Possibilities for Making the Concepts of "Strategic Segment" and

advertisement

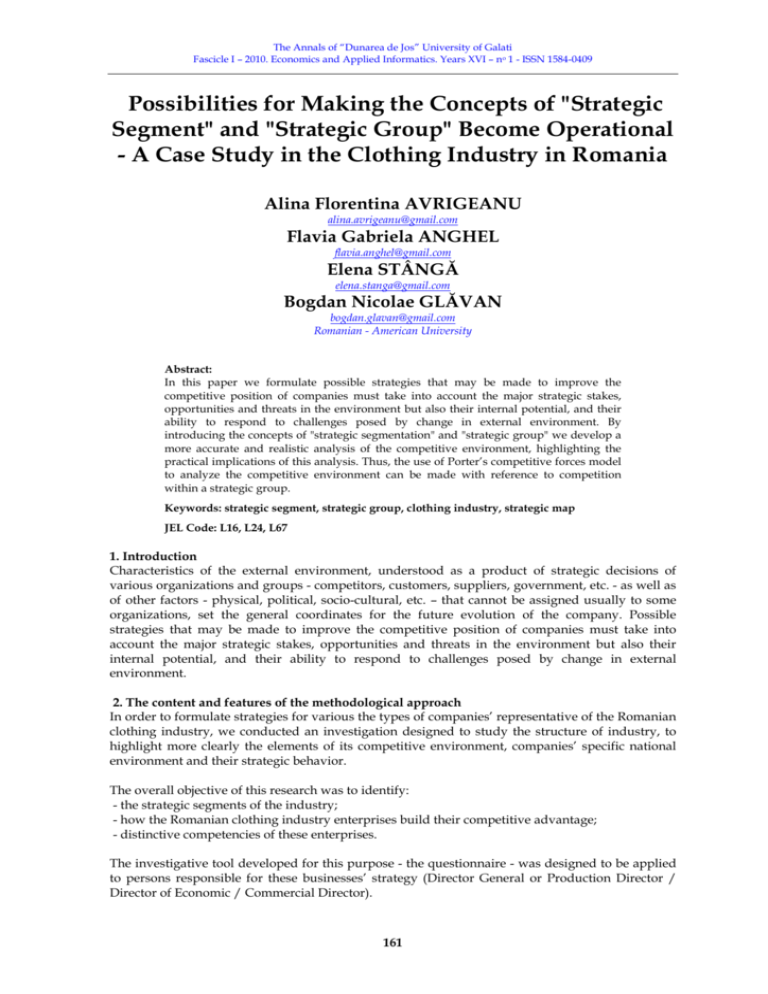

The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Possibilities for Making the Concepts of "Strategic Segment" and "Strategic Group" Become Operational - A Case Study in the Clothing Industry in Romania Alina Florentina AVRIGEANU alina.avrigeanu@gmail.com Flavia Gabriela ANGHEL flavia.anghel@gmail.com Elena STÂNGĂ elena.stanga@gmail.com Bogdan Nicolae GLĂVAN bogdan.glavan@gmail.com Romanian - American University Abstract: In this paper we formulate possible strategies that may be made to improve the competitive position of companies must take into account the major strategic stakes, opportunities and threats in the environment but also their internal potential, and their ability to respond to challenges posed by change in external environment. By introducing the concepts of "strategic segmentation" and "strategic group" we develop a more accurate and realistic analysis of the competitive environment, highlighting the practical implications of this analysis. Thus, the use of Porter’s competitive forces model to analyze the competitive environment can be made with reference to competition within a strategic group. Keywords: strategic segment, strategic group, clothing industry, strategic map JEL Code: L16, L24, L67 1. Introduction Characteristics of the external environment, understood as a product of strategic decisions of various organizations and groups - competitors, customers, suppliers, government, etc. - as well as of other factors - physical, political, socio-cultural, etc. – that cannot be assigned usually to some organizations, set the general coordinates for the future evolution of the company. Possible strategies that may be made to improve the competitive position of companies must take into account the major strategic stakes, opportunities and threats in the environment but also their internal potential, and their ability to respond to challenges posed by change in external environment. 2. The content and features of the methodological approach In order to formulate strategies for various the types of companies’ representative of the Romanian clothing industry, we conducted an investigation designed to study the structure of industry, to highlight more clearly the elements of its competitive environment, companies’ specific national environment and their strategic behavior. The overall objective of this research was to identify: - the strategic segments of the industry; - how the Romanian clothing industry enterprises build their competitive advantage; - distinctive competencies of these enterprises. The investigative tool developed for this purpose - the questionnaire - was designed to be applied to persons responsible for these businesses’ strategy (Director General or Production Director / Director of Economic / Commercial Director). 161 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 The study was conducted between November 23 to December 11, 2009 on a sample of 204 clothing enterprises, selected from the member database of the Light Industry Employers' Federation and the database of the General Directorate of Industrial Policy and Competitiveness within the Ministry of Economy. At the end of completing the forms there were collected 68 completed questionnaires, of which 51 were completed in full and are considered valid. Synoptic presentation of the respondents is presented in Table 1. Name Table 1: Synoptic presentation of the respondents Locality I1 Slatina I2 Bacău I3 Sebiş I4 Bacău I5 Brăila I6 Focşani I7 Bârlad I8 Bârlad I9 Bucureşti I10 I11 I12 Galaţi Bucureşti Galaţi I13 Satu Mare I14 Sibiu I15 Constanţa I16 Bucureşti I17 Baia Mare I19 Cluj Napoca Satu Mare I20 Bucureşti I18 I21 I22 I23 I24 Odorheiu Secuiesc Bucureşti Cluj Napoca Bucureşti Main Products Monthly Production Capacity (no. pieces per month) Număr salariaţi în anul 2008 Number of employees in 2008 (pers.) 200000 165 341443991 10000 72 2144378 600 42 2323986 100000 481 13724865 400000 2113 50056040 44000 155 2128360 250000 1235 29555126 4000 60 2509709 28000 90 3414741 100000 200000 100000 336 24 49 14077991 2285935 8319824 2500 53 4496799 40000 538 20243612 12000 26 118 40000 372 14299932 500 23 9912272 5000 9 320239 8000 106 4136892 32000 225 7324586 8000 1428 42681807 10000 60 3236562 70000 335 10303094 300 10 