SPECIAL REPORT

JUNE 30, 2014

STEVEN MADDEN, LTD.

SHOO – $33.83

$39

One of Our Favorite Ideas for 2H14

Price Target (Previous)

$39

With June coming to an end and second quarter earnings season just around the

corner, the question we get asked most these days is: what do you like for 2H14?

One of our favorite ideas for the back half of the year has been SHOO, and

although the stock has already started to move upwards (up 6% MTD vs. a 2%

rise in the S&P), we thought it would be helpful to lay out our favorable thesis.

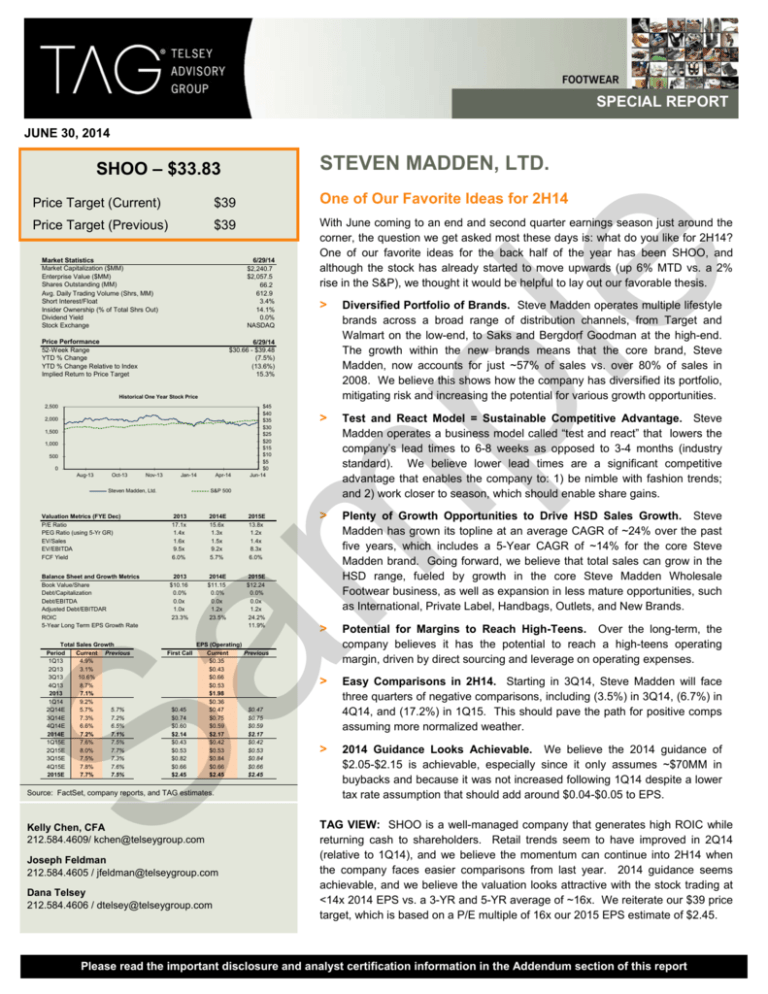

Market Statistics

Market Capitalization ($MM)

Enterprise Value ($MM)

Shares Outstanding (MM)

Avg. Daily Trading Volume (Shrs, MM)

Short Interest/Float

Insider Ownership (% of Total Shrs Out)

