Fundamental Research - May 3 2013

advertisement

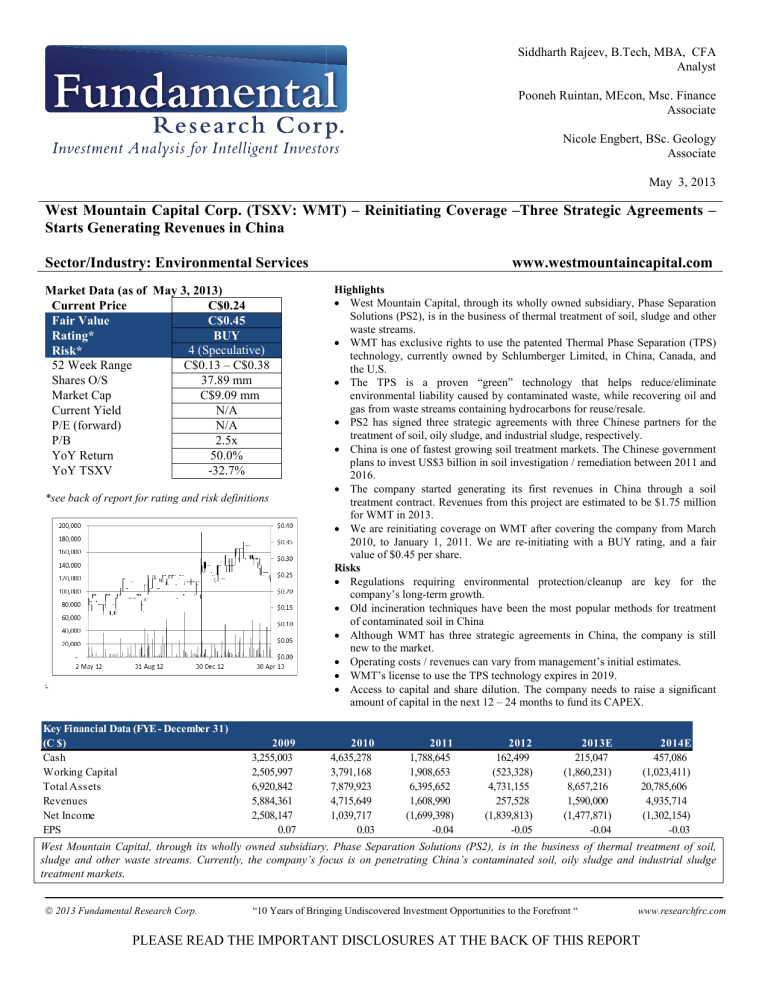

Siddharth Rajeev, B.Tech, MBA, CFA Analyst Pooneh Ruintan, MEcon, Msc. Finance Associate Nicole Engbert, BSc. Geology Associate May 3, 2013 West Mountain Capital Corp. (TSXV: WMT) – Reinitiating Coverage –Three Strategic Agreements – Starts Generating Revenues in China Sector/Industry: Environmental Services Market Data (as of May 3, 2013) Current Price C$0.24 Fair Value C$0.45 Rating* BUY 4 (Speculative) Risk* 52 Week Range C$0.13 – C$0.38 Shares O/S 37.89 mm Market Cap C$9.09 mm Current Yield N/A P/E (forward) N/A P/B 2.5x YoY Return 50.0% YoY TSXV -32.7% *see back of report for rating and risk definitions . Key Financial Data (FYE - December 31) (C $) Cash Working Capital Total Assets Revenues Net Income EPS 2009 3,255,003 2,505,997 6,920,842 5,884,361 2,508,147 0.07 www.westmountaincapital.com Highlights • West Mountain Capital, through its wholly owned subsidiary, Phase Separation Solutions (PS2), is in the business of thermal treatment of soil, sludge and other waste streams. • WMT has exclusive rights to use the patented Thermal Phase Separation (TPS) technology, currently owned by Schlumberger Limited, in China, Canada, and the U.S. • The TPS is a proven “green” technology that helps reduce/eliminate environmental liability caused by contaminated waste, while recovering oil and gas from waste streams containing hydrocarbons for reuse/resale. • PS2 has signed three strategic agreements with three Chinese partners for the treatment of soil, oily sludge, and industrial sludge, respectively. • China is one of fastest growing soil treatment markets. The Chinese government plans to invest US$3 billion in soil investigation / remediation between 2011 and 2016. • The company started generating its first revenues in China through a soil treatment contract. Revenues from this project are estimated to be $1.75 million for WMT in 2013. • We are reinitiating coverage on WMT after covering the company from March 2010, to January 1, 2011. We are re-initiating with a BUY rating, and a fair value of $0.45 per share. Risks • Regulations requiring environmental protection/cleanup are key for the company’s long-term growth. • Old incineration techniques have been the most popular methods for treatment of contaminated soil in China • Although WMT has three strategic agreements in China, the company is still new to the market. • Operating costs / revenues can vary from management’s initial estimates. • WMT’s license to use the TPS technology expires in 2019. • Access to capital and share dilution. The company needs to raise a significant amount of capital in the next 12 – 24 months to fund its CAPEX. 2010 4,635,278 3,791,168 7,879,923 4,715,649 1,039,717 0.03 2011 1,788,645 1,908,653 6,395,652 1,608,990 (1,699,398) -0.04 2012 162,499 (523,328) 4,731,155 257,528 (1,839,813) -0.05 2013E 215,047 (1,860,231) 8,657,216 1,590,000 (1,477,871) -0.04 2014E 457,086 (1,023,411) 20,785,606 4,935,714 (1,302,154) -0.03 West Mountain Capital, through its wholly owned subsidiary, Phase Separation Solutions (PS2), is in the business of thermal treatment of soil, sludge and other waste streams. Currently, the company’s focus is on penetrating China’s contaminated soil, oily sludge and industrial sludge treatment markets. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 2 Company Overview Headquartered in St. John's, Newfoundland, West Mountain Capital, through its wholly owned subsidiary, Phase Separation Solutions (PS2), is in the business of thermal treatment of soil, sludge and other waste streams. The company has exclusive rights to use the patented Thermal Phase Separation (TPS) technology for hazardous waste decontamination treatment services in Canada, China and the U.S. Unlike incineration (directly burning contaminated materials), one of the most commonly adopted methods of waste disposal, the TPS technology produces no harmful air emissions. The main advantages of the TPS technology are that it reduces/eliminates environmental liability caused by contaminated waste, while recovering oil and gas from waste streams containing hydrocarbons for reuse/resale. Although incineration and land filling have been the primary ways of waste disposal for decades, the growing importance of environmental protection, real-estate prices, and the need to recover value from brownfield sites (land that is abandoned / underused due to environmental contamination) is increasing demand for “green” technologies, such as TPS. PS2 started generating revenues from soil treatment in 2005, at its facility in Wolseley, Saskatchewan. The PCB (Polychlorinated Biphenyl) contaminated soil treatment market in Canada, one of the company’s main focus at that time, was an oligopoly, dominated by PS2 and a bigger company, BENEV Capital Inc. (TSX: BEV; Market Capitalization - $60.03 million as of April 26, 2013). The PCB market in Canada got a big boost in late 2008, when the Canadian Federal Government came out with new regulations to remove all stored PCB soils in federally registered storage facilities by the end of 2009 (later extended to 2011). As a result, 2009, and 2010, were very strong years financially for WMT. However, the company’s business slowed considerably in 2011, due to the limited remaining volume of PCB contaminated soil, and the end of the regulatory deadline for the removal of PCB stockpiles in Canada Foreseeing the declining market in Canada, in 2010, WMT entered the Chinese remediation market and announced three strategic joint venture agreements. The first agreement was with the Nanjing Institute of Environmental Sciences (NIES) of the State Environmental Protection Agency, Ministry of Environmental Protection (MEP), to establish a 50/50 partnership. Subsequently, in August 2012, the two firms signed a contract with Hangzhou DADI Environmental Protection Engineering Company Ltd. for the treatment of 33,000 tonnes of pesticide contaminated soil in Hangzhou, China. The operations started in December 2012. The second agreement was with a private company (signed in August 2010), Zhoushan Nahai Solid Waste Central Disposal Co. Ltd. (Nahai), to establish a 50/50 partnership to build an oily sludge waste treatment facility in Zhoushan, Zhejiang province. The facility would process and recover oil from the oily sludge waste generated from oil storage operations, and oil tanker cleaning activities in the region. In 2012, the company signed their third agreement; this was with another private company called Huafu Environmental Engineering Company (“Huafu”), for the treatment of hazardous industrial sludge in Changquing dictrict, Shandong province. The three strategic agreements have given WMT a great opportunity to tap into China’s potentially huge and developing environmental remediation market - which, 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 3 we believe, will be the company’s key growth driver going forward. Thermal Phase Solution (TPS) Technology The company’s management team acquired the Thermal Phase Separation (TPS) technology from an Alberta-based company (Trimac Transportation – TSX: TMA - one of the largest providers of bulk transportation services in North America) in the 1990s. Management further developed the technology, and eventually sold it to M-I Swaco of Houston, TX (now owned by Schlumberger Limited - NYSE: SLB) in 1999. Since the acquisition, M-I Swaco has been using the technology exclusively for the treatment of drilling mud, and cuttings generated by the oil and gas industry. In 2002, PS2 licensed the technology from M-I Swaco, wherein PS2 received exclusive rights to use the technology, in Canada and the U.S., for all types of hazardous and nonhazardous waste streams, until 2012. In return, PS2 paid an initial licensing fee of $61,460, and agreed to pay a royalty of US$10 per tonne of material processed, after the first 15,000 tonnes, or for any material processed after October 31, 2008. In 2008, M-I Swaco agreed to extend the expiry date of the license to 2019, and in 2009, granted PS2 the exclusive rights to use the technology in China as well. The royalty payment due to Schlumberger for the use of TPS in China has not been finalized at this moment. Management indicated that a final decision will be made in the coming weeks. The technology is patented in the U.S. and Canada, but not in China. WMT had to still license the technology as TPS is trademarked and owned by Schlumberger. Note that there is a risk that Schlumberger might not extend the license after 2019. Details of the technology: TPS is a type of Thermal Desorption Unit (TDU). Thermal desorption is a non-incineration technology that utilizes heat to remove contaminants from solid matrices such as soil or sludge. Thermal desorption units are classified into two categories: batch-feed and continuous feed (or closed loop). For a batch-feed system, as the name suggests, waste streams are fed into a facility in batches. As for a continuous-feed system, large waste streams can be fed continuously and treated. TPS is a continuous feed (closed loop) indirectly heated thermal desorption unit, capable of separating hydrocarbons, with boiling points up to 500 ºC, in two stages. Stage 1: Desorption / Pyrolization - In this stage, contaminated feedstock is fed into an extraction chamber; which is indirectly heated by a heated combustion chamber using fuel. The heat in the combustion chamber is transferred to the extraction chamber, and then to the feedstock. The significant increase in temperature results in volatilization of organic hydrocarbons, to form gases. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 4 A schematic representation of the TPS Source: West Mountain Capital Stage 2 involves condensation – In this stage, the formed gases in Stage 1 are first cooled (using water), and the resulting liquid stream is passed through a three-phase oil/water/solids separator where : a) the separated solids are re-hydrated, collected, analyzed, and released for landfilling or for use as backfill material. b) oil is recovered, and held for reuse/resale; also, non-condensable gases are recovered and reused by the TPS as fuel c) recovered water, in most cases, is treated and returned to the system for reuse. Traditional management of contaminated soil/industrial sludge, and other wastes, involves incineration or landfilling (burying waste under the ground) techniques. The main benefits of the TPS technology compared to these techniques are: • • • TPS treatment produces significantly less greenhouse gas emissions compared to incineration, as TPS does not involve direct combustion. Incineration, on the other hand, is widely criticized due to its emissions. TPS treatment of hydrocarbon-based industrial sludge and other wastes enables the recovery of oil that can be reused or sold. According to WMT, TPS is the only technology of its kind capable of extracting up to 90% oil by volume from industrial waste, paint and pharmaceutical waste. Compared to landfilling techniques, the TPS technology results in a 85% decrease in 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 5 waste volume, reducing the need for landfill sites. Also, landfilling is a temporary solution as it does not destroy the contaminants. Although the TPS technology has significant advantages over traditional techniques used for waste management, the technology can compete efficiently in only those applications/regions where - a) it is cost-competitive compared to its competitors, or b) government policies require proper treatment of waste. The technology is proven, and according to management, has already been applied to treat hundreds of thousands of tonnes of contaminated material worldwide. The technology has so far been used in Australia, the U.S., Japan, U.A.E., Russia, Kazakhstan, Algeria, Bolivia, Ecuador, and Argentina (Source: Management). In 2011, TPS was selected as one of five technologies from around the world to present at the Beijing United Nations Industrial Development Organization (UNIDO) conference. As for Canada, the company started with a fixed facility at Wolseley, Saskatchewan, which became operational in late 2005, and was fully commissioned in early 2006. Although the TPS technology was originally developed as a mobile, onsite remedial technology, the company decided to deploy the technology at a fixed facility because of its cost advantages (economies of scale). The company strategically chose Wolseley, Saskatchewan, so that it could target both eastern and western Canadian markets, and the U.S. The facility operated in 2009-2010, but is currently not operating significantly. Source: West Mountain Capital One of the main advantages of this facility is that it is one of the most broadly permitted (because of a wide range of applications), and flexible, non-incineration facilities in Canada. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 6 The Wolseley Facility is also one of only three fixed facilities in Canada permitted for the treatment of large volumes of PCB and dioxin/furan impacted soil. The facility has an annual treatment capacity of up to 20,000 tonnes. The following table shows a list of potential applications: Facility Capabilities Tank Sludge Paint Sludge Petrochemical Sludge Refining Catalyst Solvent Distillation Sludge PCBs Dioxin/Furan PERC PAH/Creosote Waste Pharmaceuticals TPS’s primary applications are listed below: Contaminated Soil - Contaminates generally comprise less than 0.75% of the volume of the soil. The TPS technology can be applied for treatment of a large volume of soil contaminated with PCBs, chlorinated organics (such as dioxins and furans), DDT and other pesticides. Sludge – PS2’s target in this sector is any hazardous hydrocarbon-based material that has greater than 50% hydrocarbons, and large volume of recoverable oil. Competing Technologies / Processes The following section highlights the advantages / disadvantages of the various technologies / processes used for soil / sludge treatment: Incineration: There are two types of incineration - old (uncontrolled) and modern (state-ofthe-art). Old incineration is a burning process without energy recovery, while modern incineration is an environmental-friendly process equipped with pollution control devices. In China, incineration is the most popular method of waste treatment. Compared to TPS, according to management, the operating cost of an uncontrolled (non-environmentally benign) incineration method in China is about $20/tonne less than the TPS, and the operating cost of a modern incinerator is about three times higher than TPS. Therefore, based on efficiency and costs, we believe TPS technology has competitive advantages over both methods of incineration. Micro-Organism Remediation: This technology uses micro-organism metabolism to transform pollutants in to easily degradable substances. However, this method has low efficiency. Also, if the process is not controlled, it is possible that organic contaminants may not be broken down fully, resulting in toxic by-products. Moreover, the process has a long duration of treatment time. Solvent Extraction: This method removes pollutants from contaminated soils with solvent. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 7 This method can effectively remove organic pollutants from soil, however, the solvent chemical used may cause secondary pollution to the environment. Solidification/Stabilization: This method can reduce the fluidity of pollutants, instead of destroying them. Solidification is cheap, however, it will not destroy the pollutants permanently. Thermal Desorption: As mentioned earlier, thermal desorption removes volatile and semi volatile organic pollutants via heating. This is an environmentally friendly, and efficient method, however, compared to the other methods mentioned above, has higher installation and operating costs. The following table shows the operating cost of typical TDUs. Thermal Desorption Unit Cost ( Per Ton) Continuous -Feed Batch-Feed Small to medium direct contact dryer $40-$200 $120-$250 Large direct contact dryer $35-$100 $48-$51 Indirect contact dryer $80-$150 about $100 Source: Overview of TDU by Foster Wheeler Environmental Corporation and Battelle Corporation As shown in the table above, TDU costs range between $35 - $250 per ton. The cost of closed loop indirectly heated systems (which are similar to TPS) range between $80 - $150 per ton. The operating cost of TPS is considered to be lower than other TDUs due to the following two key factors – 1) TPS recycles / reuses the required fuel and water throughout the process, and 2) the required personnel for operating a TPS unit is a maximum of 4 people, compared to 6-8 people for typical TDUs. Although management