463552 Women clothing, Children and youth clothing, ski suits, beach, etc.. Women clothing, menswear and casual sports Leather products Women clothing, menswear Women shirts, men shirts Women apparel, children and youth apparel Men shirts, women blouses, pajamas Women clothing Women clothing youth and children's wear Women clothing Women clothing Menswear Women clothing, menswear Women clothing menswear Women clothing, children's wear Women clothing menswear Sports clothing, ski suits Women clothing Women clothing Women clothing menswear Menswear Women clothing Women clothing Children's wear 162 Turnover in 2008 (lei) Name The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Locality I25 Braşov I26 Craiova Piatra Neamţ Satu Mare Iaşi Constanţa Cluj Napoca I27 I28 I29 I30 I31 I32 Oradea I33 Piatra Neamţ I34 Buzău I35 I37 I38 I39 I40 Botoşani Odorheiu Secuiesc Oradea Roman Craiova Bucureşti I41 Sighişoara I36 I43 I44 Curtea de Argeş Focşani Bacău I45 Deva I46 Târgu Neamţ I47 Hunedoara I48 I49 I50 I51 Urziceni Constanţa Târgovişte Brăila I42 Monthly Production Capacity (no. pieces per month) Număr salariaţi în anul 2008 Number of employees in 2008 (pers.) 5000 52 2068011 60000 426 9552465 15000 70 1983326 600000 10000 7000 730 93 109 9552465 5669231 5491214 500000 1501 116203136 10000 32 1164085 35000 97 11678238 80000 206 13773944 170000 913 24921544 40000 906 32670559 Fur clothing Women clothing Women clothing Women clothing Men's shirts, women blouses, pajamas Men's shirts 10000 500 100000 40000 42 36 89 757 1470096 1306965 1014292 33825163 160000 567 12836909 25000 76 2453826 Women clothing Women clothing Women clothing, menswear Pajamas 100000 4000 539 130 42638053 5489820 550000 274 4880435 18000 140 7112424 350000 30 30 134769296 1020118 500 150000 1473 27 14 365 100000 1020118 442788 47463332 1128277181 Main Products Confecţii femei Ladieswear Women clothing Women clothing menswear Women clothing Women clothing Women clothing Women clothing Bathing suits, fitness, lingerie Women clothing Women clothing, menswear Pants Menswear Women clothing, menswear Women clothing Children's wear Women clothing Women clothing TOTAL Turnover in 2008 (lei) The 51 garment enterprises are distributed in all developing regions, as shown in Table 2. Table 2: The distribution of the garment enterprises in all developing regions Development Region Northwest Northeast Southwest Southeast South Center West Bucharest-Ilfov Northwest Northeast Number of enterprises 9 11 3 9 3 5 3 8 9 11 163 Share 17,64% 21,56% 5,88% 17,64% 5,88% 9,80% 5,88% 15,68% 17,64% 21,56% The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 We should mention that this research has some particular limitations, the most important of which are the small size of the sample of firms considered in research and the honesty of respondents. 3. Building the strategic segment - strategic group dyad The strategic approach for improving the competitive position of firms in the clothing industry has its starting point in a review of these enterprises’ competitive environment, given that success depends on proper identification and of competitors, customers or area where the firm’s power and resources can be used in an optimum manner, creating the premises for the adoption of a rational economic behavior. A more detailed analysis of categories that require differentiated behaviors should be provided for a more efficient use of resources. More specifically, strategic intuition urges focus on customers' most important competitors, i.e. on a segment assumed to have the greatest influence on results. Strategic segmentation is carried out to obtain a "magnifying effect", i.e. to focus on a part of the whole analysis. In practical work, competitive relationship in which one’s gain means the other’s loss are only available for a number of "players", i.e. a firm will be in direct competition with only a segment or part of all organizations that have a similar activity. If it is accepted that companies that address the same market segment operate in a zero-sum game, then they are in a stronger relationship than if they would address different segments. The relationship is one of providerclient, specific to marketing, "referee" in this game is the customer who chooses the product of either companies that cover the respective segment 1 and the "arena" competition is the strategic segment. Strategic