Dividend Yield

Stock Exchange

6/29/14

$2,240.7

$2,057.5

66.2

612.9

3.4%

14.1%

0.0%

NASDAQ

Price Performance

52-Week Range

YTD % Change

YTD % Change Relative to Index

Implied Return to Price Target

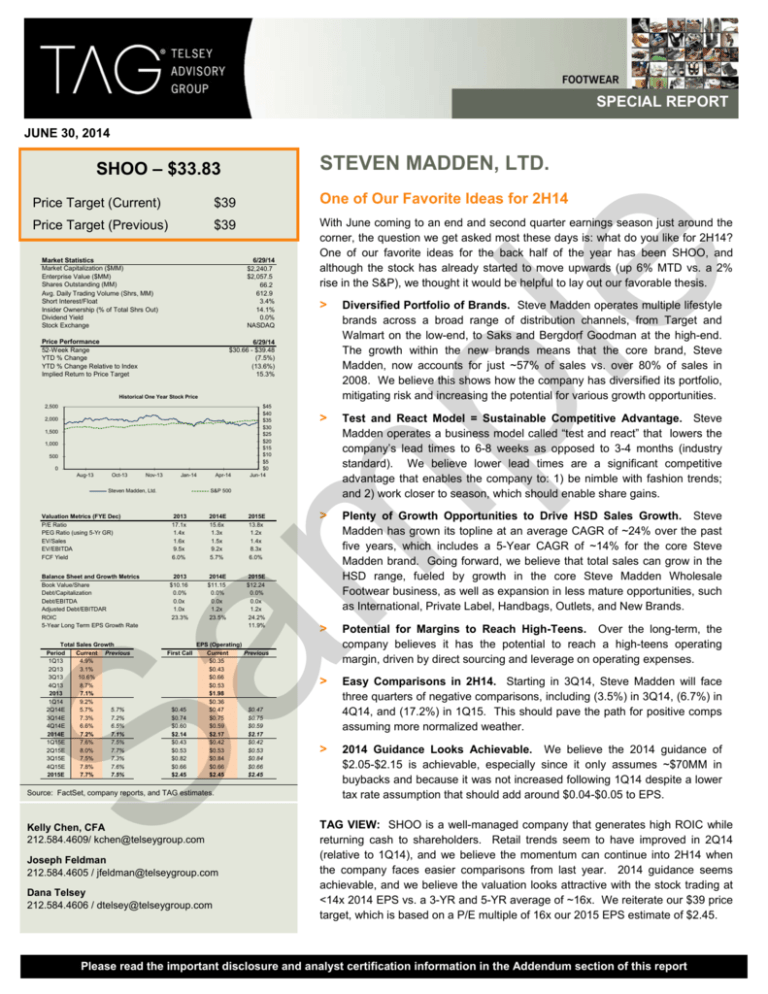

Historical One Year Stock Price

2,000

1,500

1,000

500

0

Oct-13

>

Diversified Portfolio of Brands. Steve Madden operates multiple lifestyle

brands across a broad range of distribution channels, from Target and

Walmart on the low-end, to Saks and Bergdorf Goodman at the high-end.

The growth within the new brands means that the core brand, Steve

Madden, now accounts for just ~57% of sales vs. over 80% of sales in

2008. We believe this shows how the company has diversified its portfolio,

mitigating risk and increasing the potential for various growth opportunities.

>

Test and React Model = Sustainable Competitive Advantage. Steve

Madden operates a business model called “test and react” that lowers the

company’s lead times to 6-8 weeks as opposed to 3-4 months (industry

standard). We believe lower lead times are a significant competitive

advantage that enables the company to: 1) be nimble with fashion trends;

and 2) work closer to season, which should enable share gains.

6/29/14

$30.66 - $39.48

(7.5%)

(13.6%)

15.3%

2,500

Aug-13

pl

e

Price Target (Current)

Nov-13

Jan-14

Apr-14

S&P 500

m

Steven Madden, Ltd.

$45

$40

$35

$30

$25

$20

$15

$10

$5

$0

Jun-14

Valuation Metrics (FYE Dec)

P/E Ratio

PEG Ratio (using 5-Yr GR)

EV/Sales

EV/EBITDA

FCF Yield

2014E

15.6x

1.3x

1.5x

9.2x

5.7%

2015E

13.8x

1.2x

1.4x

8.3x

6.0%

2013

$10.16

0.0%

0.0x

1.0x

23.3%

2014E

$11.15

0.0%

0.0x

1.2x

23.5%

2015E

$12.24

0.0%

0.0x

1.2x

24.2%

11.9%

>

Plenty of Growth Opportunities to Drive HSD Sales Growth. Steve

Madden has grown its topline at an average CAGR of ~24% over the past

five years, which includes a 5-Year CAGR of ~14% for the core Steve

Madden brand. Going forward, we believe that total sales can grow in the

HSD range, fueled by growth in the core Steve Madden Wholesale

Footwear business, as well as expansion in less mature opportunities, such

as International, Private Label, Handbags, Outlets, and New Brands.

>

Potential for Margins to Reach High-Teens. Over the long-term, the

company believes it has the potential to reach a high-teens operating

margin, driven by direct sourcing and leverage on operating expenses.

Sa

Balance Sheet and Growth Metrics

Book Value/Share

Debt/Capitalization

Debt/EBITDA

Adjusted Debt/EBITDAR

ROIC

5-Year Long Term EPS Growth Rate

2013

17.1x

1.4x

1.6x

9.5x

6.0%

Total Sales Growth

Period

Current Previous

1Q13

4.9%

2Q13

3.1%

3Q13

10.6%

4Q13

8.7%

2013

7.1%

1Q14

9.2%

2Q14E

5.7%

5.7%

3Q14E

7.3%

7.2%

4Q14E

6.6%

6.5%

2014E

7.2%

7.1%

1Q15E

7.6%

7.5%

2Q15E

8.0%

7.7%

3Q15E

7.5%

7.3%

4Q15E

7.8%

7.6%

2015E

7.7%

7.5%

EPS (Operating)

First Call

Current

Previous

$0.35

$0.43

$0.66

$0.53

$1.98

$0.36

$0.45

$0.47

$0.47

$0.74

$0.75

$0.75

$0.60

$0.59

$0.59

$2.14

$2.17

$2.17

$0.43

$0.42

$0.42

$0.53

$0.53

$0.53

$0.82

$0.84

$0.84

$0.66

$0.66

$0.66

$2.45

$2.45

$2.45

Source: FactSet, company reports, and TAG estimates.

