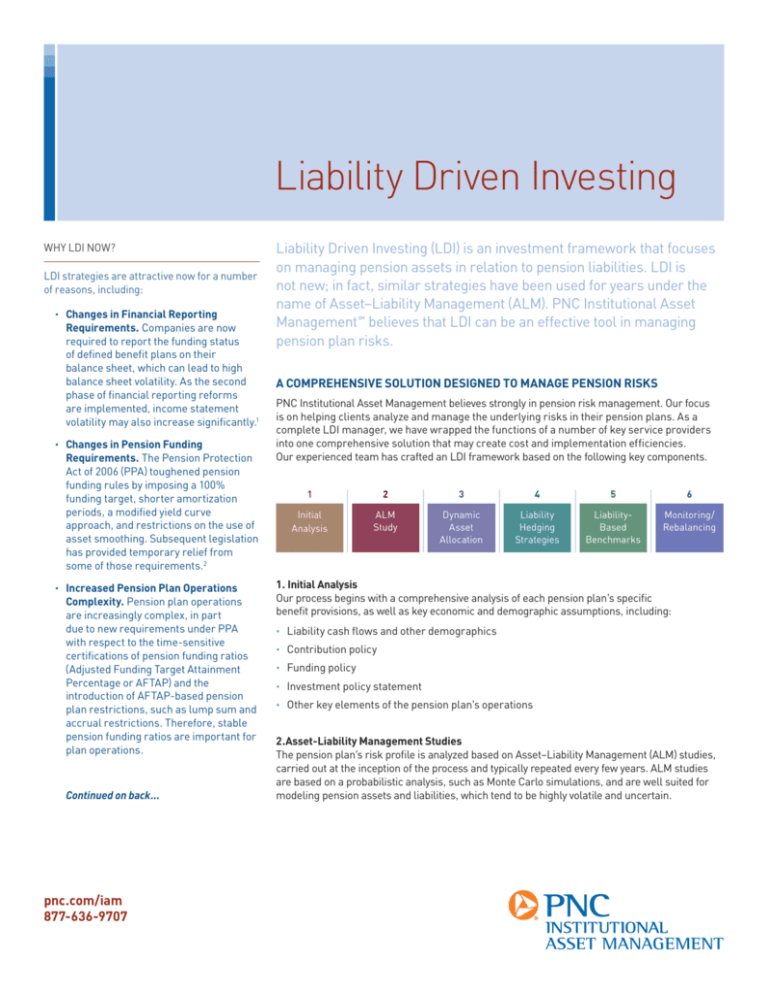

Our experienced team has crafted an LDI framework based on the following key components.

1

2

3

4

5

6

Initial

Analysis

ALM

Study

Dynamic

Asset

Allocation

Liability

Hedging

Strategies

LiabilityBased

Benchmarks

Monitoring/

Rebalancing

1. Initial Analysis

Our process begins with a comprehensive analysis of each pension plan’s specific

benefit provisions, as well as key economic and demographic assumptions, including:

• Liability cash flows and other demographics

• Contribution policy

• Funding policy

• Investment policy statement

• Other key elements of the pension plan’s operations

2.Asset-Liability Management Studies

The pension plan’s risk profile is analyzed based on Asset–Liability Management (ALM) studies,

carried out at the inception of the process and typically repeated every few years. ALM studies

are based on a probabilistic analysis, such as Monte Carlo simulations, and are well suited for

modeling pension assets and liabilities, which tend to be highly volatile and uncertain.

pnc.com/iam

877-636-9707

ASSET MANAGEMENT

• Increased Capital Markets Volatility.

Volatility of capital markets was

unprecedented in recent years, leading

to significant volatility of pension

assets and liabilities, and resulting in

volatility of pension funding status, cash

contributions, pension expense and

balance sheet impacts.

• Improved Pension Funding Levels.

Funding levels of pension plans

rebounded significantly after the credit

crisis of 2008, while declining slightly

during 2014. Generally improved

funding levels make LDI strategies

more appealing today than in the past as

companies see an opportunity to lock-in

recent gains.

• Rebounding Interest Rates.