analysis of the competitive environment of enterprises in the Romanian clothing industry is based on structural analysis suggested by Michael Porter, completed, clarified and made applicable in subsequent professional work of other professionals and researchers in the field of strategic management. To achieve the strategic segmentation of the clothing industry in our country will go through an analytical process based on "scheme" proposed by T. Atamer and R. Calori, in "Diagnostic et strategiques Decisions' published by Dunod, Paris, in 1993, using segmentation criteria suggested by D.F. Abel and J.S. Hammond in "Strategic Market Planning: Problems and Analytical Aproaches", Prentice Hall, Upper Saddle River, NJ, 1979. To identify the basic activities Abel and Hammond propose a division of the industry by three criteria associated with a clearly defined geographical area: o technology; o application, referring to the use or need that the product is intended; o client / consumer. Given the specific elements of the garment industry and the homogeneous nature of the manufacturing technologies from this sector, we will operate the strategic segmentation of the industry using the criteria "application" and "customer." Since the two companies operating in the same industry but in different geographical areas may not be in a competitive relationship, we define strategic segments using a geographical demarcation of the area in which these firms operate - domestic (national) or foreign (EU). The analysis of the basic activities of the 51 companies investigated based on the combination Application - Customer (Tables 3 and 4) leads to the identification of a set of combinations (Figures 1 and 2) that present technical and economic logic, defining seven strategic sectors for both domestic and foreign market. We considered that a company operates domestically if the value of productions sold in this market in 2008 exceeded 15%, representing the average production for domestic market in 20042008. As shown in the survey, only 20 of the 51 companies surveyed have sold domestically at least 15% of production achieved in 2008. 164 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Table 3: Analysis of basic activities of the 20 companies based on the combination application domestic client Application Customer 1. Functional Clothing 1. Final consumer (standard) 2. Fashin clothing 2. Retailers (differentiated) 3. Ski equipment 3. Other local clothing manufacturers 4. Protective clothing 4. Industrial Figure 1: Sets of combinations application - domestic client 31 E 12 A 32 F 21 B 44 G 22 C 23 D The investigation carried out in the clothing industry revealed that 37 of the 51 firms in the sample respondents have sold their products in foreign markets in 2008. Table 4: Analysis of the 37 basic activities based on the combination of business applications customer for domestic market Application Customer 1. Functional Clothing 1. Final consumer (standard) 2. Fashin clothing 2. Retailers (differentiated) 3. Other European clothing manufacturers 4. Brokers Figure 2: Sets of combinations application - external market 22 E 12 A 23 F 13 B 24 G 14 C 21 D Tables 5 and 6 shows the position of the various competitors against seven strategic sectors identified for domestic and external market, respectively. Table 5 - Industry segments and competitors’ position themselves – domestic Segmente de industrie I8 I11 I12 I13 I17 I18 I19 I22 I24 I25 Firme SSA SSB SSC X X X X SSD SSE SSF SSG X X X X X X X X 165 X X The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Segmente de industrie I29 I30 I31 I32 I37 I38 I44 I46 I49 I50 I1 I2 I3 I4 I5 I6 I7 I9 I10 I14 I15 I16 I20 I21 I22 I23 I25 I26 I27 I28 I29 I30 I31 I32 I33 I34 I35 I36 I39 I40 I41 I42 I43 I45 I47 I48 I51 Firme SSA SSB SSC X X X X SSD SSE SSF SSG X X X X X X X X X X X Table 6 - Industry segments and competitors’ position - the foreign market X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X 166 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Based on their option, reflected in the number of strategic segments addressed, clothing companies can be divided into: • specialists, represented in one segment; • multi-specialists, represented in two or more segments; Table 5 shows the position of the 20 competitors in relation to the seven segments identified for domestic industry, allowing us to separate: 13 