Kelly Chen, CFA

212.584.4609/ kchen@telseygroup.com

Joseph Feldman

212.584.4605 / jfeldman@telseygroup.com

Dana Telsey

212.584.4606 / dtelsey@telseygroup.com

>

Easy Comparisons in 2H14. Starting in 3Q14, Steve Madden will face

three quarters of negative comparisons, including (3.5%) in 3Q14, (6.7%) in

4Q14, and (17.2%) in 1Q15. This should pave the path for positive comps

assuming more normalized weather.

>

2014 Guidance Looks Achievable. We believe the 2014 guidance of

$2.05-$2.15 is achievable, especially since it only assumes ~$70MM in

buybacks and because it was not increased following 1Q14 despite a lower

tax rate assumption that should add around $0.04-$0.05 to EPS.

TAG VIEW: SHOO is a well-managed company that generates high ROIC while

returning cash to shareholders. Retail trends seem to have improved in 2Q14

(relative to 1Q14), and we believe the momentum can continue into 2H14 when

the company faces easier comparisons from last year. 2014 guidance seems

achievable, and we believe the valuation looks attractive with the stock trading at

<14x 2014 EPS vs. a 3-YR and 5-YR average of ~16x. We reiterate our $39 price

target, which is based on a P/E multiple of 16x our 2015 EPS estimate of $2.45.

Please read the important disclosure and analyst certification information in the Addendum section of this report

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

Diversified Portfolio of Brands

Steve Madden started off as a footwear company in 1990 when the namesake designer

started crafting shoe designs in his factory in Queens, NY. Since then, the company has

grown into a $1.3B business that operates multiple lifestyle brands across a broad range of

distribution channels, from Target and Walmart on the low-end, to Saks and Bergdorf

Goodman at the high-end.

pl

e

The company’s core brand, Steve Madden (which includes all related brands like Madden Girl

and Steve etc.), generated sales of ~$749MM in 2013, accounting for approximately 57% of

sales vs. over 80% of sales in 2008. We believe this showcases how the company has

diversified its portfolio, mitigating risk and increasing the potential for various growth

opportunities.

CORE STEVE MADDEN BRAND SALES

$1,400

$1,200

$565

$1,000

$537

$800

$380

$600

$400

$200

$97

$62

$48

$395

$456

2008

2009

$538

$589

2010

2011

$690

$749

2012

2013

m

$0

Steve Madden Brand Net Sales

Non-Steve Madden Brand Net Sales

Note: Steve Madden Brand includes all related brands (Madden Girl, Steven etc.)

Source: Company reports and TAG estimates.

Below, we show the company’s main brands by distribution channel, as well as its mix.

Sa

BRANDS BY DISTRIBUTION CHANNEL

Source: Company reports, the NPD Group, and TAG estimates.

th

CHANNEL MIX

Other 7%

National

Chains 8%

Shoe Stores 17%

Shoe Chains 8%

Department Stores

15%

International 9%

E-Commerce

10%

Off-Price 15%

Mass

Merchants

11%

Source: Company reports and the NPD Group.

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

2

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

Steve Madden Brand Remains Strong With #2 and #3 Market Share

The main Steve Madden brand remains highly relevant, taking the #2 and #3 market share

positions in the Junior’s and Women’s segments respectively, according to NPD data (TTM

ended Jan 2014) for brands in the relevant price grids. We believe the company has done a

good job in developing brand extensions across various channels, which should continue to

drive growth in its key accounts.

BETTER & JUNIORS – STEVE MADDEN MARKET SHARE

Market Share

Rank

1

Skechers

Brand

12.4%

1

Skechers

3.6%

2

Steve Madden

8.3%

2

UGG

3.4%

3

Nine West

4

Vince Camuto

5

AK Anne Klein

6

Madden Girl

7

Franco Sarto

8

Jessica Simpson

9

Rampage

10

Enzo Angiolini

Brand

Market Share

pl

e

Rank

TOTAL WOMEN’S – STEVE MADDEN MARKET SHARE

5.5%

3

Steve Madden

2.5%

4.7%

4

Clarks England

2.4%

2.3%

3.8%

5

Michael Michael Kors

3.6%

6

Sperry Top-Sider

2.0%

3.3%

7

Nine West

1.7%

2.8%

8

Nike

1.6%

2.7%

9

Vince Camuto

1.4%

2.3%

10

Sam Edelman

1.3%

Source: Company reports, the NPD Group, and TAG estimates.

Source: Company reports, the NPD Group, and TAG estimates.