Even though interest rates remain

at depressed levels, they increased

significantly during 2013, while

declining somewhat in 2014, making

LDI strategies more attractive now

than in the past.

3. Dynamic Asset Allocation

A key feature of our LDI framework is dynamic asset allocation or glidepath. The implementation

of an LDI strategy typically starts with a small (if any) pre-determined percentage of assets

allocated to the liability hedging assets. Over time, if and when funding status improves and

according to the glidepath schedule created and adopted at the inception of the LDI strategy,

periodic rebalancing will lead to an increased allocation to the liability hedging assets.

4. Liability Hedging Strategies

Once the dynamic asset allocation is established, we work with clients to determine whether

a liability hedging strategy is an appropriate fit for them. If so, a number of strategies are

considered in order to create a so-called liability hedging asset class, which is designed

to highly correlate with (and therefore hedge) pension liability.

5. Liability-Based Benchmarks

The main objective of an LDI strategy is to optimize the pension plan’s funding status. As

a result, an appropriate benchmark for LDI strategies is the “return” on a pension plan’s

liabilities. Plan-specific liability-based benchmarks are created and customized for each

plan in order to assess the performance of the LDI strategy.

6. Monitoring and Rebalancing

Monitoring is an essential part of our LDI framework with market values of pension assets

and liabilities determined on a regular basis. Once the thresholds are reached (as specified

by the dynamic asset allocation decision rules established at the inception of the strategy),

asset rebalancing is initiated and any funding status gains earned are locked in.

WORK WITH US TODAY

1 Financial Accounting Standards Board statement

ASC 715 (2006).

2 The Moving Ahead for Progress in the 21st Century Act (2012).

PNC Institutional Asset Management believes strongly in pension risk management. Our focus is

on helping clients analyze and manage the underlying risks in their pension plans. We built our

LDI framework on several key components — ALM studies, dynamic asset allocation, liabilitybased benchmarks, numerous investment options, and sophisticated reporting — integrated into

a single, comprehensive solution that may create cost and implementation efficiencies.

For more information, contact your Business Development Officer.

The PNC Financial Services Group, Inc. (“PNC”) uses the marketing name PNC Institutional Asset Management∑ for the various

discretionary and non-discretionary institutional investment activities conducted by PNC Bank, National Association (“PNC Bank”),

which is a Member FDIC, and investment management activities conducted by PNC Capital Advisors, LLC, a registered investment

adviser (“PNC Capital Advisors”). PNC Bank uses the marketing names PNC Retirement Solutions∑ and Vested Interest® to provide

non-discretionary defined contribution plan services and PNC Institutional Advisory Solutions∑ to provide discretionary investment

management, trustee, and other related services. Standalone custody, escrow, and directed trustee services; FDIC-insured banking

products and services; and lending of funds are also provided through PNC Bank. Securities products, brokerage services, and

managed account advisory services are offered by PNC Investments LLC, a registered broker-dealer and a registered investment

adviser and member of FINRA and SIPC. PNC does not provide legal, tax, or accounting advice unless, with respect to tax advice, PNC

Bank has entered into a written tax services agreement. PNC does not provide services in any jurisdiction in which it is not authorized

to conduct business. PNC does not provide investment advice to PNC Retirement Solutions and Vested Interest plan sponsors or

participants. PNC Bank is not registered as a municipal advisor under the Dodd-Frank Wall Street Reform and Consumer Protection

Act (“Act”). Investment management and related products and services provided to a “municipal entity” or “obligated person”

regarding “proceeds of municipal securities” (as such terms are defined in the Act) will be provided by PNC Capital Advisors.

“Vested Interest” is a registered trademark and “PNC Institutional Asset Management,” “PNC Retirement Solutions,” and “PNC

Institutional Advisory Solutions” are service marks of The PNC Financial Services Group, Inc.

Investments: Not FDIC Insured. No Bank Guarantee. May Lose Value.

©2014 The PNC Financial Services Group Inc. All rights reserved.

pnc.com/iam

877-636-9707

INV PNCII PDF 1114-0109-185661

ASSET MANAGEMENT