Deconglomeration

Deconglomeration

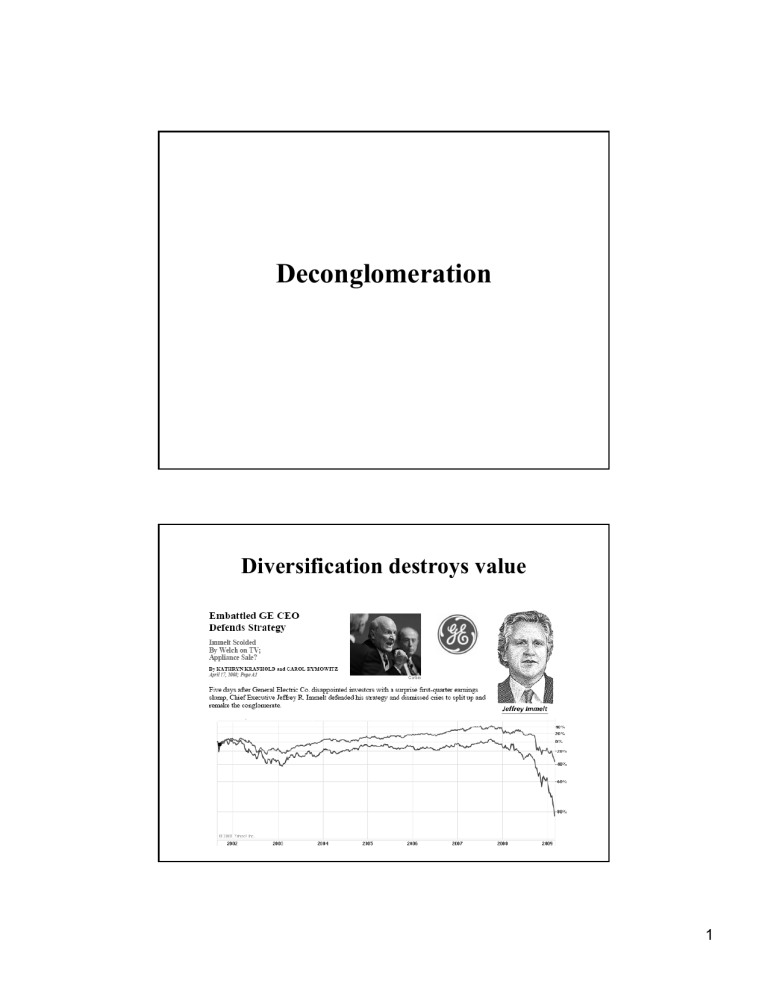

Diversification destroys value

1

“Deconglomeration” around the world

Deconglomeration or “refocusing”

1. Asset sales

2. Spinoffs

3. Equity carve-outs

4. Tracking stock

5. Split-offs

2

Asset sales

• Simplest, quickest, cheapest method of divesting an unwanted business

• Major problem: taxes

• Can sometimes be difficult to find a buyer

Example of a “bust-up” asset sale

• Beatrice’s LBO:

15% gain in asset value

3

Spinoffs

1.

A wholly-owned division of the parent is incorporated as a separate, stand-alone company.

2.

Stock in the company is issued as a dividend to shareholders of the parent.

3.

Stock begins to trade; ownership of the two companies separates over time.

4.

Generally a tax free transaction if requirements are met.

Pepsico stock rose 10.0% on 29 April 1997

An example

4

Spinoff data

($ Millions)

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

0

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06

Totals for 2002-06

US $196 billion

Europe $100 billion

Asia $30 billion

Returns to spinoffs

• Parent stock prices rise more than 5%, on average, when a spinoff is announced:

5

Pepsi vs. Coca Cola

• Before the spinoff

(five years)

• Since the spinoff

Ex post performance of spinoffs

6

Tricon since the spinoff

Ex post performance of spinoffs

7

Equity carve-outs

1. Business unit is placed into a separate corporation, just as in a spinoff

2. Stock is sold to the public in an initial public offering (IPO)

3. Usually only a minority of shares are sold

(often less than 20%), with remaining interest retained by parent

U.S. equity carve-outs, 1986-2001

20.0

15.0

10.0

5.0

0.0

1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

8

Example

Equity carve-outs

• Many carve-outs are done to “highlight the value” of a subsidiary that the market may be overlooking.

• Increasingly used as first step of a spinoff.

9

Parent company stock price reactions

8%

7%

6%

5%

4%

3%

2%

1%

122 companies

0%

-1%

-2%

-10 -5 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90

Days

Carve-outs prior to spinoffs

• The problem: early selling pressure at time of spinoff distribution

10

How carve-outs increase liquidity

• A base of interested shareholders exists already at time of spinoff distribution

• Greater research coverage of the stock

• Publicity effect of the IPO

11

Evidence for liquidity effect

Source: Low, “A Study of Two-Step Spinoffs,” NYU Stern School 2001

Better analyst coverage

12

Carve-outs and the Internet

• A large wave of tech carveouts were issued in 1999-

2001.

• Many of these carved out subsidiaries barely existed and were invented to capitalize on the Internet

IPO craze

DLJ Direct

Snap

Playboy.com

Barnesandnoble.com

13

Can the market add and subtract?

3com’s carve-out of Palm

$40

$30

$20

$10

$60

$50

Palm

$53.4 bn

3Com carves out

6 percent of Palm; retains 94 percent and announces plan for spinoff

3Com

$28.6 bn

Spinoff date

$0

Jan '00 Feb Mar Apr May Jun Jul Aug '00

Carve-ins

• Many Internet carve-outs were issued with great fanfare and then bought back after the bubble burst, at a huge discount to the original IPO proceeds.

• Disney Internet Group (aka Go.com)

Market cap of $1.5 billion on IPO date,

November 18, 1999 (71% owned by parent)

Retired in an exchange offer for 85% less,

March 19, 2001

14

Tracking stock

• Company issues a special class of common stock via a dividend or IPO

– Example: General Motors

Class E and Class H

• Annual dividend to holders of the tracking stock is determined by profitability of one business unit

• Usually has no voting rights

15

Tracking stock

• Can be useful as an “acquisition currency”

• Can signal intention to dispose of the business in the future

• Announcement effect: avg. +2.5%

• Long-term investment performance is poor; no possibility of collecting takeover premium

Split-offs

• Example: Dupont and Conoco, 1998-99

– Conoco acquired in 1981; management decides to divest in 1998.

– 30% of shares sold in IPO for $4.4 billion

– 70% of shares offered to current Dupont shareholders in exchange offer

– Terms: 2.95 Conoco shares for 1 Dupont share; 18% premium

– Conoco acquired in 2001 by Phillips Petroleum

16

Why use a split-off?

• Allows shareholders to separate into “clienteles” without taxes and trading costs that would accompany a spinoff

Capital structure and deconglomeration

• Separating the assets of a firm is usually straightforward

• Creating a capital structure for a divested firm is much more problematic

– Incentives for “risk shifting” are large

– “Agency costs of debt”

17

Risk shifting in spinoffs

Marriott’s spinoff proposal (1992)

18

Marriott’s spinoff proposal

• Widely interpreted as a transfer from debt to equity, leading to renegotiation.

• Today, “event risk” covenants are standard.

Marriott’s final spinoff (1993)

19