Test and React Business Model = Sustainable Competitive Advantage

m

Steve Madden operates a unique business model called “test and react.” One of the main

benefits of the model is its ability to lower the company’s lead times to 6-8 weeks as opposed

to 3-4 months (industry standard). Meanwhile, inventory turns ~10.5x a year (~1x a quarter in

retail and ~1x a month in wholesale). In some ways, we believe this makes Steve Madden

the fast-fashion player within the footwear space. Note that within specialty retail, fast fashion

apparel companies have lead times of around 2-4 months vs. around 6-9 months for

traditional specialty retail. Additionally, we point out that Steve Madden started working with

fast-fashion giant Forever 21 over this past year, which supports our view.

Sa

We believe lower lead times are a significant competitive advantage that enables the

company to: 1) be nimble with fashion trends; and 2) work closer to season. These

capabilities will likely make Steve Madden a preferred vendor for retailers that try to buy

closer-to-need and limit markdown risk, especially when there is a high degree of uncertainty

or volatility in the market.

Test and React Process

Step 1: Designer creates an idea for a shoe in the morning and develops a prototype for

the shoe by the end of the day.

Step 2: On day two, the company produces several cases of the shoes in Queens and

overnights the products to Steve Madden stores that have proven to be good leading

indicators for the rest of the chain.

Step 3: The company closely monitors the sell-throughs of the shoe over the next week.

Step 4: If the shoe meets the company’s requirements, the shoe is taken to its Wholesale

accounts and mass produced in China. If the shoe does not meet the company’s

requirements, the process ends, and the company arguably saved itself from a potential

fashion miss.

Plenty of Growth Opportunities to Drive HSD Sales Growth

Steve Madden has grown its topline at an average CAGR of ~24% over the past five years,

which includes a 5-Year CAGR of ~14% for the core Steve Madden brand. Going forward,

we believe that total sales can grow in the HSD range, fueled by growth in the core Steve

th

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

3

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

Madden Wholesale Footwear business, as well as expansion in less mature opportunities,

such as International, Private Label, Handbags, Outlets, and New Brands.

1) Grow Core Steve Madden US Wholesale Footwear Through Men’s and Madden Girl.

Steve Madden’s business has always been weighted to wholesale (~84% of sales in

2013 and ~73% of sales in 2008), and while we expect the penetration of Retail sales to

increase modestly over time, Wholesale will always be the company’s bread and butter –

particularly Footwear, which represented ~78% of Wholesale sales in 2013.

pl

e

Over the past few years, the Steve Madden US Wholesale Footwear business has grown

at around 4% each year. However, the company believes it can accelerate growth in the

business in 2014 by: 1) growing Steve Madden Men’s; and 2) growing Madden Girl, the

brand’s more moderately-priced line.

Steve Madden Men’s. We estimate that Steve Madden Men’s represents less than

10% of the total business. However, in some of its own retail stores, Men’s has

reached around 20%-25% of sales, suggesting that the business is underpenetrated

in the wholesale channel.

Management brought on a new Men’s president in 2013 that has already helped

oversee a series of changes that have produced strong results. Some of those

changes include: redefining the brand architecture, elevating the line with higher

price points, and using the Madden line to drive business with the younger, more

casual customer. The Men’s business was up ~15% in 2H13 and the company

believes Men’s can grow DD in 2014.

At macys.com, we estimate that the Steve Madden core brands account for

~4.5% of the women’s footwear SKUs vs. ~2.7% of the men’s footwear SKUs,

suggesting that there is opportunity for the brand to increase its presence/share

in men’s.

m

Madden Girl. Madden Girl has also benefited from a better-defined pricing

architecture and brand repositioning on the Women’s side. At Macy’s, management

repositioned Steve Madden Women’s by putting it into the Impulse section, taking it

out of the Junior’s section. As a result, the Steve Madden brand is now positioned at

the value-end of the women’s shoe department, enabling the company to take up

price points. Meanwhile, this move opens up space for the Madden Girl brand to

increase share gains in juniors. We believe those types of executional changes,

along with some near-term product momentum in the product (due in part to the

Kendall and Kylie Jenner capsule collection), can generate above-average sales

growth in 2014.

Sa

At nordstrom.com, we estimate that the Steve Madden core brands account for

~2.0% of the women’s footwear SKUs vs. ~0.2% of the men’s footwear SKUs,

suggesting that there is opportunity for the brand to increase its presence in

men’s.

2) Grow International Business.

In 2013, International sales increased 20% YoY,

representing around 9% of total sales. In particular, Steve Madden highlighted strength

in Canada (up over 30% YoY), Europe, the Middle East, and Asia.

In 2014, the International business should benefit from the addition of 50 stores and 1520 concessions in 2014. Mr. Rosenfeld has said that the International business

represents the largest opportunity for the firm over the next few years, with the potential

to reach mid-teens penetration.

While a distributor business represents the preferred channel in the near-term, the

company noted the potential for Steve Madden to acquire and bring regions in-house

over the long-term once they reach scale, which would be margin-accretive. Other

considerations for whether or not to bring a region in house are dependent on the

management team and the political stability of the country. Management has indicated

th

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

4

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

that there could be the potential for this to happen over the next year. We believe the

regions that are most likely to be brought in-house are Mexico or Latin America. Below, we

show how the company grew and developed the Canadian business when it was converted

to an in-house operation in order to show the potential contribution from other regions.

