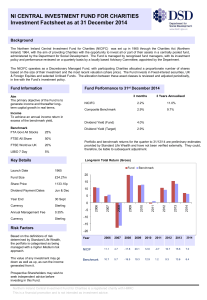

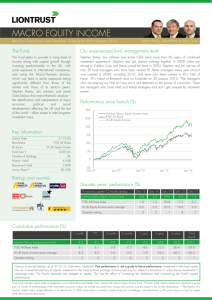

International GPS Dividend Equity Fund

advertisement

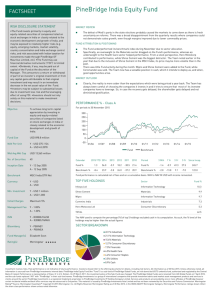

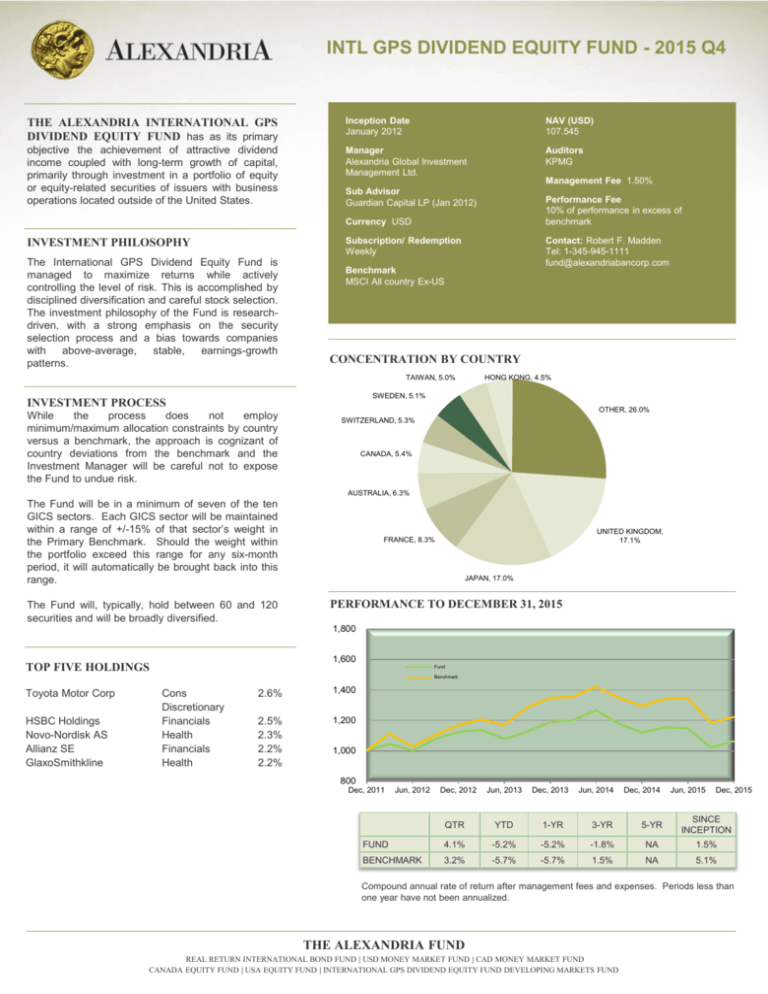

INTL GPS DIVIDEND EQUITY FUND - 2015 Q4 THE ALEXANDRIA INTERNATIONAL GPS DIVIDEND EQUITY FUND has as its primary Inception Date January 2012 NAV (USD) 107.545 objective the achievement of attractive dividend income coupled with long-term growth of capital, primarily through investment in a portfolio of equity or equity-related securities of issuers with business operations located outside of the United States. Manager Alexandria Global Investment Management Ltd. Auditors KPMG Management Fee 1.50% Sub Advisor Guardian Capital LP (Jan 2012) Performance Fee 10% of performance in excess of benchmark Currency USD Subscription/ Redemption Weekly INVESTMENT PHILOSOPHY The International GPS Dividend Equity Fund is managed to maximize returns while actively controlling the level of risk. This is accomplished by disciplined diversification and careful stock selection. The investment philosophy of the Fund is researchdriven, with a strong emphasis on the security selection process and a bias towards companies with above-average, stable, earnings-growth patterns. Contact: Robert F. Madden Tel: 1-345-945-1111 fund@alexandriabancorp.com Benchmark MSCI All country Ex-US CONCENTRATION BY COUNTRY TAIWAN, 5.0% HONG KONG, 4.5% SWEDEN, 5.1% INVESTMENT PROCESS While the process does not employ minimum/maximum allocation constraints by country versus a benchmark, the approach is cognizant of country deviations from the benchmark and the Investment Manager will be careful not to expose the Fund to undue risk. OTHER, 26.0% SWITZERLAND, 5.3% CANADA, 5.4% AUSTRALIA, 6.3% The Fund will be in a minimum of seven of the ten GICS sectors. Each GICS sector will be maintained within a range of +/-15% of that sector’s weight in the Primary Benchmark. Should the weight within the portfolio exceed this range for any six-month period, it will automatically be brought back into this range. The Fund will, typically, hold between 60 and 120 securities and will be broadly diversified. UNITED KINGDOM, 17.1% FRANCE, 8.3% JAPAN, 17.0% PERFORMANCE TO DECEMBER 31, 2015 1,800 1,600 TOP FIVE HOLDINGS Fund Benchmark Toyota Motor Corp HSBC Holdings Novo-Nordisk AS Allianz SE GlaxoSmithkline Cons Discretionary Financials Health Financials Health 2.6% 1,400 2.5% 2.3% 2.2% 2.2% 1,200 1,000 800 Dec, 2011 Jun, 2012 Dec, 2012 Jun, 2013 Dec, 2013 Jun, 2014 Dec, 2014 Jun, 2015 Dec, 2015 QTR YTD 1-YR 3-YR 5-YR SINCE INCEPTION FUND 4.1% -5.2% -5.2% -1.8% NA 1.5% BENCHMARK 3.2% -5.7% -5.7% 1.5% NA 5.1% Compound annual rate of return after management fees and expenses. Periods less than one year have not been annualized. THE ALEXANDRIA FUND REAL RETURN INTERNATIONAL BOND FUND | USD MONEY MARKET FUND | CAD MONEY MARKET FUND CANADA EQUITY FUND | USA EQUITY FUND | INTERNATIONAL GPS DIVIDEND EQUITY FUND DEVELOPING MARKETS FUND