experts (of which 3 per segment A, one in segment B, seven in segment C, one in segment E and one in segment F) and 6 multi-specialists (of which 6 are represented by B and C segments and one in segments E and F). The 37 businesses that address the external market, as can be seen from Table 6, are grouped into: 26 experts (of which one in segment C, 2 in segment E, in segment F and 20 in G) and 11 multi-specialists (4 of which are represented by segments F and G, 5 by E and F segments and one by segments D and E, respectively, A, B and E). It appears that, of the 51 companies investigated, most engage in strategic segment G, activating on external market (application: differentiated products, customer: Intermediate, Community market): 21 specialists and 5 multi-specialists. Basic typology illustrates a "primary" strategic option on specialization, from which those categories appear. A certain segment can be addressed by an enterprise in any category listed, which is able of achieving a strategic advantage. "Specialists" will seek superiority through focusing, translated by a better knowledge of the process, so that to obtain a reduction in costs from this source, while the "generalist" will seek superiority of shared management, translated into achieving economies of scale. Each strategic segment comprises several sectors which are not all similarly exposed to the competitive field and with a coherent set of key success factors. As a consequence, the segment can integrate different strategies and the analysis of possible behaviors of the main groups proves to be indispensable. If firms in an industry are perceived as "mechanisms" related to an aggregate performance results related to how satisfied the customer is and linked to how the available resources (which can be profitability, economic value, etc.) are managed, then rivalry will exist at any given time only between organizations which adopt similar behavior. Different behaviors are the result of different views of stakeholders or of the constraints associated to the mode of operation at a time dictated by resources, skills, positioning, etc. For this type of competition the concept that sets the "arena" is the strategic group and "referee" is the main shareholder or owner. Grouping firms in the clothing industry in our research by similarity of strategies and resources involves tracking equally the different practices and the main sources of competitive advantage which manifest themselves within the industry. We will use for this purpose, a refined analysis of the structure of an industry populated by many groups of competitors, each occupying a distinct place in a market and having a specific image in the minds of buyers, proposed by Michael Porter mapping strategic groups. The author's conception is that any sector consists of a variety of segments that are not subject to the same intensity of competitive forces and, consequently, the strategies that can be applied may vary from segment to segment. Given this, Porter recommends splitting entity sector more homogenous units of analysis, which he called strategic groups. Criteria by which to identify firms that operate in a market and are a strategic group approach resulted from identical behavior of market mechanisms. These criteria relate primarily to: targeting the same customer groups, customers satisfaction with products / services with the same main features, providing similar production lines, offering the same services, use the same distribution channels, using intensity comparable advertising and media advertising, offering products / services that are at very close levels of price / quality ratio. Insofar as many strategic dimensions are interdependent, Michael Porter suggests to decide for two dimensions, namely those which are also the most independent and most explicit about the soundness of strategic positions in the sector. Such attitude allows the firm to focus its analysis on several crucial issues which constitute additional protection for an effective and sustainable 167 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 competitive stance. Different strategic groups within a sector may represent a strategic map of the scale envisaged, that is, in fact, a chart on the details of which are strategic variables; strategic groups are represented by circles, their diameters are proportional with companies of