Canada Case Study

Upon Acquisition in 1Q12: The company recorded $42MM in Sales ($30MM in

wholesale and $12MM in Retail) and $10MM-$11MM in EBIT

Recent Results: Sales have grown to ~$50MM and EBIT growth remains strong

pl

e

Prior to Acquisition: Generated $8MM in Sales and $1MM in EBIT

3) Expand the Private Label Business. The private label business has grown nicely over

the past few years, generating approximately $350MM in sales in 2013. Although the

business is dilutive to margins (we estimate that the gross margin is in the mid-teens), the

company leverages a lot of its existing infrastructure in terms of design and production,

meaning that there is very little incremental investment involved. As a result, the

business is accretive to ROIC.

Over the next few years, Steve Madden believes there is potential to continue growing

this business, particularly at Target, where the Mad Love label has seen strong results

and will be expanded into new categories besides just footwear.

4) Expand Wholesale Branded Handbags Business. In total, accessories accounted for

~22% of wholesale sales in 2013. We estimate that around 60%-65% of accessory sales

were derived from handbags. Encouragingly, the handbag product is being well received

and seems to be filling in a niche in the ~$100-price point range (below Coach and

Michael Kors, with no dominant player).

m

Going forward, we believe there is still plenty of growth left in handbags as the company

expands distribution (only in select JWN and M doors vs. all JWN and M doors for

footwear) and increases the assortment within existing doors. The company also has the

potential to grow handbags within other brands: for example, the company launched

Madden Girl handbags at a $50-$60 price point in 2013 and will be expanding the line to

new distribution points in 2014. Additionally, we believe the company could leverage the

Atwood brand to break into higher-priced leather handbags.

Sa

Below, we show how Steve Madden is focused the lower price tiers within the department

store channel.

SHOO’S HANDBAG POSITIONING AT MACY’S

# of SKUs

Under $50

$50-$100

$100-$150

$150-$200

$200-$250

$250-$300

$300+

Total SKUS

All Brands

543

872

470

342

187

157

148

2719

SHOO Total

22

67

3

N/A

N/A

N/A

N/A

92

Steve Madden

2

15

3

N/A

N/A

N/A

N/A

20

Madden Girl

7

N/A

N/A

N/A

N/A

N/A

N/A

7

STEVEN

1

N/A

N/A

N/A

N/A

N/A

1

Big Buddha

5

31

N/A

N/A

N/A

N/A

N/A

36

Betsey Johnson

8

20

N/A

N/A

N/A

N/A

N/A

28

% of Mix

Under $50

$50-$100

$100-$150

$150-$200

$200-$250

$250-$300

$300+

Total SKUS

All Brands

20%

32%

17%

13%

7%

6%

5%

100%

SHOO Total

24%

73%

3%

N/A

N/A

N/A

N/A

100%

Steve Madden

10%

75%

15%

N/A

N/A

N/A

N/A

100%

Madden Girl

100%

N/A

N/A

N/A

N/A

N/A

N/A

100%

STEVEN

0%

100%

N/A

N/A

N/A

N/A

N/A

100%

Big Buddha

14%

86%

N/A

N/A

N/A

N/A

N/A

100%

Betsey Johnson

29%

71%

N/A

N/A

N/A

N/A

N/A

100%

Source: Company reports and TAG estimates.

th

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

5

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

SHOO’S HANDBAG POSITIONING AT NORDSTROM

All Brands

129

405

184

298

158

218

717

2109

SHOO Total

4

61

8

1

0

0

0

74

Steve Madden

0

6

1

N/A

N/A

N/A

N/A

7

Madden Girl

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

STEVEN

4

24

2

1

N/A

N/A

N/A

31

Big Buddha

N/A

9

N/A

N/A

N/A

N/A

N/A

9

Betsey Johnson

N/A

22

5

N/A

N/A

N/A

N/A

27

% of Mix

Under $50

$50-$100

$100-$150

$150-$200

$200-$250

$250-$300

$300+

Total SKUS

All Brands

6%

19%

9%

14%

7%

10%

34%

100%

SHOO Total

5%

82%

11%

1%

0%

0%

0%

100%

Steve Madden

0%

86%

14%

N/A

N/A

N/A

N/A

100%

Madden Girl

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

STEVEN

13%

77%

6%

3%

N/A

N/A

N/A

100%

Big Buddha

N/A

100%

N/A

N/A

N/A

N/A

N/A

100%

Betsey Johnson

N/A

81%

19%

N/A

N/A

N/A

N/A

100%

pl

e

# of SKUs

Under $50

$50-$100

$100-$150

$150-$200

$200-$250

$250-$300

$300+

Total SKUS

Source: Company reports and TAG estimates.

5) Grow Retail through Outlets and E-commerce.

m

Over the past few years, the

company’s Retail division has gone through quite a transformation. Between the years of

2008 and 2011, the company was primarily a net store closer, consolidating its base to

84 stores in 2011, down from 101 in 2007. During those years, management pruned the

store base and focused on A malls while closing stores in the secondary and tertiary

Midwest markets. As a result, the store productivity rose dramatically, with sales per

square foot increasing to $810 in 2011 vs. $628 in 2008 (based on the old methodology).

Once the store base was fairly healthy, the company resumed growth in 2012 and 2013,

expanding the store count to 121 stores (including the acquisition of 7 stores in Canada),

which represented average unit growth of around 20% over the last two years.

Going forward, we believe Retail can grow in the HSD-LDD range over the next few

years, driven by HSD unit growth (focused on outlet expansion), a return to positive

comps, and growth in e-commerce. Ultimately, the company believes that Retail margins

can surpass Wholesale margins.

Outlets. The company ended 1Q14 with 123 stores, including 20 outlet stores and

four Internet stores. For 2014, Steve Madden has talked about opening 3-4 full line

stores (mostly in Canada) and 10-12 outlet stores. The company also expects to

close around 3 stores, netting out to unit growth of around 10%.

Sa

Going forward, we believe Steve Madden will be more focused on expanding the

outlet store channel, which could reach 50-60 units by the end of 2016. Ultimately,

the outlet channel has the potential to reach 125-130 stores.

Encouragingly, outlets tend to generate higher returns relative to full-price stores,

with a four-wall contribution that is roughly 150 bps better. Over time, the company

believes the differential could reach 300-400 bps. We believe the higher margin

profile stems from a lower expense structure as well as the potential for better gross

margins as the company improves made-for-factory margins through higher

volumes.

th

E-Commerce. E-commerce represented ~18% of the Retail business in 2013, up

from ~4% in 2005. In addition, the company estimates that roughly 10% of its

wholesale business is online. We believe the company can continue to grow its ecommerce business at a solid DD pace going forward. We note that the company

hired the head merchant from Zappos in late 2013 to oversee the business and

relaunched its website in early 2014 – these are just some of the examples of

changes that can help drive e-commerce growth.

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

6

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

6) Grow New Brands. Steven Madden has successfully implemented its business model

with its legacy brands and believes it can leverage the model to help grow new brands in

under-developed channels.

Since 2009, the company has added ten new brands to the portfolio, including: Elizabeth

and James, Olsenboye, Material Girl, Big Buddha, Madden, Betsey Johnson, Superga,

Report, Wild Pair, and Brian Atwood. The new brands generated ~$100MM in sales in

2013 and are expected to grow at a solid pace in 2014 and beyond. In particular, the

company seems most excited about the growth/potential for Mad Love and Freebird.

Potential for High-Teens Operating Margin Over the LT

pl

e

Over the long-term, the company believes it has the potential to reach a high-teens operating

margin, driven by direct sourcing and leverage on operating expenses. Assuming MSD-HSD

sales growth, SG&A should grow at a MSD rate, with fixed costs growing ~3% and variable

expenses increasing commensurate with total sales growth.

Direct Sourcing. One of the drivers for increased margins is ramping up direct sourcing.

Recall that in late May 2011, Steve Madden acquired Topline, a designer, producer, and

marketer of private label (~75% of sales) and branded footwear (~25% of sales stemmed

from brands including Report, Report Signature, and R2 by Report). In addition to

developing a relationship with Payless, one of the largest shoe retailers in the US, Steve

Madden noted that one of the main reasons for the acquisition was to gain access to

Topline’s direct sourcing operations in China. At the time, Topline sourced 100% of its

goods direct with the factories, while Steve Madden sourced most of its footwear through

agents.

m

We estimate that by the end of 2013, Steve Madden sourced ~30% of its legacy business

directly, up from 20%-25% in 3Q13, ~20% in 2Q13, 15%+ in 1Q13, ~15% in 4Q12, and

<2% in 2011. Over time, the company believes it can increase direct sourcing in the

legacy business to 50%-60%, including another 10% increase in penetration in 2014. By

cutting out the middle man, Steve Madden stands to benefit from greater profitability, as

well as improved quality and consistency in its merchandise.

Although the benefit from the shift to direct sourcing has been tempered to <200 bps due

to increased costs associated with compliance, we believe it is still a source of margin

accretion and demonstrates the company’s vigilance in optimizing costs/margins.

Sa

2014 Outlook Looks Achievable, Esp. Given Buyback and Lower Tax

In 1Q14, the company reiterated its 2014 guidance for sales growth of 5%-7% and EPS of

$2.05-$2.15.

We believe the guidance looks achievable and point out that it was kept the same despite a

lower than expected tax rate of ~35.1%, down from 37.5% previously, which we estimate

would add around $0.04-$0.05 to EPS.