has not disclosed TPS’s operating costs in China, we estimate them to be $85 - $105 per ton (estimated based on the revenue and margin figures announced by the company) – which is on the lower-end of the range of indirect-contact TDUs. Overall, we believe, WMT has an advantage over other waste and soil treatment service providers as TPS is proven and cost-efficient. TDUs in China In China, thermal desorption has been applied in two projects (we have not identified any other projects that have used TDUs in China) 1) Thermal desorption was applied by the Ministry of Environmental Protection of China to treat PCB contaminated soil in a project titled “China PCB Management and Disposal Demonstration”. This project was conducted in Zhejian province, with the co-operation of the World Bank. The total cost of the project was $32.1 million. The project lasted 7 years, from 2005 to 2012. TDUs were only used in the final phase of the project. A TDU unit was brought in to China from the U.S. (from an undisclosed supplier) and was installed by one of PS2’s current joint venture partners, Hangzhou DADI Environmental Protection Engineering 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 8 Company Ltd. Although the World Bank website claims that the project was successful, DADI’s interest in collaborating with NIES and WMT to apply TPS, instead of the TDU used in the project in Zhejian, can be considered as a testimonial of TPS’s value proposition. 2) In 2008-2009, BCEG Environmental Remediation Co. Ltd. (BCEER), in a project based in Beijing, utilized three technologies for the remediation of 18,363 tonnes of heavy metals and organic chemical soil. The technologies used were thermal desorption, incineration, and solidification (Details on BCEER are presented later in the report). Company History PS2 was formed as a private corporation in 2003 by Stephen Clarke, WMT’s VP of Business Development. Over the next year, the company completed the necessary environmental assessment requirements, permitting, site evaluation, design, equipment engineering, facility planning, and financing to establish the Wolseley Facility. The Wolseley Facility was fully commissioned in early 2006. Paul Antle joined the company as President and CEO in 2005. The company commenced commercial operations (providing contaminated soil treatment services) at the Wolseley Facility in February 2006. In 2007, the company began offering pharmaceutical waste treatment services to drug manufacturers/distributors. Although the company generated revenues of $0.42 million in 2007, and $1.10 million in 2008, from this sector, the company decided to exit the sector due to lower than anticipated margins. PS2 became public in 2007, through a revere acquisition of a capital pool company, West Mountain Capital Corp. Shareholders of PS2 received West Mountain shares on a one for one basis at a deemed price of $0.30. Prior to the transaction, PS2 had an outstanding debenture of $3.95 million due to Golden Opportunities Fund (GOF). GOF agreed to convert $3.45 million of this amount into 11.50 million WMT shares. The remaining $0.51 million was repaid by PS2 in cash. The company did not generate any revenues from soil treatment in 2008. However, things turned around in late 2008, when the Canadian Federal Government came out with new regulations to remove all stored PCB soils in federally registered storage facilities by the end of 2009 (later extended to 2011). These new regulations had a significant impact on the company’s performance in 2009 and 2010. However during the last two years (2011/2012), due to the limited remaining volume of PCB soil in Canada, the company’s activities significantly declined; which adversely affected its financial performance. In 2010, foreseeing the unfavorable soil remediation market in Canada, the company stepped into China – a market with significant potential for contaminated soil remediation. Since then, WMT has signed three strategic agreements; described in detail later in this report. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 9 The following chart shows WMT’s structure: Source: Company PS2 in Canada A few of the major soil remediation projects completed by WMT are listed below: • • • • PS2 in China In 2009, PS2 was contracted to remove/treat 6,300 tonnes of PCB contaminated soil/debris stored in a storage facility located in Western Canada for approximate revenues of $6.9 million (or $1,095/tonne). In 2010, PS2 was contracted to transport/treat approximately 1,500 tonnes of PCB contaminated soil for approximate revenues of $0.90 million (or $600/tonne). PS2 subsequently received 600 additional tonnes from this contract. In June 2010, PS2 signed a contract with a customer in Western Canada to transport and treat about 800 tonnes of PCB contaminated soil for revenues of $0.50 million ($625/tonne). On December 14, 2010, the company signed a contract to treat 800 tonnes of PCB contaminated solids from a municipality in Ontario for revenue of $560,000 ($700/tonne). The following section discusses WMT’s agreements with Chinese entities in detail: First Agreement - Contaminated Soil Treatment In Q2-2010, the company signed an agreement with Nanjing Institute of Environmental Sciences (NIES) of the State Environmental Protection Agency, Ministry of Environmental Protection (MEP), to establish a 50/50 partnership. NIES is a Chinese government 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 10 environmental agency. It conducts scientific and technological research, and promotes environmentally friendly technologies. According to the Ministry of Environmental Protection China, there are 600,000+ contaminated sites in China. WMT/NIES believes approximately 300 of those sites, with total soil volume of between 30 million and 45 million tonnes (on average 100,000-150,000 tonnes per site), will require remediation within the next 5 years. The key target markets are Beijing, and the provinces of Jiangsu and Zhejiang – all three regions are in the east coast of China. The average volume of soil per site in China is significantly higher than Canada, as most sites in Canada averaged between 5,000 – 30,000 per site. The partnership plans to: • • • • Construct a (mobile) TPS unit, the capital expenditures to be shared 50:50 (completed) Undertake a demonstration project: 2,000 – 3,000 tonnes (completed) Design, plan, launch, bid, operate and participate in various remediation projects throughout China; Provide solutions and consulting services related to environmental remediation issues. On December 16, 2010, PS2, and its partner, awarded a contract to CSSC Nanjing Luzhou Environment Protection Co. Ltd. of Nanjing, China, for the engineering/assembly of the TPS unit’s steel structure. Subsequently, in February 2011, the venture awarded a contract to JME (Hunan) Automation Engineering Co. Ltd. of Changsha, China, for the assembly of the electrical, controls and instrumentation systems of the TPS. Following the completion of the fabrication of the first TPS unit (capacity – 30,000 tonnes per year) in mid February 2012, the joint venture transported their first TPS unit in China to a demonstration site in Suzhou (a major city in Jiangsu province – one of WMT’s key markets), owned by NEIS. Installation, commissioning and testing of the TPS was completed shortly after that. Approximately 2,000 tons of soil was treated for the demonstration. According to management, the total CAPEX of the project was $1.6 million; of which, WMT funded its 50% share of $0.8 million. The pilot project enabled the company to assess the operating costs (undisclosed) of the TPS unit. Also, the project proved TPS’s potential to treat highly contaminated soil with POPs, pesticides and other organic chemicals. Following the success of the demonstration project, in August 2012, WMT, and its partner, signed a sub-contract with Hangzhou DADI Environmental Protection Engineering Co. Ltd. (“Dadi”). Dadi is a private hi-tech environmental protection company that provides professional services in the field of contaminated soil and groundwater site treatment. The company has more than 50 professional / technical staff. Our research indicates that Dadi is one of the only two companies in China that is licensed by the State Environment Protection Administration (SEPA) for PCB waste management. The other licensed firm is Shenyang Institute of