each group share in total market sales. Thus, we obtain a topography that allows competitive sector to forecast the development and the risks of destabilization and to identify marginal but profitable groups and the big holes that can become easily factors for generating profits. In order to make applicable the concept of strategic group analysis it is needed to use hierarchical techniques and discriminate analysis. In this way it is possible to see homogeneous groups practice strategies, taking into account the two most discriminated strategic dimensions. Variables considered in the construction diagram must not be closely related - in this case circles representing strategic marketing groups will string along a diagonal, thus making it irrelevant one of the variables. For clothing industry the first two strategic dimensions are cooperation in production and the degree of product differentiation. Shaping the strategic map for the 26 industrial enterprises engaged in strategic segment G requires a number of clarifications on the process of grouping the firms based on the two dimensions listed, ordered by a qualitative scale with three levels, such as: low differentiation, medium and high / strong and, respectively, with two - low and high levels of cooperation. For dividing firms in strategic groups based on product differentiation, given the wide variety of customization elements related to the supply of various clothing manufacturers, we approximated the average differentiation if at least one of the following conditions is fulfilled: flexibility, meaning the company has the ability to adapt to the needs of specific operational requirements and wishes to continue diversifying and customizing the customers, by making the change, offering a variety of types and models of products or different versions of a base portfolio. Rating firms for flexibility was done aiming at both its manifestations - static and dynamic - considering companies that offer flexible CAD-CAM systems and highly qualified human resources; Quality, as providing the best products without defects, performed under strict adherence to design specifications and design technology. In achieving the strategic map, we considered that a company makes quality products and has quality processes if: - makes "premium" highly developed products, with cutting edge fashion items made from raw materials and auxiliary high quality and in small series; - implements the quality management system ISO 9001; - implements the quality management system integrated with environmental management and occupational health and safety in accordance with the requirements of ISO 9001, ISO 14001 and OHSAS 18001; - implements the TQM system; - implements the quality management system standards required by customers from multinational firms category, holding internationally known trademarks, - enterprises´ capability to execute and deliver products with outstanding technological features or by using exclusively more advanced technologies (by innovation), or through a better exploitation of an existing technology. We considered that a company has this capability if it has CAD - CAM, sewing equipment with high automation (automatic pocket sewing, etc.), automatic processing devices (fusing machines and presses, preformed collars, cuffs, pockets, slit, etc.), overhead transmission systems of individual products or packages, computer equipment and embedded computing systems, consisting of a series of appropriate sub-functions of the undertaking, each subsystem comprising in turn a number of applications which use computer and allows makes possible modeling the production and business processes through: making online connections with customers and suppliers of systems, orders’ management, planning, scheduling and production tracking, cost control on the product, order, model, etc.; Promptitude, understood as the capacity of the company to meet orders quickly and in time. Timeliness is focused on compliance and reduction of delivery times set by the beneficiaries and is based on three essential characteristics of the production management system of the 168 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 enterprise a) the system's ability to establish reasonable delivery times, characterized by a low risk of failure; for this it is necessary to know precisely the production cycle, the time needed to carry