Additionally, we note that the 2014 outlook only assumes ~$70MM in share buybacks, which

will could prove conservative given that the company has been buying back shares at a pace

of ~$30MM on average for the past four quarters.

Maintain $39 Price Target

SHOO is a well-managed company that generates high ROIC while returning cash to

shareholders. Retail trends seem to have improved in 2Q14 (relative to 1Q14), and we

believe the momentum can continue into 2H14 when the company faces easier comparisons

from last year. 2014 guidance seems achievable, and we believe the valuation looks

attractive with the stock trading at <14x 2014 EPS vs. a 3-YR and 5-YR average of ~16x. We

reiterate our $39 price target, which is based on a PE multiple of 16x our 2015 EPS estimate

of $2.45.

th

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

7

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

SALES BREAKDOWN BY DIVISION

1Q12

MAR

191.5

37.4

228.9

2Q12

JUN

198.7

49.4

248.1

3Q12

SEP

228.7

82.8

311.5

37.0

40.6

45.3

68.3

266.0

288.7

356.9

YOY GROWTH

Wholesale Footwear

Wholesale Accessories

Total Wholesale

76.6%

45.1%

70.5%

33.8%

85.7%

41.6%

Retail

SSS

17.6%

11.9%

19.4%

6.8%

Total Sales

60.5%

38.0%

MIX

Wholesale Footwear of WS

Wholesale Accessories of WS

83.6%

16.4%

80.1%

19.9%

Wholesale Footwear

Wholesale Accessories

Total Wholesale

72.0%

14.1%

86.1%

68.8%

17.1%

85.9%

Retail

13.9%

14.1%

Retail

Total Sales

1Q13

MAR

189.2

44.7

233.9

2Q13

JUN

199.2

52.2

251.4

3Q13

SEP

272.2

73.7

345.9

4Q13

2013

DEC TOTAL

199.4

860.0

74.0

244.6

273.4 1104.5

1Q14

MAR

219.7

45.3

265.0

2Q14E 3Q14E 4Q14E

JUN

SEP

DEC

212.1 289.9 209.4

54.8

79.6

78.4

266.9 369.5 287.8

2014E

TOTAL

931.1

258.1

1189.2

191.3

45.1

46.2

48.9

69.5

209.7

39.6

47.6

54.2

77.8

219.2

315.5

1227.1

278.9

297.6

394.8

342.9

1314.2

304.6

314.5

423.7

365.6

1408.5

8.3%

23.6%

12.0%

4.1%

25.0%

9.4%

24.8%

36.5%

27.3%

-1.2%

19.3%

2.1%

0.3%

5.6%

1.3%

19.0%

-11.0%

11.0%

13.5%

3.3%

10.6%

8.2%

1.4%

6.6%

16.2%

1.3%

13.3%

6.5%

5.0%

6.2%

6.5%

8.0%

6.8%

5.0%

6.0%

5.3%

8.3%

5.5%

7.7%

27.2%

8.6%

27.0%

5.9%

23.5%

7.9%

21.7%

3.0%

13.9%

2.5%

7.9%

(3.5%)

1.8%

(6.7%)

9.6%

(2.1%)

-12.1%

(17.2%)

2.9%

(4.5%)

10.9%

2.5%

11.9%

5.0%

4.5%

(3.6%)

13.7%

12.8%

26.7%

4.9%

3.1%

10.6%

8.7%

7.1%

9.2%

5.7%

7.3%

6.6%

7.2%

73.4%

26.6%

71.0%

29.0%

76.7%

23.3%

80.9%

19.1%

79.2%

20.8%

78.7%

21.3%

72.9%

27.1%

77.9%

22.1%

82.9%

17.1%

79.5%

20.5%

78.5%

21.5%

72.8%

27.2%

78.3%

21.7%

64.1%

23.2%

87.3%

55.7%

22.7%

78.4%

64.8%

19.7%

84.4%

67.8%

16.0%

83.8%

66.9%

17.5%

84.5%

68.9%

18.7%

87.6%

58.2%

21.6%

79.7%

65.4%

18.6%

84.0%

72.1%

14.9%

87.0%

67.4%

17.4%

84.9%

68.4%

18.8%

87.2%

57.3%

21.5%

78.7%

66.1%

18.3%

84.4%

12.7%

21.6%

15.6%

16.2%

15.5%

12.4%

20.3%

16.0%

13.0%

15.1%

12.8%

21.3%

15.6%

Sa

m

Source: Company reports and TAG estimates.

4Q12

2012

DEC TOTAL

175.6

794.5

71.6

241.3

247.2 1035.8

pl

e

Year ending DEC

$MM, Except per Share Data

Wholesale Footwear

Wholesale Accessories

Total Wholesale

th

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

8

JUNE 30, 2014

STEVEN MADDEN, LTD. (SHOO)

SPECIAL REPORT

ADDENDUM

Important Disclosures:

Valuation Method for Target Price: Price-to-Earnings, enterprise-value-to-EBITDA, P/E to growth, price to free cash flow, and discounted cash flow analysis.