Environment Science, which 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 11 has used incineration on three PCB sites in Zhejiang. The sub-contract with Dadi is for the treatment of 33,000 tonnes of pesticide contaminated soil in Hangzhou (largest city in Zhejiang province – one of WMT’s key target markets). Dadi’s head contract for the project (with an undisclosed client) involves the treatment of approximately 160,000 tonnes of contaminated soil. The initial contract for 33,000 tonnes (which is expected to take one year) is basically a demonstration to evaluate the efficiency of the TPS technology. If Dadi is satisfied with TPS, WMT expects to receive contracts for additional volume. PS2 and NIES moved their 30,000 tonne per year TPS unit (which they built for the pilot project) to the project site, and started soil treatment in December 2012. The contaminated soil includes carcinogens, DDT (dichlorodiphenyltrichloroethane), DDE (dichlorodiphenyldichloroethylene) and DDD (dichlorodiphenyldichloroethane). The project is expected to be completed by the end of 2013, and management’s estimate for revenues is $3.5 million, or $106 per tonne, split between WMT and NIES. Note that WMT used to charge $600 - $700 per tonne for their projects in Canada. Management indicated to us that, once they establish a track record in China, they will be able to charge a much higher rate than $106 per tonne going forward. Management has identified two other sites in the Jiangsu province. The company’s goal is to increase its annual capacity from the current 30,000 tonnes to 150,000 tonnes by 2014, and to 450,000 tonnes by 2015. To put things in perspective, a 450,000 tonnes per year facility, running at full capacity, could generate $47.70 million in revenues (assuming $106 per tonne pricing). WMT’s estimated CAPEX for the expansion, from 30,000 to 150,000 tonnes, is $6.7 million, and from 150,000 to 450,000 tonnes, is $16 million. Although NIES has a 50% interest in the unit that has already been built (and currently being used for the Dadi project), management does not expect NIES to have any interest in the expansion. Second Agreement - Oily Sludge Treatment In August 2010, the company signed a collaboration agreement with Zhoushan Nahai Solid Waste Central Disposal Co. Ltd. Nahai is a private, hazardous waste and oily sludge management company in Zhoushan, Zhejiang (the same province as WMT/NIES’s current project with Dadi). Nahai is the only enterprise that has a waste management processing permit in Zhoushan. Their infrastructure includes an oil storage facility (2.5 million tonnes), a waste oil recovery facility (capacity of 1 million tonnes per year), bilge water treatment process (20,000 tonnes per day), and a solid waste destruction facility (20 tonnes/day). The agreement between the two companies is to establish a 50/50 partnership to build an oily sludge waste recovery facility (non-TPS) in Zhoushan. The facility would process and recover oil from the oily sludge waste generated from oil storage operations and oil 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 12 tanker cleaning activities. The facility will utilize proprietary thermal, mechanical and chemical systems. The JV between the two companies, known as Zhejiang Nahai Phase Environmental Science and Technology Limited, received a license to operate its oily sludge treatment facility in March 2011. The 30 year license is valid until 2041, and has an option to be renewed. Zhoushan, China: Zhoushan consists of a group of islands located at the opening of the Yangtze River, just south of Shanghai. Zhoushan has one of the largest ports in the world, and has the biggest commercial petroleum transit base in China (Source: Zhoushan Municipal Government). According to management, Zhoushan generates about 180,000 tonnes per year of oily sludge waste. Several oil storage facilities are located in this region. For example, the Aoshan terminal, a large-sized oil transshipment base located in Zhoushan, has a crude oil tank storage capacity of 2.58 million cubic meters (Source: Sinochem Xingzhong Oil Staging (Zhoushan) Co., Ltd.). Also, the biggest crude oil dock in China, Alsi Sinochem Cezi, with a capacity of 300,000 tons, is a part of Zhoushan’s port. All the above makes Zhoushan a very good market for treating oily sludge. The JV’s facility will be designed to treat up to 50,000 tonnes per year, with the potential to expand to 100,000 tonnes per year if required. The JV’s strategy is to buy oily sludge, process it, and then sell the recovered oil (light diesel). Management estimates that they would be able to recover at least 85% of the contained oil. The facility was initially expected to be operational by August 2011. However, due to a delay in construction, and delivery of a number of equipment, commencement of operations has been postponed to Q3-2013. According to management, to date, necessary design, engineering, civil work, and commissioning processes to prepare the site for treatment have been completed. The treatment equipment is expected to be installed in the next few months. The company estimates a total CAPEX of $3 million for the project; of which, WMT will have to pay its 50% share of $1.5 million. Management estimates that, at full capacity, the facility has the potential to generate annual revenues of approximately $15 million ($300 per tonne), with a 20% EBIT margin. Details regarding the cost to purchase oily sludge, the amount of diesel that can be generated from one tonne of oily sludge, etc were not disclosed. Third Agreement - Industrial Sludge Treatment In September 2012, PS2 China entered into a 10 year sub-contract agreement with Huafu Environmental Engineering Company, a subdivision of Liaoning Huafu Group of China. Formed in 1992, the Huafu Group provides services in the area of heavy oil recovery, wastewater treatment, and energy conservation to various industries. Huafu also provides services in R & D, consulting, procurement, manufacturing, engineering, etc. According to Huafu’s website, the group has developed about 300 products and technologies in the fields of oil recovery and water treatment, which are being used by major Chinese oil producers, 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 13 such as Sinopec / China Petroleum & Chemical Corporation (NYSE: SNP), China National Petroleum Corp (CNPC), and China National Offshore Oil Corporation (CNOOC; NYSE: CEO). Huafu’s website also mentions that they hold 45+ patents related to environmental equipment. Huafu is expecting to sign a head contract with an undisclosed client to design, build and operate a hazardous industrial sludge treatment facility in Changquing, Shandong province (eastern China). The contract is expected to have a 10 year term. Management expects that a definitive agreement will be signed before the end of the year. Huafu signed a sub-contract agreement with WMT to jointly operate the project, wherein TPS will be integrated into Huafu’s sludge treatment facility. WMT and Huafu are contemplating a 15,000 tonne per year facility (CAPEX - $1 million). WMT believes that, if this facility is successful, they will be able to expand to at least 6 more locations. In February 2013, WMT announced that they intend to form a JV with Huafu, targeting industrial sludge management projects. A definitive agreement, or details of the JV, are yet to be finalized. Management believes they can generate approximately $2.3 million per location (or 15,000 tonnes per year facility), with an EBIT margin of 25%. Competition In Canada, WMT’s main competitor was BENEV Capital Inc., formally Bennett Environmental Inc. BENEV had a larger treatment facility with an annual processing capacity of 100,000 metric tonnes. Just like WMT, BENEV’s business suffered heavily in the past two years. BENEV uses an incineration based technology, and to date, has not stepped into Chinese market. BENEV recently entered into a purchase and sale agreement to sell its waste treatment plant, and related assets and liabilities, to one of its employees (manager) for $10 million. In China, one of WMT’s main competitors is FMC Corporation (NYSE: FMC; market capitalization - US$8.3 billion; 2012 revenues – US$3.7 billion). In September 2012, The Environmental Solutions Division of FMC Corporation, and two other private companies, BCEG Environmental Remediation