out administrative work required by a specific order, production resources and existing manufacturing technologies during production, b) capacity of the system to comply with strict delivery deadlines established, a requirement that is expressed through the gap between fixed delivery date and actual date of delivery for every order received by the firm c) system's ability to reduce the delivery times of orders by reducing cycle times and by accelerating the production and distribution of products, following the adoption of measures to decrease the operational times, interruptions and time consumed with the administrative processing of orders. We considered that a company fulfils this quality if it has the capacity to perform promptly and observe an order within a maximum of 4 weeks for products intended for export. In the category of enterprises characterized by strong differentiation we have included companies characterized by at least one of the following: they are sensitive, distinguished by their flexibility and timeless, able to discover and understand the changes occurring in the customer requirements, sometimes even to anticipate them, and react quickly to meet them through the launch of new offerings; they are safe, differentiated by quality, timeliness and cost, have the ability to meet orders within a short time, respecting deadlines, quality characteristics and sales prices, with relatively small additional cost. These companies provide themselves a “shield” in relations with customers, making the customer "addicted" to the supplier. The second dimension, cooperation in production, must be considered given the strategic choices firms need to adjust to the position occupied in clothing production network and the strategies of other companies, particularly those of the firms governing or coordinating the network. In building the strategic chart we considered that firms are characterized by high degree of cooperation in production if they meet at least one of the following features: production is made under sustainable arrangements, contractual or informal, based on trust, with a minimum term of 2 years; activities of the two entities are closely coordinated through integrated logistics systems; conscious and voluntary exploitation of technology, information and common knowledge; inter-action between individuals working with the two organizations is strong. Entities involved in a contractual arrangement or informal cooperation aim to meet specific interests. Thus, the interests of intermediaries as customers of the clothing manufacturers are mainly: get products as cheap as possible, made by “safe” manufacturers, with the knowledge, technical expertise, innovative potential and experience necessary for understanding and compliance with the requirements of large retailers, for fulfilling orders in the amount requested, observing deadlines and condition of "zero defects", and for coordinating other manufacturers as subcontractors. Producers' interests converge toward obtaining the best possible prices for their products, getting regular orders, and using the experience, the relations and the economies of scale and scope achieved by dealers and intermediaries. Both intermediaries and producers in partnership pursue their interest in establishing transfer costs so that any change of partners takes place under conditions as favorable to their own company. To this end, the costs involved in changing your partner are continuously compared with the price variation that is associated with continuing the actual business arrangement. When the transfer cost is less than the variation (increase) the price, then partners will change. 169 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Degree of product differentiation high A B medium D C small E low high Degree of cooperation in production Figure 3. Strategic groups of enterprises engaged in strategic segment G, the external market General characteristics of each group are: Group A, consisting of firms I5, I30 and I43 with a turnover in 2008 of 52,801,647 lei, exploits the potential offered by the industry through increased product differentiation. Firms in this strategic group are sensitive to customers, reacting quickly to meet them through the launch of new offerings, providing reliable products, of quality and with relatively low additional cost. Distinctive competencies of these