REPUBLIC OF THE PHILIPPINES

advertisement

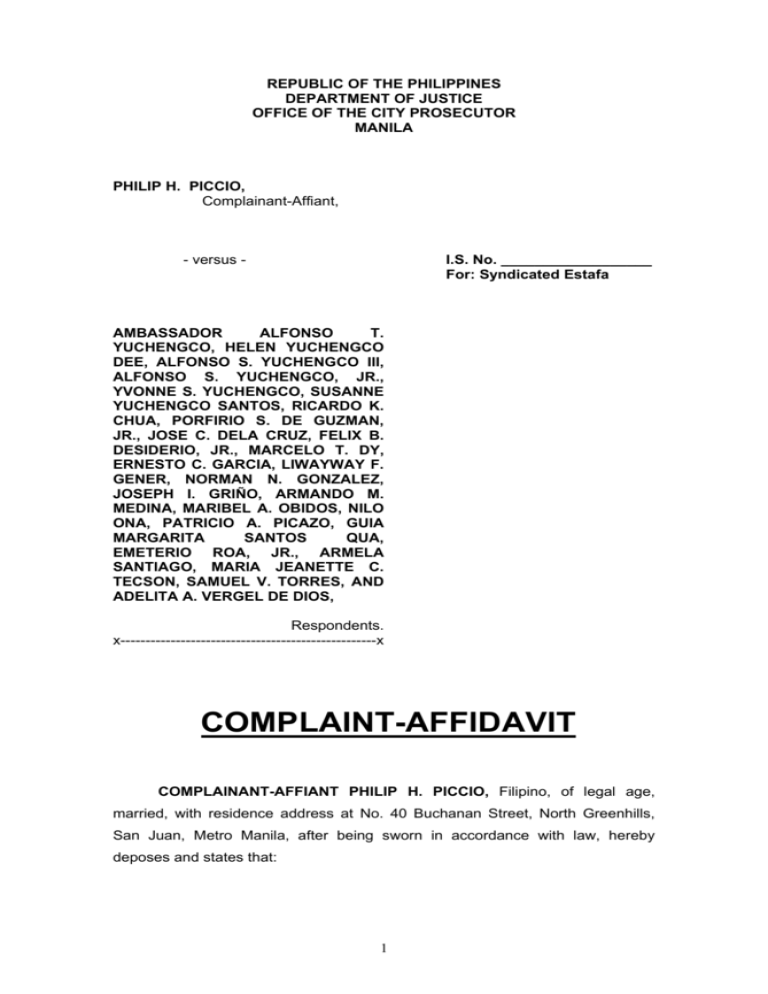

REPUBLIC OF THE PHILIPPINES DEPARTMENT OF JUSTICE OFFICE OF THE CITY PROSECUTOR MANILA PHILIP H. PICCIO, Complainant-Affiant, - versus - I.S. No. __________________ For: Syndicated Estafa AMBASSADOR ALFONSO T. YUCHENGCO, HELEN YUCHENGCO DEE, ALFONSO S. YUCHENGCO III, ALFONSO S. YUCHENGCO, JR., YVONNE S. YUCHENGCO, SUSANNE YUCHENGCO SANTOS, RICARDO K. CHUA, PORFIRIO S. DE GUZMAN, JR., JOSE C. DELA CRUZ, FELIX B. DESIDERIO, JR., MARCELO T. DY, ERNESTO C. GARCIA, LIWAYWAY F. GENER, NORMAN N. GONZALEZ, JOSEPH I. GRIÑO, ARMANDO M. MEDINA, MARIBEL A. OBIDOS, NILO ONA, PATRICIO A. PICAZO, GUIA MARGARITA SANTOS QUA, EMETERIO ROA, JR., ARMELA SANTIAGO, MARIA JEANETTE C. TECSON, SAMUEL V. TORRES, AND ADELITA A. VERGEL DE DIOS, Respondents. x---------------------------------------------------x COMPLAINT-AFFIDAVIT COMPLAINANT-AFFIANT PHILIP H. PICCIO, Filipino, of legal age, married, with residence address at No. 40 Buchanan Street, North Greenhills, San Juan, Metro Manila, after being sworn in accordance with law, hereby deposes and states that: 1 The Parties 1. Complainant-Affiant is the holder of one (1) fully paid Traditional Pacific Educational Plans (hereinafter “PEPTRAD”), described as follows: Beneficiary Paola Nicola T. Piccio Type of Plan Traditional Date & Place of Issue Dec. 18, 1990, Manila EPA No. 1085648-5 Copies of Complainant-Affiant’s respective plan and certificate are hereto attached as Annexes “A” and “B”, respectively. 2. Pacific Plans, Inc. (hereinafter “PPI”) is a domestic corporation duly organized and existing under Philippine laws, with current office address at No. 9304 Kamagong corner Dungon Sts., Barangay San Antonio, Makati City. However, during the pertinent period when the crime was committed, and as stated in its January 5, 2005 General Information Sheet (GIS) and Articles of Incorporation filed with the Securities and Exchange Commission, its principal office is located at Y Tower I, 500 Q. Paredes Street, Binondo, Manila. 3. Respondents are the Directors and/or officers of PPI who, as a syndicate consisting of more than five (5) persons, carried out the unlawful and fraudulent acts described herein. Specifically, they have defrauded herein Complainant-Affiant and other members of the general public numbering at least 34,000 planholders by: 1) falsely pretending to possess power, capability and capacity to assume the risks inherent in open-ended Traditional Educational Plans and to honor its contractual obligations to its Traditional Educational planholders “irrespective of cost at the time of availment”; and 2) inducing Complainant-Affiant and other private citizens into signing contracts for Traditional Educational Plans with PPI and parting with their hard-earned money, based on their fraudulent misrepresentation that they will assume the risks inherent in open-ended Traditional Educational Plans and honor PPI’s contractual obligations. Respondents are charged for committing the crime of Syndicated Estafa under Article 315, Par. 3(a) and Article 315, Par. 2(a) of the Revised Penal Code, as amended by P.D. 1689. 2 4. The identified members of the Board of Directors and officers of PPI from 1986, when the Company started selling and misrepresenting to the public that it will assume the risks inherent in its open-ended Traditional Educational Plans, until the present time when it reneged on its contractual obligations, are as follows: NAMES OF RESPONDENTS a) Chua, Ricardo K. b) Dee, Helen Yuchengco c) De Guzman, Porfirio S., Jr. d) Dela Cruz, Jose C. e) Desiderio, Felix B., Jr. f) Dy, Marcelo T. g) Garcia, Ernesto C. h) i) j) k) l) m) Gener, Liwayway F. Gonzalez, Norman N. Griño, Joseph I. Medina, Armando M. Obidos, Maribel A. Ona, Nilo n) Picazo, Patricio A. o) Qua, Guia Margarita Santos p) Roa, Emeterio, Jr. q) Santiago, Armela r) Santos, Susanne Yuchengco