Co., Ltd. (BCEER) and BRISEA Group, Inc, signed a joint venture agreement to manufacture and market cost-effective technologies and environmentally friendly products for soil and groundwater remediation in China for the first time. The venture, named Beijing Enviro- Chem, plans to also provide research and development, design and technical support services. Below is a short description of the three partners: FMC Corporation: FMC Corporation, headquartered in the U.S., is a diversified chemical company which operates globally with about 5,700 employees. FMC Environmental Solutions is a division of FMC Corporation. The division specializes in air pollution control, soil and groundwater remediation, and water treatment. This company provides products and services to assist businesses in managing cost and compliance issues related to the environment. BCEG Environmental Remediation Co., Ltd. (BCEER): BCEER, based in Beijing, is a 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 14 subsidiary of Beijing Construction Engineering Group Co., Ltd. BCEER supplies environmental remediation services. As we mentioned earlier, in 2008-2009, BCEER, in a project based in Beijing, treated 18,363 tones heavy metals and organic chemicals soil by utilizing three technologies (TDU, incineration, and solidification). BRISEA Group, Inc. - BRISEA Group, Inc., founded in 1999, in New Jersey, USA, provides environmental and energy services, as well as technology transfer, to developing nations. BRISEA has completed over 100 projects in China in the environmental and energy sections. FMC and its partners have yet to announce any contracts. Types of contaminated sites in China The following are the major types of contaminated sites in China: Brownfields: Brownfields, which are typically sites of previous chemical plants or factories, are abandoned and underused due to pollution. There is an increasing need for remediating these sites for reuse. The following images shows some examples of brownfields: Source: World Bank According to World Bank, brownfield remediation / redevelopment was included in the (Chinese) government priority list for World Bank assistance in 2009. Polluted Farmland: According to the State Environmental Protection Administration, it is estimated that about 100,000 sq.km. of China’s cultivated land is currently polluted. These polluted land are mostly in economically developed areas and account for 1/10th of China’s cultivatable land. As China has only 7% of the world’s farmable land, but has 22% of the world population, it is essential that its farmland are preserved. As an example to show the extent of pollutions for farmland in China, the following picture, from the China Environmental Remediation’s website shows containers filled with dangerous chemicals, abandoned in a field, without treatment. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 15 Source: China Environmental Remediation It should be noted that crops grown in, or near polluted land, can absorb chemicals and heavy metals, and cause serious health damage. As a result, the importance of treating polluted farmland is increasing in China. Major types of contaminants The following section discusses the primary contaminants: Persistent Organic Pollutants (POP): The following image shows the various types of POPs contaminating sites in China. Source: POP Actions for Contaminated Sites in China- September 2011 According to Article 6 of the Stockholm Convention on POP, China should endeavor to 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 16 develop strategies to identify sites contaminated by chemicals, and remediation of these sites should be undertaken by applying environmental friendly methods. The Stockholm Convention on POP is an international environmental agreement, effective May 2004, which aims to eliminate or restrict the production and application of POPs. By 2015, China plans to establish an inventory of POP contaminated sites and treatment plans. Some of the actions taken by the Chinese government for controlling POP contamination are as follows: 2008-2011 2009-1010 Central World Bank and Government Central Government, prepared an prepared technical action plan guideline for site investigation, remediation and risk assessment and monitoring. 2009-2011 UNDP ( United Nation of Development Program), World Bank and Central Government completed Environmental Impact Assessment (EIA) for pesticide POP sites. 2010-2011 2011-2012 UNDP and Central World bank Government conducted pilot established a project for site national data base remediation for contaminated sites. Source: POP Actions for Contaminated Sites in China- September 2011 We believe the above mentioned plans/actions demonstrate the increasing importance the Chinese government places on POP contamination – which is encouraging for remediation companies such as WMT. Heavy Metals: The annual heavy metal polluted grains in China is estimated at 12 million tonnes, which lead to an economic loss of over US$3 billion. (Source: Xinhua). According to the European Times, approximately 16% of the polluted farmland in China is polluted by heavy metals. According to the Shanxi Provincial Agriculture Department, Shanxi will invest $2.46 million, during 2011 - 2015, for the treatment of heavy metal polluted sites. Government action / regulations related to soil remediation China has one of fastest growing soil treatment markets, however, the country is not as experienced in site cleanup as Western countries. The main priorities for China in the environmental remediation sector are the restoration and disposal of soil contaminated with pesticides, PCBs, industrial water treatment and brownfield remediation. In the beginning of 2011, the Chinese government announced a five year plan to invest about US$3 billion in soil investigation, remediation and improving regulations. There are currently two national laws in China related to sites with contaminated soil – the Environmental Protection Law and the Solid Waste Law. Under these laws, an enterprise which generates environmental pollution has the obligation to prevent the pollution and should adopt measures to eliminate and control the waste (Source: A Hidden Problem: China’s contaminated site soil pollution crisis). There are also regulations that directly consider soil pollution at the provincial and city levels. WMT’s three key target markets, Zhejiang, Jiangsu, and Beijing, have local laws/regulations regarding the prevention/control 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 17 of environmental pollution. The following two developments are very positive for the industry: • • The Chinese Government recently announced that soil pollution prevention regulations will be nationally legislated. Recently, four Chinese Ministries – the Ministry of Environmental Protection, Ministry of Land and Resources, Ministry of Industry and Information Technology, and the Ministry of Housing and Urban-Rural Development – passed a regulation called the “China Soil and Factory Relocation Policy”. The new regulation has been enforced to govern remediation and to guarantee the environmental safety of the development/utilization of industrial fields for reuse. As mentioned earlier, we believe, TPS technology can compete efficiently in only those applications/regions were it is cost-competitive compared to its competitors, or where government policies require proper treatment of waste. Therefore, the new legislation and government actions in China are very good for WMT’s prospects. Management Team The company has a strong management team with extensive experience in the industry. Management and the board hold approximately 60 – 65% of the outstanding shares. Brief biographies of the management team and board of directors, as provided by the company, follow: Paul Antle, B.Sc., M.Eng., CCEP: Chairman, President and CEO - Mr. Antle is a native of St. John's, NL and possesses a Bachelor of Science Degree (Chemistry) from Memorial University and a Master of Engineering Degree (Chemical Engineering) from the University of New Brunswick. In 2007 he graduated from Harvard Business School after completing the OPM Executive Education Program. He is currently President and CEO of Phase Separation Solutions Inc., a wholly owned subsidiary of West Mountain Capital Corp.. Prior to this he spent over 20 years in the environmental industry where he started, operated, grew and sold numerous businesses. Over the last five years he has been Chair of the Board of the Newfoundland Symphony Orchestra; Chair of the Newfoundland and Labrador Legacy Nature Trust; a member of the UNB Campaign Cabinet; and Chair of a Special Advisory Group on International Trade for the Environment. From 1997 to 2002 Mr. Antle was a member of the Prime Minister’s National Round Table on the Environment and Economy. Mr. Antle was inducted into the Academy of Entrepreneurs in September 1995, was a Finalist for Atlantic Canada’s Entrepreneur of the Year Award in 1995, received a World Young Business Achiever Award in 1997, was recognized for his contribution to the Newfoundland Environmental Industry in 2002, in August 2002 was part of Canada’s Official Delegation to the United Nations World Summit on Sustainable Development held in Johannesburg, South Africa, in May 2003 was named one of Canada’s Top 40 Under 40 and in November 2003 named Alumnus of the Year for Gonzaga High School. In October 2012. Mr. Antle received the Queen Elizabeth II Diamond Jubilee Medal. In May 2012, he was selected by Atlantic Business Magazine as one of the Top 50 CEOs in Atlantic Canada. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 18 Stephen Clarke, BA. CEA, CCEP: VP Business Development - Mr. Clarke has been involved in the hazardous waste, biomedical waste, oilfield solids control and thermal remediation sectors of the environmental industry since 1995 both in the public and private sectors. While employed with the Newfoundland and Labrador Department of the Environment he served as Secretary to the Provincial Round Table on the Environment and the Economy acting as liaison with its National counterpart and with the Irish-Newfoundland Business Development Partnership. He has been integral in the international success of the Canadian designed mobile thermal remediation system, TPS, having worked as Director of International Marketing for the technology with its developer SCC Environmental Group and with the Global Support Division of an oilfield service industry leader. As founder and Vice President of Phase Separation Solutions, Mr. Clarke has been central to the creation, implementation and growth of one of Canada's premier integrated thermal treatment facilities. Paul Coombs, C.M.A., C.G.A., M.B.A. - CFO Mr. Coombs has over 15 years experience in the financial management of both public and private companies. He has worked with Fisheries Products International and Northern Light Fisheries overseeing their global financial, administrative and supply chain management systems Additionally, Mr. Coombs has a number of years experience in the mining industry, having worked in various financial management capacities with Xstrata, Falconbridge, Noranda and Aurora Energy. Glenn Antle, P.Eng. - COO - Mr. Antle is a native of St. John’s, Newfoundland and possesses a Bachelor of Science Degree in Engineering (Civil) from the University of New Brunswick. During his 15-year career in the environmental industry he has gained has extensive experience in the management of hazardous waste, remediation of contaminated sites, and oilfield environmental services. He has been instrumental in the development of thermal, mechanical, and chemical environmental technologies for waste treatment for use in site remediation and oil and gas drilling. Prior to joining Phase Separation Solutions he held various positions within a major international oil field services company in research and development, technical services, operations, and business development. He is named as a co-inventor on a United States Patent for the Thermal Phase Separation technology. Mr. Antle is a registered professional engineer with the Association of Professional Engineers, Geologists, and Geoscientists of Alberta Board of Directors Daniel E. Kenney, LLB, Corporate Secretary - Mr. Kenney is a partner at Davis & Company in Calgary. His practice is focused on securities and corporate finance transactions, mergers and acquisitions and corporate governance matters. He has extensive experience with public and private offerings of securities, including initial public offerings, business combinations and restructuring's through assets and share acquisitions, plans or arrangements and takeover bids. He also has considerable experience in all dealings with securities regulators including stock exchanges and securities commissions. Grant Kook: Director - Mr. Kook is a Saskatchewan based fund manager. He is the President and CEO of Cheung On Investments Group Ltd., owner and manager of a number 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 19 of international investor syndicated funds. He is Chairman, President and CEO of the Ramada Hotels in Regina and Saskatoon, both of which are wholly owned properties of the above noted funds. Mr. Kook is also the founder, Chairman, and Fund Manager of Golden Opportunities Fund, a Labour Sponsored Venture Capital Corporation. Dr. John Wiebe: Director - Dr. Wiebe is currently President and CEO of the Globe Foundation of Canada, an organization that engages Canadian industries, government agencies and financial institutions in environmental and energy business opportunities and projects around the world. Steven Thompson: Director - Mr. Thompson acted as the VP of Banyon Engineering, an oilfield engineering firm, for 10 years prior to becoming the current President of Triumph EPCM Ltd. of Calgary. Anthony Vysniauskas: Director - Mr. Vysniauskas, now an independent businessman was co-founder of Calgary based process simulation and engineering software leader, Hyprotech. He acted as Vice President from 1982 through 1992 then serving as President and CEO through 1997 when the company was acquired by AEA. Following the acquisition he served for 3 years as the new amalgamated company Executive VP. Financials The following chart shows the company’s revenues since 2005 (when the company started generating revenues). Revenues (2005 – 2014E) As shown in the chart, 2009 (12 months ended December 31, 2009) was the best year so far, when the company posted record revenues of $5.88 million. The second best year was 2010, with revenues of $4.72 million. As mentioned earlier, 2009/2010 were the company’s best years financially, due to the significant increase in the utilization of the Wolseley facility. Revenues have dropped significantly since then. In 2012, the company generated just $0.26 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 20 million, of which, $0.15 million came from two soil processing projects in Canada, and the remaining $0.11 million came from the company’s first project in China (with Dadi). The project started generating revenues in December 2012. We made the following assumptions for our revenue projections: - - - No revenues from the U.S./Canada Soil treatment – we assume the company will gradually increase annual capacity to 450,000 tonne per year by 2016 - the company will process 30,000 tonne in 2013, and 45,000 tonne in 2014. Over the long-term, for conservatism, we have assumed the company’s facilities will operate at just 50% capacity. Oily sludge – commence generating revenues from the agreement with Nahai through a 50,000 tonne per year facility – like the soil treatment segment, we have assumed the company’s facility will operate at just 50% capacity. Industrial sludge - commence generating revenues from the collaboration with Huafu through a 15,000 tonne per year facility – we have assumed the company’s facility will operate at 100% capacity, but do not assume any expansion beyond the 15,000 tonne annual capacity. Our revenue forecasts for 2013, and 2014, are $1.59 million and $4.94 million, respectively. Except 2009, and 2010, the company reported net losses every year since 2005. The following chart shows a summary of performance since 2009. The following table shows margins since 2009. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 21 Margins 2009 2010 2011 2012 2013E Gross EBITDA EBIT EBT Net 65.85% 49.57% 42.41% 40.43% 42.62% 73.15% 40.78% 29.67% 28.64% 22.05% 5.00% -92.67% -126.95% -128.43% -105.62% -49.17% -476.93% -684.73% -703.61% -714.41% 25.00% -53.71% -91.60% -92.95% -92.95% Environme ntal and Facilities Service s Industry 18.30% 6.50% 3.20% 1.20% Gross margins were between 65 – 75%, and EBIT was between 25% - 45% in the company’s peak years, 2009 and 2010. The company expects EBIT to be between 20% 25% for their operations in China. In the company’s best year, 2009, it generated $2.51 million (EPS: $0.07) in net profit. The company reported a net loss of $1.84 million in FY2012 (EPS: -$0.05). Our forecasts for 2013, and 2014, are net losses of $1.48 million (EPS: -$0.04), and $1.30 million (EPS: $0.04), respectively. Cash Flow Summary The following table shows a summary of cash flows since 2009. As shown, cash flows from operations have been negative in the past two years. We expect CAPEX of $4.50 million, and $12.50 million, in 2013, and 2014, respectively – which are our estimates of the funds required for expansion. Summary of Cash Flows 2009 2010 2011 2012 2013E 2,929,119 2,197,192 (1,546,679) (1,027,857) (393,378) Cash Flows from Investing (89,868) (734,306) (1,307,953) (932,788) (4,500,000) Cash Flows from Financing (194,837) (82,611) 7,999 334,499 4,945,926 2,789,262 1,550,775 (2,799,202) (1,945,195) (4,893,378) Cash Flows from Operations Free Cash Flows Liquidity At the end of 2012, the company had $0.16 million in cash. Working capital was negative $0.52 million. Liquidity Analysis Cash Working Capital Current Ratio Debt / Capital EBIT Interest Coverage Ratio 2009 $3,255,003 $2,505,997 2.74 11.3% 21.4 2010 $4,635,278 $3,791,168 5.25 1.8% 29.0 2011 $1,788,645 $1,908,653 3.68 1.9% (85.8) 2012 $162,499 -$523,328 0.40 10.6% (36.3) 2013E $215,047 -$1,860,231 0.17 24.9% (68.0) The company had a low debt to capital of 11% at the end of 2012, significantly lower than the industry average of 24.6%. In order to fund its CAPEX for the next two years, the company has arranged or is arranging the following: - Executed a Commitment Letter for $3.5 million in debt financing with HSBC Bank of Canada 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 22 - - In February 2013, the company announced its plans to pursue a non-brokered private placement of up to $1.50 million by issuing 8% unsecured convertible bonds (maturity date – 24 months; conversion price - $0.35 per share). In March 2013, the company announced it plans to undertake multiple rounds of equity financing (of up $25 million) over the next 12 months to fund its costs in China Stock Options and Warrants – At the end of December 2012, the company had 2.66 million stock options outstanding, with a weighted average exercise price of $0.22 per share. Approximately 0.66 million are currently in the money. The company has no outstanding warrants. Valuation Our Discounted Cash Flow (DCF) valuation model on the company gave a fair value of $0.45 per share. A summary of our valuation model is shown below. DCF Valuation (C$) FFO Change in WC CFO CAPEX Free Cash Flow PV Discount Rate (WACC) Terminal Growth Present Value Cash - Debt PV Equity Shares O/S (dil) DCF Value/Share 2014E 2015E 2016E 2017E 2018E 2019E Terminal (795,890) (163,180) 402,512 (583,500) (393,378) (746,680) (4,500,000) (12,500,000) (4,893,378) (13,246,680) (4,456,637) (10,650,506) 2013E 3,481,571 303,293 3,784,864 (8,000,000) (4,215,136) (2,991,848) 6,297,817 246,616 6,544,433 (500,000) 6,044,433 3,787,461 6,298,180 (234,023) 6,064,157 (500,000) 5,564,157 3,077,915 6,223,560 (239,630) 5,983,930 (500,000) 5,483,930 2,678,020 6,145,210 (239,630) 5,905,580 (500,000) 5,405,580 25,690,269 13% 3% $17,134,675 -$23,327 $17,111,348 38,273,415 $0.45 The following table show how we estimated the Weighted Average Cost of Capital (WACC): Cost of Equity Environmental and Facility Services Industy Beta* 10-year Government bond yield Market Risk Premium* Discount Rate 1.17 1.71% 8.00% 11.1% WACC Environmental and Facility Services Industy - Debt to Capital Ratio Cost of Debt Return on Equity Tax rate WACC Adusted WACC** *Consensus estimates (from several sources) ** Adjusted for size, liquidity and operations in an emrging market Source: Fundamental Research Corp and Capital IQ 2013 Fundamental Research Corp. 24.60% “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ 5.0% 11.1% 26.0% 9.3% 13.3% www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 23 Comparables: As WMT’s current revenues/EPS do not reflect their potential to expand in China, we do not believe a comparables analysis is appropriate at this time. Sensitivity Analysis The following table shows the sensitivity of our valuation to changes in the discount rate and capacity utilization. Sensitivity Discount Rate Value Per Share Utilization - soil treatment Value Per Share Utilization - oily sludge Value Per Share Utilization - industrial sludge Value Per Share 8.0% $1.61 25% -$0.15 25% $0.39 10.0% $0.95 50% $0.45 50% $0.45 13.3% $0.45 75% $0.87 75% $0.47 15.0% $0.30 100% $1.36 100% $0.49 25% 50% 75% 100% $0.40 $0.42 $0.44 $0.45 Rating Based on our review of the company, and our valuation, we reinitiate coverage on WMT with a BUY rating, and a fair value estimate of $0.45 per share. Risk • Due to the end of the regulatory deadline for the removal of PCB soil stockpiles, Canada’s PCB soil treatment market is slow, and we do not expect any revenues from this market in the near future. • Regulations requiring environmental protection/cleanup are key for the company’s longterm growth. • Old incineration techniques have been the most popular methods for treatment of contaminated soil in China, and are more cost effective compared to TPS. • Although WMT has three strategic agreements in China, the company is still new to the market. • Operating costs / revenues can vary from management’s initial estimates. • Our valuation is highly dependent on the company’s ability to capitalize on the three agreement/partnerships. • Huafu has yet to sign the head contract with its client. • WMT’s license to use TPS technology expires in 2019. • Access to capital and share dilution. The company needs to raise a significant amount of capital in the next 12 – 24 months to fund its CAPEX. We rate the shares a Risk of 4 (Speculative). 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 24 Appendix S TATEMENTS OF OPERATIONS (in C$) S ales 2009 5,884,361 2010 4,715,649 2011 1,608,990 2012 257,528 2013E 1,590,000 2014E 4,935,714 COGS 2,009,746 1,266,022 1,528,592 384,143 1,192,500 3,739,286 Gross Profit 3,874,615 3,449,627 80,398 (126,615) 397,500 1,196,429 886,620 1,478,571 1,065,439 1,171,983 1,289,181 36,187 79,500 246,786 (853,983) (339,538) 602,482 892,188 Expenses G&A Stock-based compensation 71,244 47,934 1,167,859 387,697 15,855 Bad Debt EBITDA Amortization EBIT Interest & Bank Charges EBT 2,916,751 1,923,122 420,941 524,134 2,495,810 1,398,988 116,693 2,379,117 48,271 1,350,717 Exchange rate gain(loss) Gain from sales of the assets EBT 2013 Fundamental Research Corp. 551,547 (2,042,560) 23,804 (2,066,364) 20,966 35,000 2,379,117 Discontinued operations, net of income taxes Income Taxes Net Earnings for the period (1,491,013) 129,030 2,508,147 (1,228,241) 535,126 (1,763,367) 48,634 (1,812,001) (1,456,465) 21,407 (1,231,726) 70,428 (1,477,871) (1,302,154) (27,812) 1,350,717 (2,010,398) (1,839,813) (1,477,871) (1,302,154) (311,000) 1,039,717 311,000 (1,699,398) (1,839,813) (1,477,871) (1,302,154) “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 25 BALANCE SHEETS (in C$) 2009 2010 2011 2012 2013E 2014E Assets Cash and cash equivalents Cash held by Joint venture 3,255,003 4,635,278 1,788,645 225,000 162,499 27,161 215,047 27,161 457,086 27,161 681,075 9,144 6,984 40,566 249,926 311,000 45,144 115,178 41,199 118,353 14,019 367,394 43,517 Current Assets 3,945,222 4,682,828 2,619,715 346,037 374,579 895,157 Restricted Cash Property Plan and Equipment Intenginble Asset 217,394 2,716,322 41,904 305,283 2,855,028 36,784 360,713 3,383,560 31,664 376,163 3,982,411 26,544 376,163 7,885,049 21,424 376,163 19,497,981 16,304 Total Assets 6,920,842 7,879,923 6,395,652 4,731,155 8,657,216 20,785,606 864,972 474,203 38,732 61,318 5,000 530,431 30,000 648,426 405,647 439,376 1,405,647 817,882 1,405,647 512,922 45,229 311,000 891,660 32,636 24,342 11,281 711,062 869,365 2,234,810 1,918,569 75,775 43,867 11,013 500,000 500,000 150,471 150,471 150,471 7,452,298 714,518 10,952,298 794,018 24,452,298 1,040,804 (7,276,535) Accounts receivable Income tax receivable Assets related to discontinued operations Prepaid Expenses and deposits Liabilities & Shareholders' Equity Bank loan Accounts Payables & Accrued Liabilities Deferred Revenue Convertible debentures Liabilities related to