3. Making a payment claim

advertisement

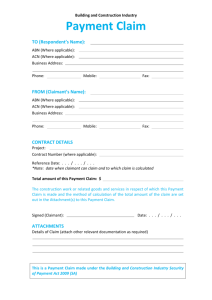

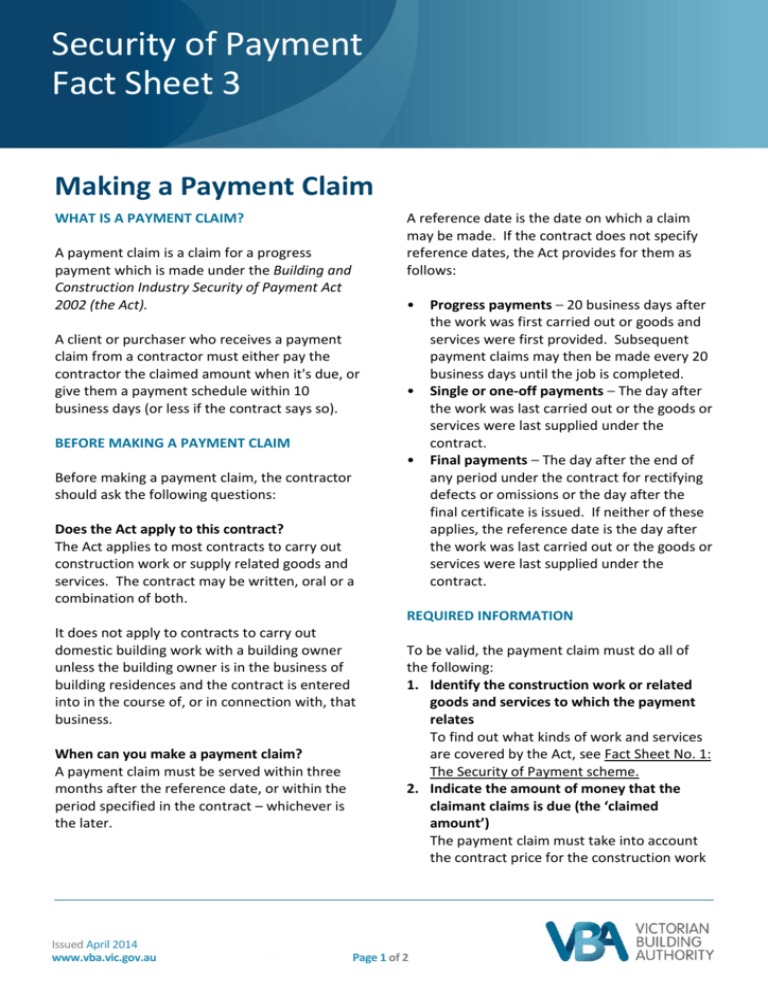

Security of Payment Fact Sheet 3 Making a Payment Claim WHAT IS A PAYMENT CLAIM? A reference date is the date on which a claim may be made. If the contract does not specify reference dates, the Act provides for them as follows: A payment claim is a claim for a progress payment which is made under the Building and Construction Industry Security of Payment Act 2002 (the Act). • A client or purchaser who receives a payment claim from a contractor must either pay the contractor the claimed amount when it's due, or give them a payment schedule within 10 business days (or less if the contract says so). • BEFORE MAKING A PAYMENT CLAIM • Before making a payment claim, the contractor should ask the following questions: Does the Act apply to this contract? The Act applies to most contracts to carry out construction work or supply related goods and services. The contract may be written, oral or a combination of both. Progress payments – 20 business days after the work was first carried out or goods and services were first provided. Subsequent payment claims may then be made every 20 business days until the job is completed. Single or one-off payments – The day after the work was last carried out or the goods or services were last supplied under the contract. Final payments – The day after the end of any period under the contract for rectifying defects or omissions or the day after the final certificate is issued. If neither of these applies, the reference date is the day after the work was last carried out or the goods or services were last supplied under the contract. REQUIRED INFORMATION It does not apply to contracts to carry out domestic building work with a building owner unless the building owner is in the business of building residences and the contract is entered into in the course of, or in connection with, that business. When can you make a payment claim? A payment claim must be served within three months after the reference date, or within the period specified in the contract – whichever is the later. Issued April 2014 www.vba.vic.gov.au To be valid, the payment claim must do all of the following: 1. Identify the construction work or related goods and services to which the payment relates To find out what kinds of work and services are covered by the Act, see Fact Sheet No. 1: The Security of Payment scheme. 2. Indicate the amount of money that the claimant claims is due (the ‘claimed amount’) The payment claim must take into account the contract price for the construction work Page 1 of 2 Fact Sheet 3 or supply of related goods and services, any other rates or prices set out in the contract and the estimated cost of rectifying any defect. Your payment claim may include claimable variations but not excluded amounts. For more information about these amounts, see Fact Sheet No. 4: Claimable variations and excluded amounts. 3. Include the ‘Security of Payment Statement’ The payment claim must notify the respondent that it is made under the Act. It should say: ‘This is a payment claim under the Building and Construction Industry Security of Payment Act 2002’. Serving a copy on the respondent A copy of the payment claim must be served on the client or purchaser (the ‘respondent’) in one of the following ways: • Delivered in person. It is ‘served’ when the respondent receives it. • Lodged during business hours at the respondent’s ordinary place of business. It is ‘served’ when it is received at that address. • Sent by post to the respondent’s ordinary place of business. It is ‘served’ two business days after the day it is posted. • Faxed to the respondent’s ordinary place of business. It is ‘served’ at the time it is received unless it is received after 4pm. If it is received after 4pm, it is taken to have been ‘served’ on the next business day. • Provided in any other manner specified in the contract. Issued April 2014 www.vba.vic.gov.au Page 2 of 2