DIRECT INVESTMENT (January – February 2015)1 According to

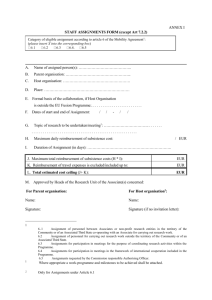

advertisement

DIRECT INVESTMENT 1 (January – February 2015) According to preliminary data, foreign direct investment in Bulgaria reported following the directional principle amounted to EUR 128.2 million (0.3% of GDP) in January – February 2015, declining by EUR 9.5 2 million (6.9%) from January – February 2014 (EUR 137.7 million, 0.3% of GDP) . In February 2015 foreign direct investment in the country grew by EUR 53.9 million, compared with an increase of EUR 94.7 million in February 2014. With the implementation of the Sixth Edition of the Balance of Payments and International Investment Position Manual (IMF, 3 4 2008) and the Fourth Edition of the OECD Benchmark Definition of Foreign Direct Investment a principally different approach has been adopted for the presentation of direct investment, i.e. the asset/liability presentation. Taking into consideration the analytical importance of the directional principle presentation (based on the direction of the initial investment), the BNB shall continue compiling and publishing direct investment data according to the directional principle presentation. These data are available in the balance of payments press release table under Additional information (Annex 1), as well as in Table 10 - Direct Investment in the Balance of Payments monthly publication. The major methodological changes in the compilation of the balance of payments statistics in accordance with the new methodological requirements are presented in the paper Compilation of the balance of payments in accordance with the methodology of the sixth edition of the Balance of Payments and International Investment 5 Position Manual (major methodological changes) . (EUR million) 2014 Direct investm ent, net Direct investm ent abroad * 2015 2015/2014 Jan Feb Total Jan Feb Total Jan - Feb 60.0 -88.9 -29.0 -100.3 -44.5 -144.8 -115.8 -125.3 103.0 5.7 108.7 -26.0 9.4 -16.6 Equity capital 5.8 2.3 8.1 10.7 3.2 13.9 5.8 Reinvestment of earnings 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Debt instruments 97.2 3.4 100.6 -36.7 6.2 -30.5 -131.1 43.0 94.7 137.7 74.3 53.9 128.2 -9.5 2.8 51.1 53.9 7.6 5.4 12.9 -41.0 Foreign Direct Investm ent Equity capital, incl. from privatisation 0.0 0.0 0.0 0.0 0.0 0.0 0.0 non-privatisation flows 2.8 51.1 53.9 7.6 5.4 12.9 -41.0 Reinvestment of earnings 14.1 14.1 28.2 13.4 13.4 26.8 -1.3 Debt instruments 26.1 29.5 55.6 53.3 35.1 88.4 32.8 Data presented following the directional principle and compiled in accordance with the methodological requirements of the Sixth Edition of the Balance of Payments and International Investment Position Manual (IMF, 2008) . Source: direct investment companies, banks, notaries, National Statistical Institute, Central Depository, Privatisation Agency. A positive sign denotes an increase in assets and liabilities; a negative sign denotes a decrease in assets and liabilities. Equity (acquisition/disposal of shares and equities in cash and contributions in kind by non-residents in/from the capital and reserves of Bulgarian enterprises and receipts/payments from/for real estate deals in the country) amounted to EUR 12.9 million in January – February 2015. It dropped by EUR 41 million in 1 Preliminary data. The data for February 2015 are to be revised with the March 2015 report. The 2014 and 2015 data are subject to revisions with the annual NSI data and reports from foreign direct investment enterprises. 2 GDP amounting to EUR 42,671 million for 2015 (BNB estimate), and EUR 42,009.8 million for 2014 (NSI data as of 06.03.2015) according to ESA 2010. 3 http://www.imf.org/external/pubs/ft/bop/2007/bop6comp.htm 4 www.oecd.org/daf/inv/investmentstatisticsandanalysis/40193734.pdf 5 The papers related to the implementation of the sixth edition of the Balance of Payments and International Investment Position Manual are available on the BNB website www.bnb.bg, section Statistics/ Methodological notes (left-hand menu). comparison with that attracted in the same period of 2014 (EUR 53.9 million). The receipts from real estate investments of non-residents amounted to EUR 4.5 million, compared with EUR 14.7 million attracted in January 2014. Foreign Direct Investment in Bulgaria January - February (2014 and 2015) (EUR mln.) 200 150 137.7 128.2 88.4 100 55.6 53.9 50 28.2 26.8 12.9 0 Total Equity 2014 Reinvestment of Debt instruments earnings 2015 4 Based on preliminary data on profit/loss, reinvestment of earnings (the share of non-residents in the undistributed earnings/ loss of the enterprise) were estimated at EUR 26.8 million for January – February 2015, compared with EUR 28.2 million in the same period of 2014. The net debt instruments (the change in the net liabilities between affiliated enterprises on financial loans, suppliers’ credits and debt securities) totalled EUR 88.4 million in January – February 2015, compared 6 with EUR 55.6 million in January – February 2014 . By country, the largest net direct investment inflow in Bulgaria for January – February 2015 was from the Netherlands (EUR 46.6 million). 6 The data on debt instruments are based on preliminary information from foreign direct investment enterprises on credits extended/received to/from nonresidents. The data for 2014 and 2015 are subject to revisions with their quarterly and annual reports. FDI Flows in Bulgaria Geographical Breakdown (January - February 2015) (EUR mln.) 60 45.7 40 19.5 15.6 15.1 20 2.9 7.0 0.9 7.7 0.0 1.8 1.1 0 -0.1 8.1 0.4 1.2 0.4 2.9 -2.1 -20 Equity and reinvested earnings Debt instruments According to preliminary data, direct investment abroad decreased by EUR 16.6 million in January – February 2015, compared with an increase of EUR 108.7 million in January – February 2014. In February 2015 it grew by EUR 9.4 million, compared with an increase of EUR 5.7 million in February 2014.