s) Tecson, Maria Jeanette C. t) Torres, Samuel V. u) Vergel de Dios, Adelita A. v) Yuchengco, Ambassador Alfonso T. w) Yuchengco, Alfonso S., Jr. x) Yuchengco, Alfonso S. III y) Yuchengco, Yvonne S. ADDRESS c/o Pacific Plans Inc., GPL Bldg., 221 Gen. Gil J. Puyat Ave., Makati City 1150 Tamarind Road, Forbes Park, Makati City 33 Soriano St., BF Homes, Parañaque City Tordesillas, Salcedo Village, Makati City c/o Pacific Plans Inc., GPL Bldg., 221 Gen. Gil J. Puyat Ave., Makati City 501 One Magnificent Mile-Citra, San Miguel Ave., Ortigas Center, Pasig City 23 Reynado St., T. Bella Homes, Tandang Sora, Quezon City 3rd Floor, Grepalife Building, 221 Gen. Puyat Ave., Makati City c/o Y Tower I, 500 Q. Paredes Street, Binondo, Manila Y Tower II, 500 Q. Paredes St., Binondo, Manila c/o Y Tower I, Q. Paredes St., Binondo, Manila Alexandra Condominium, Pasig City Y Tower II, 500 Q. Paredes St., Binondo, Manila c/o Pacific Plans Inc., GPL Bldg., 221 Gen. Gil J. Puyat Ave., Makati City c/o Pacific Plans Inc., GPL Bldg., 221 Gen. Gil J. Puyat Ave., Makati City Wack Wack Cond., Mandaluyong City 549 Greenhills, Mandaluyong City c/o Pacific Plans Inc., GPL Bldg., 221 Gen. Gil J. Puyat Ave., Makati City 47 McKinley Road, Forbes Park, Makati City 501 One Magnificent Mile-Citra, San Miguel Ave., Ortigas Center, Pasig City c/o 7th Floor, Yuchengco Tower I, RCBC Plaza, 6819 Ayala Avenue, Makati City GPL Building, 221 Gil Puyat Ave., Makati City 29 Tamarind Rd., Forbes Park, Makati City Yuchengco Drive, Pacific Malayan Village, Alabang, Muntinlupa City 1202 Salcedo Place Condominium, Tordesillas, Salcedo Village, Makati City Alexandra Condominium, Pasig City 5. This Criminal Complaint also impleads “John Does” who participated in the criminal acts described hereunder but whose exact identities and addresses cannot yet be ascertained at the present time. Complainant-Affiant undertakes to identify them during the course of these proceedings. 3 Acts Constituting Violations of Article 315 Par. 3(a) and Article 315, Par. 2(a) of the Revised Penal Code PPI and Respondents induced Complainant-Affiant and other private citizens into signing contracts for Traditional Educational Plans with PPI and parting with their money, based on their fraudulent misrepresentation that they will assume the risks inherent in open-ended Traditional Educational Plans and honor PPI’s contractual obligations. 6. Article 315, Par. 3 (a) of the Revised Penal Code states that Swindling or Estafa is committed: “3. means: Through any of the following fraudulent (a) By inducing another, by means of deceit, to sign any document….” 7. In 1986, PPI, through its Directors and Officers, sold its Traditional Educational Plan (“PEPTRAD”) to the general public. In its Educational Plan Agreement, PPI represented to the general public that, under its PEPTRAD policies, it will pay, “irrespective of cost at the time of availment”, the tuition and standard school fees for enrollment of the scholar, to wit: “In consideration of the payment of the PreNeed Price (PNP), including handling charges if any, and the fulfillment of the other terms and conditions of the Education Plan Agreement, PACIFIC guarantees to pay, irrespective of cost at the time of availment, the tuition and other standard school fees for enrollment of the SCHOLAR in the Educational Program contracted by the PLANHOLDER.” 1 (Emphasis supplied.) A copy of the PEPTRAD Educational Plan Agreement which Complainant-Affiant executed with PPI is attached hereto as Annex “A”. 1 Education Plan Agreement (Annex “A”), First Paragraph, Section I (“Consideration and Guarantees”). 4 8. In its plan-agreements, advertisements, product brochures, letterhead and other printed materials, PPI proudly carried the familiar blue hexagon logo of the Yuchengco Group of Companies (hereinafter “YGC”) and boldly identified itself as “a YGC Company”. 