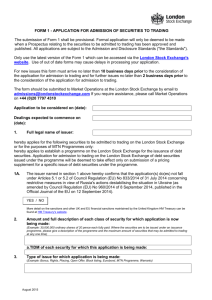

London Stock Exchange Admission and Disclosure Standards 16

advertisement