firms are evident in many directions: the creative potential allows them to record a very high rate of product innovation; design of highly differentiated products relative to competitors; high quality products is certified according to ISO. Financial rate of return of these companies recorded an average of 8.21% in 2008, giving an average attractiveness to this group; Group B, consisting of firms I6 and I35 support a sharp distinction, focusing both on directly, on the attributes of products, and indirectly, on the relationship with customers, on internal relations and on links with other companies contributing to the product. These firms pursue competitive advantages of sensitivity and security in a sustainable perspective, given the privileged relations they establish with different partners under cooperation agreements, subcontracting, joint venture, manufacturing licenses, etc. Distinctive competencies of these firms, their assets in the effort to capitalize on opportunities occurring in their environment are: very close relationships with all customers in order to identify their needs, to cooperate for developing and improving the products / services; particularly creative potential, reflected in the products and technologies high rate of renewal; total quality management system, which allows to increase quality beyond that achieved by competitors, high productivity manufacturing equipment capable of significantly lowering the manufacturing costs, the special design of products, which increases their attractiveness compared to competitors products, high quality products, certified according to ISO. Turnover of these companies in 2008 was of ROL 27,049,204 and the average financial return was 20.04% - this is the most attractive strategic group; 170 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 Group C, consisting of firms I1, I4, I6, I9, I10, I15, I20, I23, I34, I40, I41 and I47, firms characterized by an average differentiation, competitive advantage of which is flexibility (all 12 business group), with a combined turnover of ROL 466768681 in 2008 and an average rate of financial return 2.07%; Group D consists of I7, I22, I25, I27, I28, I33 and I42, medium firms differentiated, flexible and aimed to establish sustainable relations, cooperation in production, with a combined turnover of 63,625,738 lei in 2008 and an average rate of financial return 13.55% - giving an average attractiveness to this group; Group E is composed of I2, I39 and I45, poorly differentiated businesses, with a combined turnover of 8,038,205 lei in 2008 and an average of 1.69% financial return - which gives a low attractiveness of the group. 4. Conclusion The strategic map of industry analysis allows us to distinguish between two levels of competition, i.e. competition within each group (among firms representing the group) and inter-group competition, which depends on the strategic moves made by the firms. A competitor who belongs to a certain strategic group has the following options: to improve its position in the existing group to the detriment of other competitors by capturing a segment of their market, which could lead to increased profitability. Dealing with competitors that addresses the same market segment will be made through improved performance relative to products offered, while confrontation involving different market segments and thus a comparison of aggregate economic performance, requires a proper management of cost and prices; to improve profitability with other competitors in the group, modeling group advantageous characteristics, modeling that is based on achieving a combination of high profitability, achieved through actions on the price and / or costs, and "favorable barriers (high at the entry point in the strategic group and low at the exist point, which would theoretically lead to a decreased number of competitors and increasing rivalry); to achieve an integration movement in another strategic group with more favorable characteristics, namely improved profitability and lower entry barriers at the moment of accession, which then become high for others aspiring to enter the group; to establish a new strategic group, based on a strategy focused on an innovative element located in one of the links in the value chain: a technology or new features of an existing product, a new way of marketing the product or managing the customer