9. The Yuchengco Group of Companies is a formidable conglomerate of some of the country’s top corporations, which include the Malayan Group, the Grepalife Group, the Rizal Commercial Banking Corporation (hereinafter “RCBC”) Group and the House of Investments Group, under which falls the EEI Corporation, Landev Corporation, Funeraria Paz Sucat, Manila Memorial Park Cemetery, Inc. and Mapua Institute of Technology. 10. The plan-agreements, advertisements, product brochures, letterhead and other printed materials which were disseminated by PPI and its Directors and officers to the general public capitalized on the financial muscle of the Yuchengco Group of Companies and the renowned Yuchengco name to induce and entice Complainant-Affiant and numerous other planholders, numbering at least 34,000, to choose PPI’s Traditional Education Plans over comparative products offered by other pre-need companies. 11. Relying on PPI’s guarantee that it will pay, irrespective of cost at the time of availment, the tuition and standard school fees for enrollment of the scholar, Complainant-Affiant was induced to part with his hard earned money and purchase one (1) Traditional Educational Plan from PPI on March 2, 1992. a) By buying an educational plan from PPI, Complainant-Affiant obliged himself to regularly pay for the monthly premiums due and the corresponding penalties for late payments. b) PPI’s obligation, on the other hand, is stated under the Education Plan Agreement (hereinafter “EPA”), wherein PPI guaranteed that it will pay, “irrespective of cost at the time of availment”, the tuition and standard school fees for enrollment of the scholar (Annex “A”). 5 12. Complainant-Affiant invested in the PEPTRAD because he dreamt of giving his child a better future by ensuring that his child receives quality education. Little did Complainant-Affiant know that, after inveigling him to part with his hard-earned money, PPI, through its Directors and officers, will now try to avoid compliance with its contractual obligation to pay for the tuition and other standard school fees of the beneficiaries of the PEPTRAD plans. PPI fraudulently pretended to possess the power and ability to assume the risks inherent in its open-ended Traditional Educational Plans and to honor its contractual obligation to pay, “irrespective of cost at the time of availment”, the tuition and other standard school fees for enrollment of its scholars. 13. Article 315, Par. 2(a) of the Revised Penal Code states that Swindling or Estafa is committed: “2. By means of any of the following false pretenses or fraudulent acts executed prior to or simultaneously with the commission of the fraud: “(a) By using a fictitious name, or falsely pretending to possess power, influence, qualifications, property, credit, agency, business or imaginary transactions or by means of similar deceits.” (Emphasis supplied) 14. The elements of the crime of Estafa by means of deceit under Paragraph 2(a), Article 315 of the Revised Penal Code are: a) That there must be a false pretense, fraudulent act or fraudulent means; b) That such false pretense, fraudulent act or fraudulent means must be made or executed prior to or simultaneously with the commission of the fraud; c) That the offended party must have relied on the false pretense, fraudulent act, or fraudulent means; that is, he was induced to part with his money or property because of the false pretense, fraudulent act, or fraudulent means; and d) That as a result thereof, the offended party suffered damage. 6 15. All the above-mentioned elements are present in the case at bar, thus warranting the conviction of Respondents for the crime of Syndicated Estafa under Article 315, Par. 2(a) of the Revised Penal Code, as amended by P.D. 1689. 16. As stated under the Education Plan Agreement, PPI, through its Directors and officers, guaranteed that it will pay, “irrespective of cost at the time of availment”, the tuition and other standard school fees for enrollment of the scholars. This misrepresentation and false pretense that it possesses power, capacity and capability to assume the risks inherent in its open-ended Traditional Educational Plans and to honor its contractual obligations thereunder were made by PPI, through its Directors and officers, prior to or simultaneously with the commission of the fraud in order to induce Complainant-Affiant and other planholders to part with their hard-earned money. Complainant-Affiant believed in PPI’s false pretense that it would assume the risks inherent in its open-ended Traditional Educational Plans and honor its contractual obligation to shoulder the tuition and other standard school fees for enrollment of the planholders’ scholars. 17. PPI, through its Directors and officers, profusely assured Complainant-Affiant and other planholders that they made the right choice in purchasing the Traditional Educational Plans and that “no matter what the cost is, no matter what happens, (their) child is assured of education”. Thus, in its congratulatory letter to buyers of PEPTRAD plans, PPI acclaimed: “You could not have made a wiser decision when you decided to get a PACIFIC EDUCATION PLAN (PEP) for your child. In so doing, you have just made certain that no matter what the cost is, no matter what happens, your child is assured of education. THIS PLAN IS AN INHERITANCE OF KNOWLEDGE THAT YOU ARE HANDING TO YOUR CHILD. IT IS OF INESTIMABLE VALUE. THERE CAN BE NO GREATER GIFT. PACIFIC EDUCATION PLAN offers more than just an education. It assures your child’s future and everything that comes with it.” (Emphasis supplied.) A copy of a sample congratulatory letter from PPI is attached hereto as Annex “C”. 7 18. The Education Plan Agreement or PEPTRAD policy itself expressly guarantees as follows: “In consideration of the payment of the PreNeed Price (PNP), including handling charges if any, and the fulfillment of the other terms and conditions of the Education Plan Agreement, PACIFIC guarantees to pay, irrespective of cost at the time of availment, the tuition and other standard school fees for enrollment of the SCHOLAR in the Educational Program contracted by the 2 PLANHOLDER.” (Emphasis supplied.) A copy of the PEPTRAD Educational Plan Agreement which Complainant-Affiant executed with PPI is attached hereto as Annex “A”. 19. The policy likewise provided for other benefits, such as cash awards for scholastic achievement and insurance benefits (Please see ComplainantAffiant’s PEPTRAD Education Plan Agreement attached hereto as Annex “A”.) 20. Complainant-Affiant and the other planholders scrimped, saved and/or borrowed to meet payments due on their respective PEPTRAD policies, which are comparatively more expensive than the fixed value plans, in order to avoid cancellation of the plans and forfeiture of their payments. 21. Any planholder who failed to pay any installment, regardless of the reason for such failure to pay, was subjected to the following penalty provisions of the Education Plan Agreement: “VIII. GRACE PERIOD PLANHOLDER is given a grace period of two (2) months within which to pay any installment due. If any installment remains unpaid beyond the grace period, this Agreement shall be considered of no force and effect. However, the PLANHOLDER shall be allowed to reinstate this Agreement within a period of two (2) years from date of default. Otherwise, this Agreement shall be considered automatically cancelled and all payments shall be forfeited in favor of PACIFIC as liquidated damages.” 3 2 3 Education Plan Agreement (Annex “A”), First Paragraph, Section I (“Consideration and Guarantees”). Education Plan Agreement (Annex “A”), Section VIII. 8 Furthermore, reinstatement was conditioned upon full payment of all overdue installments with surcharge from due date at the rate of 18% per annum.” 4 22. On June 9, 2004, the Board of Directors of PPI, who included some of the Respondents herein, passed a Board Resolution approving the sale of PPI’s memorial, pension and fixed educational plans to Lifetime Plans, Inc., in exchange for shares of stock in said corporation. 23. Subsequently, on August 12, 2004, Lifetime Plans was incorporated as a wholly-owned subsidiary of PPI via an asset-for-share swap. PPI assigned to Lifetime Plans all its pre-need plans businesses (except the long-discontinued PEPTRAD) in exchange for one million (1,000,000) shares of stock of Lifetime Plans, with a total par value of One Hundred Million Pesos (Php100,000,000.00). A copy of PPI’s 2005 audited Financial Statements (which contain its audited Financial Statements for the Years 2004 and 2005) is attached hereto as Annex “D”. 24. Sometime in August, 2004, PPI, through its Board of Directors, approved the sale of all its shares of stock in Lifetime Plans to PPI’s own parent company, GPL Holdings, Inc., at a purchase price of only Php205,137,860.00. PPI, therefore, violated its representation to the SEC that Lifetime Plans would be a wholly-owned subsidiary of PPI. Moreover, PPI did not receive a centavo of the Php205,137,860.00 purchase price in cash. In his Affidavit of General Financial Condition, 5 PPI’s incumbent President/Chairman Ernesto C. Garcia explained that the Php205,137,860.00 purchase price was offset against an alleged liability of PPI to GPLHI. 6 Strangely, however, while GPLHI is the parent company of PPI and is clearly a related party to the latter, no mention of any such alleged liability of PPI to GPLHI appears in the auditor’s notes on “Related Party Transactions” in either the 2003 or 2004 audited Financial Statements of PPI. Moreover, neither PPI nor Lifetime Plans disclosed to the SEC that PPI was about to transfer its entire shareholdings in Lifetime Plans. 4 5 6 Ibid, Section IX(3). PPI’s Petition for Corporate Rehabilitation with Prayer for Suspension of Payments, Annex “E”. Ibid., page 6, item 17C. 9 25. By virtue of the foregoing transfers and misappropriation of funds, trust funds and assets from PPI to Lifetime Plans, PPI, through its Directors and Officers, self-engineered its state of “financial distress” and artificially contrived a “liquidity problem” for PPI to support its Petition for Corporate Rehabilitation and Suspension of Payments and effectively deny Complainant-Affiant and the other planholders of their full rights under their Traditional Educational Plans. 26. Thus, on March 31, 2005, the members of the Board of Directors of PPI, who include some of the Respondents herein, passed a Board Resolution approving the filing of a Petition for Corporate Rehabilitation with Suspension of Payments in court. Subsequently, on April 7, 2005, without prior notice to the planholders, PPI filed said Petition in Special Proceedings No. M-6059 before Branch 61 of the Regional Trial Court of Makati City. A copy of said Petition is attached hereto as Annex “E”. 27. In Special Proceedings No. M-6059, PPI, through its Directors and Officers, seeks to impose upon PEPTRAD planholders a mandatory swap at a lower yield of seven percent per annum (7% p.a.) to mature and be paid-out date in the year 2010. 28. This clearly deviates from the agreement of the parties, as stated in the Educational Plan Agreement (Annex “A”), that “PACIFIC guarantees to pay, irrespective of cost at the time of availment, the tuition and other standard school fees for enrollment of the SCHOLAR in the Educational Program contracted by the PLANHOLDER” 7 29. Thus, after swindling the planholders off their hard-earned money, PPI, through its Directors and Officers, now tries to avoid compliance with its contractual obligations. The fraudulent scheme perpetrated by PPI was severely criticized by SEC on pages 49-55 of its Comment dated May 16, 2005 which it filed in Special Proceedings No. M-6059, stating: a) that PPI’s Petition for Corporate Rehabilitation filed before the RTC of Makati City is “part of a predesigned plan of Pacific”; b) that “the series of dispositions and acquisitions by Pacific vis a vis its related companies is a FRAUDULENT SCHEME to keep its assets away from the reach of the traditional planholders”; and c) that PPI has been guilty of bad faith in its dealings with SEC and the BIR, to wit: 7 Express guarantee of PPI in the Education Plan Agreement or PEPTRAD policy (Annex “A”), which PPI itself drafted. 10 “The sequence of actions undertaken by Pacific prior to its filing of the instant petition plainly shows that this petition is part of a pre-designed plan of Pacific to relieve release of its not so profitable business, which is the traditional education plans… The hasty recourse to this Court appears to be a ploy on the part of Pacific to Elude SEC intervention and enable it to force its Swap Offer to the planholders in the guise of a rehabilitation proceedings. With the filing of the instant petition, Pacific simple wanted to tie the hands of the SEC so that it can no longer pursue administrative measures to protect the investors, as it has been duty bound to do… The series of dispositions and acquisitions by Pacific vis-à-vis its related companies is a FRAUDULENT SCHEME to keep its assets away from the reach of traditional planholders… This, in addition to the abovementioned actions by Pacific, exhibits the company’s BAD FAITH in its dealings with the SEC and BIR…” 8 (Emphasis supplied) A copy of SEC’s Comment dated May 16, 2005 is attached hereto as Annex “F”. 30. Subsequently, in an Order dated 24 May 2005 and a Resolution dated 24 June 2005, the SEC en banc revoked the Certificate of Incorporation of Lifetime Plans, Inc., in recognition of the said corporation’s role in the fraudulent transfer of PPI assets to put them beyond the reach of the rightful beneficiaries: the planholders. Copies of the SEC’s Order dated 24 May 2005 and the Resolution dated 24 June 2005 are hereto attached and made an integral part hereof as Annexes “G” and “H”. 31. Now, PPI, through its Directors and Officers, conveniently claims that it can no longer comply with its obligation to “pay, irrespective of cost at the time of availment, the tuition and standard school fees for enrollment of the scholar,” to the prejudice of Complainant-Affiant and other planholders who have religiously complied with their obligation to pay their monthly premiums. Consequently, Complainant-Affiant suffered actual damage and sleepless nights, resulting from the non-payment of the full tuition fees and other standard school fees for School Year 2005-2006. 8 Securities and Exchange Commission COMMENT dated 16 May 2005 (Annex “F), pp. 4955. 11 32. While PPI, through its Directors and Officers, claims that it is “illiquid” and, therefore, needs to suspend payment to its planholders, its own audited Financial Statements for the Years 2004 and 2005 show otherwise. Indeed, PPI’s own audited Financial Statements for the Years 2004 and 2005 will show that PPI is liquid and solvent. They also show that PPI’s Trust Fund has a positive variance when compared to its Actuarial Reserve Liability, thus evincing that it has sufficient funds to pay the benefits due its planholders and that it has sufficient liquid assets to pay the same within the maturity periods of the plans. A copy of PPI’s 2005 audited Financial Statements (which contain its audited Financial Statements for the Years 2004 and 2005) is attached hereto as Annex “D”. 