Investment Risks: Telsey Advisory Group’s (TAG’s) equity research department covers consumer-focused sectors including apparel, casinos,

cosmetics, cruise lines, department stores, discounters, entertainment and communications, footwear and sporting goods, freight and logistics, gaming,

hardlines, internet, lodging, luxury, restaurants, and specialty apparel. Risks across or specific to one or more of these sectors include volatility of

commodity costs, consumer spending, currency, rising interest rates, weaker consumer confidence and unemployment rates. Additionally, access to

capital, supply chain disruptions, commodity costs, private label distribution, currency, geopolitical uncertainly, unfavorable government regulations, lack

of appropriate real estate sites, and the use of the World Wide Web to sell merchandise represent unique industry risks.

Analyst Certification

pl

e

The Research Analyst(s) who prepared the research report hereby certify that the views expressed in this report accurately reflect the Analyst(s)

personal views about the subject companies and their securities. The Research Analyst(s) also certify that the Analyst(s) have not been, are not, and

will not be receiving direct or indirect compensation for expressing the specific recommendation(s) or view(s) in this report.

Kelly Chen, CFA, Joseph Feldman, Dana Telsey

Historical Price Targets

To see price charts and TAG’s historical price targets please click the following link: http://www.telseygroup.com/files/historicalprices.pdf

Company-Specific Disclosures

None

Disclosures required by United States laws and regulations

See company-specific regulatory disclosures above for any of the following disclosures required as to companies referred to in this report: manager or

co-manager in a pending transaction; 1% or other ownership; compensation for certain services; types of client relationships; managed/co-managed

public offerings in prior periods; directorships; market making and/or specialist role.

The following are additional required disclosures:

m

Ownership and material conflicts of interest: TAG prohibits its analysts, professionals reporting to analysts and members of their households from

owning securities of any company in the analyst's area of coverage.

Analyst compensation: Neither TAG nor its employees/analysts receives any compensation from subject companies for inclusion in our research.

Analysts are paid in part based on the overall profitability of TAG which may include investment banking revenues.

Analyst as officer or director: TAG analysts, persons reporting to analysts or members of their households do not serve as officers, directors, advisory

board members or employees of any of our subject companies in the analyst's area of coverage.

Investment banking activities: TAG provides investment banking, other non-investment banking securities related services, and non-securities services

and may seek such relationships from subject companies.

Distribution of ratings: TAG analysts do not assign ratings to covered companies.

Sa

Price chart: See the price chart, with price targets in prior periods, above, or, if distributed in electronic format or if multiple companies are the subject of

this report, on the TAG website at http://www.telseygroup.com/files/historicalprices.pdf.

TAG is a member of FINRA (http://www.finra.org) and SIPC (http://www.sipc.org).

Other Disclaimers

TAG is a registered broker dealer offering equity research, trading and investment banking services. The Equity Research Department of TAG produces and

distributes research products for institutional clients of TAG and is for our institutional clients only. This research is based on current public information that we

consider reliable. We seek to update our research as appropriate. Other than certain industry reports published on a periodic basis, the large majority of reports

are published at irregular intervals as appropriate in the analyst's judgment. TAG updates research reports as it deems appropriate, based on developments with

the subject company, the sector or the market that may have a material impact on the research views or opinions of TAG analysts. All TAG publications are

prepared in accordance with TAG compliance and conflict management policies. TAG is committed to the integrity, objectivity, and independence of our

research. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients, which may reflect

opinions that are contrary to the opinions expressed in this research. This research is not an offer to sell or the solicitation of an offer to buy any security in any

jurisdiction where such an offer or solicitation would be illegal. These publications are furnished for informational purposes only and on the condition that it will not

form the sole basis for any investment decision. Any opinion contained herein may not be suitable for all investors or investment decisions. Each investor must

make its own determination of the appropriateness of an investment in any company referred to herein based on considerations applicable to such investor and

its own investment strategy. By virtue of these publications, neither TAG nor any of its employees, nor any data provider or any of its employees shall be

responsible for any investment decision. The price and value of the investments referred to in this research and the income from them may fluctuate. Past

performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. All research reports made available

to clients are simultaneously available on our website, http://www.telseygroup.com. Not all research content is redistributed, e-mailed or made available to thirdparty aggregators. For all research reports available on a particular stock, please contact your sales representative.

TAG publications may not be reproduced, distributed, or published without the prior consent of TAG.

© 2014. All rights reserved by Telsey Advisory Group. Telsey Advisory Group and its logo are registered trademarks of Telsey Advisory Group LLC.

th

> Telsey Advisory Group 535 Fifth Avenue, 12 Floor, New York, NY 10017 p 212 973 9700 f 212 973 9711 www.telseygroup.com

9