discountinued operations Current Portion of Obligations Under Capital Lease Income Tax payable Current Liabilities Obligations under capital lease Convertible debentures Shareholders' loans Long-term debt Asset retirement obligation Shareholder's Equity Share Capital Contributed surplus Equity component of convertible debentures Deficit Total Liabilities & Shareholders' Equity 2013 Fundamental Research Corp. 1,439,225 97,631 113,052 124,355 136,791 6,935,817 252,940 49,193 (1,967,016) 7,419,168 296,264 (927,299) 7,452,298 678,331 (2,626,697) (4,466,510) (5,974,381) 6,920,842 7,879,923 6,395,652 4,731,155 8,657,216 “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ - 20,785,606 www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 26 STATEMENTS OF CASH FLOWS (in C$) Operating Activities Net earnings for the period Discontinued operations, net of income taxes Items not involving cash Asset retirement obligation Amortization Gain on settlements of debentures Stock-based compensation 2009 2010 2011 2012 2013E 2014E 2,508,147 (129,030) 1,039,717 (1,699,398) (1,839,813) (1,477,871) (1,302,154) 531,158 (2,013) 47,934 1,616,796 551,547 (35,000) 387,697 (795,154) 535,126 48,868 410,664 (5,621) 71,244 2,904,272 602,482 892,188 36,187 (1,268,500) 79,500 (795,890) 246,786 (163,180) 134,748 311,000 3,945 (209,050) (3,175) (249,041) (31,422) (334,541) (242,942) (311,000) (4,578) 117,995 Accounts receivable Income tax recoverable Prepaid deposits Accounts payable and accrued liabilities Deferred revenues Accrued convertible interest payable Income tax payable Changes in non-cash operating working capital Cash prvided by (used in) operating activities- continuing operations Cash provided by (used in) operating activities- discontinued operations (173,404) 2,904,272 24,847 311,000 619,128 2,235,924 (38,732) (311,000) (751,525) (1,546,679) - Cash from (used in) operations 2,929,119 2,197,192 Financing activities Deferred financing costs Shareholders loans Cash aquired on reverse takeover Repayment of long-term debt Proceeds from bank loan Bank loan Payment of capital lease obligations Payment of promissory note payable Proceeds from capital lease obligations Proceeds from long-term debt Proceeds (repayment ) of debentures - net Proceeds from finance lease obligations Proceeds from issurance of common share and excersice of stock options Cash provided by (used in) financing activities 674,091 27,180 378,506 (29,498) (304,960) 240,643 (1,027,857) 402,512 (393,378) (583,500) (746,680) (1,546,679) (1,027,857) (393,378) (746,680) 5000 25000 375,647 1,000,000 (73,145) (44,501) (41,148) (24,074) (82,165) 35,200 32,499 27,500 (194,837) (82,611) 7,999 (50,011) (87,889) (107,000) (56,115) (31,722) - Investing activities Increase in restricted cash Cash Advanced to Join Venture Purchase of capital assets Purchase of license Porceed from disposal of property, plan and equipmet Cash used in investing activities- continuing operations Cash provided by investing activities- discontinued operations Cash provided by (used in) investing activities (139,857) (189,868) 100,000 (89,868) Increase (decrease) in cash Cash beginning of period Cash end of period 2013 Fundamental Research Corp. (11,281) 470,000 334,499 3,500,000 13,500,000 4,945,926 13,488,719 (646,417) (55,430) (225,000) (1,062,523) (15,450) 197,839 (1,115,177) (4,500,000) (12,500,000) (734,306) 35,000 (1,307,953) (932,788) (4,500,000) (12,500,000) (734,306) (1,307,953) (932,788) (4,500,000) (12,500,000) 2,644,414 1,380,275 (2,846,633) (1,626,146) 52,548 242,039 216,440 2,860,854 4,241,129 1,788,645 162,499 215,047 2,860,854 4,241,129 1,394,496 162,499 215,047 457,086 “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT Page 27 Fundamental Research Corp. Equity Rating Scale: Buy – Annual expected rate of return exceeds 12% or the expected return is commensurate with risk Hold – Annual expected rate of return is between 5% and 12% Sell – Annual expected rate of return is below 5% or the expected return is not commensurate with risk Suspended or Rating N/A— Coverage and ratings suspended until more information can be obtained from the company regarding recent events. Fundamental Research Corp. Risk Rating Scale: 1 (Low Risk) - The company operates in an industry where it has a strong position (for example a monopoly, high market share etc.) or operates in a regulated industry. The future outlook is stable or positive for the industry. The company generates positive free cash flow and has a history of profitability. The capital structure is conservative with little or no debt. 2 (Below Average Risk) - The company operates in an industry where the fundamentals and outlook are positive. The industry and company are relatively less sensitive to systematic risk than companies with a Risk Rating of 3. The company has a history of profitability and has demonstrated its ability to generate positive free cash flows (though current free cash flow may be negative due to capital investment). The company’s capital structure is conservative with little to modest use of debt. 3 (Average Risk) - The company operates in an industry that has average sensitivity to systematic risk. The industry may be cyclical. Profits and cash flow are sensitive to economic factors although the company has demonstrated its ability to generate positive earnings and cash flow. Debt use is in line with industry averages, and coverage ratios are sufficient. 4 (Speculative) - The company has little or no history of generating earnings or cash flow. Debt use is higher. These companies may be in start-up mode or in a turnaround situation. These companies should be considered speculative. 5 (Highly Speculative) - The company has no history of generating earnings or cash flow. They may operate in a new industry with new, and unproven products. Products may be at the development stage, testing, or seeking regulatory approval. These companies may run into liquidity issues, and may rely on external funding. These stocks are considered highly speculative. Disclaimers and Disclosure The opinions expressed in this report are the true opinions of the analyst about this company and industry. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. The analyst and Fundamental Research Corp. “FRC” does not own any shares of the subject company, does not make a market or offer shares for sale of the subject company, and does not have any investment banking business with the subject company. Fees were paid by WMT to FRC. The purpose of the fee is to subsidize the high costs of research and monitoring. FRC takes steps to ensure independence including setting fees in advance and utilizing analysts who must abide by CFA Institute Code of Ethics and Standards of Professional Conduct. Additionally, analysts may not trade in any security under coverage. Our full editorial control of all research, timing of release of the reports, and release of liability for negative reports are protected contractually. To further ensure independence, WMT has agreed to a minimum coverage term including four updates. Coverage can not be unilaterally terminated. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time. The performance of FRC’s research is ranked by Investars. Full rankings and are available at www.investars.com. The distribution of FRC’s ratings are as follows: BUY (67%), HOLD (8%), SELL (5%), SUSPEND (20%). To subscribe for real-time access to research, visit http://www.researchfrc.com/subscribe.php for subscription options. This report contains "forward looking" statements. Forward-looking statements regarding the Company and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company's products/services in the marketplace; acceptance in the marketplace of the Company's new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company's periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators. By making these forward looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. A report initiating coverage will most often be updated quarterly while a report issuing a rating may have no further or less frequent updates because the subject company is likely to be in earlier stages where nothing material may occur quarter to quarter. Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE THIS REPORT WITHOUT OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction. 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT