support agreement - Midas Gold Corp.

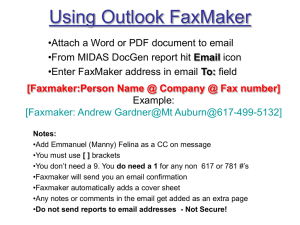

advertisement