33. That PPI is indeed liquid and solvent is confirmed by no less than the Securities and Exchange Commission, the supervisory arm of the Philippine Government, which reported on pages 32-49 of its Comment dated May 16, 2005 filed in Special Proceedings No. M-6059 (a copy of which is attached as Annex “F” hereof) that: a) “(P)er the documents submitted to the SEC in compliance with its reportorial obligations, Petitioner is solvent and liquid. Thus, resort to corporate rehabilitation is not necessary” (See page 49 of SEC’s Comment attached as Annex “F” hereof); b) PPI is a “financially stable corporation capable of meeting its obligations as they fall due” (See page 46 of SEC’s Comment attached as Annex “F” hereof); c) PPI’s 2004 audited Financial Statements show that, as of December 2004: 1) its assets exceeded its liabilities and it had a Solvency Ratio of 1.24:1.0; 2) its current assets exceeded its current liabilities and it had a Liquidity Ratio of 1.77: 1 (See pages 33 and 47 of SEC’s Comment attached as Annex “F” hereof); 12 d) “(A)s of December 2004, PPI exceeded its Trust Fund Liquidity Reserve Requirement by P3,772,485,371.66”. (See page 33 of SEC’s Comment attached as Annex “F” hereof); e) “The company has been declaring stock and cash dividends since 1989”. (See page 40 of SEC’s Comment attached as Annex “F” hereof); f) Based on the Table of Projected Benefits and Trust Fund Contributions submitted by PPI on October 29, 2004, PPI is capable of meeting its projected obligations until the year 2014. According to SEC, “in fact, its trust fund exceeds its projected benefits by P1,209,062,409.26, which does not even include interest income that should accrue annually on the trust fund and possible foreign exchange gain that may be earned by the Napocor bonds, the main asset of the trust fund.” (See pp. 47-48 of Comment attached as Annex “F” hereof). 34. Based on the foregoing findings by SEC, PPI is not a “financially distressed corporation”, as it misrepresents itself to be. SEC, therefore, concluded that: “All these audit findings reveal a healthy financial status of Pacific…and its deliberate attempt to evade the payment of its contractual obligations by diverting its funds to the payment of dividends to its stockholders to the prejudice of the planholders.” ((See page 45 of SEC’s Comment attached as Annex “F” hereof). 35. Pursuant to the Order dated April 12, 2005 issued by the Court in Special Proceedings No. M-6059, PPI released tuition support for the first semester of School Year 2005-2006. Such tuition support, however, fell short of the full tuition and PPI’s contractual obligation to pay “irrespective of cost at the time of availment”. Likewise, little or no tuition support was given for the second semester of school year 2005-2006. Consequently, Complainant-Affiant suffered actual damage and sleepless nights, resulting from the non-payment of the full tuition fees and other standard school fees for School Year 2006-2005. The tuition and other standard school fees for enrollment of the planholders’ 13 designated scholars which PPI failed to pay, thus causing damage and prejudice to herein Complainant-Affiant, are as follows: Beneficiary Paola Nicola T. Piccio Tuition Support P28,000.00 Actual Tuition P32,000.00 Balance P4,000.00 A copy of the tuition fee receipt in support of the foregoing is hereto attached and made an integral part hereof as Annex “I”. 36. Despite repeated demands made by Complainant-Affiant and other planholders, PPI, through its Directors and Officers, continues to fail and refuse to comply with its contractual obligation under the Education Plan Agreement, wherein it guaranteed to pay “irrespective of cost at the time of availment”, the tuition and other standard school fees for enrollment of the scholars (Annex “A”). D. Elements of Syndicated Estafa under PD 1689 37. Presidential Decree No. 1689 9 (hereinafter “PD 1689”) increases the penalty of Swindling or Estafa which is committed by a syndicate consisting of five or more persons. The elements of the crime are as follows: a. Estafa or other forms of swindling as defined in Articles 315 and 316 of the Revised Penal Code is committed; b. The estafa or swindling is committed by a syndicate; c. Defraudation results in the misappropriation of moneys contributed by stockholders, or members of rural banks, cooperatives, "samahang nayon(s)," or farmers associations, or of funds solicited by corporations/associations from the general public. 10 38. All the above-mentioned elements are present in the case at bar, thus warranting the application of PD 1689 with the consequent increase in the penalty to life imprisonment to death. 9 10 P.D. No. 1689 – Increasing the Penalty for Certain Forms of Swindling or Estafa. Bobis, et al. v. The Provincial Sheriff of Camarinas Norte, G.R. No. L-29838. March 18, 1983. 14 a) As already discussed earlier, Estafa under Article 315 of the Revised Penal Code has been committed by PPI and Respondents through their fraudulent representations and machinations in order to avoid compliance with PPI’s contractual obligations. b) PD 1689 defines a syndicate as "consisting of five or more persons formed with the intention of carrying out the unlawful or illegal act, transaction, enterprise or scheme." Here, Respondents number more than five (5), acting together to defraud herein Complainant-Affiant and other PEPTRAD planholders. c) Respondents’ acts amounted to a defraudation resulting in the misappropriation of funds solicited by corporations/associations from the general public: i. As a pre-need company, PPI operated on funds solicited from the general public to whom it marketed its products. ii. The Supreme Court has ruled that to be criminally liable under PD 1689, one need not necessarily threaten the economic stability of the nation; it is enough that the acts complained of contravenes public interest: “Assuming arguendo that the preamble was part of the statute, appellants' contention that they should not be held criminally liable because it was not proven that their acts constituted economic sabotage threatening the stability of the nation remains too flimsy for extensive discussion. As the preamble of P.D. No. 1689 shows, the act prohibited therein need not necessarily threaten the stability of the nation. It is sufficient that it "contravenes public interest." Public interest was affected by the solicitation of deposits under a promise of substantial profits, as it was people coming from the lower income 15 brackets who were victimized by the illegal scheme.” 11 iii. The perpetration by PPI of its scheme to eschew its clear contractual obligation has eroded the public confidence in pre-need companies, precipitating the demise of the pre-need industry in our country. Respondents’ acts, therefore, contravened public interest because they victimized at least 34,000 planholders, thus resulting in the erosion of public confidence in the pre-need industry. iv. The SEC has confirmed that “Pacific is not an ordinary corporation. Its business activity is imbued with public interest considering that its clients are the innocent investors, parents mostly who pay their hardearned money to these pre-need companies in order to secure the education of their children.” (See page 51 of SEC’s Comment dated May 16, 2005, attached as Annex “F” hereof.) 39. As clearly established above, the elements of PD 1689 are all present in this case, hence, warranting the imposition of the increase in the penalty of the crime to life imprisonment to death, with the consequence of having the offense elevated to a non-bailable offense. 40. Considering that PPI is a corporation, the case of Prudential Bank vs. IAC 12 clearly states that “It is clear that if the violation or offense is committed by a corporation, partnership, association or other juridical entities, the penalty shall be imposed upon the directors, officers, employees or other officials or persons therein responsible for the offense.” 41. The crime of Estafa committed herein was committed as early as 1990 and continues until the present time, and the same may be tried in the court of the municipality or territory wherein any one of the essential ingredients thereof took place. 11 12 People v. Balasa, et al., G.R. No. 106357. September 3, 1998. December 1992. 16