relations. By introducing the concepts of "strategic segmentation" and "strategic group" we develop a more accurate and realistic analysis of the competitive environment, highlighting the practical implications of this analysis. Thus, the use of Porter’s competitive forces model to analyze the competitive environment can be made with reference to competition within a strategic group. References: 1. Bâgu, C., Deac, V., “Strategia firmei”, Editura Eficient, 2000 2. Cârstea, Gh. Deac, V., Popa, I. şi Podgoreanu, S. „Analiza strategică a mediului concurenţial”, Editura Economică, 2002 3. Gereffi, G., Korseniewicz, M., „Commodity Chains and Global Capitalism”, Greenwood Press, Westport, 1994 4. Gluck, F., Kaufman, S., Walleck, S., „Strategic Management for Competitive Advantage”, Harvard Business Review, July-August, 1980 5. Popa, I.,” Management strategic”, Ed. Economică, Bucureşti, 2004 6. Popa, I., “Lohn? De ce nu?”, Revista Capital, nr. 5, 19 iunie 2003 7. Porter, M.E.,” Avantajul concurenţial”, Ed. Teora, Bucureşti, 2000 8. Russu, C., „Management strategic”, Editura All Beck, Bucureşti, 2009 9. Russu, C., “Economie industrială”, Editura Economică, Bucureşti, 2003 10. Rumelt, R.P., “Towards a Strategic Theory of the Firm”, în Lamb, R.B. (ed.), “Competitive strategic management”, Prentice Hall, Englewood Cliffs, NJ, 1984 11. Russu, C., “Management strategic”, Editura All Beck, Bucureşti, 2009 12. Russu, C., “Economie industrială”, Editura Economică, Bucureşti, 2003 13. Selznik, P., “Leadership in Administration”, Harper&Row, New York, 1957 171 The Annals of “Dunarea de Jos” University of Galati Fascicle I – 2010. Economics and Applied Informatics. Years XVI – no 1 - ISSN 1584-0409 14. Simon, H., “The New Science of Management Decision”, Harper & Row, New York, 1960 15. Stalk, G.P., Evans, P., Shulman, L., “Competing on Capabilities: The New Rules of Corporate Strategy”, Harvard Business Review, vol.70, nr. 2, 1992 16. Strategor, Strategie, “Structure, decision, identite, Politique generale de l’entreprise”, Inter Edition, Paris, 1988 17. Sturgeon, T.J., “How Do We Define Value Chains and Production Networks”, Special Working Paper Series, MIT IPC Globalization Working Paper 00-010, Industrial Performance Centre, Massachusetts Institute of Technology, April 2001 18. Tanţău, A.D., “Management strategic”, Ed. Economică, Bucureşti, 2003 19. Voinea, L., Raport de cercetare GEA, “Restructurare forţată: vremuri grele pentru industria uşoară – contribuţie la Reactualizarea strategiei industriei textile, confecţii şi pielărie-încălţăminte în contextul scăderii producţiei în lohn şi necesităţii revigorării industriei primare şi de resurse pentru perioada 2005-2008”, Grupul de Economie Aplicată, 2005 20. Wernerfelt, B., A Resource, “Based View of the Firm”, Strategic Management Journal,vol.5, 1984 21. Winter, S.G., “The Satisfying Principle in Capability Learning”, Strategic Management Journal, 18, 2000 22. Winter, S.G., “Understanding Dynamic Capabilities”, Strategic Management Journal, 24, 2003 23. Yoruk, D. E., “Patterns of industrial upgrading in the garment industry in Poland and Romania”, Centre for the Study of Economic & Social Change in Europe, London, 2001 24. Zollo, M., Winter, S.G., “Deliberate Learning and the Evolution of Dynamic Capabilities”, Organization Science, 12, 2002 25. ASPES, “Avantaje competitive ale industriei prelucrătoare din România în Uniunea Europeană”, Ed. ASPES, Bucureşti, 2007 26. Citizens Development Corps for the CHF Consortium in Romania, “Assessment Report:Textile sector, cooperative agreement no. 186-A-00-03-00101-00”, 2003 27. Euratex, “Opportunities and Challenges for Financing Innovation in the European Textile and Clothing Industry”, Bruxelles, 2007 28. EUROSTAT,” Statistics in focus”, nr. 50/2009 29. Industria uşoară între regres şi relansare, “Buletinul trimestrial al Comisiei Naţionale de Prognoză nr. 1/2009” 30. Institut Francais de la Mode, “Study on the competitiveness, economic situation and location of production in the textiles and clothing, footwear, leather and furniture industries, Final Report (volume I)”, Paris, 2007 31. Schiţa privind înfăptuirea economiei de piaţă în România, “Programul Postolache” – Buletin, Institutul Naţional de Cercetări Economice, mai, 1990 32. Institutul Naţional de Statistică, “Anuarul Statistic al României” 33. Colecţia revistei “Dialog Textil”, 1999-2010 172